Category Archive: 2) Swiss and European Macro

Italien und Stabilität werden sich nie ineinander verlieben

Italien hat zwar nach Griechenland bereits die höchste Staatsschuldenquote der Eurozone. Doch ist die neue Regierung in Rom überzeugt, dass nur noch viel mehr Schulden das Land aus seiner immer noch schwelenden Wirtschaftskrise befreien können. Grundsätzlich kann die Stabilitätskriterien verpflichtete EU dieser unsoliden Haushaltspolitik nicht zustimmen. Wer soll die neuen Schulen überhaupt finanzieren? Steht bei …

Read More »

Read More »

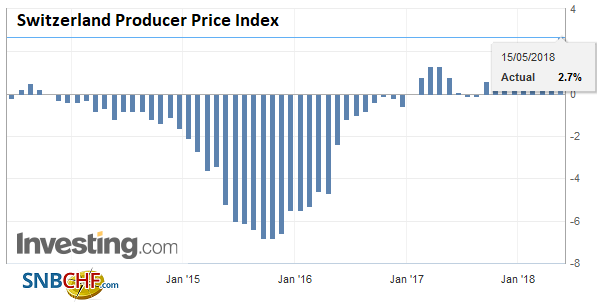

Swiss Producer and Import Price Index in April 2018: +2.7 percent YoY, +0.4 percent MoM

The Producer and Import Price Index increased in April 2018 by 0.4% compared with the previous month, reaching 102.8 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products and machinery. Compared with April 2017, the price level of the whole range of domestic and imported products rose by 2.7%.

Read More »

Read More »

Markus Miller – Prof. Hans-Werner Sinn: 46 Prozent des deutschen Auslandsvermögens sind verloren!

Ausführlicher Artikel unter: https://goo.gl/DuPT45 Das Target-2-System hält die Europäische Union und das Bankensystem noch am Leben – Die EZB ist bei den Wertpapieraufkaufprogrammen längst zur verdeckten Staatsfinanzierung übergegangen....

Read More »

Read More »

Yanis Varoufakis on Lost U.S. Credibility in Middle East, from Iran Deal to Israel Embassy Move

https://democracynow.org – In the latest economic fallout from President Trump’s decision to pull the United States out of the landmark Iran nuclear agreement, top White House officials said Sunday that the Trump administration is prepared to impose sanctions on European companies that do business with Iran. We get response from former Greek Finance Minister Yanis …

Read More »

Read More »

Buffetts Favoriten: Apple & Co.

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ In diesem Video wollen wir uns das Portfolio von Altmeister Warren Buffett mal etwas genauer anschauen. Apple ist seine Nummer 1, das ist kein Geheimnis und ich beantworte euch die Frage, ob die Aktie momentan einen Kauf wert …

Read More »

Read More »

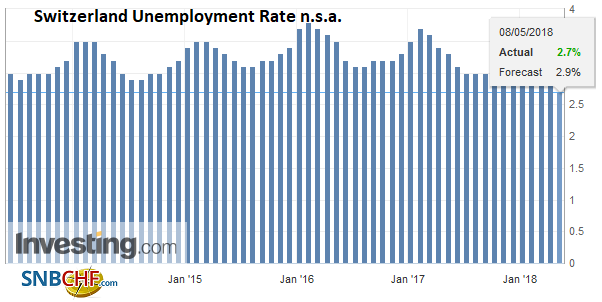

Swiss unemployment lower than it’s been in years

The Swiss unemployment rate was 2.7% in April – a level last seen in July 2012. Last month, 119,781 people were registered as without work in Switzerland – 10,632 fewer than the previous month. This brought the overall unemployment rate down from 2.9% in March to 2.7% in April, reported the State Secretariat for Economic Affairsexternal link on Tuesday.

Read More »

Read More »

Former Greek finance minister Yanis Varoufakis makes capital comprehensible

Former Greek finance minister Yanis Varoufakis makes capital comprehensible Skip to content Have you noticed how angry everyone is? Turn on the news or scroll through your social media feed, and you’ll see a kaleidoscope of rage. People are relitigating the last election or f…

Read More »

Read More »

Yanis Varoufakis on Talking to My Daughter About the Economy | The New School

Presented jointly by the The New School for Social Research and the Schools of Public Engagement. This conversation between Yanis Varoufakis, economist, academic and former Greek Minister of Finance, and Will Milberg, dean of The New School for Social Research, will build upon the themes in Varoufakis’ latest book Talking to My Daughter About the …

Read More »

Read More »

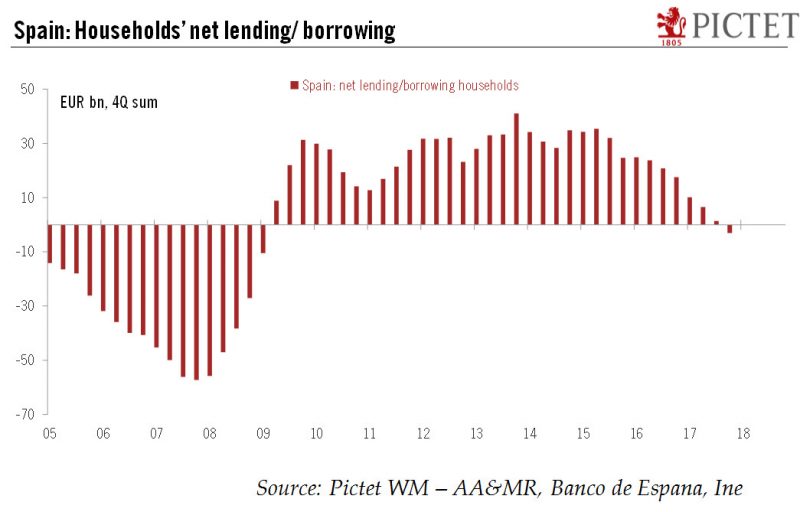

Spaniards back in the mood to borrow

Before the financial crisis, the real estate bubble and the parallel growth in borrowing meant that the indebtedness of Spanish households spiralled ever higher, reaching a peak of 84.7% of GDP in Q2 2010. Since then, Spanish’s households have tightened their belt, with indebtedness falling to 61.3% of GDP in Q4 2017.

Read More »

Read More »

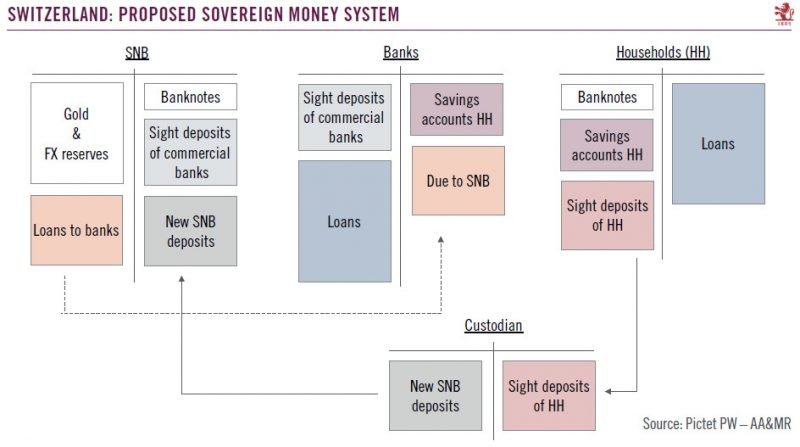

Switzerland: ‘Sovereign money’ initiative

The ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole organisation authorised to create money – not only cash and coins, but also...

Read More »

Read More »

Interview with Yanis Varoufakis the Former Minister of Finance in Greece

marcus evans is a corporate and information company that delivers annual events across all industry sectors. You can subscribe to our channel here: https://www.youtube.com/MarcusEvansInvest/ Contact | [email protected] Event Website | http://www.epi-summit.com/ LinkedIn | https://www.linkedin.com/groups/3937929/profile Website | www.marcusevans.com

Read More »

Read More »

Diese Branchen kaufen!

ERICHSEN ► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Im letzten Video ging es um die Frage, welche Branchen man kaufen sollte, um zukunftssicher aufgestellt zu sein. Die Antwort darauf, gibt es im heutigen Video. Los geht´s! ——– ➤ Mein YouTube-Kanal zum Thema Trading: http://youtube.com/tradermacherde ➤ …

Read More »

Read More »

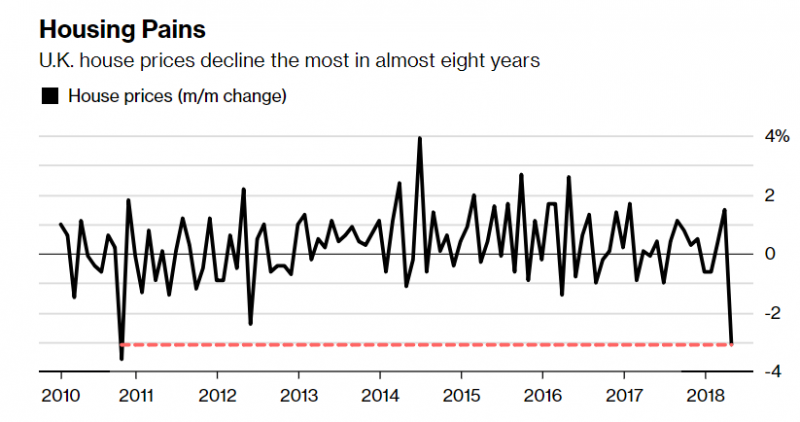

U.K. Home Prices Plunge 3.1percent In April – Largest Monthly Drop Since Financial Crisis In 2011

U.K. home prices plunged the most in almost eight years in April, adding to signs of weakness in Britain’s property market. Values dropped 3.1 percent from March to an average 220,962 pounds ($299,140), mortgage lender Halifax said in a report Tuesday. That’s the biggest drop since September 2010. While that figure can be volatile, the quarterly measure also showed a decline. It fell 0.1 percent, a third straight drop.

Read More »

Read More »

Switzerland Unemployment in April 2018: Down to 2.7 percent from 2.9 percent, seasonally adjusted decreased from 2.9 percent to 2.7 percent

Registered unemployment in April 2018 - According to the State Secretariat for Economic Affairs (SECO), at the end of April 2018, 119,781 unemployed were registered at the Regional Employment Centers (RAV), 10,632 less than in the previous month. The unemployment rate fell from 2.9% in March 2018 to 2.7% in the month under review. Compared with the same month of the previous year, unemployment fell by 26'546 persons (-18.1%).

Read More »

Read More »

Hat Gold als Anlageklasse noch Charme?

Schon allein aufgrund der unruhigen geopolitischen Zeiten müsste Gold als sicherer Anlagehafen eigentlich sehr gefragt sein. Das gilt auch mit Blick auf die weltweite Verschuldung, die seit der Finanzkrise 2008 nicht ab-, sondern weiter aufgebaut wurde. Doch zeigt sich der Goldpreis davon kaum beeindruckt. Welche Faktoren beeinflussen die weitere Entwicklung des Goldpreises und wie ist …

Read More »

Read More »

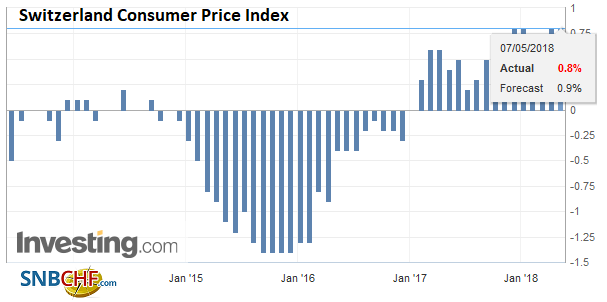

Swiss Consumer Price Index in April 2018: +0.8 percent YoY, +0.2 percent MoM

The consumer price index (CPI) rose by 0.2% in April 2018 compared with the previous month, reaching 101.7 points (December 2015=100). In comparison with the same month of the previous year, inflation stood at 0.8%. These figures were compiled by the Federal Statistical Office (FSO).

Read More »

Read More »

Welche Branchen kaufen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Genau hier an dieser Stelle sitze ich sehr häufig und sage euch, ihr müsst diversifizieren! Nicht alles in ein oder zwei Aktien investieren, auch wenn sie euch noch so gut gefallen, sondern aufteilen, über die verschiedenen Branchen. Aber, …

Read More »

Read More »

Marcel Fratzscher über die Zukunft des Sparens

Welche Zukunft hat das Sparen? Wir haben dazu im Rahmen der Ausstellung “Sparen – Geschichte einer deutschen Tugend” Marcel Fratzscher, Deutsches Institut für Wirtschaftsforschung, Berlin befragt. Die Ausstellung ist vom 23. März bis zum 4. November 2018 im Deutschen Historischen Museum zu sehen. Zur Ausstellung: https://www.dhm.de/sparen #DHMSparen

Read More »

Read More »

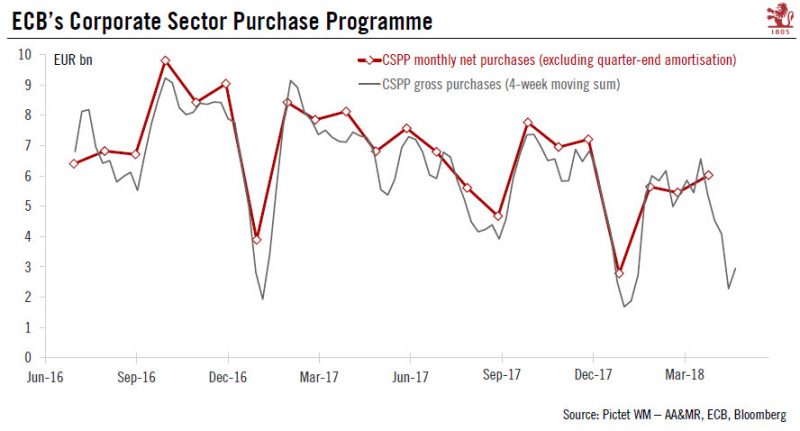

Europe chart of the week – Corporate Sector Soft Patch

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just...

Read More »

Read More »

Policy normalisation may be delayed in Europe

Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to...

Read More »

Read More »