Tag Archive: central banks

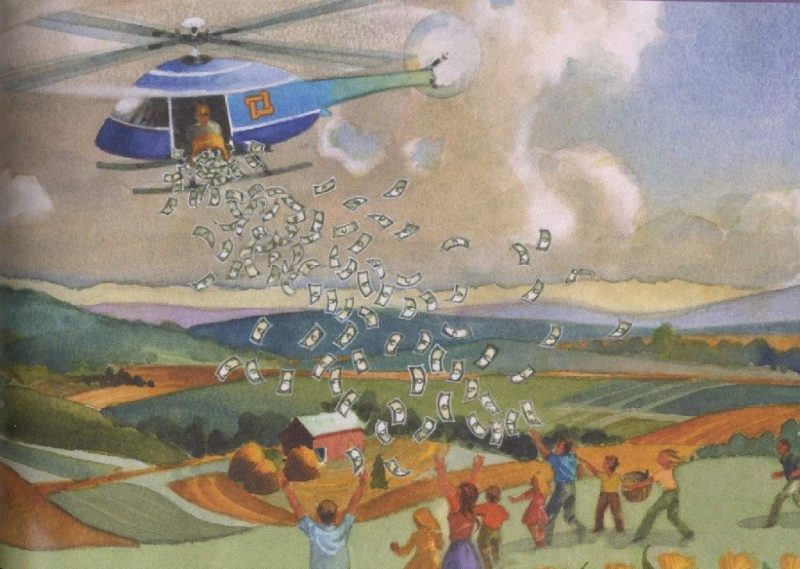

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

Alan “Bubbles” Greenspan Returns to Gold

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.

Read More »

Read More »

SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full.

Read More »

Read More »

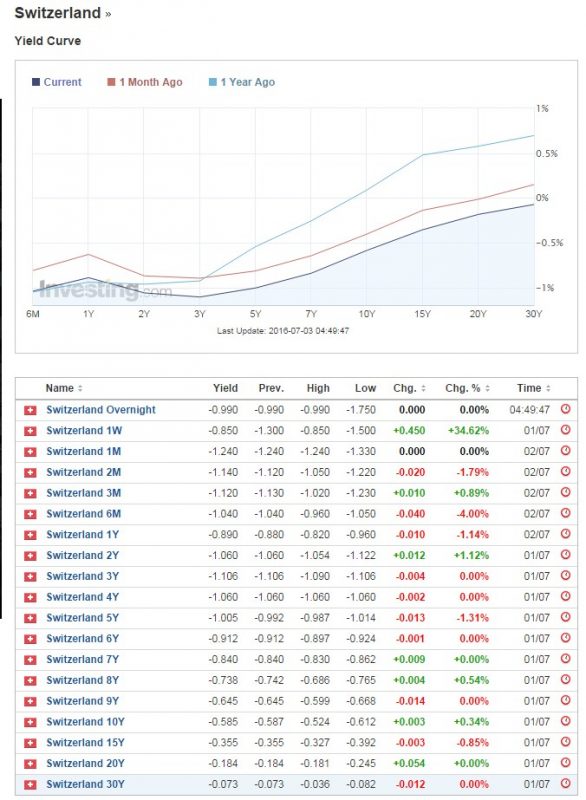

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

When the Deep State Controls All Wealth

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out.

Read More »

Read More »

Why the Fed Will Talk Down the Dollar

And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate.

Read More »

Read More »

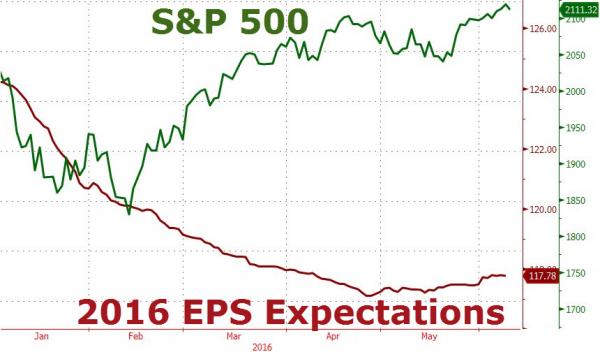

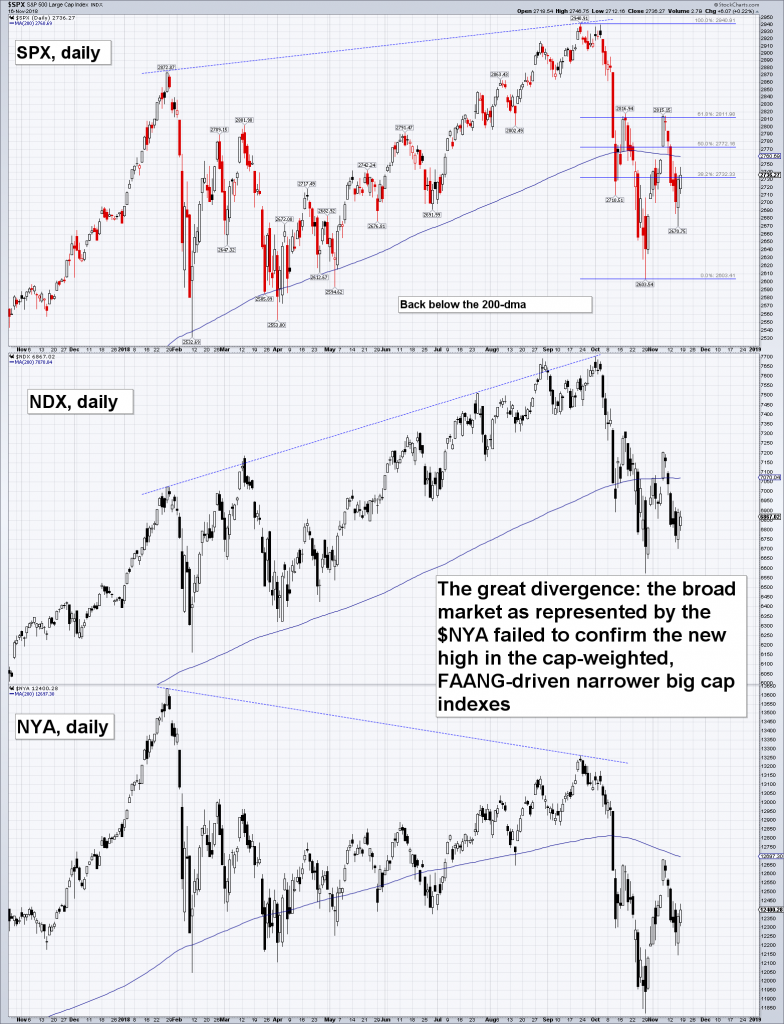

BofA: To Save Markets Central Banks Just Made Inequality And Populism Even Worse

There is a large dose of irony to the post-Brexit market response: while on one hand stocks have soared and as of today the S&P500 has already recouped more than half its post-Brexit losses (the SPX sank 5.7% peak-to-trough since the referendum and has since bounced 3.5%) an even sharper reaction has been observed in bonds.

Read More »

Read More »

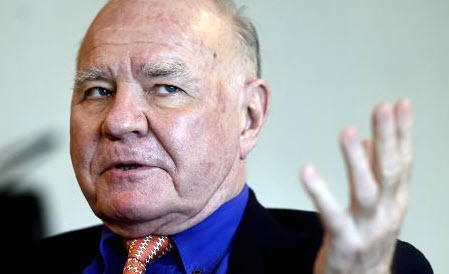

“Brexit Sends A Clear Message To Sick Political Elite” Marc Faber Sees “Only Good Contagion”

"We're moving into a global recession that has nothing to do with Brexit," warns Marc Faber stressing that Britain leaving the EU would not be disastrous, saying that if Switzerland can operate in a "single" market and outside of the EU so can Britain.

Read More »

Read More »

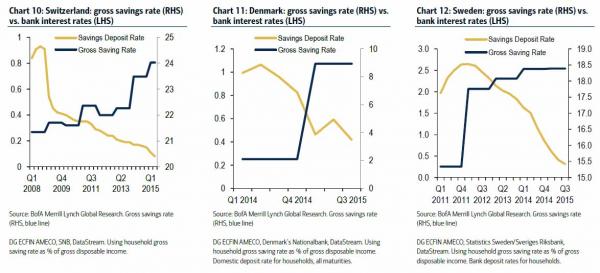

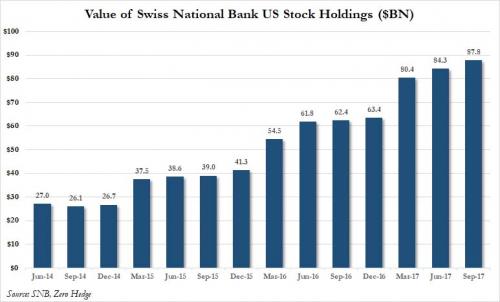

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

The British Referendum And The Long Arm Of The Lawless

Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law.

Read More »

Read More »

World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2.

Read More »

Read More »

IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leav...

Read More »

Read More »

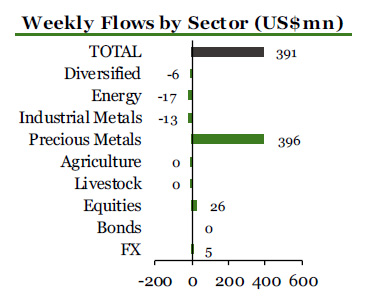

Need Safe havens: CHF or Gold?

In times of negative interest rates and falling earnings per share, gold is the ultimate safe haven. Due to negative rates, it is not the Swiss Franc.

Read More »

Read More »

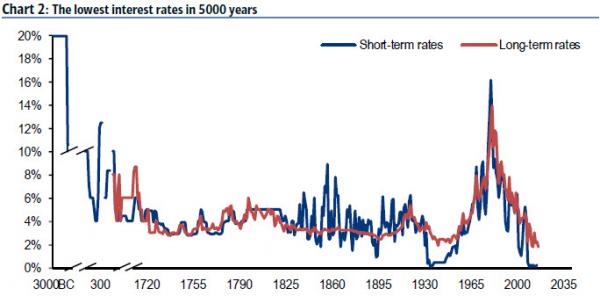

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

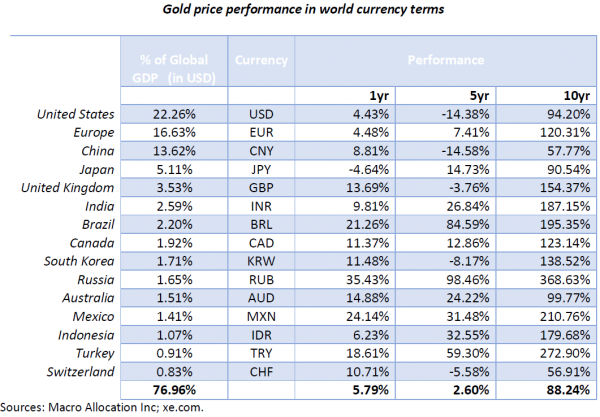

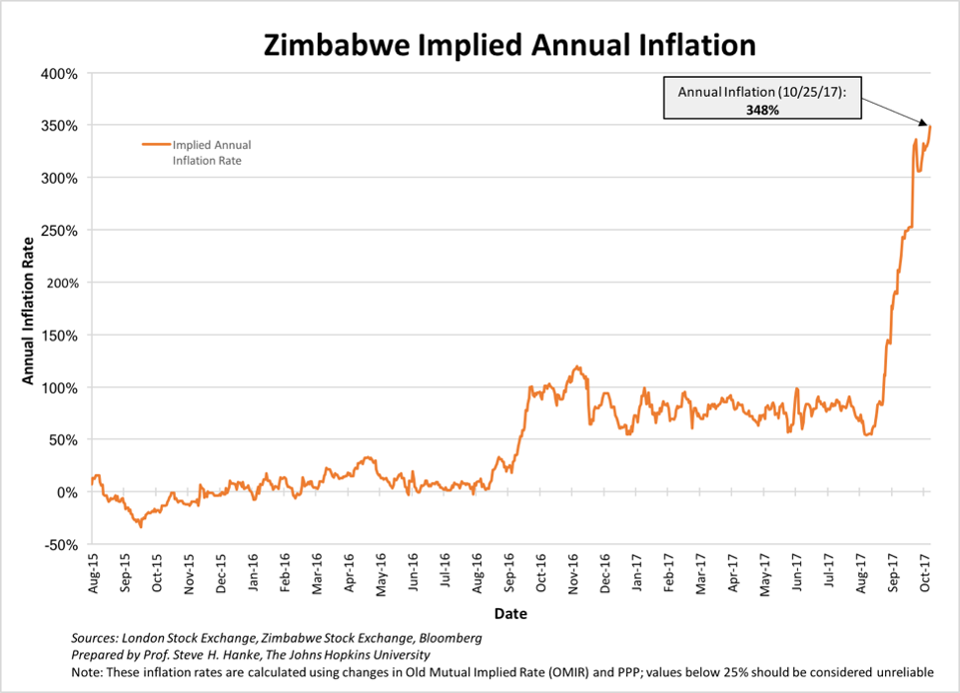

The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

Authored by Paul Brodsky via Macro-Allocation.com,

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most political...

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »