Category Archive: 2) Swiss and European Macro

Was bedeuten die Target-Salden?

Prof. Dr. Dr. h.c. mult. Hans-Werner Sinn, Präsident des ifo Instituts a.D. am 15.01.2019 http://www.hanswernersinn.de/de/themen/TargetSalden ifo Institut – Leibniz-Institut für Wirtschaftsforschung an der Universität München e.V.

Read More »

Read More »

Ökonom Hans Werner Sinn fordert neues Angebot an die Briten

Der renommierte Ökonomieprofessor Hans-Werner Sinn war Stargast beim 31. Bremer Unternehmerforum im Parkhotel. Er forderte ein neues Angebot an die Briten als Mittel gegen den Brexit. Die EU solle selbstkritisch die Migration und die Einmischungen aus Brüssel in die nationale Politik beurteilen. Damit könne man die Briten vielleicht von einem zweiten Referendum überzeugen und von …

Read More »

Read More »

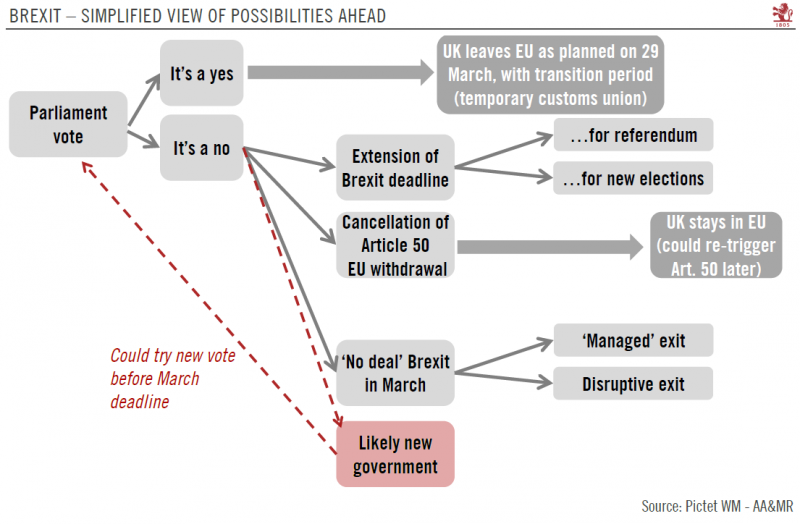

Jetzt wird die Brexit-Frage erst richtig interessant

Mit großer Mehrheit hat das britische Parlament den Brexit-Deal zwischen der Insel und der EU abgelehnt. Wie geht es jetzt weiter? Kommt es zum Schlimmsten, zu einem ungeordneten Brexit mit (wirtschafts-)politischen Schäden auf beiden Seiten des Ärmelkanals? Oder kommt es zu politischen Veränderungen in London, die dem Brexit-Prozess eine völlig neue Richtung geben, bei der …

Read More »

Read More »

Brexit-Chaos: Was ich mache!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Droht das totale Chaos an den Aktienmärkten durch den Brexit? Morgen kommt es zur alles entscheidenden Abstimmung im britischen Parlament, über das Austrittsabkommen. In diesem Video möchte ich euch sagen, wie ich mich als langfristiger Investor verhalte, aber …

Read More »

Read More »

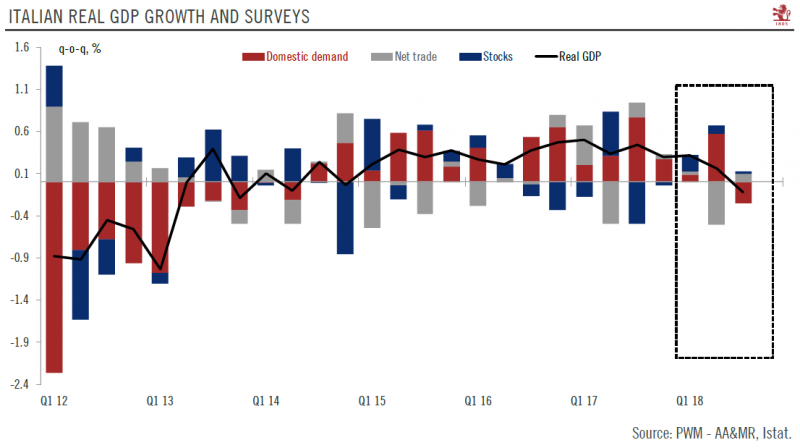

Concerns about Italy have not gone away

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP).

Read More »

Read More »

Warum die Riesterrente keine Rendite abwerfen wird – Heiner Flassbeck

Der Wirtschaftswissenschaftler Heiner Flassbeck erklärt, warum die deutschen Sparbeiträge ins Ausland wandern und warum die #Riesterrente keine Rendite abwerfen wird. #Riester #Rente Ganzes Video: https://www.youtube.com/watch?v=RT36zak5XUY Aktuelles Buch von Flassbeck: https://www.amazon.de/Gescheiterte-Globalisierung-Ungleichheit-Renaissance-suhrkamp/dp/3518127225

Read More »

Read More »

UK Politicians remain stuck in the mire

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.

Read More »

Read More »

Heiner Flassbeck: Better economic prospects for Africans require a different economic policy

Emmanuel Ametepeh, a political scientist from Ghana and project leader of the Black & White initiative, interviews the German economic politician and economist Heiner Flassbeck about his views on the economic policy that would be needed in Africa in order to eliminate the causes of flight. He is a professor at the University of Hamburg …

Read More »

Read More »

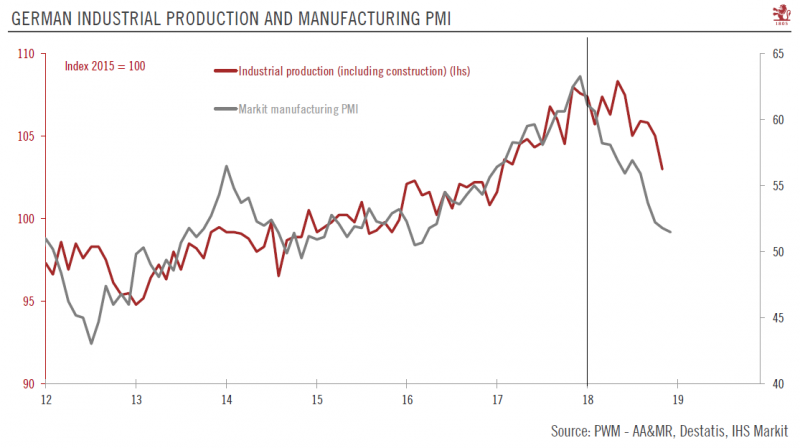

Germany is Stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.

Read More »

Read More »

…And Get Bigger

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme.

Read More »

Read More »

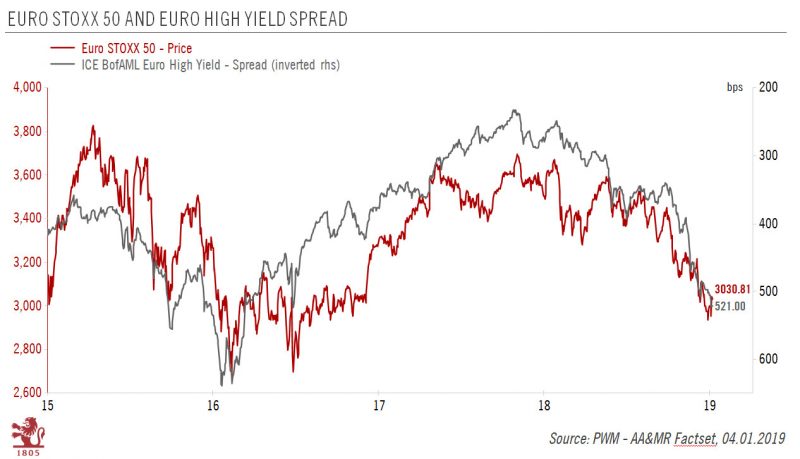

Euro Credit: 2019 Outlook

Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly.

Read More »

Read More »

Horror-Jahr für Hedgefonds!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ In diesem Video möchte ich nicht nur darüber sprechen, warum es für die Hedgefond-Branche in den letzten drei Jahren so hundsmiserabel gelaufen ist, sondern ich möchte auch darüber sprechen, was wir als Privatanleger davon lernen können, was wir …

Read More »

Read More »

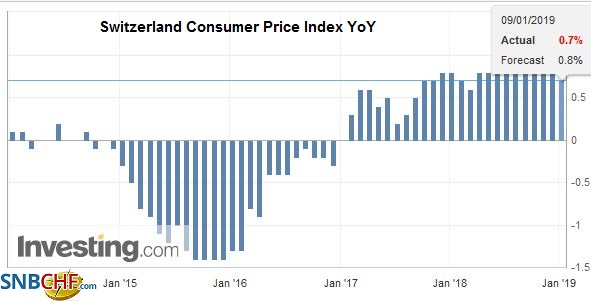

Swiss Consumer Price Index in December 2018: +0.7 percent YoY, -0.3 percent MoM

09.01.2019 - The consumer price index (CPI) fell by 0.3% in December 2018 compared with the previous month, reaching 101.5 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. The average annual inflation reached 0.9% in 2018.

Read More »

Read More »

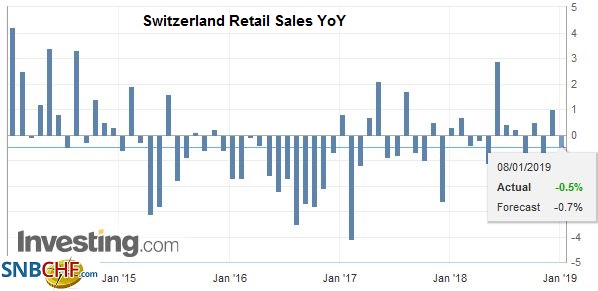

Swiss Retail Sales, November 2018: -0.2 percent Nominal and -0.5 percent Real

Turnover in the retail sector fell by 0.2% in nominal terms in November 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.2% compared with the previous month.

Read More »

Read More »

Bernie Sanders y Yanis Varoufakis lanzan nueva Internacional Progresista

VEA ESTE CONTENIDO EN enperspectiva.net Bernie Sanders y Yanis Varoufakis lanzan nueva Internacional Progresista El senador demócrata estadounidense Bernie Sanders y el ex ministro de Economía griego Yanis Varoufakis lanzaron junto a un grupo de intelectuales la nueva Internacional Progresista, una “red global” de izquierdas para combatir la corriente de gobiernos de derecha como los …

Read More »

Read More »

Yanis Varoufakis and Noam Chomsky: The Neoliberal Assault (and Hypocrisy)

Yanis Varoufakis talks to Noam Chomsky about the neoliberal assault on the world’s population in the last generation. Subscribe to Progressive Wisdom: http://www.youtube.com/subscription_center?add_user=Relaxotron ====================================== Ioannis Georgiou “Yanis” Varoufakis is a Greek economist, academic and politician, who served as the Greek Minister of Finance from January to July 2015. Varoufakis has published a...

Read More »

Read More »

Apple: Nach dem Crash kaufen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Apple war einstmals das teuerste Unternehmen der Welt. Jetzt ist der Kurs massiv eingebrochen und ich möchte die Aktie kaufen. Wie ich das machen will, das verrate ich euch in diesem Video. Los geht´s! ——– ➤ Mein YouTube-Kanal …

Read More »

Read More »

Einblick in die Wirtschaftswissenschaftliche Fakultät Würzburg

“Für mich ist ganz wichtig, dass die Wissenschaft nicht im Elfenbeinturm stattfindet. Das spielt für mich eine große Rolle in der Lehre.”, Prof. Dr. Peter Bofinger, Wirtschaftsweiser und Lehrstuhlinhaber ist froh sich für Würzburg entschieden zu haben. Die Wirtschaftswissenschaftliche Fakultät der Universität Würzburg verfügt über 20 Lehrstühle, eine Professur und drei Juniorprofessuren. Aktuell sind über …

Read More »

Read More »