Tag Archive: central banks

The Twilight Of The Gods (aka Central Bankers)

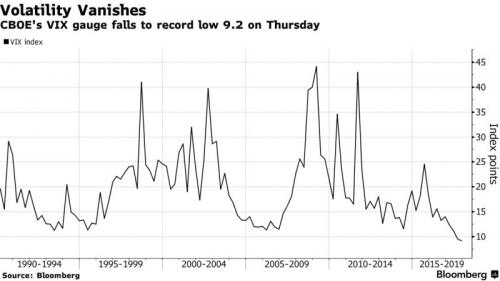

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

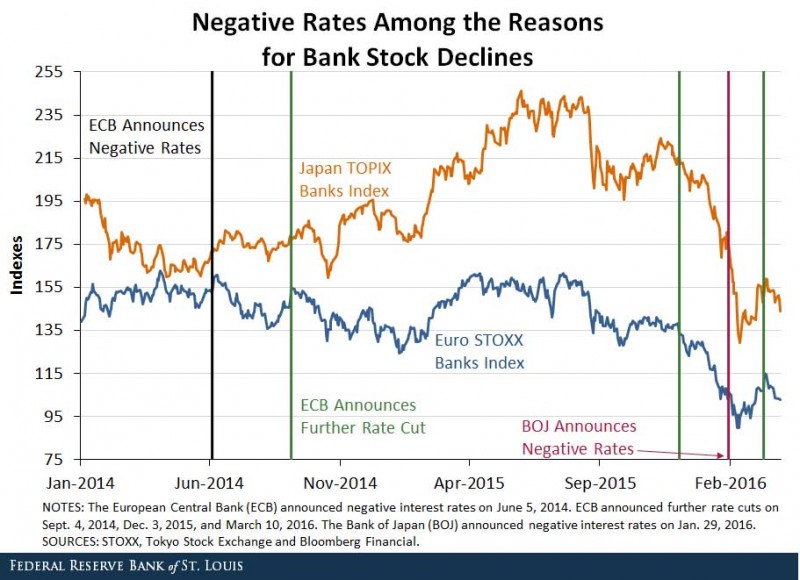

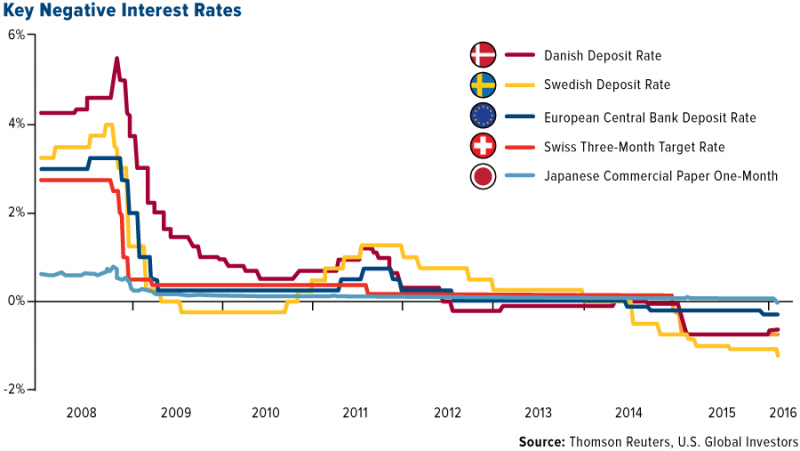

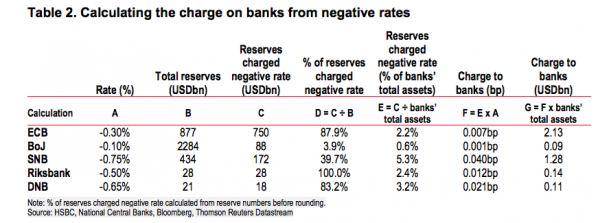

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »

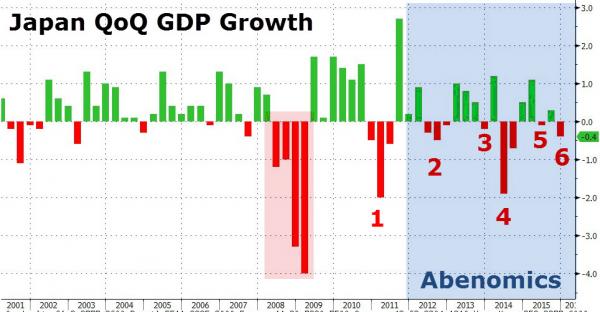

Bank of Japan: The Limits of Monetary Tinkering

After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore.

Read More »

Read More »

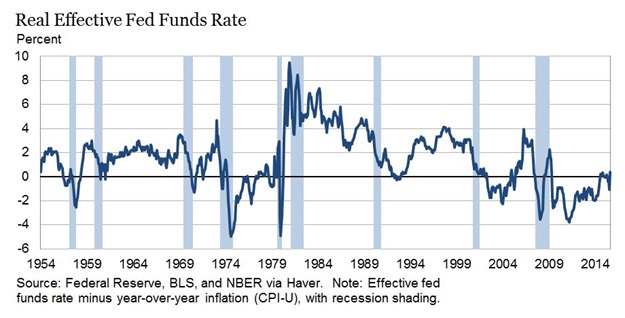

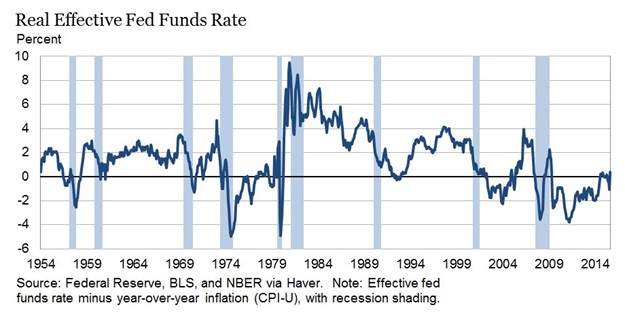

Gold And Negative Interest Rates

Submitted by Dan Popescu via Acting-Man.com,

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed h...

Read More »

Read More »

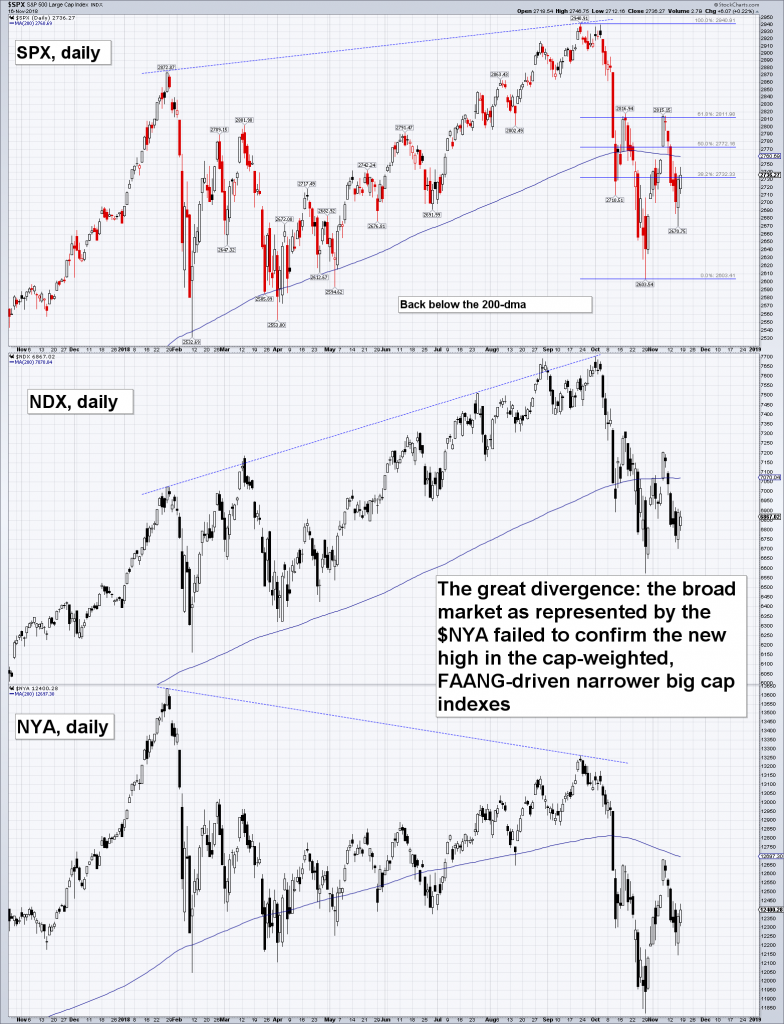

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

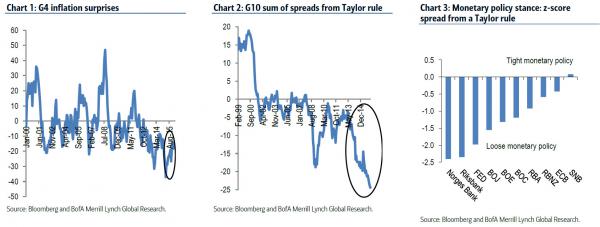

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »

Yes, the Dollar Should Be Backed by Gold…

A Return to Gold BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Sorry boys and girls, y...

Read More »

Read More »

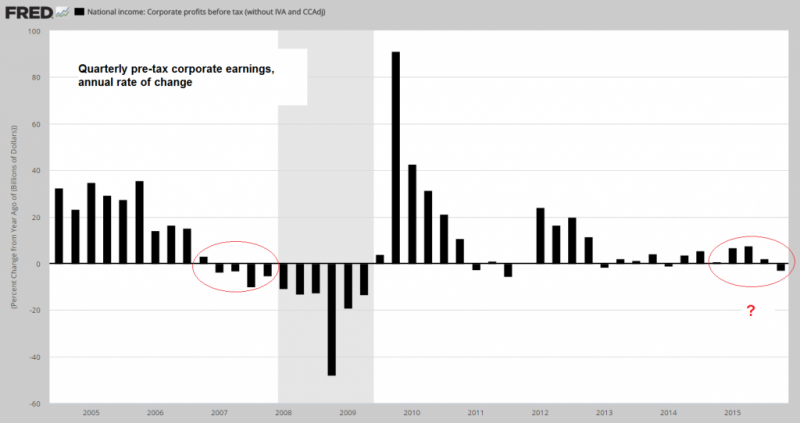

Why Janet Yellen Can Never Normalize Interest Rates

Bill Bonner explains why the Fed will normalize interest rates.

With higher rates, Yellen risks corporate profits and bond defaults.

With higher rates, Yellen risks not only bond defaults, but also bank defaults.

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

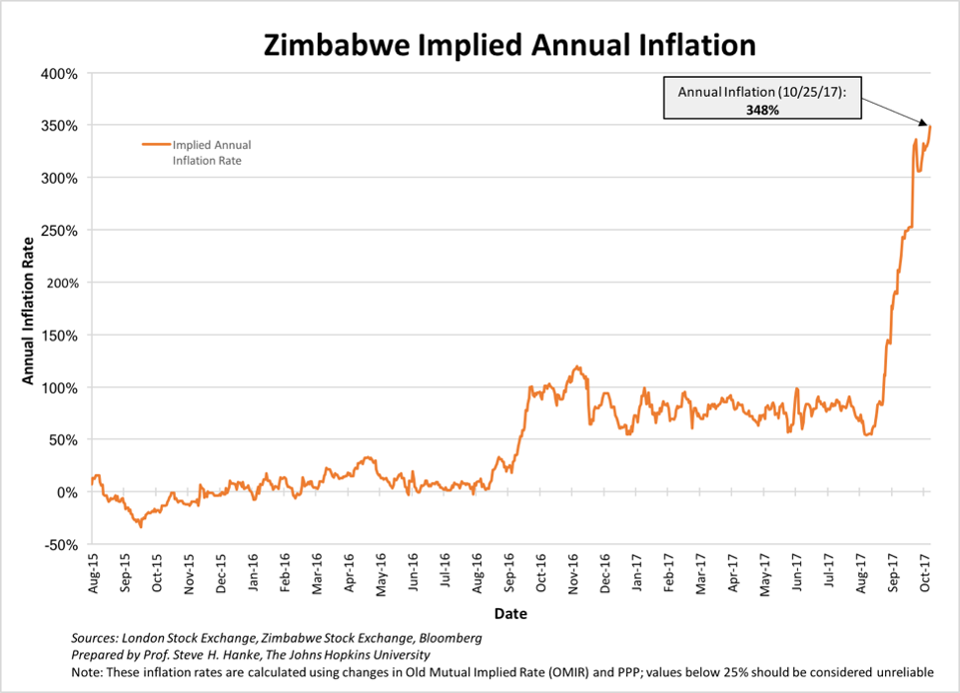

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

The Path to the Final Crisis and Negative Rates

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided ...

Read More »

Read More »

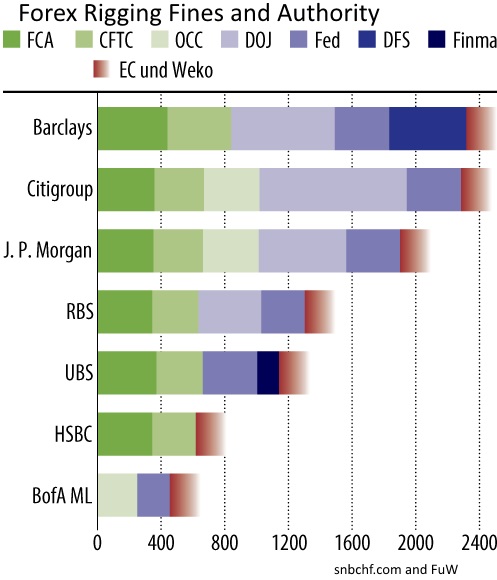

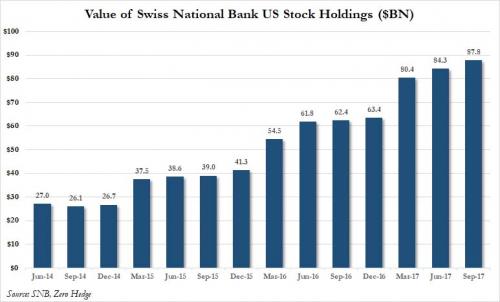

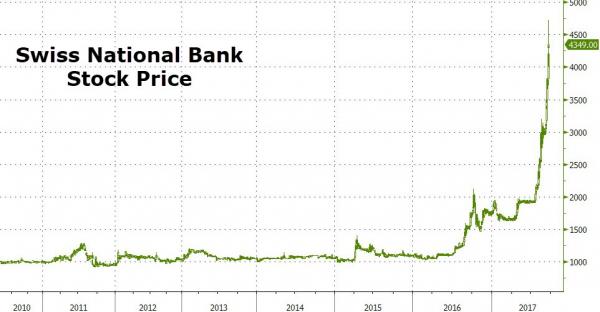

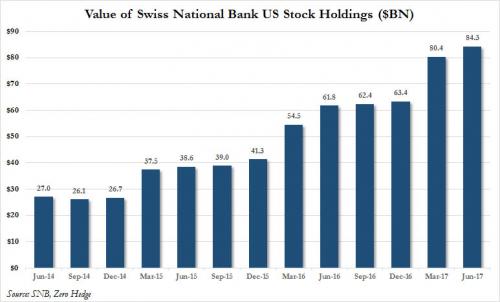

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative ...

Read More »

Read More »

HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NI...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions...

Read More »

Read More »

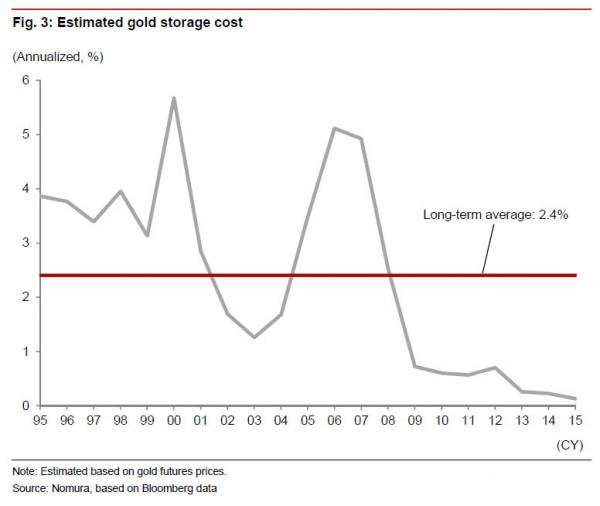

How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Pan...

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »