Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first.

The market has started testing the central banks

In recent years, FX investors had to focus primarily on getting three key market drivers right: global risk sentiment, commodity prices, and which central bank will ease more and deeper into unconventional policy territory. Interaction between these three made life difficult for FX investors. However, looking back, these three can explain the biggest moves in the FX markets in the post-crisis years: the JPY weakening when Abe and Kuroda pushed with Abenomics; the EUR weakening when the ECB introduced QE after a long delay; the weakening of commodity currencies when oil prices collapsed; the strong CHF during the Eurozone crisis and when the SNB removed the EUR floor; and the EM rally during Fed QE and the sell-off when the Fed started QE tapering, to mention some of the most notable examples.

However, something fundamental has changed in the FX markets this year. Risk sentiment and commodity prices remain key market drivers, with China and oil prices in particular. But the market reaction to central bank policies has changed substantially.

Five G10 central banks have surprised markets with their policy easing this year, namely BoJ, ECB, RBNZ, Riksbank and Norges Bank, but their currencies are now stronger. With the exception of New Zealand, equities are also down for the year in these countries, which raises questions about the effectiveness of their monetary policies. In relative terms, the RBNZ was the most effective in weakening its currency, while the Norges Bank the least effective. A weaker currency may not be the main goal of monetary policy easing, but a stronger currency--and weaker equities--after having eased more than markets had expected is definitely a puzzle.

We have recently argued that markets have stopped focusing on what central banks are doing and are now focusing on what central banks may or may not do ahead.

- In the case of the BoJ, investors took the surprise of a rate cut to negative levels in January as a sign that QE had reached its limits. They are now challenging Abenomics directly, as JPY is strengthening despite the improved global risk sentiment and market expectations for more BoJ easing in the April meeting. Indeed, our tail risk scenario for USD/JPY at 100 in our year ahead report has now become our baseline risk scenario.

- In the case of the ECB, investors (wrongly) took Draghi’s statement that there would be no more deposit rate cuts as a sign that the ECB was reaching its limits, despite clear evidence that negative rates were counterproductive and the ECB commitment to do more QE instead—the ECB minutes actually suggest that the depo rate has not reached its floor and that more cuts are possible if the outlook worsens. Indeed, not only is the Euro stronger after the March ECB meeting, but inflation expectations and equities are almost back where they started. Looking at the market reaction, it is as if the ECB did nothing in March.

- In the case of the Scandies, improving data (Sweden) and rising inflation (Norway) have made monetary policy easing ineffective for FX markets, as investors see central bank easing as a buying opportunity.

- The RBNZ has been the most effective of the five central banks in our view, but this is because they have plenty of conventional policy room to use if necessary.

- The market reaction to the surprisingly dovish comments by Yellen in March, despite improving US data and rising inflation, provides further evidence, as she persuaded markets that the Fed had a third mandate, global market stability.

Every case is different, but the common characteristic is that policy actions and forward guidance move markets only by affecting expectations for policies ahead, with such expectations often moving to different direction than what central banks had intended.

Transition to a new regime and the next big FX trade

We believe that the FX reaction to central bank policies this year reflects a transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. It is unlikely, in our view, that the next big FX trade will be from a central bank that surprises markets by easing policies more; this was the case in recent years, but not anymore. We consider more likely that the next big trade will be from a central bank that gives up easing in response to strong data and, even more, rising inflation (see Inflation and FX: What if the dog starts barking?). The Scandies offer an example, as investors have already started fighting these central banks. Our US economists also expect rising inflation to force the hand of the Fed to hike rates twice this year. We are not saying that we are about to see high inflation in the global economy. We are only saying that central banks cannot keep a loose monetary policy stance forever and this is the year that some of them may be forced to stop.

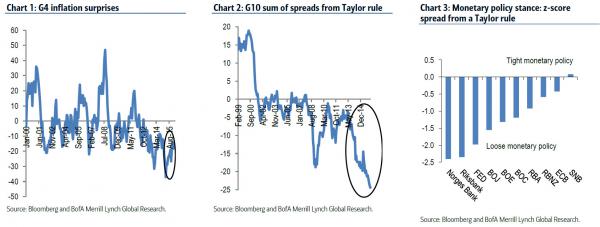

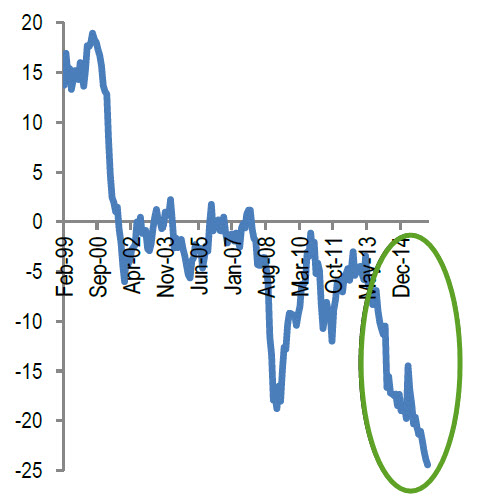

A number of pieces of evidence suggests that price pressures may indeed force some central banks to give up easing this year, triggering large FX moves. Commodity prices have stabilized. Inflation surprises remain negative, but have been declining (Chart 1). The G10 monetary policy stance is the loosest it has been in recent decades (Chart2), with every single central bank except the SNB having a loose stance compared to its own history (Chart 3). As long as the global recovery continues, some central banks will have to stop easing and eventually start tightening. We also note that monetary policies affect the economy with a long lag, usually more than a year, suggesting that it is just a matter of time for some central banks to find themselves behind the curve. Giving up could trigger sharp market moves in our view, close to the USD move after the Fed announced QE tapering, or the CHF move when the SNB removed the EUR/CHF floor.

Which central bank is likely to give up first?

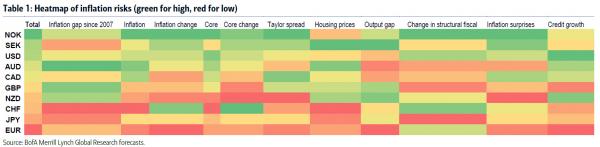

We look at a number of indicators to help us determine which central bank is likely to give up easing and eventually tighten policies first. Some are backward and some forward looking. They include: CPI inflation and its change, core inflation and its change, an index of inflation surprises, the cumulative CPI inflation gap from the 2 percent target since 2007, the spread from a Taylor rule, change in housing prices, credit growth, the output gap, and the change in the structural fiscal balance. We could include more, but we think that these indicators capture inflation pressures and risks of overheating well enough for our purpose.

Table 1 shows the results in a heatmap format, based on simple ranking of the above indicators. Our results point to inflation risks in Norway, Sweden and the US, particularly relatively to the Eurozone, Japan and Switzerland. This suggests that inflation pressures and overheating are more likely to force the hands of the Norges Bank, Riksbank and the Fed to stop easing/tighten, while the ECB, the BoJ and the SNB are likely to retain a loose monetary stance and even ease policies more.

What if we are wrong?

We can think of three scenarios in which we will be wrong.

First, it takes longer for inflation pressures to emerge and all central banks remain on hold or ease further this year.

Second, inflation pressures do emerge in some countries, but the respective central banks ignore them and are willing to accept higher inflation in the short term to support their economies.

And third, the world is in a Japan scenario and monetary policies will remain accommodative for years to come.

We believe that these three scenarios are unlikely. First, Inflation is already picking up in some cases and could intensify as commodity prices have now stabilized. Indeed, our US economists have argued that various measures of slack have narrowed, wage growth has begun to gradually but broadly improve and the evidence suggests a broad pick-up in growth (see Waking up to wage growth). Second, the case of Norway this year suggests that even if a central bank tries to ignore inflation pressures and continues easing policies, the currency could appreciate as markets do not expect such a monetary policy stance to be sustainable. And third, although the global recovery has been weak, it is already much stronger than in the experience of Japan in the last two decades; progress in deleveraging has also been much faster.

Market implications

Although divergence of monetary policies has not been a market driver this year, central banks still drive markets. We have argued in this report that markets have already started testing central banks and have been reacting counterintuitively to policy easing. Central banks can fight back, as the Fed has successfully done recently, but we do not believe that this is sustainable as long as the global recovery continues. At some point, we believe this year, central banks will have to stop easing policies and start preparing markets for tightening. The next big FX trade is likely to take place at that point.

We believe that positioning for a scenario in which some central banks give up easing is worth the cost. Our framework supports being long SEK and NOK against EUR and CHF, and being long USD/JPY and short EUR/USD. We believe that these trades will work in a risk-on market in the months ahead, particularly taking into account current levels. Our analysis suggests that although the market is now testing the ECB and the BoJ, EUR and JPY can still weaken in the months ahead if the data force the Fed to tighten. Moreover, the data also justifies more easing from both the ECB and the BoJ, which can be more effective in weakening their currencies if the Fed is hiking at the same time.

If markets remain fragile and risk sentiment volatile, we would be more cautious about shorting JPY and CHF. From this point of view, short EUR/USD and/or short EUR against the scandies could be good trades to hedge shifts in central bank policies. On other crosses, our analysis is bullish AUD/NZD and USD/CAD, and bearish EUR/GBP and cable.

* * *

So in summary - the next big trade is to fight "The Feds" by betting on the first one to fold in the face of their increasingly impotent capabilities.

Source: BofAML

Full story here Are you the author? Previous post See more for Next postTags: Abenomics,Bank of America,central banks,China,Eurozone,Global Economy,Japan,Monetary Policy,New Zealand,Norges Bank,Norway,Output Gap,recovery,Switzerland,USD/JPY