After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds.

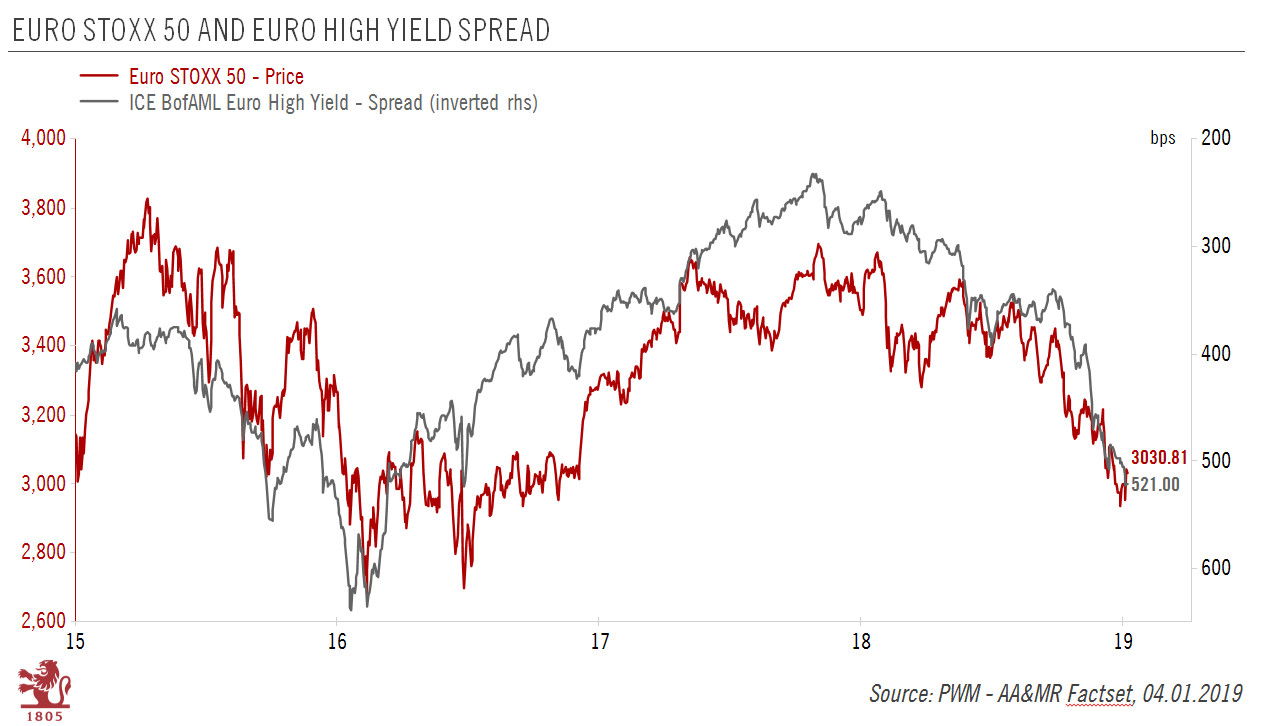

| Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly. Looking back, policy makers had a major impact on the performance of credit markets—whether the tapering of the European Central Bank’s (ECB) quantitative easing (QE), Italy’s push for fiscal stimulus, or trade tensions.

In 2019, Italian political risk and debt metrics will again be an important focus for euro corporate bond investors, especially if the Italian economy continues to stagnate or even contract. We could even see early elections, potentially leading to a further turn in fiscal policy. In addition, equity market volatility is probably here to stay, maintaining upward pressure on euro HY spreads in particular. We expect the ECB’s direct support to euro area nonbank corporates to become negligible in 2019, supressing its impact on spreads. But an extension of targeted longer-term refinancing operations (TLTROs) maturities should mean indirect support continues. The ensuing prolongation of accommodative lending conditions could mean default rates remain low in euro credit. There is a risk that the economic slowdown in the euro area this year is sharper than in our central scenario. So we have turned underweight on euro credit and are favouring quality as spreads could widen further and rating downgrades intensify. We prefer companies with deleveraging programmes and solid earnings capabilities, and we have been limiting exposure to companies still using the debt markets to enhance shareholder pay-outs. |

Euro Credit, 2015 - 2018 |

Tags: Macroview,newsletter