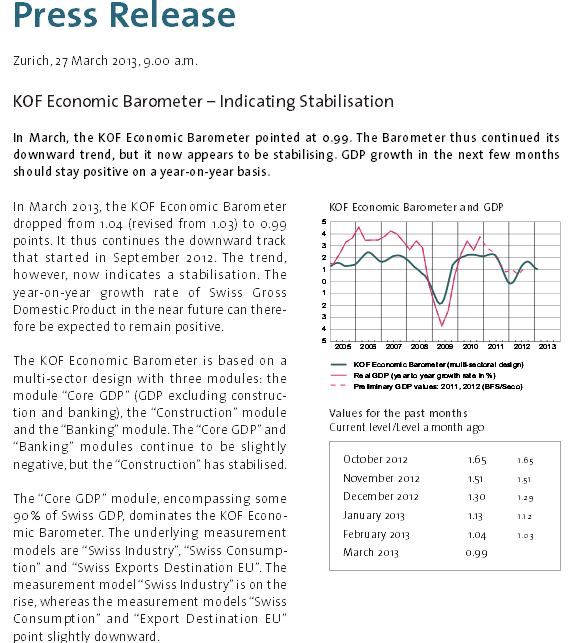

Switzerland continues to see a robust economy, even if the leading KOF indicator fell to 0.99 after highs of 1.68 in September.

On other side, real and nominal wages continue to increase. As opposed to the KOF value, the UBS consumption indicator is rising. This shows that the internal economy is able to balance the weak external demand.

The employment level is rising thanks the increasing number of commuters and immigrants. Despite the weak KOF value, exporters are resilient: the exporter-driven SVME PMI is in positive territory, after falling to levels of 44 in November 2011. Until September, industrial production was strongly increasing, in particular sales to foreigners. As confirmed by the KOF, construction is stabilizing. This despite strong investments funds flooding out of Europe as a whole and despite the introduction of two regulatory measures on the Swiss housing boom.

Inflation

At the end of 2012, the purchaser price index was strongly rising compared to the end of 2011 – due to weak oil prices and recession fear at the end of 2011 – but prices have come down now. Consumer prices are still negative YoY, but should rise over zero when the effect of the last year March’s high oil prices and the FX rate-related deflationary effects are washed out. In the meantime Sweden and partially Norway have taken the place of Switzerland. Sweden is already starting a similar deflation caused by the FX rate like Switzerland in 2011.

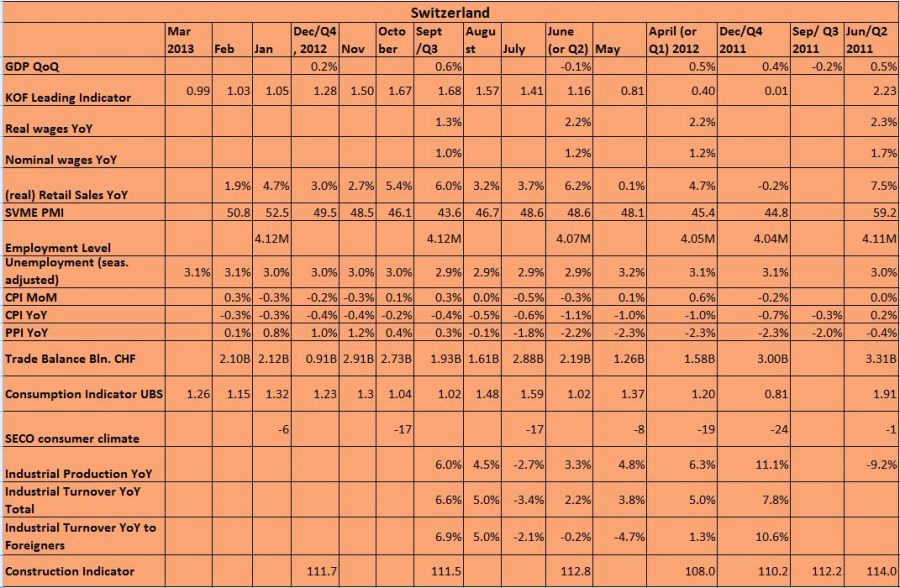

The full data set for Switzerland is here:

Are you the author? Previous post See more for Next post

Tags: Construction,Consumption indicator,GDP,Germany GfK Consumer Climate,industrial production,PMI,PPI,Producer Price,Purchasing Manager,real wages,Retail sales,SECO,SVME,Swiss economy,Switzerland,Switzerland Consumer Price Index,Switzerland KOF Economic Barometer,Switzerland Trade Balance,Switzerland UBS Consumption Indicator,Trade Balance,Unemployment