Category Archive: 2.) Pictet Macro Analysis

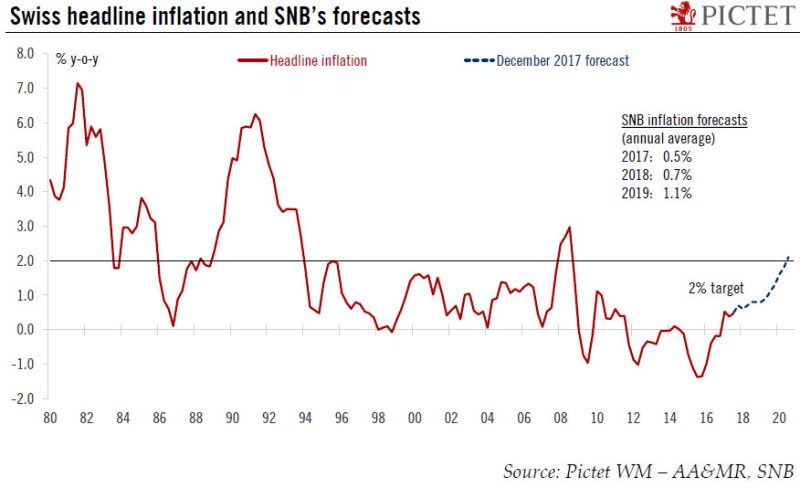

Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between - 1.25% and-0.25% and the interest rate on sight deposits at a record low of - 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency situation”.

Read More »

Read More »

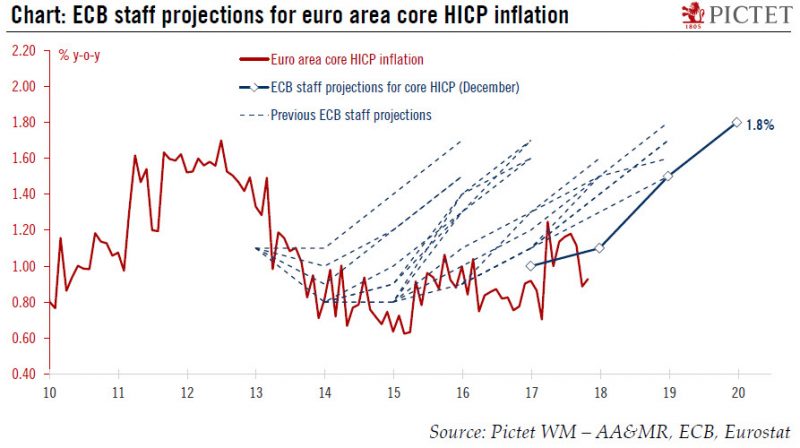

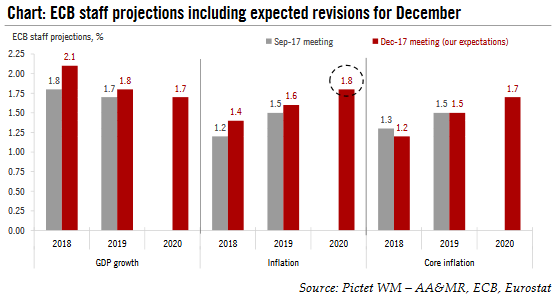

ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” - in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate.

Read More »

Read More »

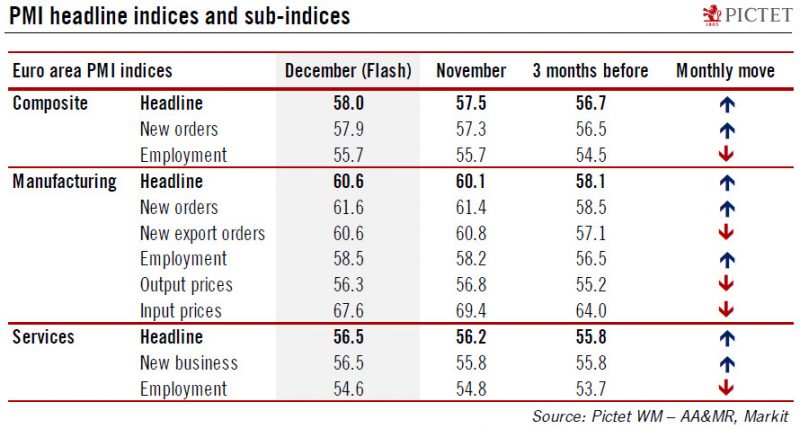

Euro area: The sky is the limit

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

Read More »

Read More »

ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone.

Read More »

Read More »

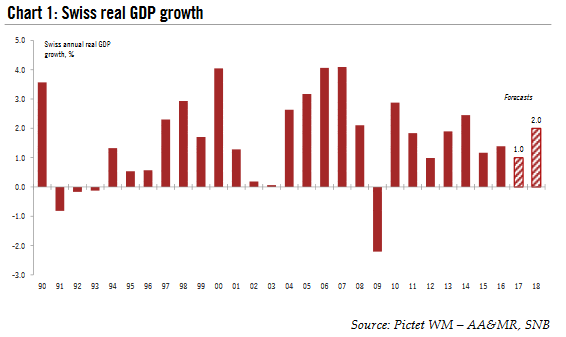

The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0% , its lowest level since 2012 . However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Read More »

Read More »

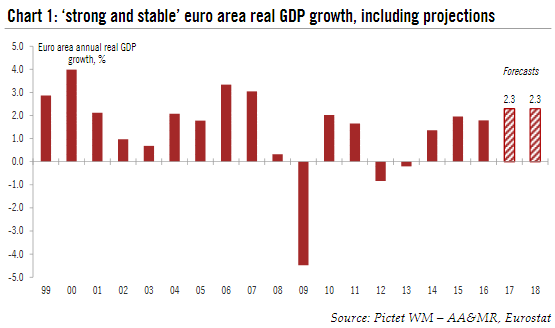

Euro Area Forecast to Grow 2.3percent in 2018

2017 was the year of the ‘Euroboom’ and the removal of political tail risks. Moving into 2018, we mark-to-market strong economic data, including carryover and revisions. We forecast annual GDP growth of 2.3% both in 2017 and 2018. Qualitatively, our forecasts reflect our view that the euro area has reached ‘escape velocity’, with important implications for investors.

Read More »

Read More »

Pictet on the sudden EUR/CHF Appreciation

While we blamed FX traders, that were waiting months for some good European news to push down the CHF, Pictet finds some more explanations.

Read More »

Read More »