Category Archive: 2) Swiss and European Macro

Bitcoin: Kaufkurse?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Bitcoin & Co. – 100% gratis: http://lars-erichsen.de/ Bitcoin: Sind das jetzt Kaufkurse? Machen wir es kurz und knapp! Meine Meinung dazu, in diesem Video! ——– ► Link zum Video “Bitcoin – Stehen die 38.000? Jetzt günstig einsteigen?”: https://youtu.be/nL6CMRmO8oQ ➤ Mein YouTube-Kanal zum Thema Trading: http://youtube.com/tradermacherde ➤ Folge …

Read More »

Read More »

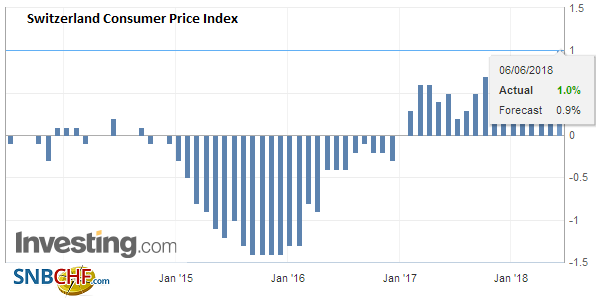

Swiss Consumer Price Index in May 2018: +1.0 percent YoY, +0.4 percent MoM

The consumer price index CPI) increased by 0.4% in May 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein

Dans le contexte morose initié en 2008, l’Espagne était considérée (et l’est encore par beaucoup) comme un « pays à risque » au regard de la rapide dégringolade qu’elle a connue à la suite de la crise des subprimes aux États-Unis d’Amérique. Entre 2007 et 2011, le produit intérieur brut espagnol a reculé de 5 % tandis que le nombre de demandeurs d’emploi passe de 1,7 million à 4,2 millions.

Read More »

Read More »

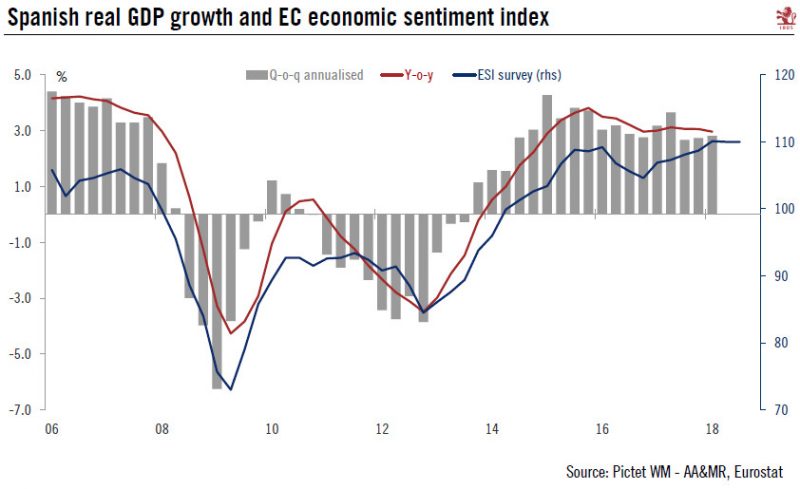

Europe chart of the week – Spanish growth

This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver.

Read More »

Read More »

Das kann doch einen Aktienmarkt nicht erschüttern

Es hat schon weniger Krisenpotenziale als aktuell gegeben, die den Aktienmarkt haben einbrechen lassen. Selbst größte Verwerfungen werden von den Anteilsscheinen mühelos weggesteckt. Was spricht für diese markante Krisenfestigkeit z.B. von deutschen Aktien, die doch massiv unter der neuen Euro-feindlichen Regierung Italiens und den Handelsstreitigkeiten leiden müssten? Oder kommt es doch noch zum Aktieneinbruch? Robert …

Read More »

Read More »

Stürzt Italien Europa in die Krise?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Stürzt Italien Europa in die Krise? Worauf können wir bei unserer Geldanlage achten, um nicht auf dem falschen Fuß erwischt zu werden? Die Antworten darauf, gibt es im heutigen Video! ——– ➤ Mein YouTube-Kanal zum Thema Trading: http://youtube.com/tradermacherde …

Read More »

Read More »

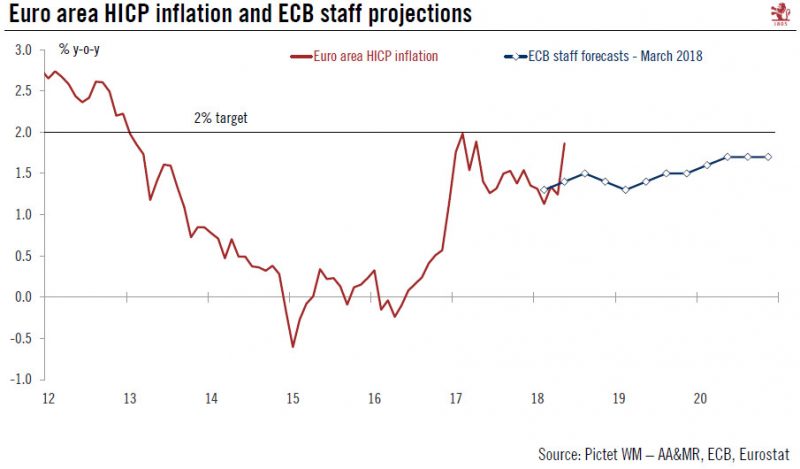

Euro area inflation close to ECB target in May

Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%).

Read More »

Read More »

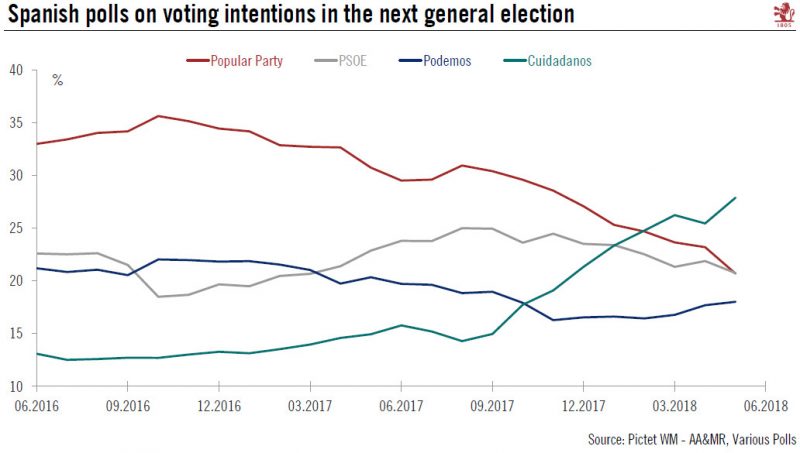

Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote probably on June 1.

Read More »

Read More »

Yanis Varoufakis: Live at Politics and Prose

Yanis Varoufakis discusses his books, ” Adults in the Room” and “Talking to my Daughter About the Economy”, at Politics and Prose on 5/10/18. In his eye-opening memoir, Adults in the Room, Varoufakis, Greece’s former Finance Minister, recounts his frustrating struggle to resolve Greece’s debt crisis without resorting to austerity measures. His book give us …

Read More »

Read More »

Yanis Varoufakis – On Major Economists

This video is an extract from an hour-long 13 January 2017 interview by Dave Rubin titled “Yanis Varoufakis and Dave Rubin Talk Greece’s Financial Crisis”. LINK: https://youtu.be/8DP_v8f8ihs Wikipedia bio mashup: Born in Athens in 1961, Phd in economics from England, taught at University of Sydney, escaped back to Greece due to the conservative turn in …

Read More »

Read More »

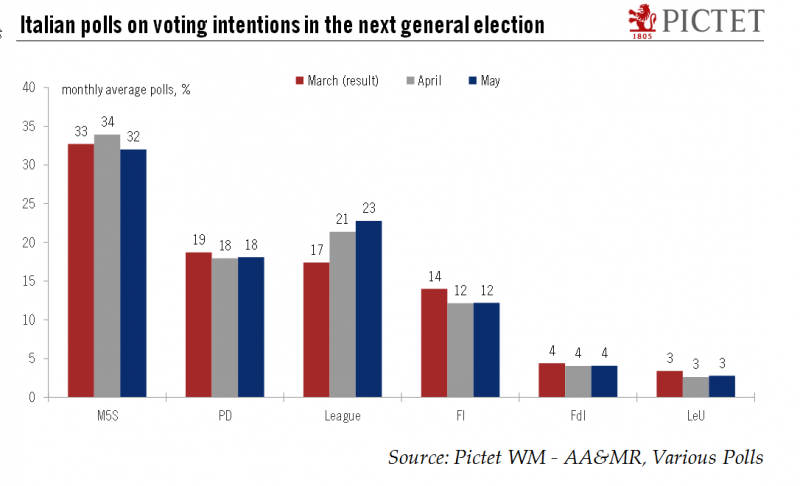

Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country.This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a...

Read More »

Read More »

Pictet – Multi-Generational Wealth, Nassau

THE ROLE OF REAL ASSETS IN A VIRTUAL WORLD? The fifth edition of the Latam Family Office Master Class took place in Nassau in April 2018, with more than 60 guests attending. This year the focus was around geopolitics, digital revolution, alternative investments and family governance. Among the speakers, we had the pleasure of welcoming …

Read More »

Read More »

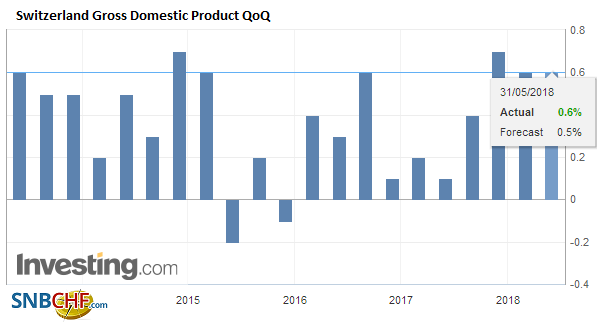

Switzerland GDP Q1 2018: +0.6 percent QoQ, +2.2 percent YoY

Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade.

Read More »

Read More »

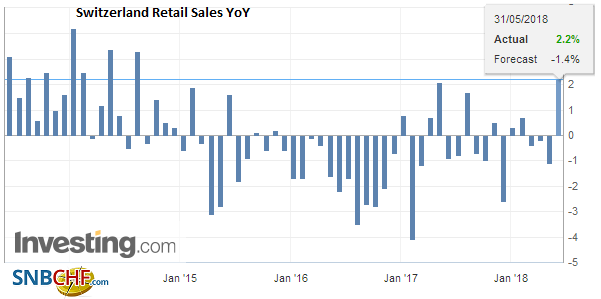

Swiss Retail Sales, April: +2.2 Percent Nominal and -0.1 Percent Real

Turnover in the retail sector rose by 2.2% in nominal terms in April 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Diese Aktie ist ein heißer DAX-Kandidat!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Den Kursverlauf der folgenden Aktie kann man nicht anders als spektakulär bezeichnen. So ist es kein Wunder, dass dieses Unternehmen ein ganz heißer Dax-Kandidat ist und den schauen wir uns heute an. Los geht´s! ——– ➤ Link zum …

Read More »

Read More »

Europe under pressure – Yanis Varoufakis on the state of the Eurozone

“We live in an interesting time where the past is no longer a good predictor of the present and future.” Speaking on the state of the Eurozone, Yanis Varoufakis, Former Minister of Finance of Greece and Professor of Economics, warns us of the possible ways that an Europe under pressure could go. For more on …

Read More »

Read More »

Italien fordert und EU und EZB werden gehorchen müssen

Da Italien einmal mehr keine Regierung findet, kommt es spätestens im Herbst zu Neuwahlen. Laut aktuellen Umfragen wird das Euro-feindliche und Schulden-freundliche Populistenbündnis eine klare Mehrheit erzielen. Welche Gefahren drohen der europäischen Idee und ihren Finanzmärkten? Wie könnten die EU und EZB reagieren? Steht sogar die nächste Euro-Krise vor der Tür? Robert Halver mit seinen …

Read More »

Read More »