Category Archive: 2.) Pictet Macro Analysis

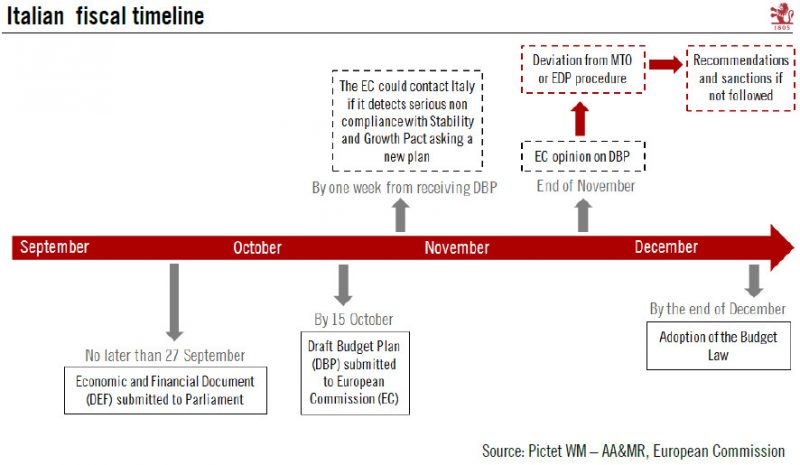

Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures.

Read More »

Read More »

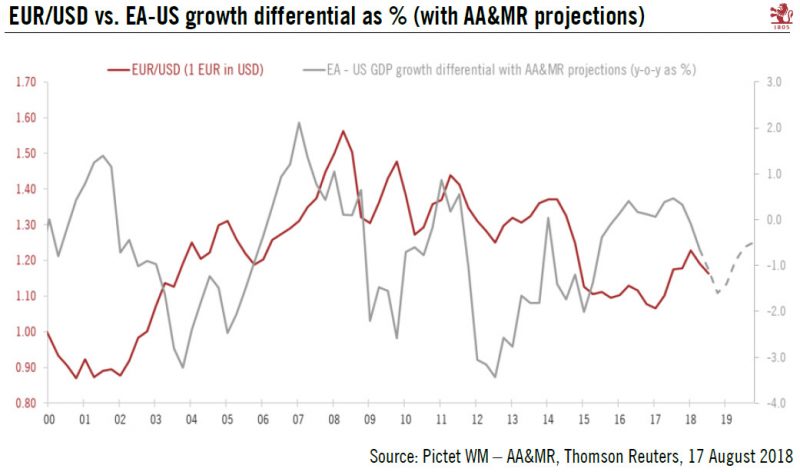

A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the...

Read More »

Read More »

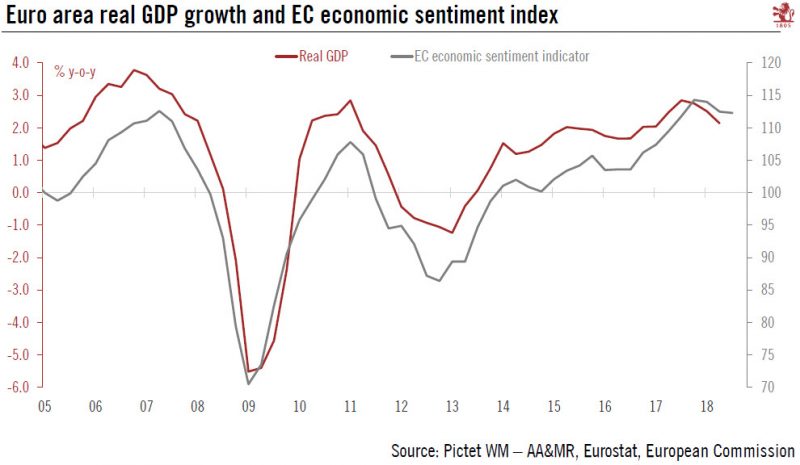

Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018.

Read More »

Read More »

Pictet – The Family Consilium (Abridged version)

The world is becoming increasingly unpredictable, as new geopolitical faultlines emerge and challenge the long-held status quo. This was the key lesson to emerge from the Pictet Family Consilium, which took place in the Swiss mountain resort of Gstaad in June. The central theme of this year’s exclusive biannual event was ‘“Who Owns the Future?”. …

Read More »

Read More »

Pictet – The Family Consilium (Full version)

The world is becoming increasingly unpredictable, as new geopolitical faultlines emerge and challenge the long-held status quo. This was the key lesson to emerge from the Pictet Family Consilium, which took place in the Swiss mountain resort of Gstaad in June. The central theme of this year’s exclusive biannual event was ‘“Who Owns the Future?”. …

Read More »

Read More »

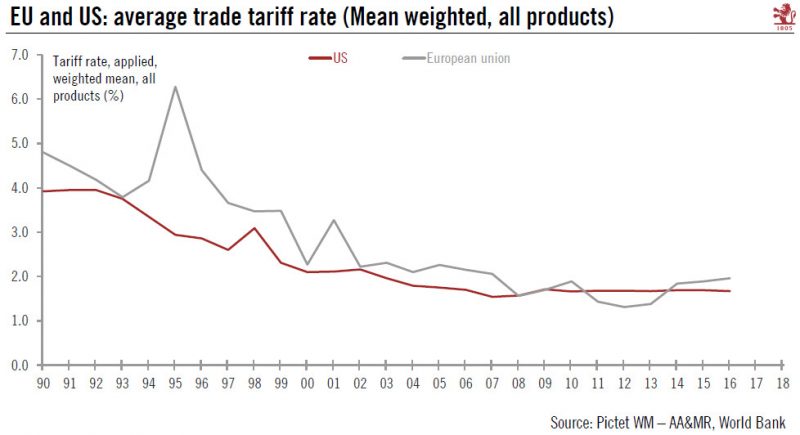

Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching.US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US.

Read More »

Read More »

What will the rest of the year bring?

Risk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets.Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018.

Read More »

Read More »

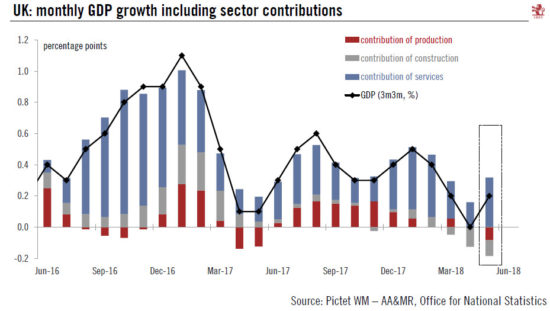

Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services.The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).Looking at the details, the services sector (79% of the...

Read More »

Read More »

In Conversation With Mattias Ljungman

Future-facing companies and disruptive business models are what Mattias Ljungman, co-founder and partner at Atomico, is all about. Mattias believes in the power of technology to shape the future of investments and he’s particularly excited about the growth potential of the gaming industry – the subject of his presentation at the Latam Family Office Master …

Read More »

Read More »

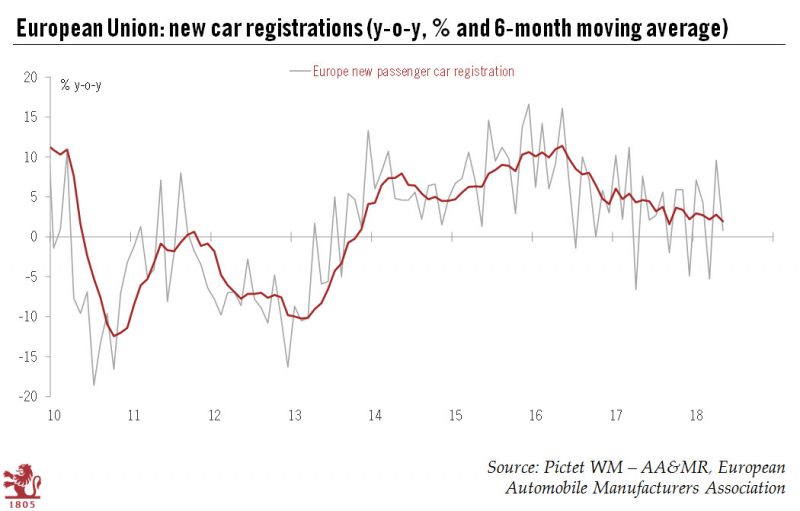

European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.

Read More »

Read More »

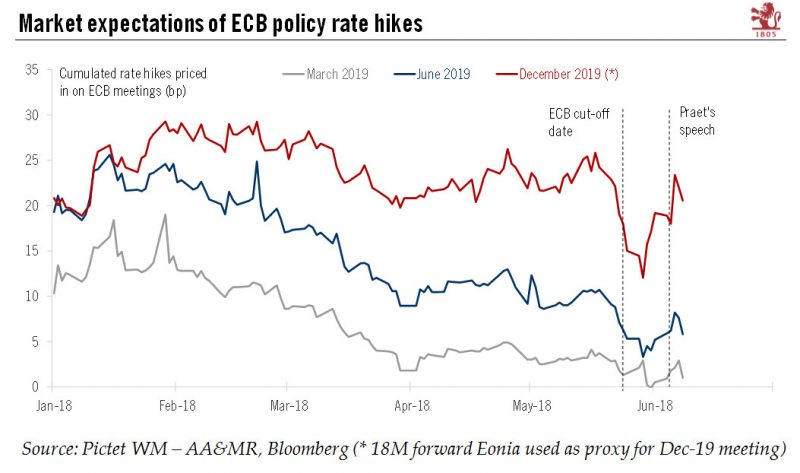

ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners).

Read More »

Read More »

Pictet – In Conversation With Alexandre Tavazzi

This year has clearly been defined by market volatility – and it feels a long way from the boom times of last year. But the message from Alexandre Tavazzi – a global strategist at Pictet Wealth Management – is that growth remains robust and investors simply need to be more nimble. He spoke from the … Continue reading...

Read More »

Read More »

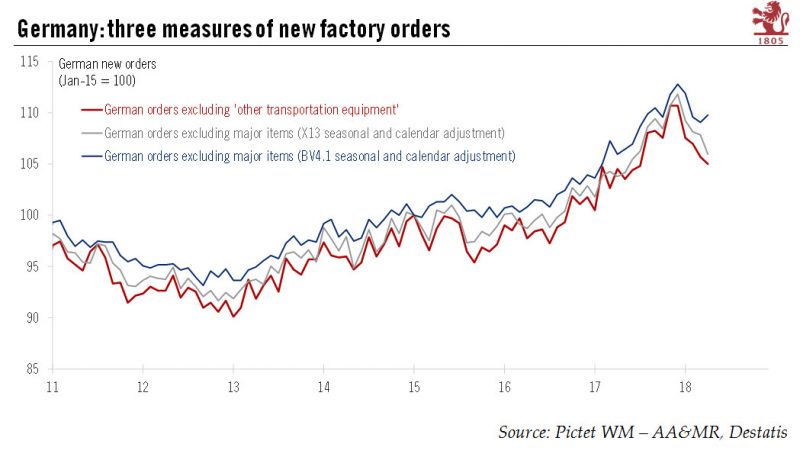

Europe chart of the week-German new orders

German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing orders are off to an extremely weak start in Q2 (-3.3% q-o-q after -2.2% q-o-q in Q1). What is more, the decline in demand for German goods in April was fairly broad-based across countries and sectors.

Read More »

Read More »

Pictet — In Conversation With Alfonso Prat-Gay

Latin America is at a crossroads in 2018 with several regional powerhouses heading to the polls. And while plenty is yet to be defined – both economically and politically – there are also causes for optimism as populism arguably shifts out of the region and into North America. Alfonso Prat-Gay, Argentina’s former finance minister and …

Read More »

Read More »

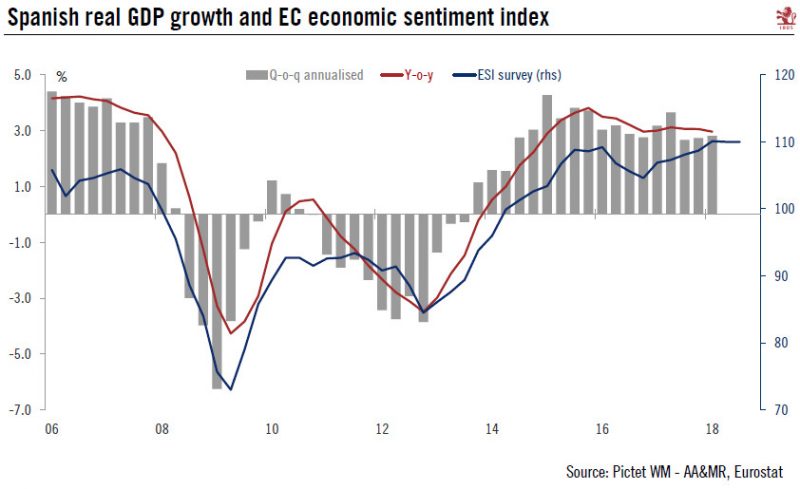

Europe chart of the week – Spanish growth

This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver.

Read More »

Read More »

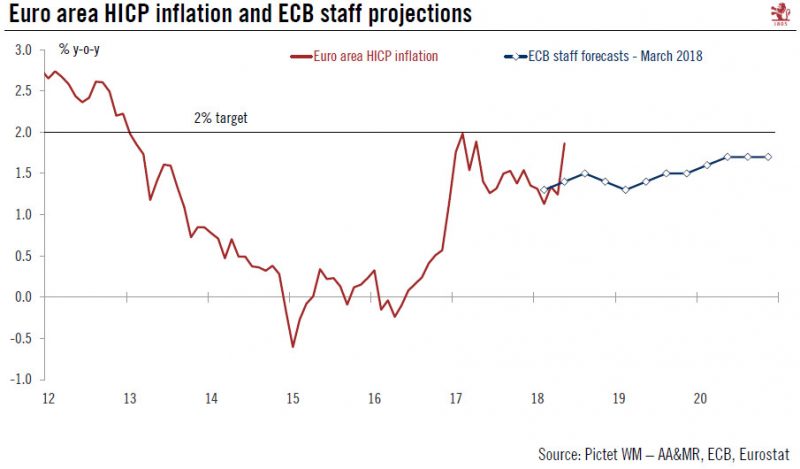

Euro area inflation close to ECB target in May

Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%).

Read More »

Read More »

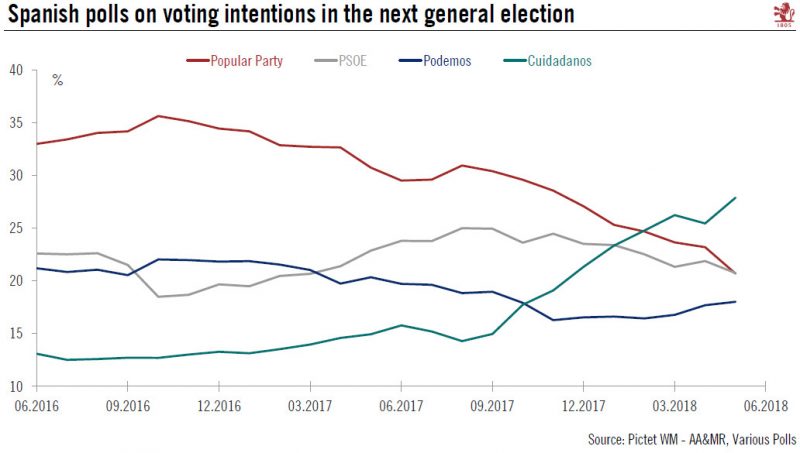

Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote probably on June 1.

Read More »

Read More »

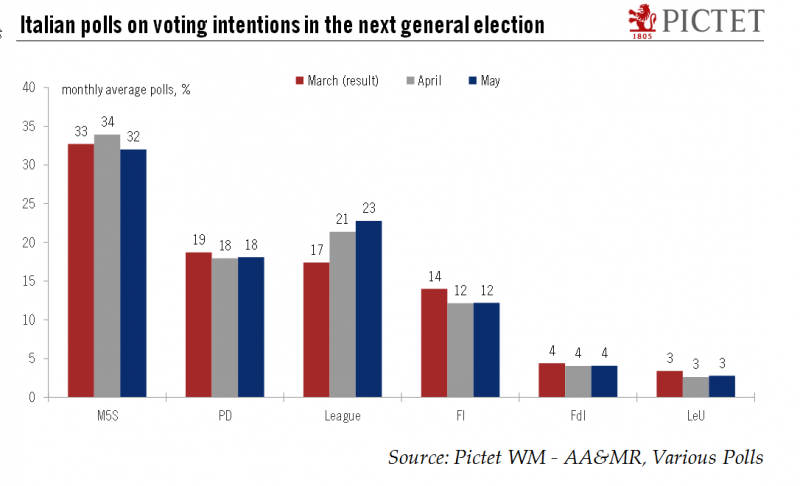

Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country.This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a...

Read More »

Read More »

Pictet – Multi-Generational Wealth, Nassau

THE ROLE OF REAL ASSETS IN A VIRTUAL WORLD? The fifth edition of the Latam Family Office Master Class took place in Nassau in April 2018, with more than 60 guests attending. This year the focus was around geopolitics, digital revolution, alternative investments and family governance. Among the speakers, we had the pleasure of welcoming …

Read More »

Read More »

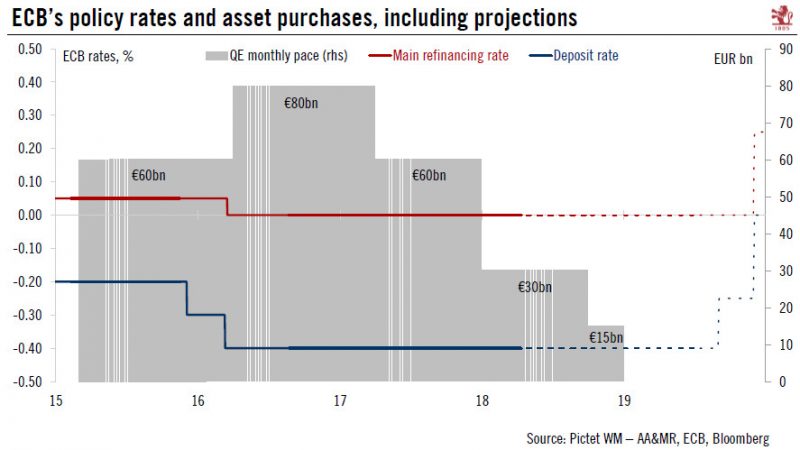

ECB: contingency plans

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled...

Read More »

Read More »