Category Archive: 1.) SNB Press Releases

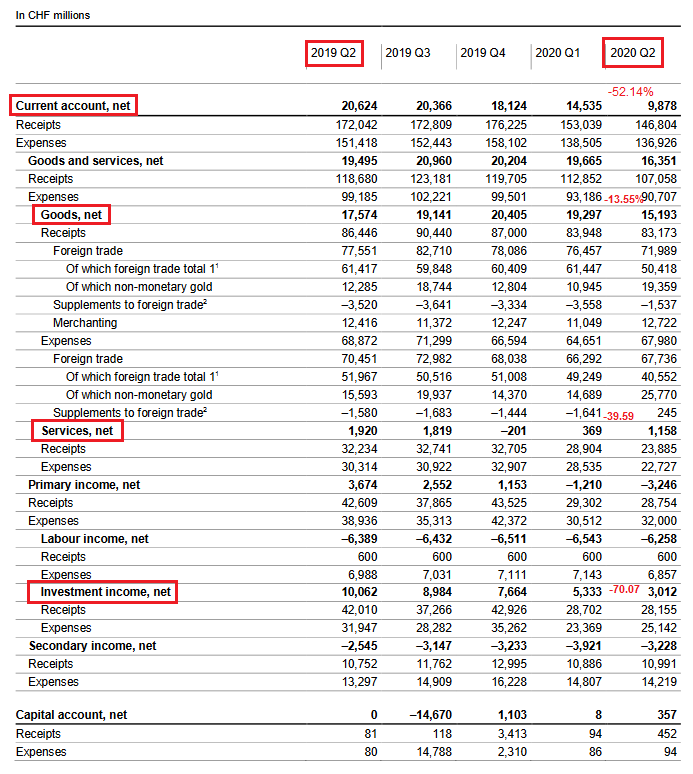

Swiss balance of payments and international investment position: Q2 2020

In the second quarter of 2020, the current account surplus amounted to CHF 10 billion; in the same quarter of 2019 it was CHF 21 billion. This decline was principally due to lower receipts from direct investment abroad. While the goods trade balance and the services trade balance changed only marginally, there was a significant decrease in receipts and expenses.

Read More »

Read More »

U.S. dollar liquidity-providing operations from 1 September 2020

In view of continuing improvements in U.S. dollar funding conditions and the low demand at recent 7-day maturity U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to further reduce the frequency of their 7-day operations from three times per week to once per week.

Read More »

Read More »

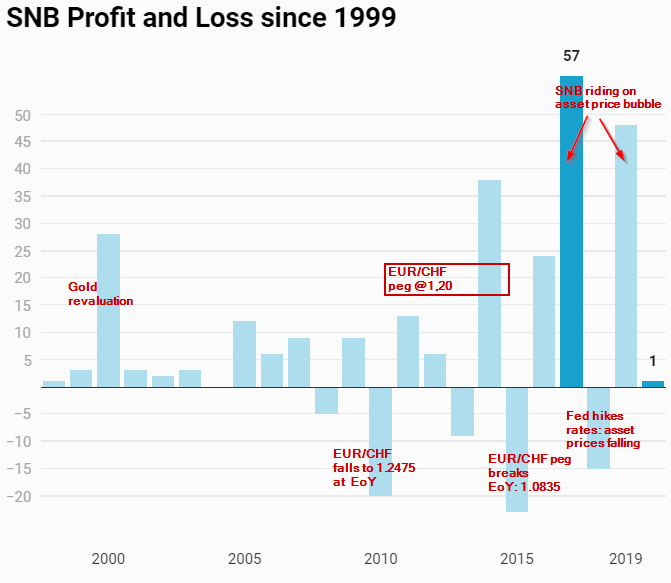

Fed and ECB Money Printing Helps SNB Back into Positive Territory

Fed and ECB money printing and massive fiscal stimulus help the SNB to come back into positive territory for the year.

The renewed asset price inflation compensate for losses on the US dollar.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 18.06.2020

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 18.06.2020

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas...

Read More »

Read More »

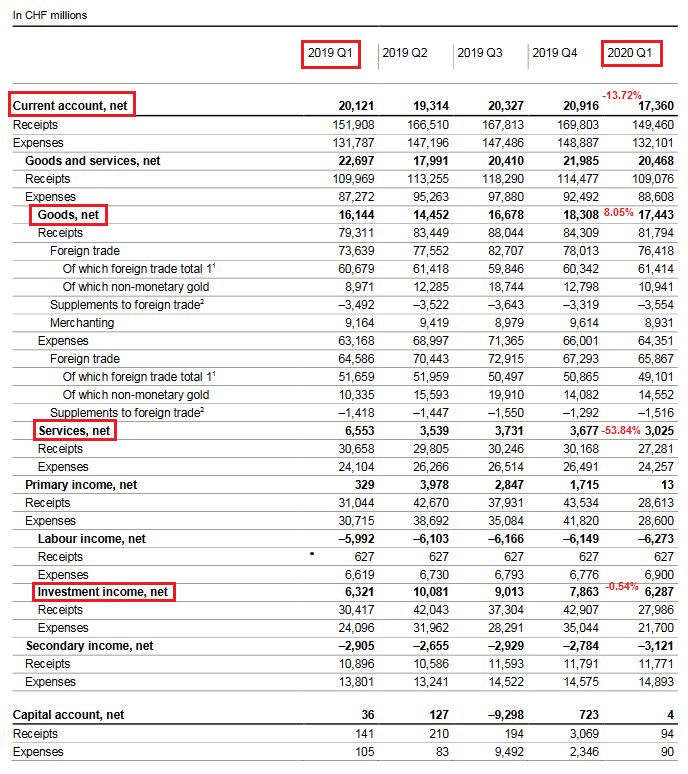

Swiss Balance of Payments and International Investment Position: Q1 2020

Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF.

Read More »

Read More »

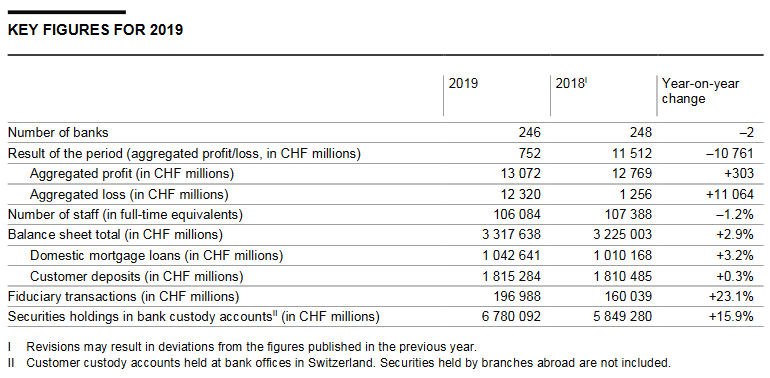

Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics. The most important figures are summarised below.

Read More »

Read More »

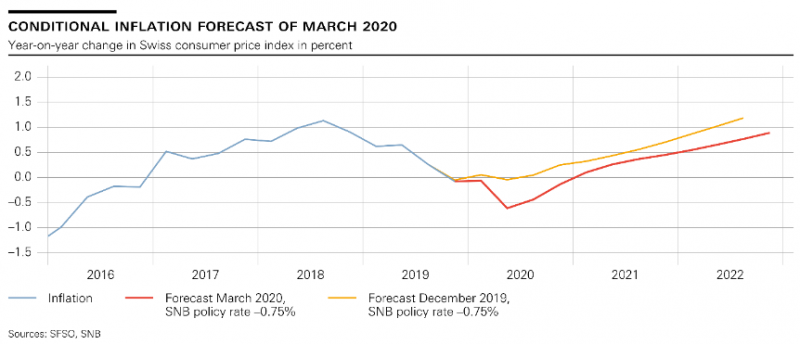

SNB Monetary Policy Assessment June 2020 and Videos

The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland.

Read More »

Read More »

Announcement regarding recall of banknotes from eighth series

The issuance of the ninth banknote series was concluded on 12 September 2019. The Swiss National Bank intends to communicate the statutory recall of the banknotes from the eighth series two months in advance in the first half of 2021.

Read More »

Read More »

SNB COVID-19 refinancing facility expanded to include cantonal loan guarantees as well as joint and several loan guarantees for startups

The Swiss National Bank announced the establishment of the SNB COVID-19 refinancing facility (CRF) on 25 March 2020. This facility allows banks to obtain liquidity from the SNB by assigning credit claims from corporate loans as collateral. In so doing, the SNB enables banks to expand their lending rapidly and on a large scale.

Read More »

Read More »

SNB appoints new delegate Fabian Schnell for regional economic relations for Zurich region

With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020.

Read More »

Read More »

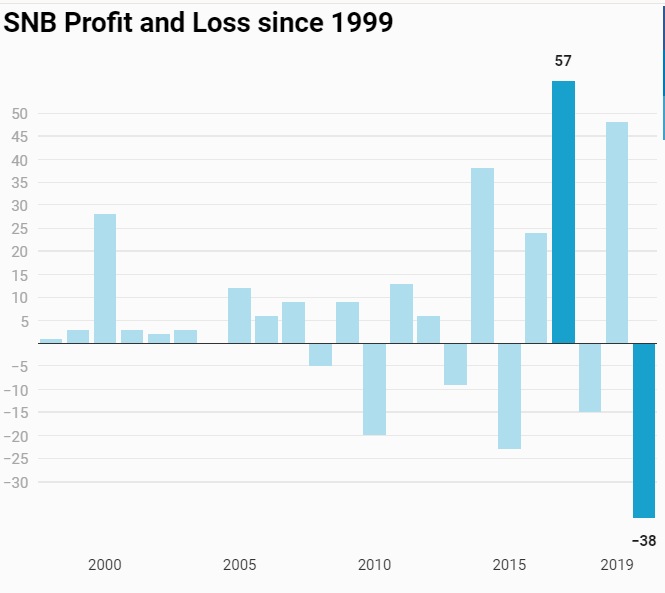

SNB Interim Results: -38 Billion, An Analysis

The Swiss National Bank reports a loss of CHF 38.2 billion for the first quarter of 2020. The loss on foreign currency positions amounted to CHF 41.2 billion.

Read More »

Read More »

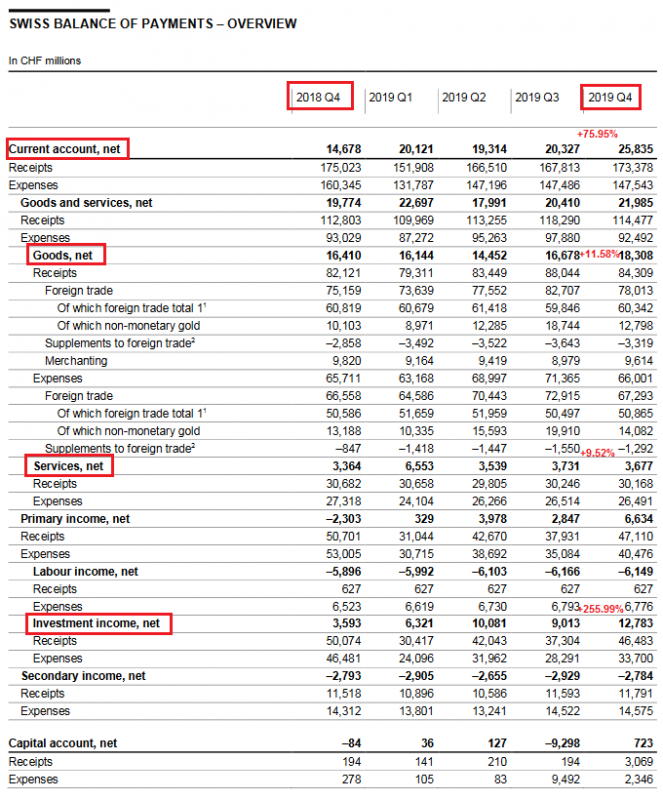

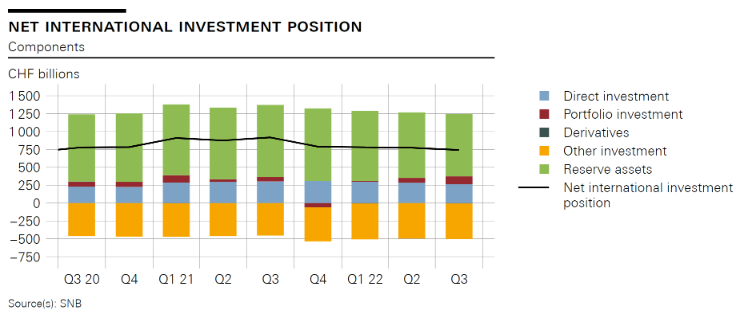

Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

In the fourth quarter of 2019, the current account surplus was CHF 26 billion, CHF 11 billionmore than in Q4 2018. The increase was primarily attributable to the higher receipts surplus in investment income and goods trade. The transactions reported in the financial account showed a net acquisition of financial assets (CHF 40 billion) and a net incurrence of liabilities (CHF 19 billion) in Q4 2019.

Read More »

Read More »

Monetary policy assessment of 19 March 2020

Swiss National Bank maintains expansionary monetary policy, raises negative interest exemption threshold, and is examining additional steps. Coronavirus is posing exceptionally large challenges for Switzerland, both socially and economically. Uncertainty has risen considerably worldwide, and the outlook both for the global economy and for Switzerland has worsened markedly.

Read More »

Read More »

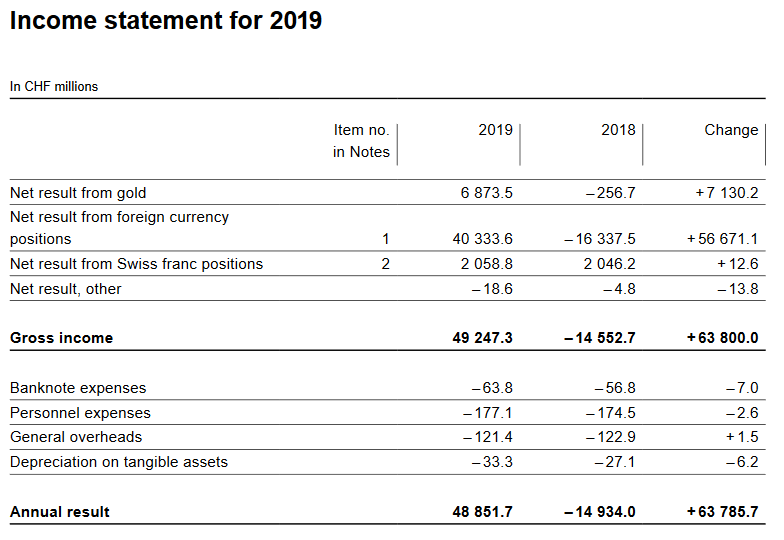

SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was … Continue reading »

Read More »

Read More »

2020-02-17 – The SNB’s Karl Brunner Distinguished Lecture Series: Carmen Reinhart to hold fifth lecture

The Swiss National Bank is honouring Carmen Reinhart with this year’s Karl Brunner Distinguished Lecture Series. Carmen Reinhart is an influential economist who has made outstanding contributions to macroeconomics. She has been Professor of the International Financial System at Harvard Kennedy School since 2012, and also currently serves on the Economic Advisory Panel of the Federal Reserve Bank of New York.

Read More »

Read More »

Cérémonie symbolique de remise du billet de 100 francs

Cérémonie de remise symbolique du billet de 100 francs à Ayent, le 12 septembre 2019

Orateurs:

Thomas Jordan, président de la Direction générale de la Banque nationale suisse

Marco Aymon, président de la Commune d’Ayent

Gustave Savioz, président du Consortage du Grand Bisse d’Ayent

Roberto Schmidt, président du Conseil d’Etat du Canton du Valais

Animation:

Romaine Jean

Read More »

Read More »

Cérémonie symbolique de remise du billet de 100 francs

Cérémonie de remise symbolique du billet de 100 francs à Ayent, le 12 septembre 2019 Orateurs: Thomas Jordan, président de la Direction générale de la Banque nationale suisse Marco Aymon, président de la Commune d’Ayent Gustave Savioz, président du Consortage du Grand Bisse d’Ayent Roberto Schmidt, président du Conseil d’Etat du Canton du Valais Animation: …

Read More »

Read More »

Central bank group to assess potential cases for central bank digital currencies

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 12.12.2019

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 12.12.2019

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »