Category Archive: 2.) Pictet Macro Analysis

Is Europe turning Japanese?

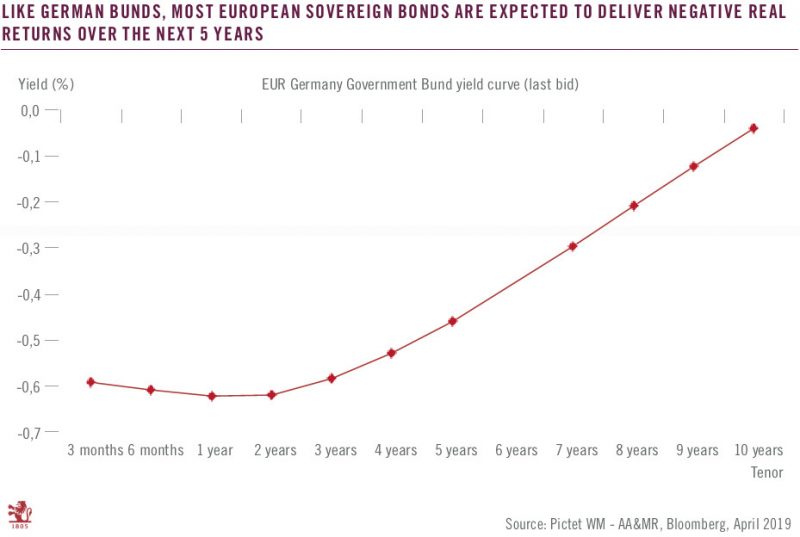

European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019.

Read More »

Read More »

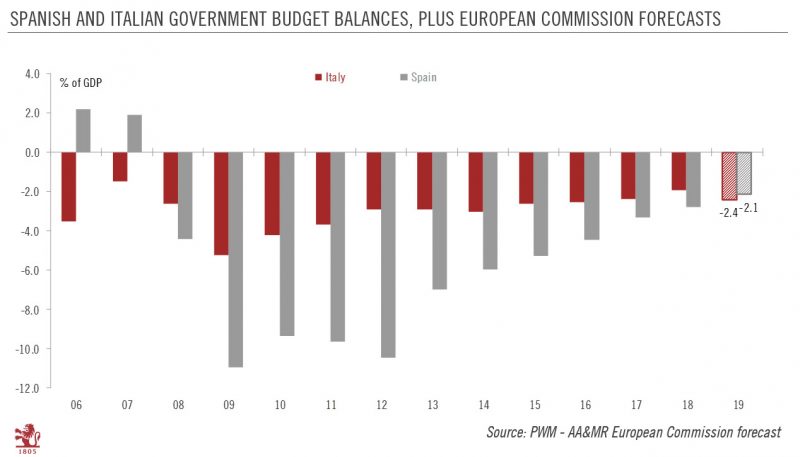

Peripheral bonds after the Spanish election

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility.On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed.

Read More »

Read More »

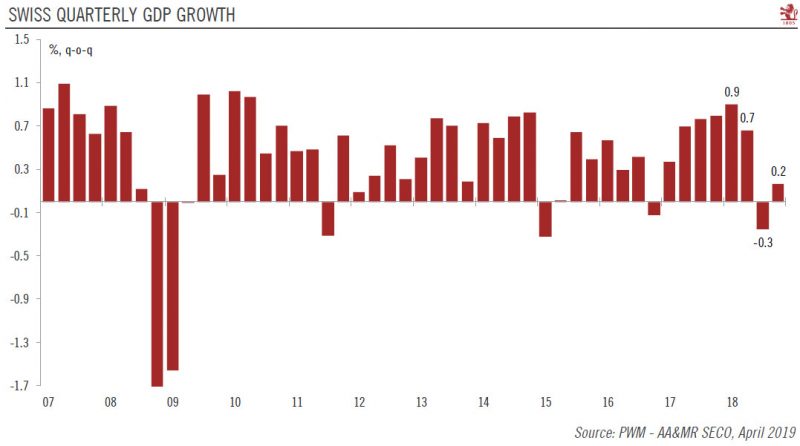

Switzerland: Lower growth, lower inflation

Growth and price rises should moderate in 2019.The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside.

Read More »

Read More »

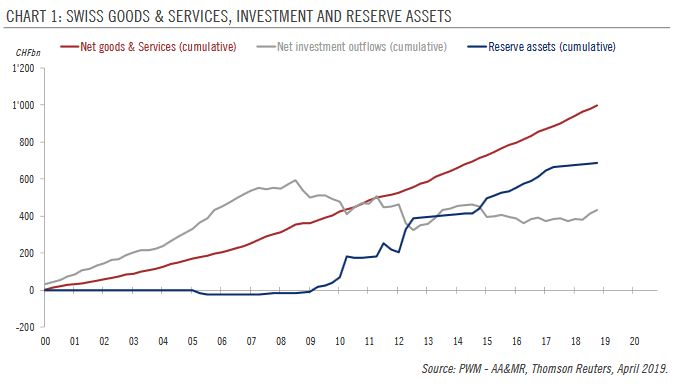

Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less...

Read More »

Read More »

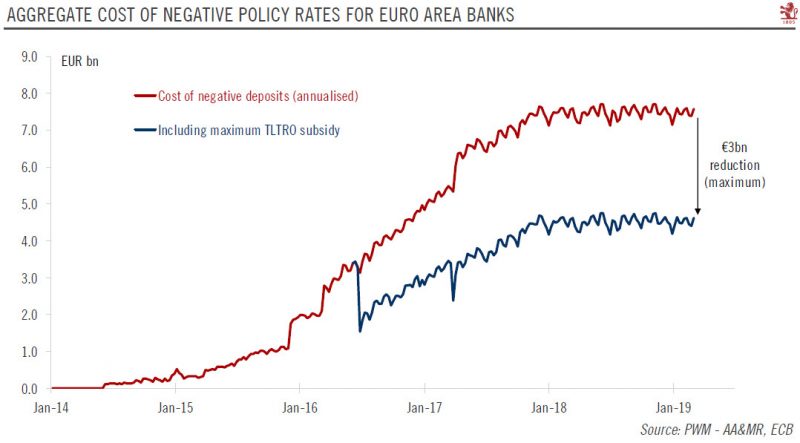

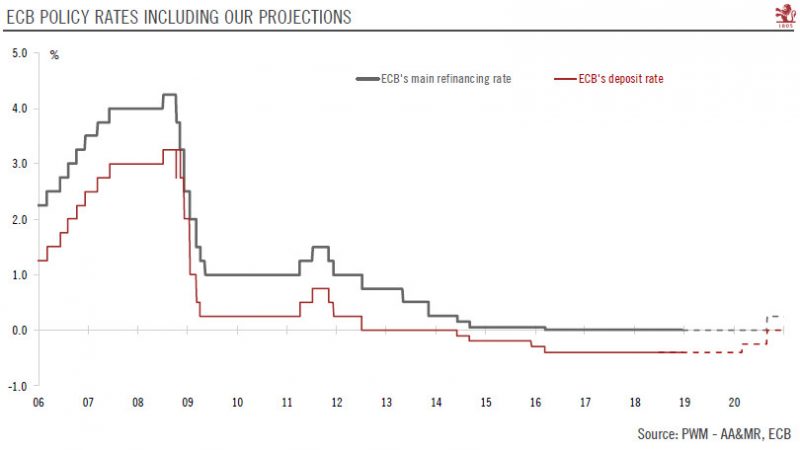

Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.

Read More »

Read More »

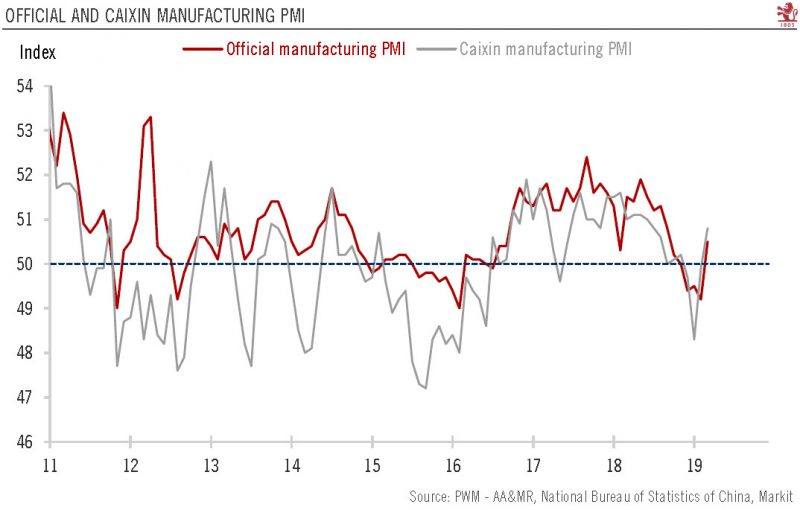

China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0.

Read More »

Read More »

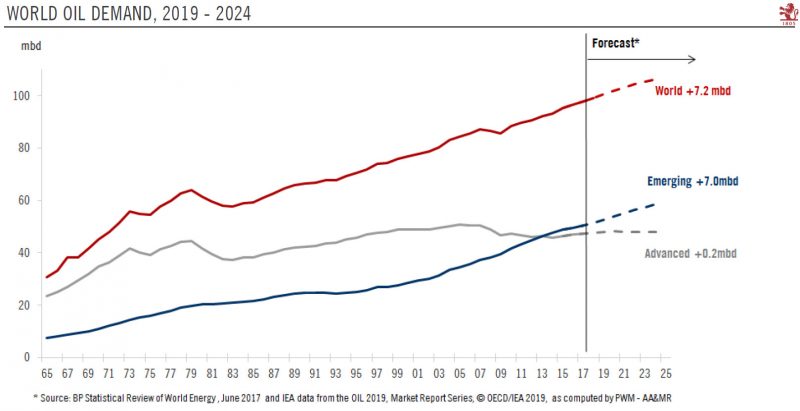

Oil prices supported by OPEC+ cuts…before market risks being flooded again

Increased US export capacity would probably force OPEC+ to change its current tactics.After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.

Read More »

Read More »

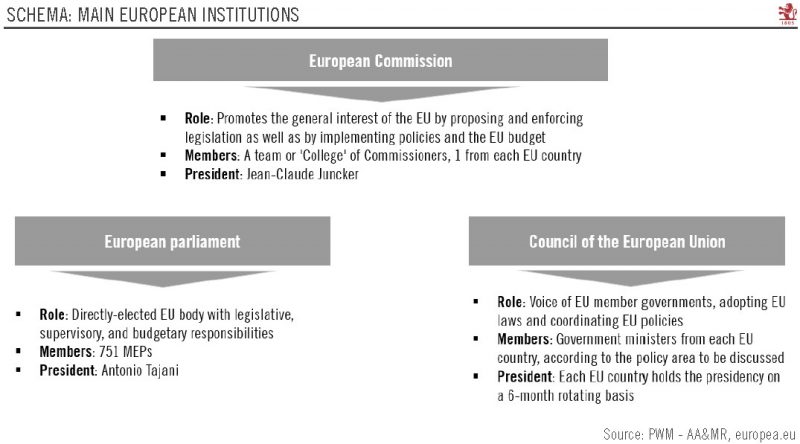

Q&A on European Parliament elections

European Parliament elections, to be held between 23 and 26 of May, will be a key political event in Europe. However, we expect limited short-term impact, given the European Parliament's limited ability to set Brussels' agenda.European Parliament (EP) elections will be a key political event in Europe, a form of ‘midterm election’ in which the electorates can state their approval or disapproval of their respective national governments.

Read More »

Read More »

Germany: signs of rebound ?

German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate.Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations.

Read More »

Read More »

Fed to Show Tolerance for Higher Inflation, Pictet’s Ducrozet Says

Mar.20 — Frederik Ducrozet, senior economist at Pictet Asset Management, discusses Federal Reserve monetary policy and its inflation target. He speaks on “Bloomberg Surveillance” alongside Peter Dixon, global equities economist at Commerzbank.

Read More »

Read More »

Brexit update: UK parliament opts for an extension

After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline.The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years).

Read More »

Read More »

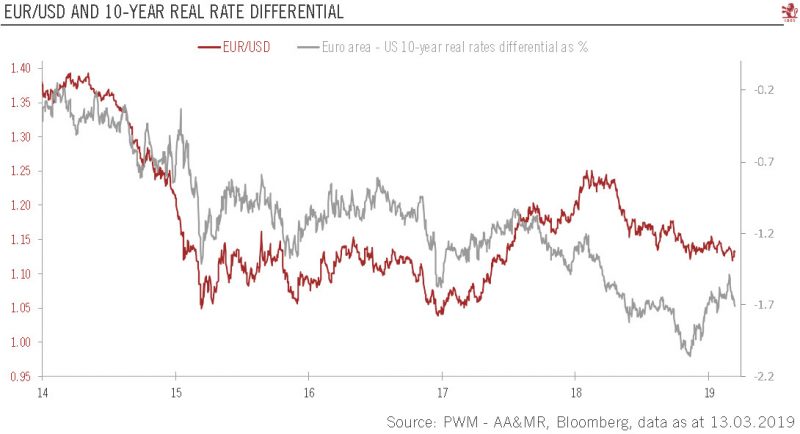

Euro slides against the dollar on ECB dovishness

The euro has declined further against the dollar but should strengthen over next 12 monthsThe euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.

Read More »

Read More »

ECB Forward Guidance: the Devil is in the Detail

Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought.

Read More »

Read More »

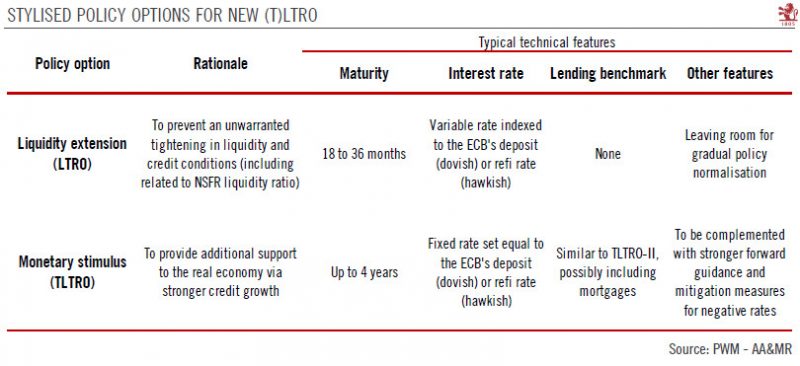

ECB: to LTRO, or not LTRO, what is the question?

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs. Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation.

Read More »

Read More »

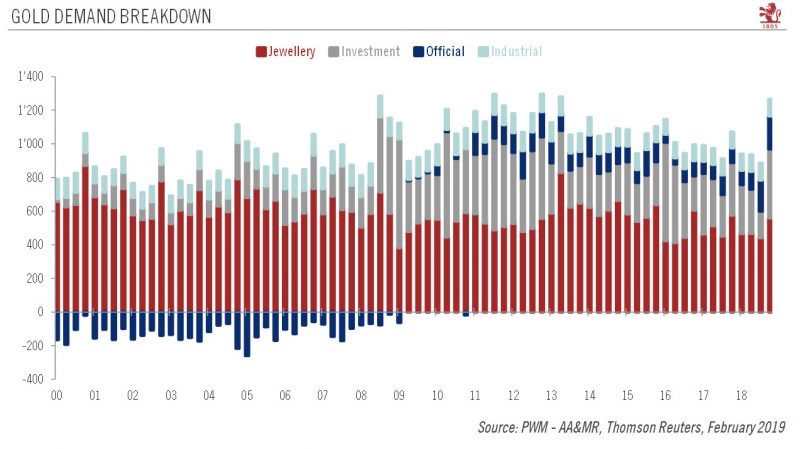

Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4).

Read More »

Read More »

Pictet Perspectives – What to expect from central banks this year

Following the Fed’s recent dovish turn, we could expect other central banks to follow suit. However, according to Frederik Ducrozet, Strategist at Pictet Wealth Management, the ongoing trade tensions and idiosyncratic constraints facing central banks today could limit their room to manoeuvre. We expect the European, Japanese and Chinese central banks to contribute to rising global liquidity this year, more than offsetting any quantitative...

Read More »

Read More »

Pictet Perspectives – What to expect from central banks this year

Following the Fed’s recent dovish turn, we could expect other central banks to follow suit. However, according to Frederik Ducrozet, Strategist at Pictet Wealth Management, the ongoing trade tensions and idiosyncratic constraints facing central banks today could limit their room to manoeuvre. We expect the European, Japanese and Chinese central banks to contribute to rising …

Read More »

Read More »

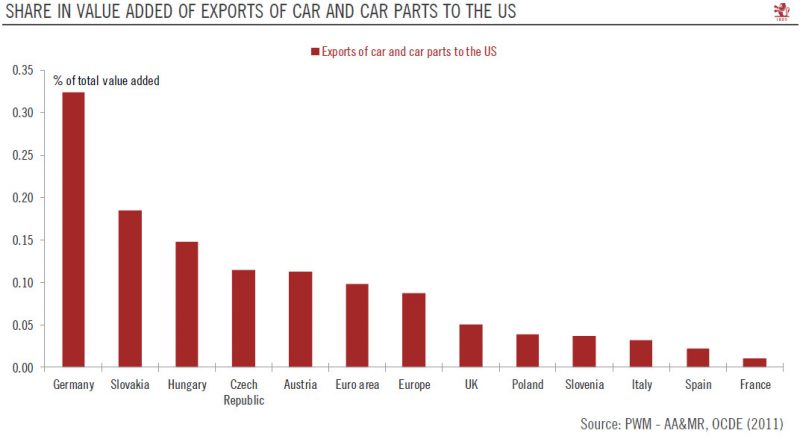

Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium.Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance.The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February.

Read More »

Read More »

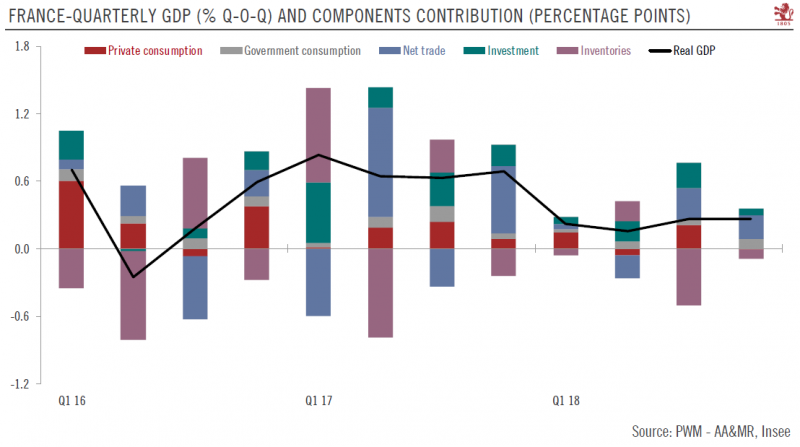

Exports save the day for French GDP growth

Prospects for French economic growth are looking up, but disruptions to consumption are possible.French GDP rose by 0.3% quarter-on-quarter (q-o-q) in Q4, the same pace as in Q3. The details reveal that Q4 exports surged significantly, while household consumption and investment slowed. This left growth for the year at +1.5%, following +2.3% in 2017.

Read More »

Read More »

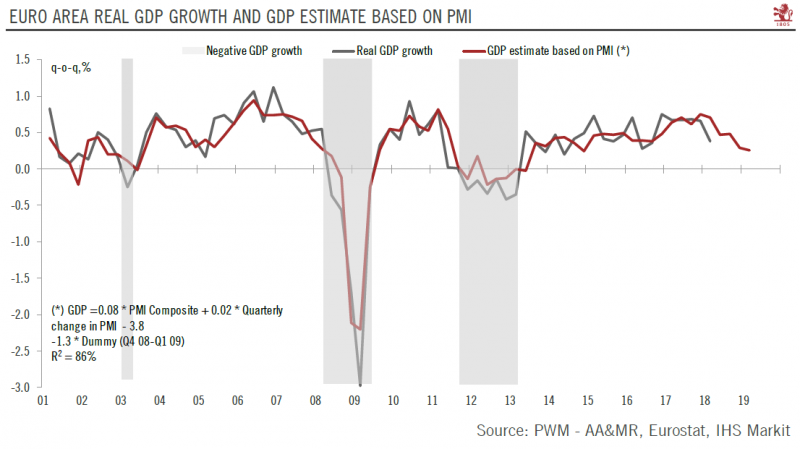

Update on euro area economic activity

The balance of risks to growth in the region is still tilted to the downside.The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013.

Read More »

Read More »