Category Archive: 2) Swiss and European Macro

Frank Schäffler – SEITENWEISE – Geschichte und Freiheit

Frank Schäffler stellt im Rahmen der Serie “Frank & Frei: Seitenweise” das von Alexander Dörrbecker herausgegebene Lord-Acton-Brevier “Geschichte und Freiheit” vor und erläutert seine Aktualität.

Read More »

Read More »

Spanish bailout: history repeating

In this video Alexandre Tavazzi explains why the markets continued on a downward path after the Spanish bailout plan was announced.

Read More »

Read More »

Frank Schäffler – SEITENWEISE – “Noch eine Chance für die Soziale Marktwirtschaft”

Frank Schäffler stellt im Rahmen der Serie “Frank & Frei: Seitenweise” das Buch “Noch eine Chance für die Soziale Marktwirtschaft” vor und erläutert seine Aktualität.

Read More »

Read More »

Thilo Sarrazins neues Buch erscheint

Ein Beitrag des Deutschlandfunk vom 22.05.2012 – Erzeugt mit AquaSoft DiaShow für YouTube: http://www.aquasoft.de

Read More »

Read More »

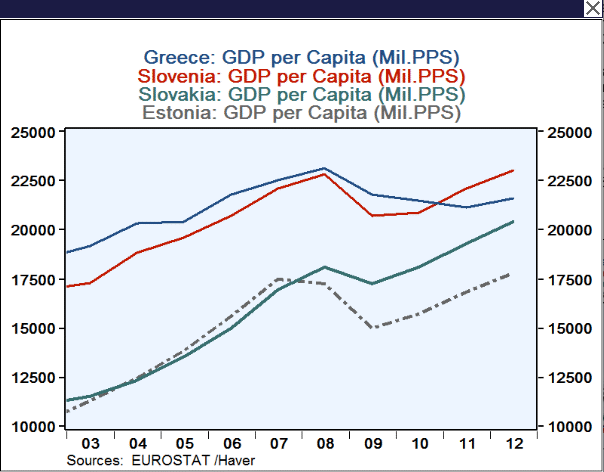

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

Frank Schäffler – SEITENWEISE – “Sozialdemokratische Zukunftsbilder” von Eugen Richter

Frank Schäffler stellt im Rahmen der Serie “Frank & Frei: Seitenweise” das Buch “Sozialdemokratische Zukunftsbilder” von Eugen Richter vor und erläutert seine Aktualität.

Read More »

Read More »

Debt crisis: selecting assets

We are getting very close to a potentially defining moment in the European crisis. The catalyst of course will be whether or not Greece stays in the common currency, a decision that might be triggered by the Europeans or the Greeks themselves. Unfortunately for investors, that outcome is extremely difficult to predict. It is a … Continue...

Read More »

Read More »

Frank Schäffler – SEITENWEISE – “Wohlstand für Alle” von Ludwig Erhard

Frank Schäffler stellt im Rahmen der Serie “Frank & Frei: Seitenweise” das Buch “Wohlstand für Alle” von Ludwig Erhard vor und erläutert seine Aktualität. Hier kostenlos als PDF: http://www.ludwig-erhard-stiftung.de/files/wohlstand_fuer_alle.pdf

Read More »

Read More »

Heiner Flassbeck im Mumble Gespräch mit den Piraten der AG Geldordnung / 15. Mai 2012

Mumble Konferenz vom 15. Mai 2012 mit Heiner Flassbeck. Piraten reden über´s Geld. AG Geldordnung Piratenpartei. Mitmachen! http://wiki.piratenpartei.de/AG_Geldordnung_und_Finanzpolitik Blog: http://www.geldsystempiraten.de

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

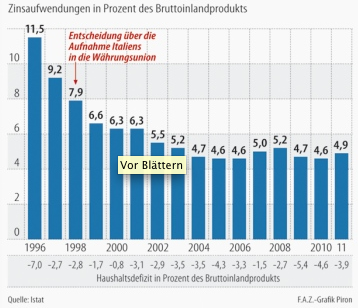

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

Frank Schäffler – SEITENWEISE – “Die Entnationalisierung des Geldes” von F.A. Hayek

Frank Schäffler stellt im Rahmen der Serie “Frank & Frei: Seitenweise” das Buch “Die Entnationalisierung des Geldes” von F.A. Hayek vor und erläutert seine Aktualität.

Read More »

Read More »

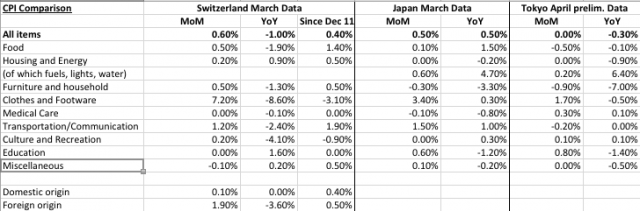

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

Frank Schäffler: Wege aus der Euro-Krise — Alternativen zum Zentralbankensystem

Original-Video: http://vimeo.com/40835049 Presseeinladung vom 13. April 2012: Vortragsveranstaltung mit Frank Schäffler MdB an der Uni Mannheim “Wege aus der Euro-Krise — Alternativen zum Zentralbankensystem” (Mannheim) Landesverband Liberaler Hochschulgruppen Baden-Württemberg und Liberale Hochschulgruppe Mannheim laden ein zu Vortrag und Diskussion an der Universität Mannheim, Raum M003, Donnerstag, 19. April 2012, 17.30 Uhr,...

Read More »

Read More »

Peter Bofinger: Inequality and Macroeconomics Dynamics 1/5

Peter Bofinger, Member of the German Council of Economic Experts speaking at the panel entitled “The Impact of Inequality on Macroeconomics Dynamics” at the Institute for New Economic Thinking’s (INET) Paradigm Lost Conference in Berlin. April 14, 2012. #inetberlin

Read More »

Read More »

Heiner Flassbeck: Is Mercantilism Doomed to Fail? 2/5

Heiner Flassbeck, Director of the Division on Globalization and Development Strategies, United Nations Conference on Trade and Development (UNCTAD) at the panel entitled “Is Mercantilism Doomed to Fail? China, Germany, and Japan and the Exhaustion of Debtor Countries” at the Institute for New Economic Thinking’s (INET) Paradigm Lost Conference in Berlin. April 13, 2012. #inetberlin

Read More »

Read More »

The reason why European banks underperform U.S. banks

The valuation of European banks and U.S. banks have varied greatly over the last 3 years. Recently, European banks have greatly underperformed their U.S. counterparts. Alexandre Tavazzi, head of advisory at Pictet, explains in this video how the central bank responses to the financial crisis have impacted the recent trading activity.

Read More »

Read More »