Tag Archive: Output Gap

The Big One, The Smoking Gun

It wasn’t just the unemployment rate which was one of the key reasons why Economists and central bankers (redundant) felt confident enough to inspire 2017’s inflation hysteria. There was actually another piece to it, a bigger piece potentially complimentary and corroborative bit of conjecture. I write “conjecture” because despite how all this is presented in the media there’s very little precision to any of it.

Read More »

Read More »

Expectations and Acceptance of Potential

The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged.

Read More »

Read More »

Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant.

Read More »

Read More »

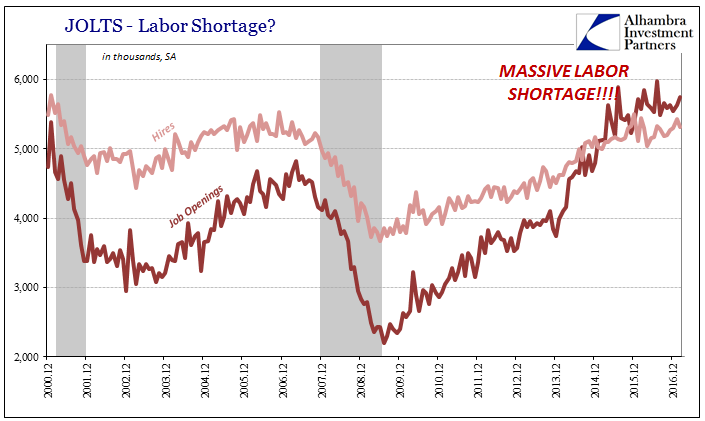

Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to give those relationships some...

Read More »

Read More »

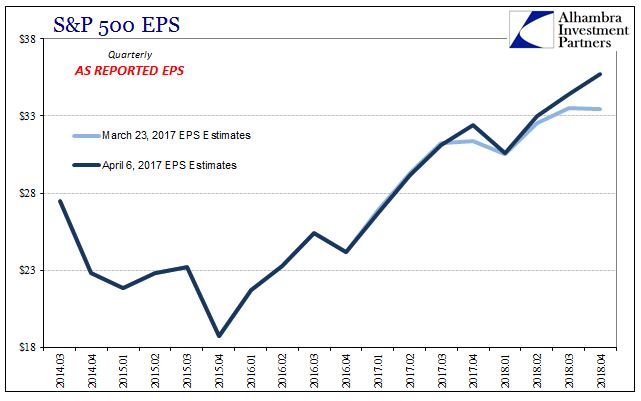

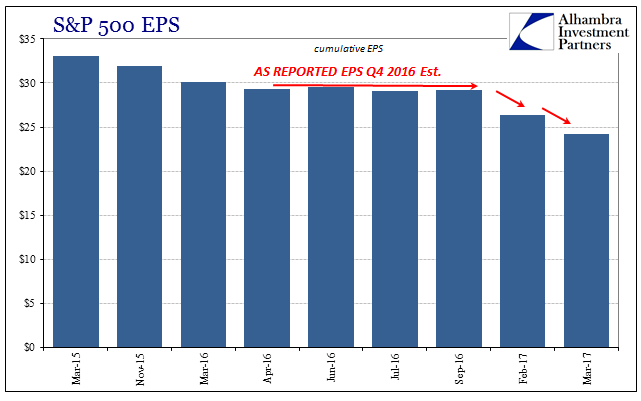

Earnings per Share: Is It Other Than Madness?

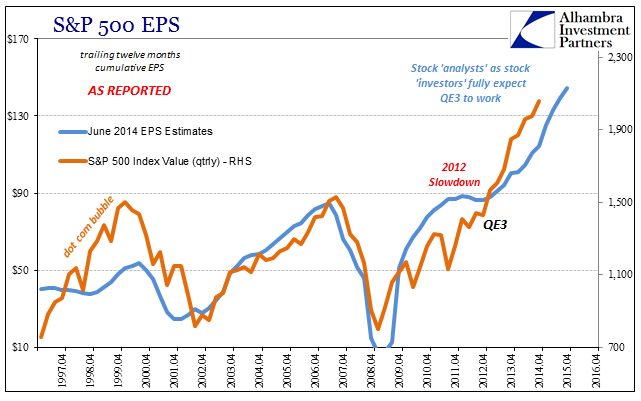

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04 to $24.16. At $26.70, that would...

Read More »

Read More »

The Inverse of Keynes

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits.

Read More »

Read More »

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »

The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense.

Read More »

Read More »

No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry.

Read More »

Read More »

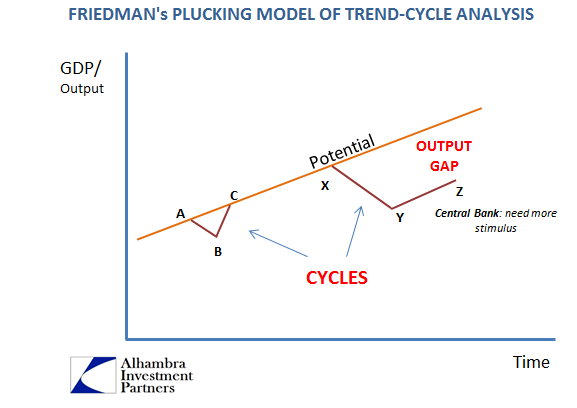

Their Gap Is Closed, Ours Still Needs To Be

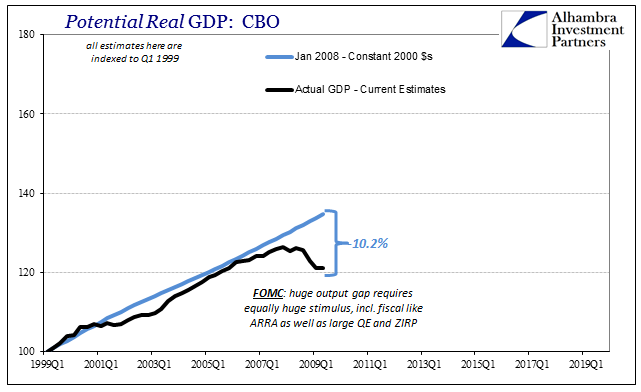

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

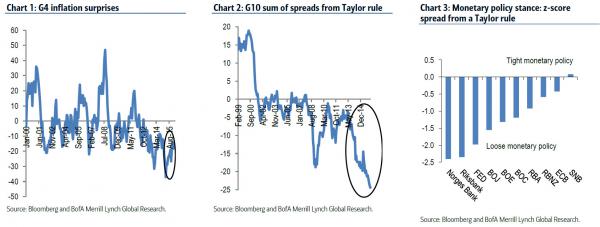

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »