Category Archive: 2.) Pictet Macro Analysis

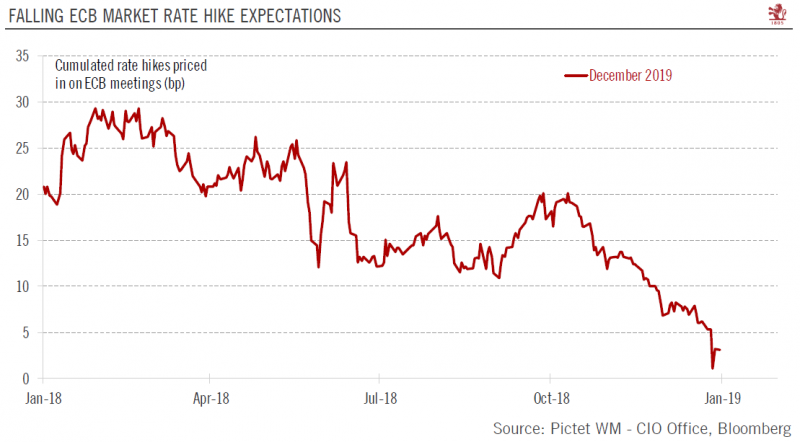

European Central Bank likely to stick to script

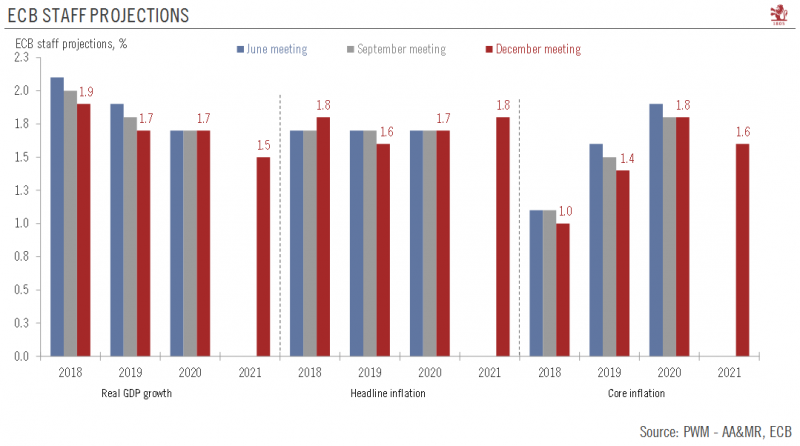

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside.

Read More »

Read More »

Pictet — Perspectives: The “Three Amigos”

2018 was a difficult year for markets and according to César Pérez Ruiz, Pictet Wealth Management’s Head of Investments and CIO, 2019 will be a year in which the “three amigos” will have to coexist. The bull will appear in economic deceleration, the bear in a democratic recession and the kangaroo across market dynamics.

https://www.group.pictet/wealth-management

Read More »

Read More »

Pictet — Perspectives: The “Three Amigos”

2018 was a difficult year for markets and according to César Pérez Ruiz, Pictet Wealth Management’s Head of Investments and CIO, 2019 will be a year in which the “three amigos” will have to coexist. The bull will appear in economic deceleration, the bear in a democratic recession and the kangaroo across market dynamics. https://www.group.pictet/wealth-management

Read More »

Read More »

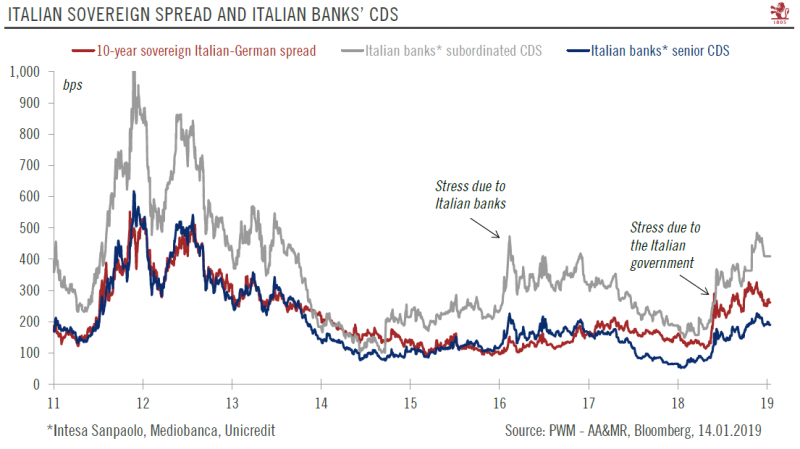

Outlook for euro periphery bonds

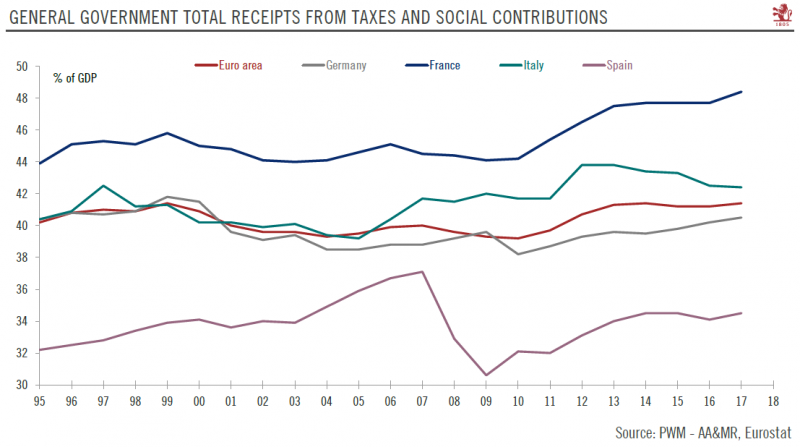

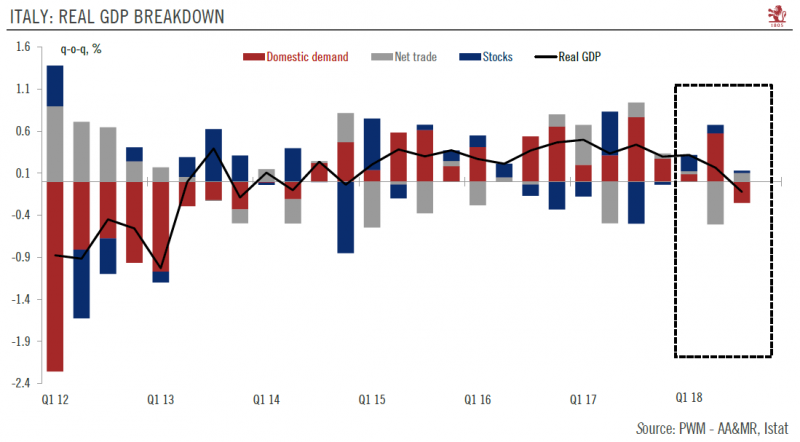

Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy.

Read More »

Read More »

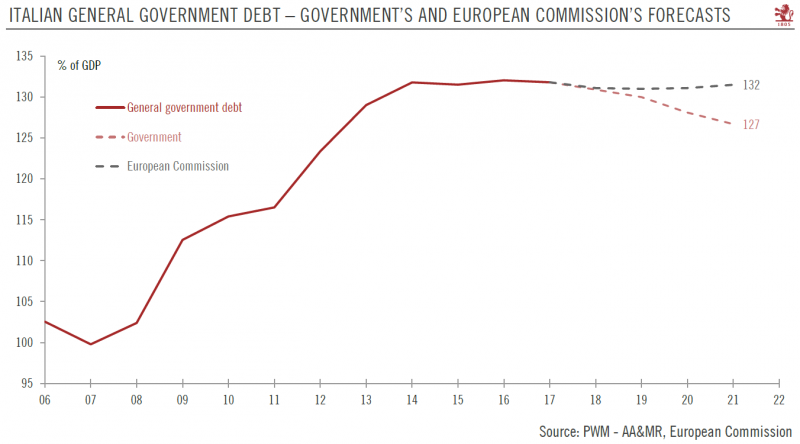

Concerns about Italy have not gone away

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP).

Read More »

Read More »

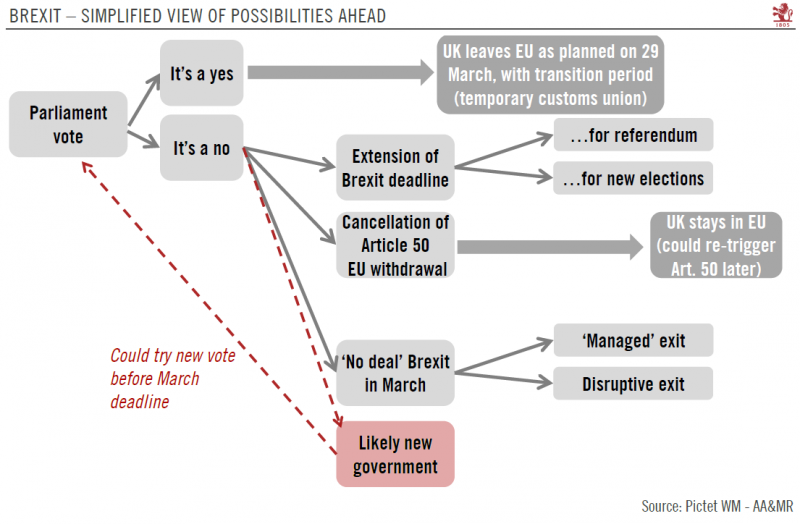

UK Politicians remain stuck in the mire

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.

Read More »

Read More »

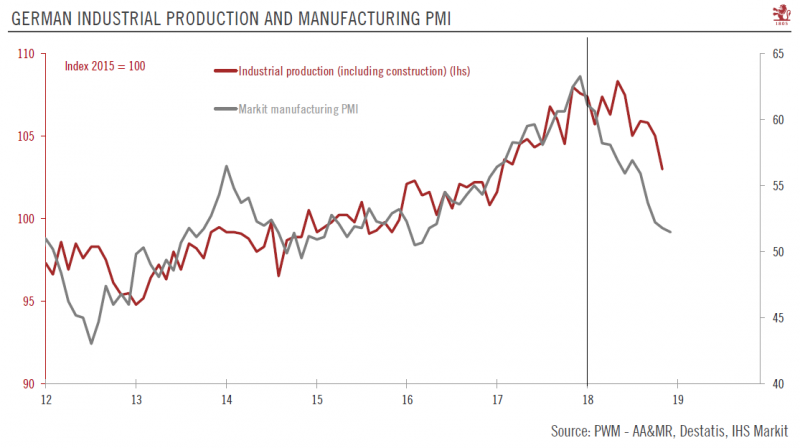

Germany is Stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.

Read More »

Read More »

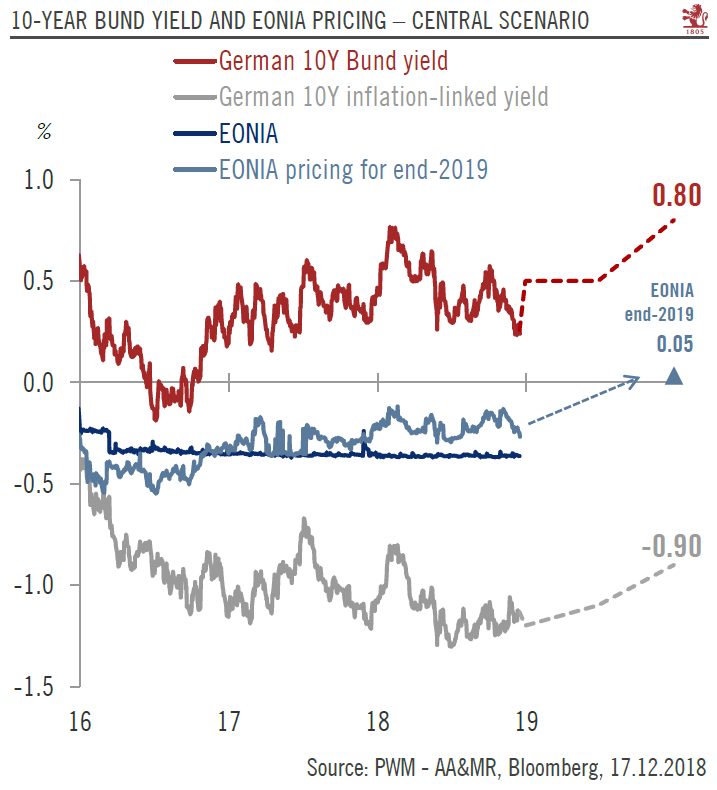

Core Euro Sovereign Bonds 2019 Outlook

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

Read More »

Read More »

Pictet – Multi-Generational Wealth, Singapore (Abridged version)

In Asia, we are seeing a generational shift as the region’s wealth creators hand over stewardship of family wealth to their sons and daughters. As this second generation’s influence grows, the management of family assets and investments is becoming increasingly sophisticated. Over the years, Pictet has been a successful partner in helping both families and their Family Offices to complete this process, and it was among the topics addressed during...

Read More »

Read More »

Pictet – Multi-Generational Wealth, Singapore (Full version)

In Asia, we are seeing a generational shift as the region’s wealth creators hand over stewardship of family wealth to their sons and daughters. As this second generation’s influence grows, the management of family assets and investments is becoming increasingly sophisticated. Over the years, Pictet has been a successful partner in helping both families and their Family Offices to complete this process, and it was among the topics addressed during...

Read More »

Read More »

Pictet – Multi-Generational Wealth, Singapore (Abridged version)

In Asia, we are seeing a generational shift as the region’s wealth creators hand over stewardship of family wealth to their sons and daughters. As this second generation’s influence grows, the management of family assets and investments is becoming increasingly sophisticated. Over the years, Pictet has been a successful partner in helping both families and …

Read More »

Read More »

Pictet – Multi-Generational Wealth, Singapore (Full version)

In Asia, we are seeing a generational shift as the region’s wealth creators hand over stewardship of family wealth to their sons and daughters. As this second generation’s influence grows, the management of family assets and investments is becoming increasingly sophisticated. Over the years, Pictet has been a successful partner in helping both families and …

Read More »

Read More »

ECB: Still Broadly Confident, but Caution Increasing

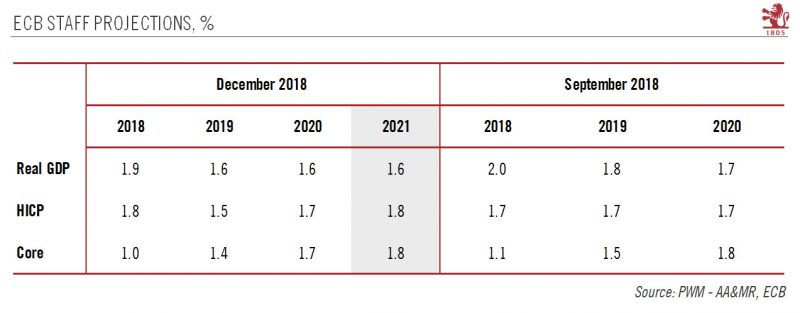

The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.

Read More »

Read More »

ECB Preview: an end to net asset purchases

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end.

Read More »

Read More »

Yellow vest protests cast cloud over Macron’s reform plans

Recent protests could have a negative impact on French growth, tax revenue and president Macron’s reform plans for his country and for Europe. French protests began on November 17 over hikes in fuel taxes, but have progressively broadened out into an expression of general anger with the French government about the cost of living and high taxes.

Read More »

Read More »

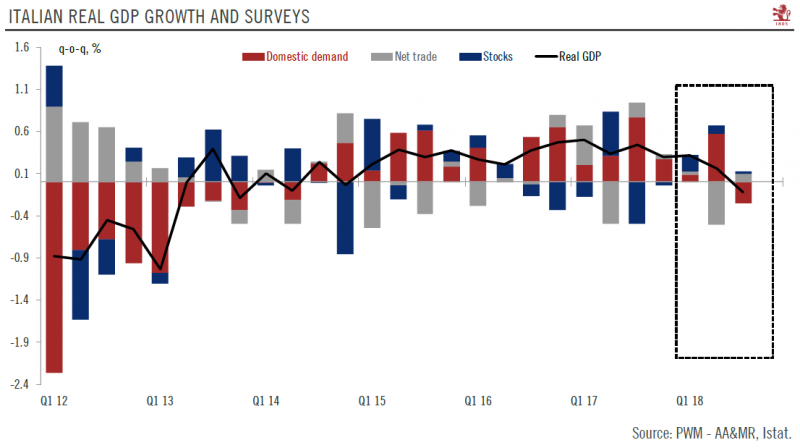

Growth Contraction puts pressure on Italian Government

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe. The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat.

Read More »

Read More »

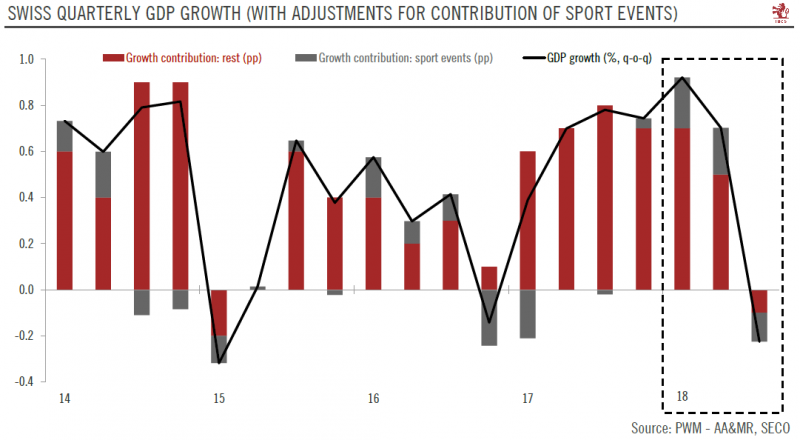

Surprise contraction in Swiss Q3 GDP

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB.The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised).

Read More »

Read More »

Italy and the EU: a debt-based excessive deficit procedure

European Commission deems Italy's budget noncompliant with EU rules.This week, the European Commission issued its opinion on Italy’s budget plans. Deeming them noncompliant with the EU’s budgetary rules, it recommended that an Excessive Deficit Procedure (EDP) be opened.Of the options available to the EU, a debt-based EDP would be the most difficult for Italy to deal with, as it would last longer and require Italy to ensure its debt stock...

Read More »

Read More »

Pictet – In Conversation with Cesar Perez Ruiz

After a decade of protection from central banks, the markets are changing. But Cesar Perez Ruiz, Pictet’s chief investment officer, says this needn’t be cause for concern. During the Investment Summit, at Pictet’s headquarters in Geneva, he made the case for active management and strategic asset allocation as important contributors to healthy returns.

Read More »

Read More »

Pictet – In Conversation with Cesar Perez Ruiz

After a decade of protection from central banks, the markets are changing. But Cesar Perez Ruiz, Pictet’s chief investment officer, says this needn’t be cause for concern. During the Investment Summit, at Pictet’s headquarters in Geneva, he made the case for active management and strategic asset allocation as important contributors to healthy returns.

Read More »

Read More »