Category Archive: 2.) Pictet Macro Analysis

Europe – ECB preview

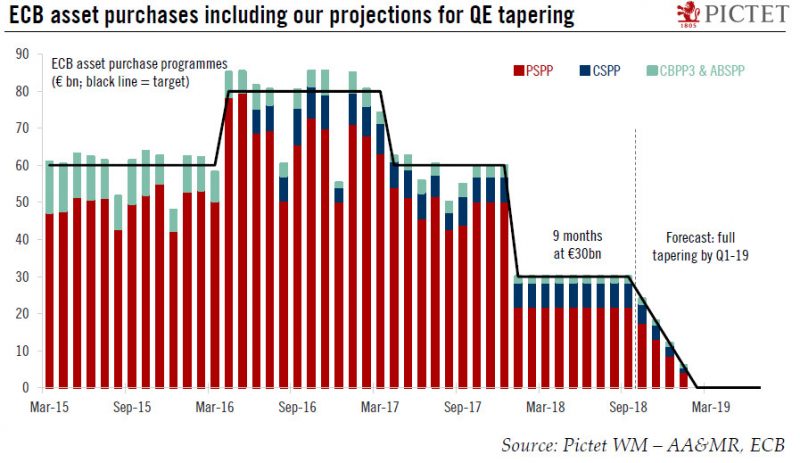

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

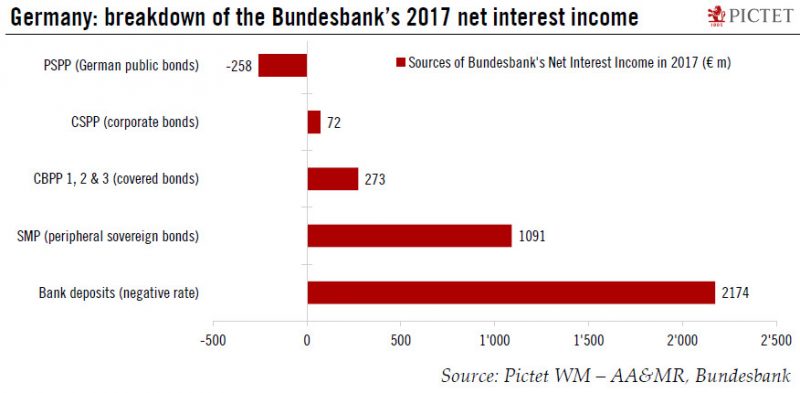

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

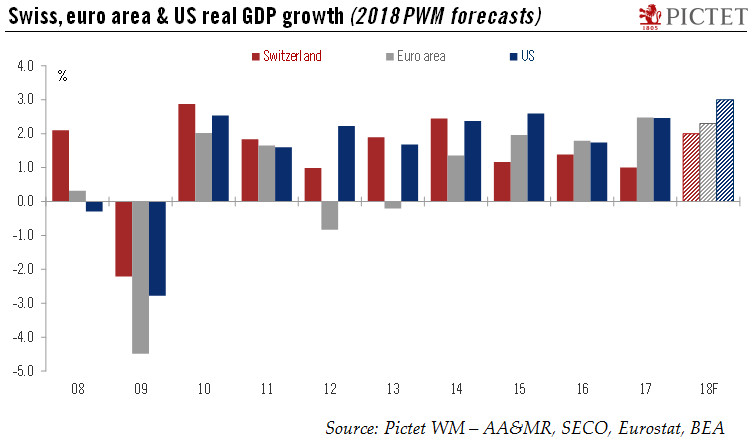

Switzerland: So far so good

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

Read More »

Read More »

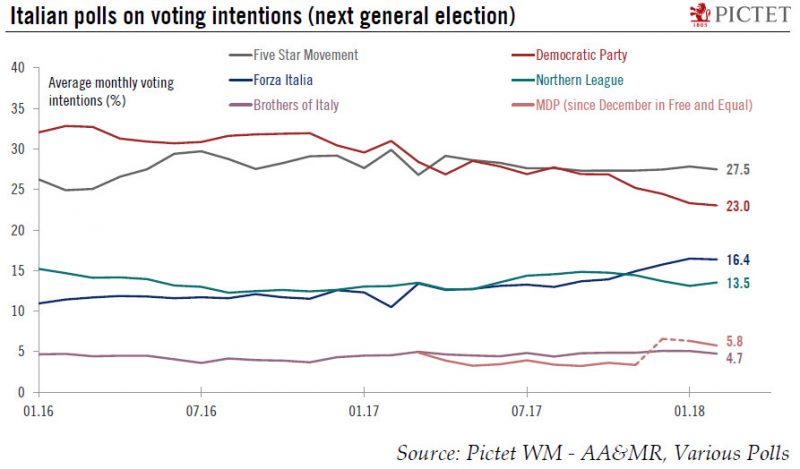

Who will tackle Italy’s root problems?

The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of "first-past-the-post" and 61% via proportional representation, with the remaining 2% reserved for overseas constituencies (see our previous Flash Note for further details).

Read More »

Read More »

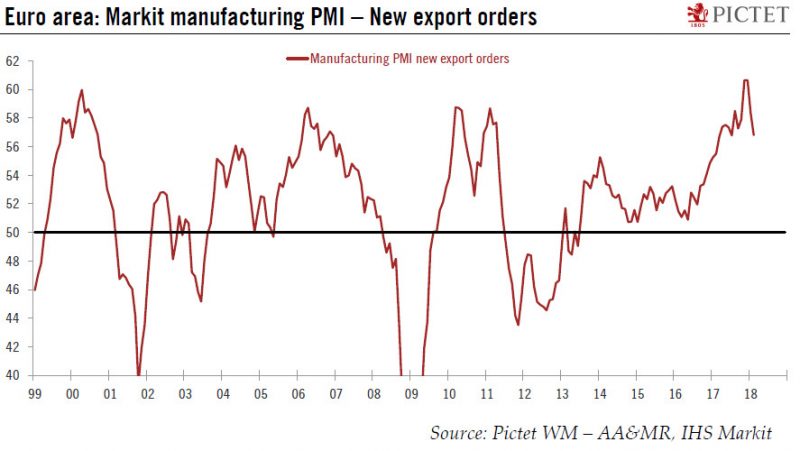

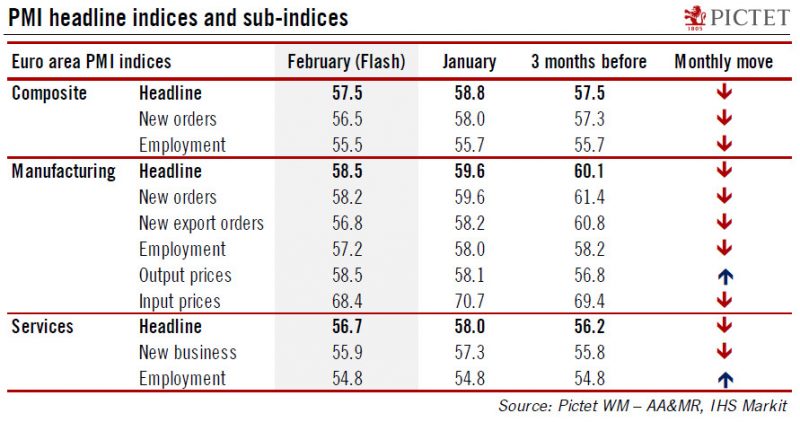

Europe chart of the week – Business surveys

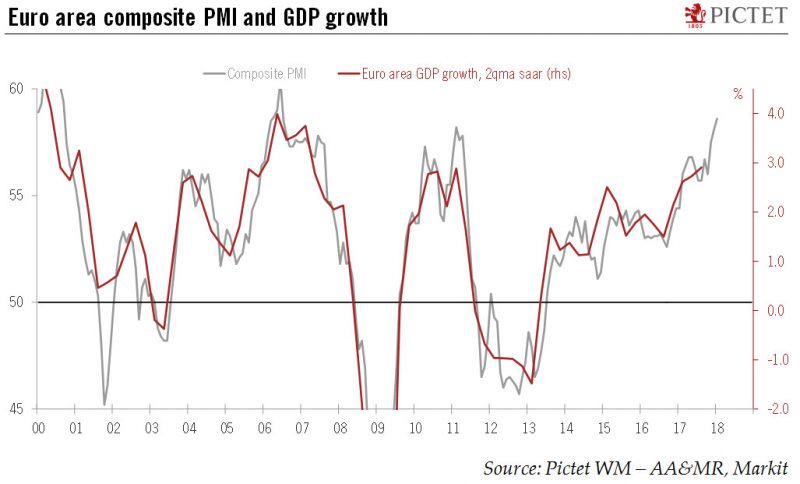

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014. National business surveys painted a similar picture.

Read More »

Read More »

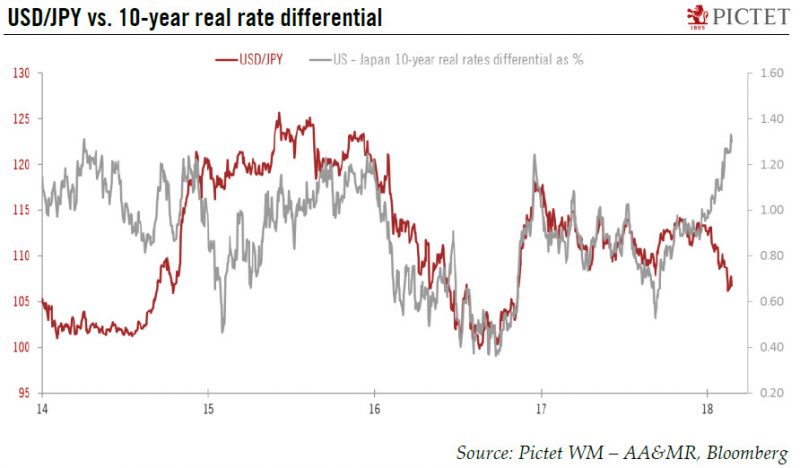

Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Read More »

Read More »

Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in new orders and output slowed...

Read More »

Read More »

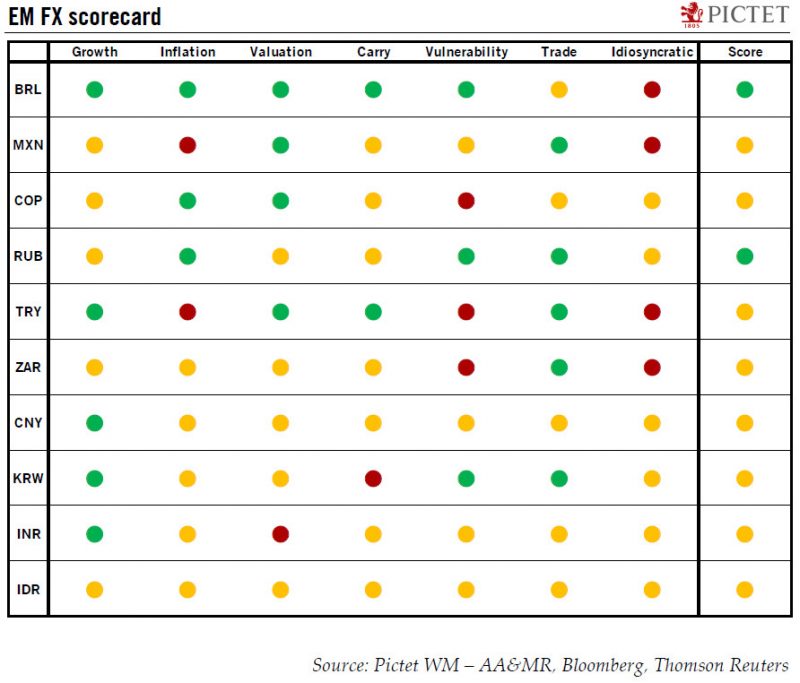

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

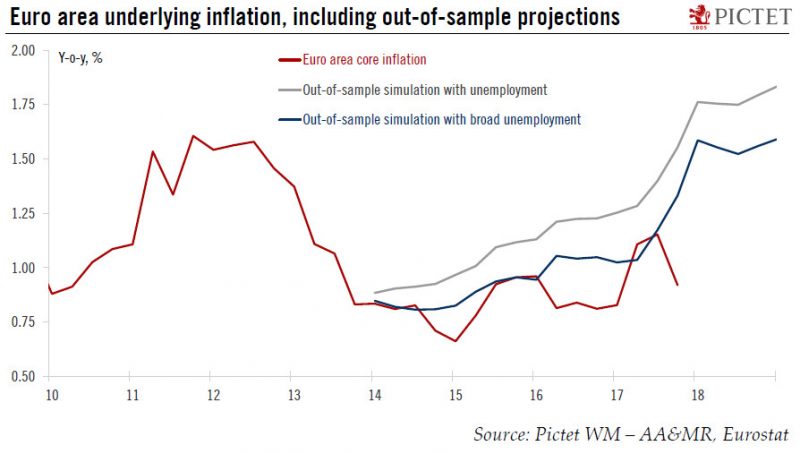

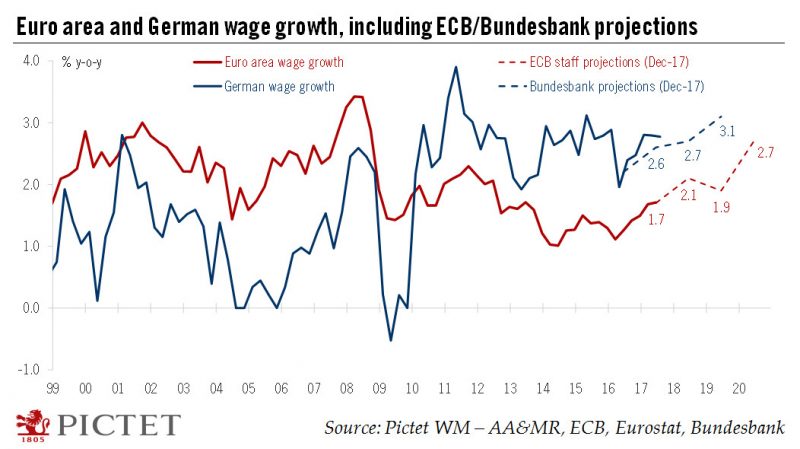

Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré last year, who described the...

Read More »

Read More »

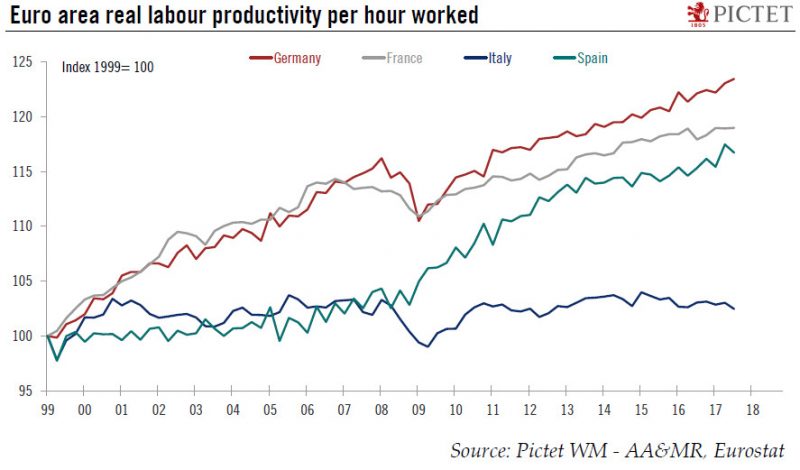

Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural...

Read More »

Read More »

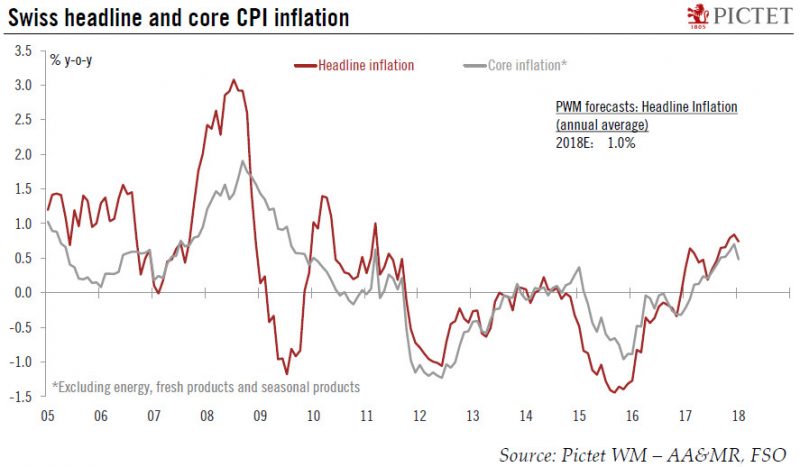

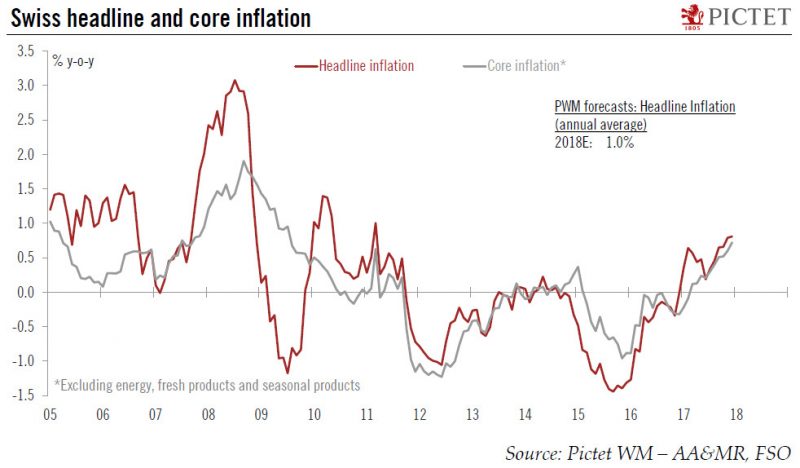

Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October 2017.

Read More »

Read More »

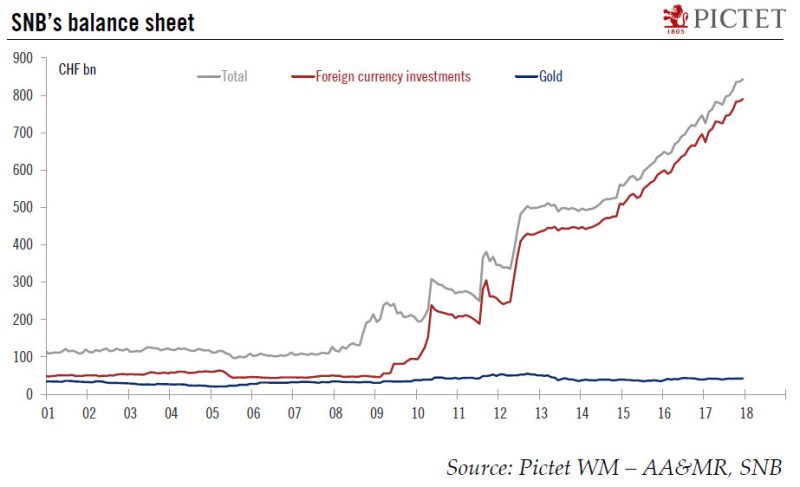

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

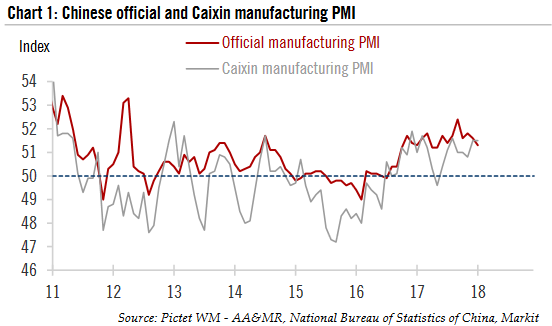

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

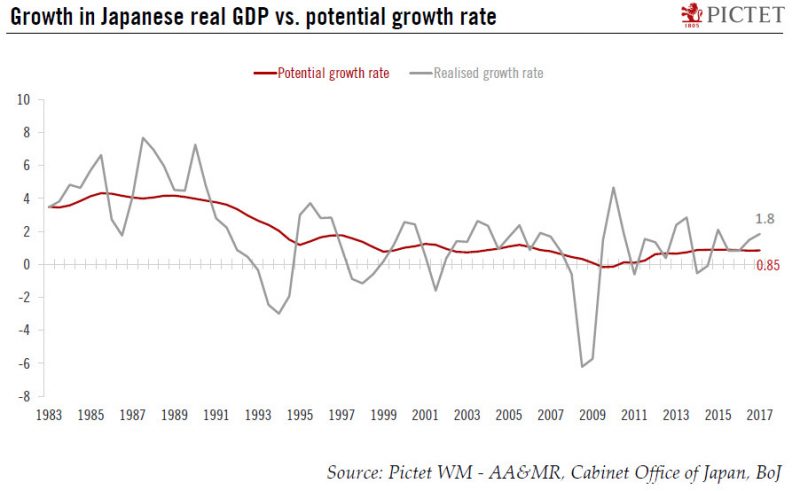

Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 - year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth, which currently stands at 0.85%, according to the Bank of Japan (BoJ, see...

Read More »

Read More »

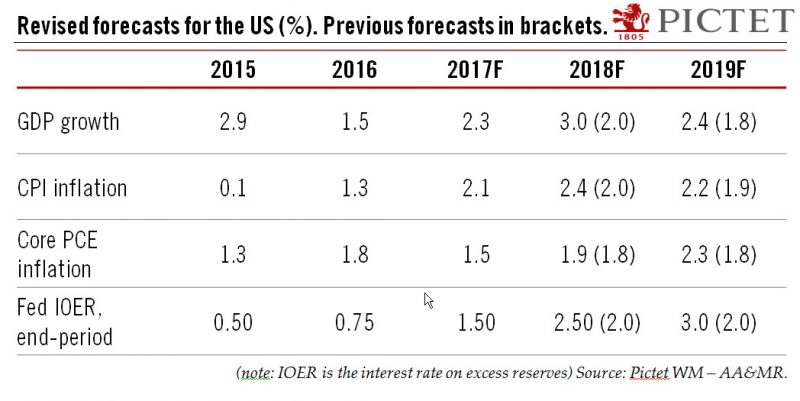

Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an estimated 4.6% in 2017. We...

Read More »

Read More »

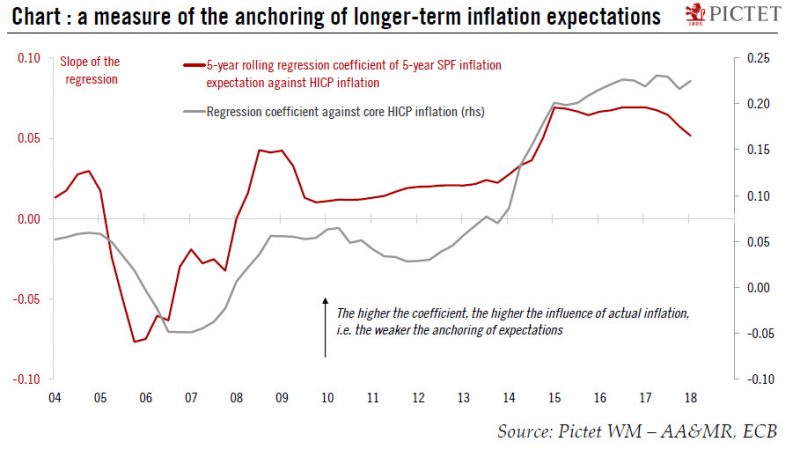

Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment.The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years, sometimes substantially.

Read More »

Read More »

Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.

Read More »

Read More »

Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year.

Read More »

Read More »

Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017.

Read More »

Read More »

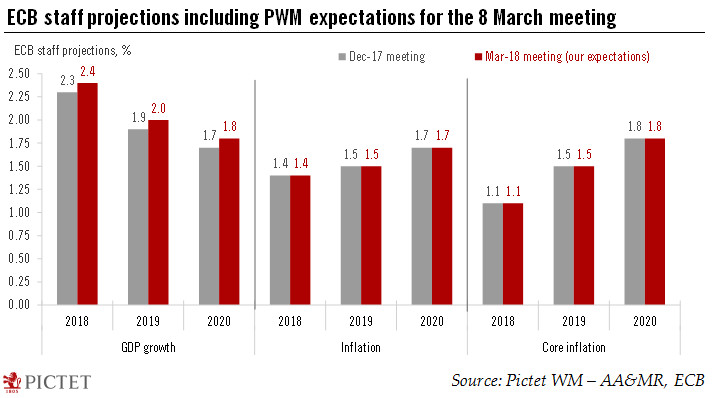

2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year.

Read More »

Read More »