Category Archive: 2) Swiss and European Macro

Kommt 2019 der Crash?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Kommt 2019 der Crash an den Märkten? Das zumindest behauptet einer der größten Investoren unserer Zeit. Wir wollen in diesem Video beleuchten, was dahinter steckt. Los geht´s. ——– ➤ Link zum Video “Wie die Wirtschaftsmaschine funktioniert”: https://youtu.be/dJMiVGlnLSc ➤ …

Read More »

Read More »

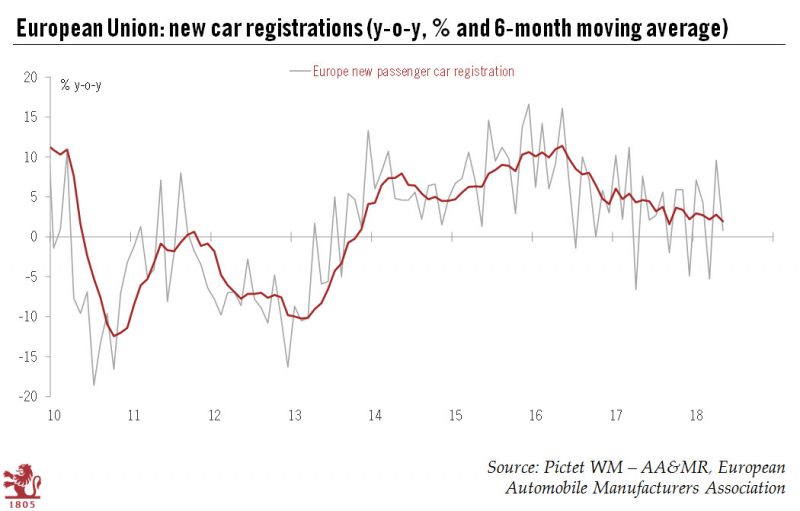

European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.

Read More »

Read More »

Union européenne. Les chiffres de la dette. LHK

Le volume cumulée d’endettement de l’UE atteint en 2017 le chiffre respectable de 12, 46664 billions d’euros (à ne pas confondre avec le billion américain!). - Cela revient à un endettement cumulé de 12 466 640 000 000 euros, soit 12 trillions d’euros (référence de mesure US)

Read More »

Read More »

Swiss Unemployment Continues to Fall

The number of registered unemployed in Switzerland dropped by 9% in May 2018 to a rate of 2.4%, down from 2.7% in April, according to a report by the State Secretariat for Economic Affairs (SECO). The rate in May 2018 was 22% lower than in May 2017.

Read More »

Read More »

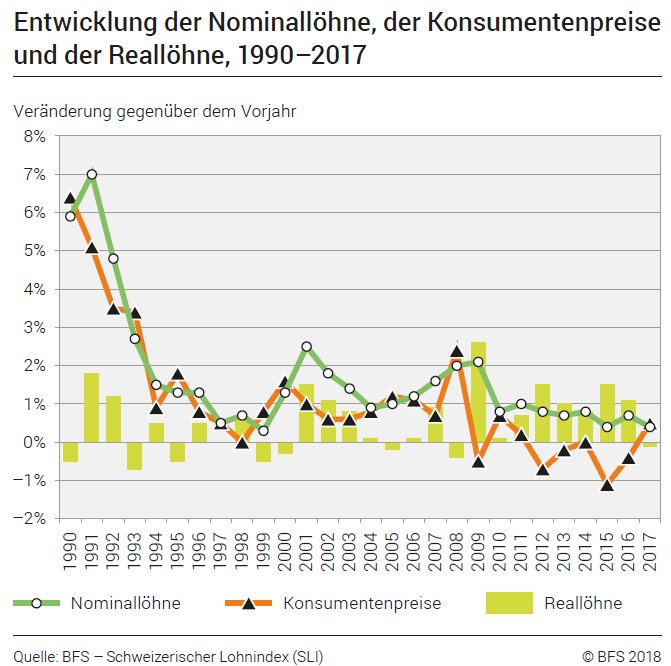

Swiss wage index 2017: Nominal wage increase of 0.4percent in 2017 – real wages decrease by 0.1percent

The Swiss nominal wage index rose by +0.4% on average in 2017 compared with 2016. It settled at 101.1 points (base 2015 = 100). Given an average annual inflation rate of +0.5%, real wages registered a decrease of -0.1% (101.0 points, base 2015 = 100) according to calculations by the Federal Statistical Office (FSO).

Read More »

Read More »

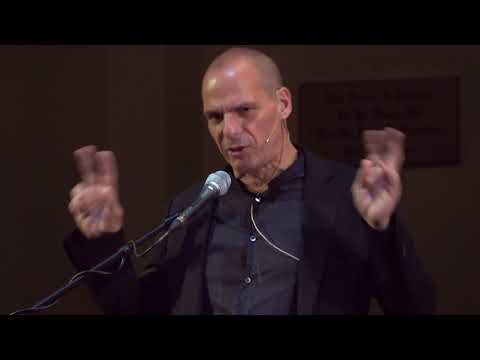

Why Germany neither can nor should pay more to save the eurozone – Yanis Varoufakis | DiEM25

Can Europe and the Eurozone continue as before or should Germany pay for Greece, Italy and others? June 11, 2018. In this presentation at the IFO institute in Munich, DiEM25 co-founder Yanis Varoufakis sets out to prove that neither is possible. He argues that in order to save the ideal of Europe and prevent a …

Read More »

Read More »

Yannis Varoufakis on Bitcoin and Political Money | The New School

Yanis Varoufakis, economist, academic and former Greek Minister of Finance, in conversation with Will Milberg, dean of The New School for Social Research, discussing Bitcoin and the concept of Political Money. Bonus material from Yanis Varoufakis on Talking to My Daughter About the Economy: https://youtu.be/UwWRSIXbpIQ See more interviews and highlight content with the most prominent …

Read More »

Read More »

Credit Spreads: Polly is Twitching Again – in Europe

The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels.

Read More »

Read More »

Vollgeld: Die Lösung unserer Probleme?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Vollgeld könnte man als Gegenstück zu Fiatgeld bezeichnen, welches Herzstück unseres derzeitigen Wirtschaftssystems ist. Bietet Vollgeld vielleicht die Lösung unserer aktuellen Probleme? Die Schweizer haben “Nein” gesagt, dennoch lohnt sich ein Blick darauf. Los geht´s! ——– ➤ Mein …

Read More »

Read More »

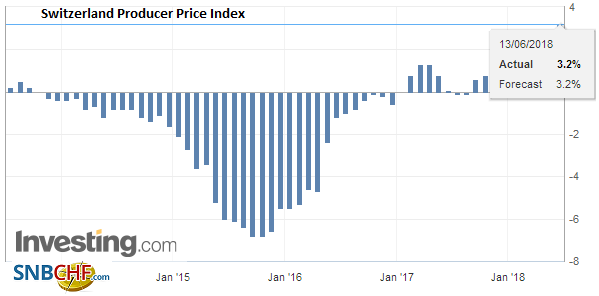

Swiss Producer and Import Price Index in May 2018: +3.2 percent YoY, +0.2 percent MoM

The Producer and Import Price Index increased in May 2018 by 0.2% compared with the previous month, reaching 103.0 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products. Compared with May 2017, the price level of the whole range of domestic and imported products rose by 3.2%. These are some of the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

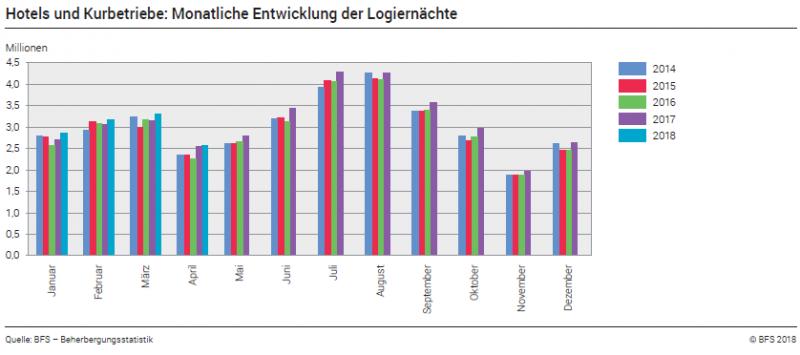

Tourist Accommodation in the Winter Season 2017/2018: Growth in Overnight stays in Switzerland

The Swiss hotel industry registered 16.5 million overnight stays during the winter tourist season (November 2017 to April 2018), i.e. an increase of 4.6% (+724 000) compared with the same period of the previous year. With a total 8.7 million overnight stays, foreign demand grew by 5.6% (+460 000). Domestic demand rose by 3.5% (+264 000) reaching 7.8 million units.

Read More »

Read More »

Das wirtschaftspolitische Aussitzen auf dem Ruhekissen des deutschen Exports ist vorbei

Trumps Platzenlassen des G7-Gipfels in Kanada zeigt, dass der US-Präsident den Handelsstreit mit Europa ernst betreibt. Amerika sorgt nicht mehr wie bisher für eine gute Binnen- und auch Weltkonjunktur, an der sich der deutsche Außenhandel laben kann. Export kann zukünftig immer weniger Deutschlands wirtschaftliche Sorgenpause sein. Berlin muss handeln. Welche wirtschaftspolitischen Alternativen gibt es? Robert …

Read More »

Read More »

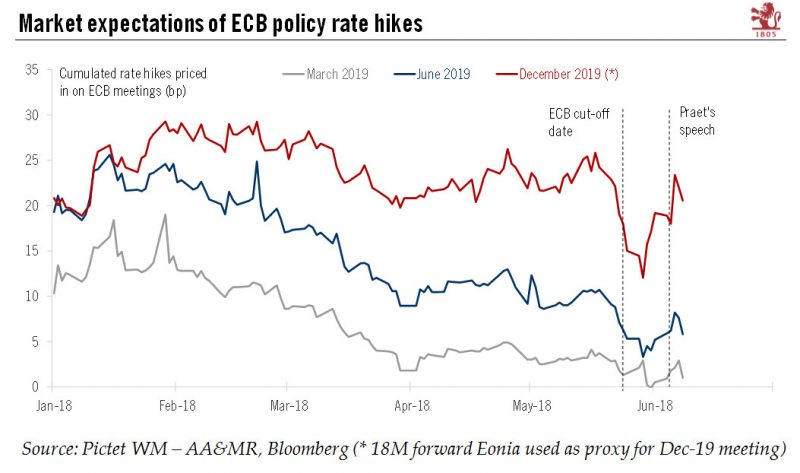

ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners).

Read More »

Read More »

Prof Dr Heiner Flassbeck Wie sozial kann Wirtschaft sein

Videolink: Quelle: TIDETVhamburg https://www.youtube.com/channel/UCkbZm8DfTRNScjklYPeW9jQ Veröfentlicht: 19.01.2018

Read More »

Read More »

Yanis Varoufakis: How Capitalism Works–and How It Fails

How should parents talk to their children about the economy: how it operates, where it came from, how it benefits some while impoverishing others? Former Finance Minister of Greece Yanis Varoufakis has appeared before heads of nations, assemblies of experts, and countless students around the world—and now he joins us to add Town Hall audiences …

Read More »

Read More »

Pictet – In Conversation With Alexandre Tavazzi

This year has clearly been defined by market volatility – and it feels a long way from the boom times of last year. But the message from Alexandre Tavazzi – a global strategist at Pictet Wealth Management – is that growth remains robust and investors simply need to be more nimble. He spoke from the … Continue reading...

Read More »

Read More »

Amazon, Facebook & Co: Wie lange geht das noch gut?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Sind die Aktien Amazon, Facebook und Co. vielleicht etwas heiß gelaufen? In diesem Video zeige ich euch die aus meiner Sicht wirklich wichtigen Marken, die nicht unterschritten werden dürfen. Los geht´s! ——– ➤ Link zum Depot der Rendite-Spezialisten: …

Read More »

Read More »

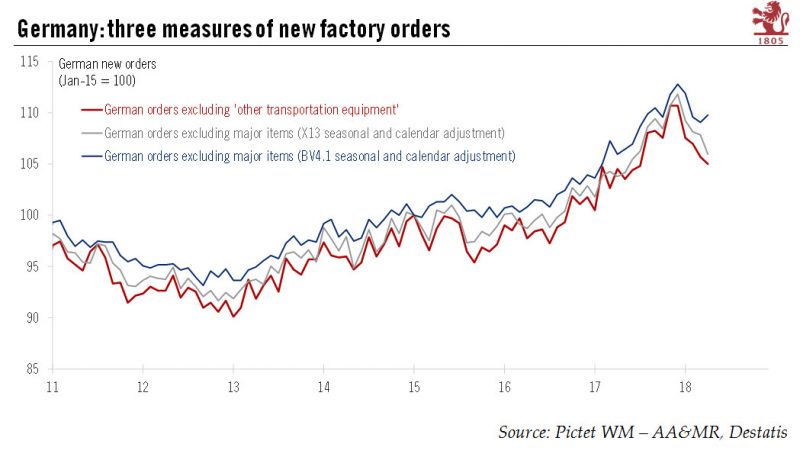

Europe chart of the week-German new orders

German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing orders are off to an extremely weak start in Q2 (-3.3% q-o-q after -2.2% q-o-q in Q1). What is more, the decline in demand for German goods in April was fairly broad-based across countries and sectors.

Read More »

Read More »

Europe’s Woes Multiply

The Markit group that provides many of the PMI surveys noted with today's reports that the eurozone outlook has "darkened dramatically." This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted.

Read More »

Read More »