Category Archive: 2) Swiss and European Macro

Industrial Production Recovers in March: Strong Franc Digested?

The sector that got hit most by the sudden appreciation of the Swiss franc, was the industrial production. They must compete with Germany, that benefits of the weak euro. The newest data show that the industry sector has strongly recovered. This opens the question once again, if the Swiss franc is really overvalued? Certainly not against the dollar, other sectors like pharmaceuticals and chemicals export at lot to the United States.

Read More »

Read More »

Yanis Varoufakis spricht über Privatisierung, Menschenrechte & Kapitalismus

In diesem Interview mit dem ehemaligen griechischen Finanzminister und Gründer von „DiEM25“ (Demokratie in Europa Bewegung 2025) Yanis Varoufakis werden vielen Themen diskutiert, unter anderem Privatisierung, Menschenrechte, Medien, seine Erfahrung mit der EU und über die Möglichkeiten des Kapitalismus sich zu reformieren. – Werden die von der Troika eingeführten Privatisierungspläne der griechischen Bevölkerung zugutekommen? – …...

Read More »

Read More »

Yanis Varoufakis on Privatization, Human Rights, Media, EU Negotiations & Capitalism

In this interview with the former finance minister of Greece and founder of DiEM25 (Democracy in Europe Movement 2025), Yanis Varoufakis a host of issues are discussed which include privatization, human rights, media, his experience with the EU and capitalism’s ability to reform. – Will privatization schemes, that are being implemented by the Troika, benefit …

Read More »

Read More »

Yanis Varoufakis – ‘Political Economy: The Social Sciences’ Red Pill’

A lecture given by former Greek Finance Minister Yanis Varoufakis, at the University of Sydney, to celebrate his appointment as Honorary Professor in the Department of Political Economy.

Read More »

Read More »

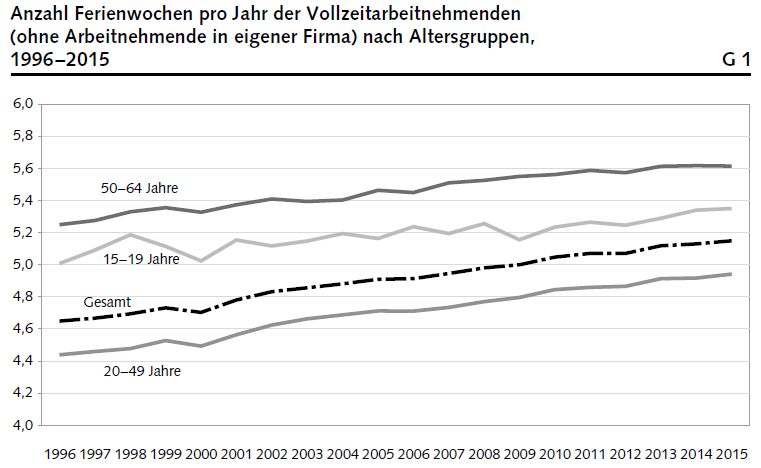

Working Hours increased in 2015

The total number of hours worked in Switzerland reached 7.889 billion in 2015, representing an increase of 2.3% compared with the previous year. Major reason were the increased number of employees and less bank holidays. Between 2011 and 2015, the actual weekly hours worked by full-time employees declined very slightly and stood at 41 hours and 17 minutes, whereas the number of weeks of annual holiday continued its gradual increase, reaching 5.15...

Read More »

Read More »

Yanis Varoufakis on EU Negotiations

Former Greek Finance Minister Yanis Varoufakis discusses what he believes will happen in the next round of negotiations between the European Union and Greece and explains what he feels is fundamentally wrong with the terms upon which those negotiations will proceed. Watch economist Yanis Varoufakis in our latest RSA Spotlight – the edits which take …

Read More »

Read More »

Deutschlands Rolle in der Europäischen Union mit Heiner Flassbeck

Im ersten Teil des Gesprächs räumt Heiner Flassbeck mit dem Mythos auf, Griechenland habe die europäische Finanzkrise verursacht. Er erläutert, wie Deutschland durch das Senken bzw. nicht Anheben der Löhne trotz steigender Produktivität seine Arbeitslosigkeit exportiert hat. Was sind die finanz- und arbeitspolitischen Maßnahmen, die zur Krise geführt haben? Wieso hat man in Deutschland nicht …

Read More »

Read More »

Noam Chomsky and Yanis Varoufakis: “The Eurozone’s Global Assault on Democracy.”

LIVE from the NYPL Recorded on April 26th, 2016 at the New York Public Library For more events by LIVE from the NYPL visit: http://www.nypl.org/events/live-nypl Watch the full 90min event here: http://goo.gl/nIMFfy Yanis Varoufakis in 7 words*: “Dedicated to subverting dominant paradigms, economic & political.” Noam Chomsky in 7 words*: “Linguistics and philosophy professor at …

Read More »

Read More »

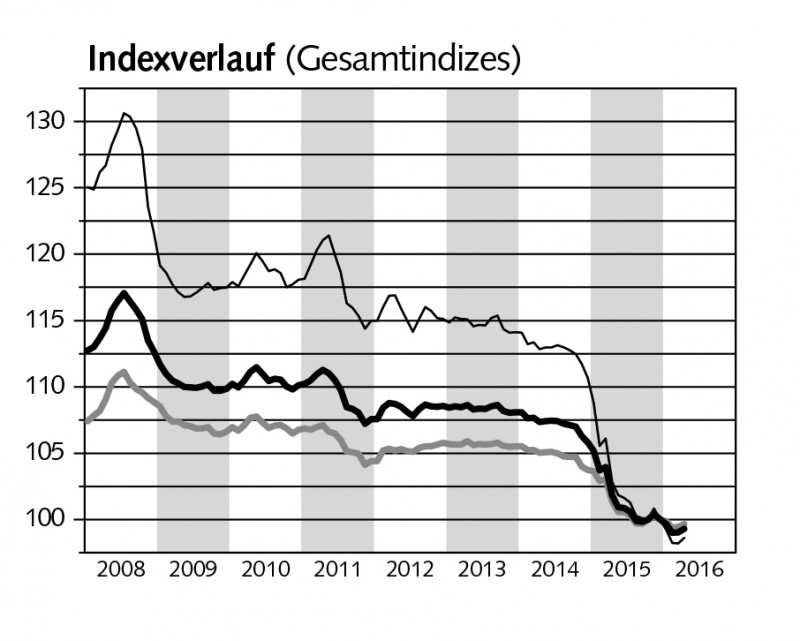

Swiss Producer and Import Price Index in April 2016: Down 2.4 percent to last year, up 0.3 vs last month

The Producer and Import Price Index (PP) rose in April 2016 by 0.3% compared with the previous month. The Producer Price Index increased by 0.2%, the Import Price Index rose by 0.4%. The rise is due in particular to higher prices for petroleum products. Compared with April 2015, the PPI is down 2.4%

Read More »

Read More »

Yanis Varoufakis Guerilla Interview Part 2

In the second and final part of our exclusive guerilla interview with Yanis Varoufakis, we discuss the Greek media, the The Labour Party’s strategy on the #Brexit referendum and the goals of his newfound Diem25.official movement. If you enjoyed this video, consider donating to help us produce more like it. We want to tell the …

Read More »

Read More »

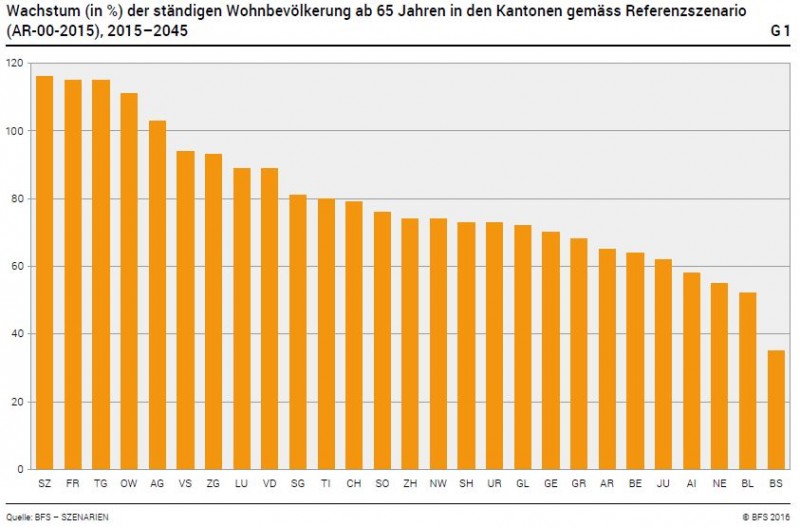

Switzerland 2015-2045: Population Increase by Immigration, Ageing Effects

Ageing effect: Swiss statistics expects that in many central and Southern cantons the number of elderly rises more strongly than in others.

Immigration of younger people to bigger towns like Zurich, Geneva, Basel or Bern, prevents such a strong ageing in other cantons.

French-speaking cantons will have less ageing issues, reasons might be found in higher fertility and higher immigration.

Read More »

Read More »

Pictet Perspectives – Central banks risk loss of credibility

A loss of confidence by markets in the effectiveness of monetary policies is the biggest risk investors face at present. Cesar Perez Ruis, Chief Investment officer at Pictet Wealth Management, discusses the issue and explains what we expect from central banks.

http://perspectives.pictet.com/

Read More »

Read More »

Pictet Perspectives – Central banks risk loss of credibility

A loss of confidence by markets in the effectiveness of monetary policies is the biggest risk investors face at present. Cesar Perez Ruis, Chief Investment officer at Pictet Wealth Management, discusses the issue and explains what we expect from central banks. http://perspectives.pictet.com/

Read More »

Read More »

DIW-Chef Fratscher: “Ungleichheit schadet allen” | Made in Germany

Nirgendwo in Europa sind Einkommen, Vermögen und Chancen so ungleich verteilt wie in Deutschland. “Deutschlands soziale Marktwirtschaft existiert nicht mehr”, kritisiert Marcel Fratzscher, Präsident des Deutschen Instituts für Wirtschaftsforschung.

Read More »

Read More »