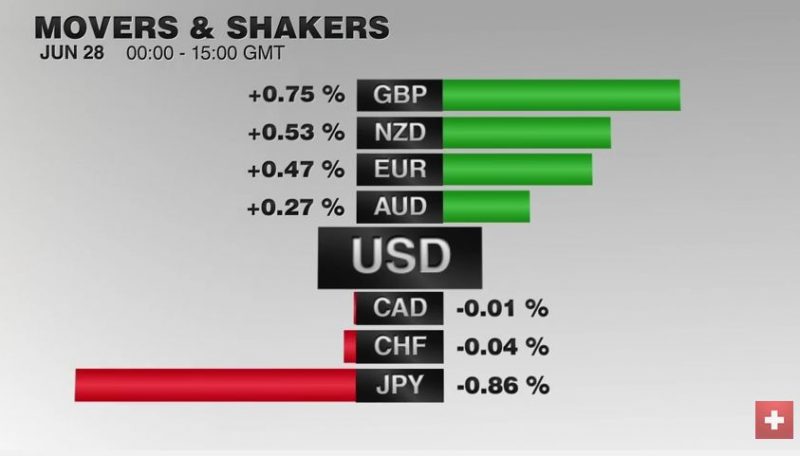

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

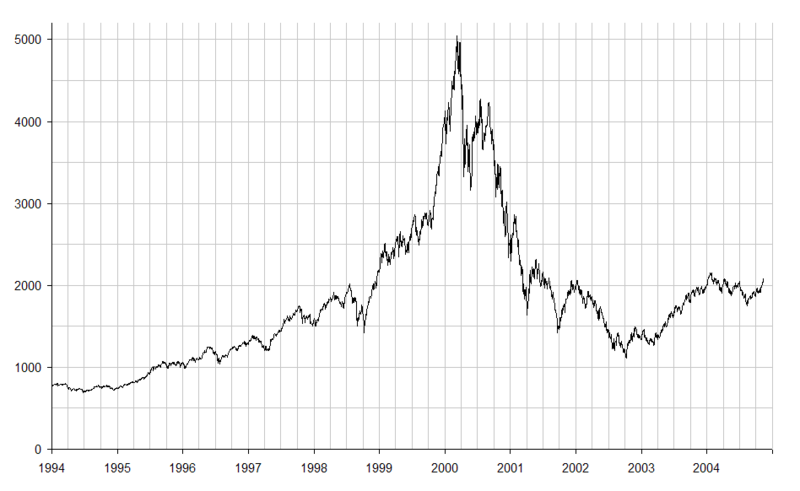

Tag Archive: U.S. Case Shiller Home Price Index (Macro)

The S&P/Case-Shiller House Price Index measures the change in the selling price of single-family homes in 20 metropolitan areas.

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

Why is Freddie Mac Reporting a Loss?

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b...

Read More »

Read More »

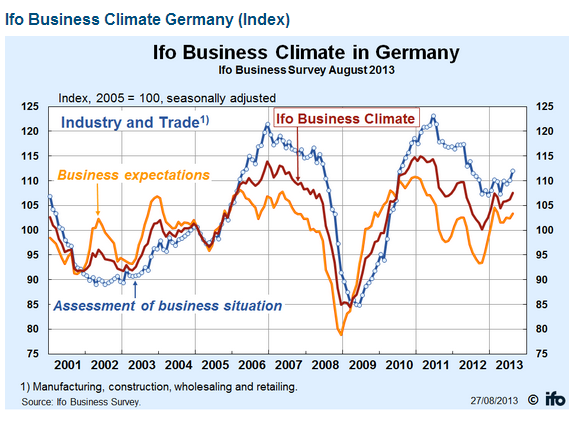

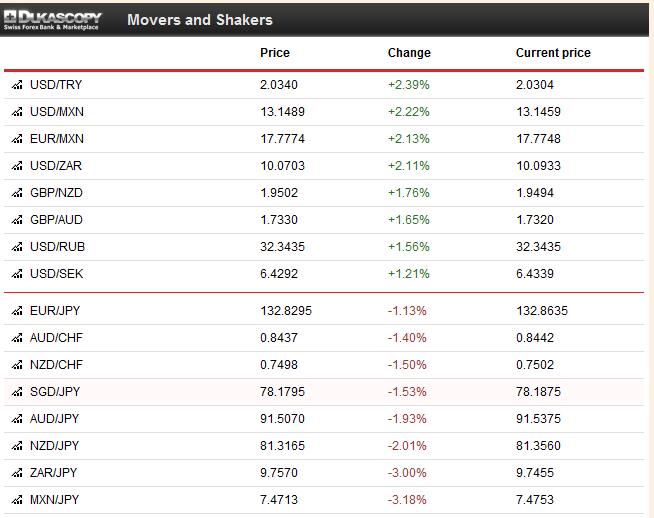

Fundamentals and FX Movements, Week September 23 to September 27

Weekly summary of fundamental news on FX with a focus on CHF and gold price movements. Weekly price movements The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD …

Read More »

Read More »

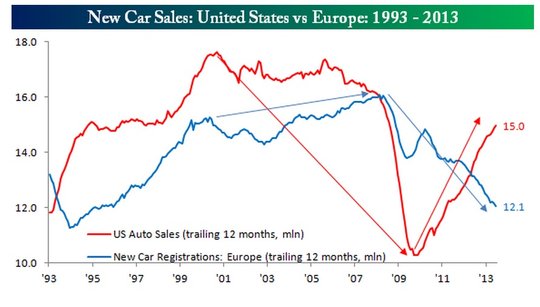

Is U.S. Housing Really Recovering? Pros and Cons

The U.S. housing market is the main driver for risk on/off movements and therewith implicitly of the gold price. We state charts, e.g. Shiller Home Price Index and U.S. New Home Sales statistics, arguments in favour of a housing recovery and the counter-arguments.

Read More »

Read More »

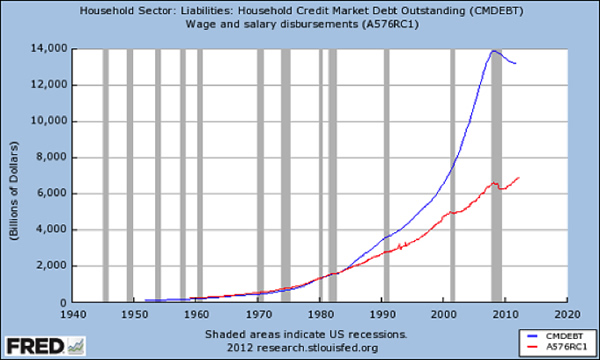

Is U.S. Housing Really Recovering? A Discussion

Collection of 6 sources showing: Housing Market Index,Home Inventory, S&P/C-Shiller, New Home Sales&Prices and Ratio to Population, MBS Purchases by the Fed, Household Liabilities and Dependency Ratio.

Read More »

Read More »