Category Archive: 1.) English Posts on SNB

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

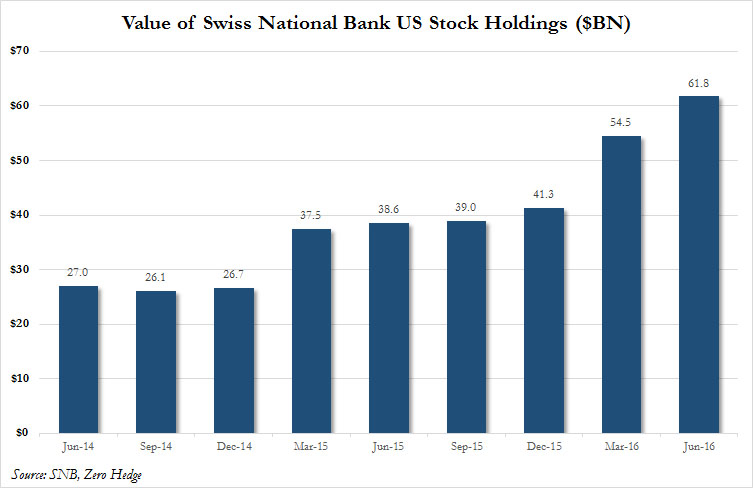

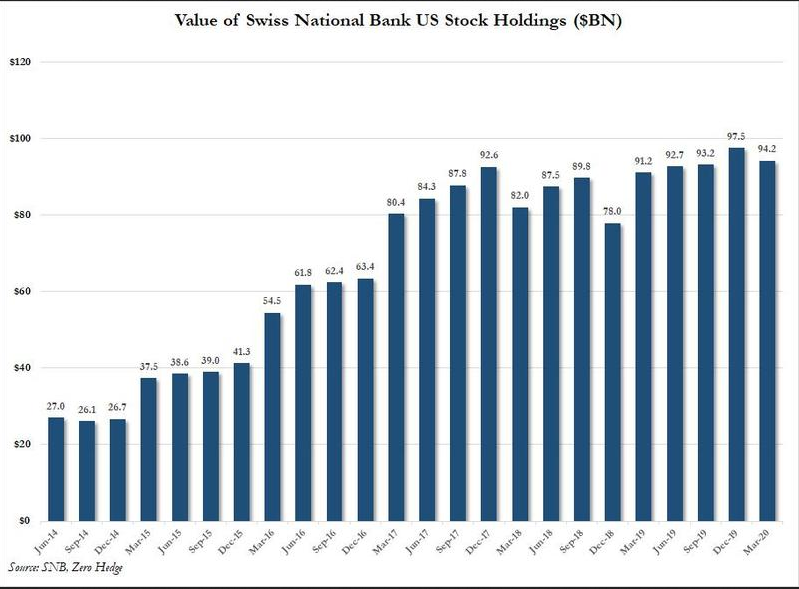

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger.

Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved.

Read More »

Read More »

SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

SNB intervenes for 6.3 bil francs in the week ending last Friday. Once again a record high since January 2015. The SNB raised the intervention level to 1.0850. Apparently conversion of GBP->CHF flows into GBP-> EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K last week.

Read More »

Read More »

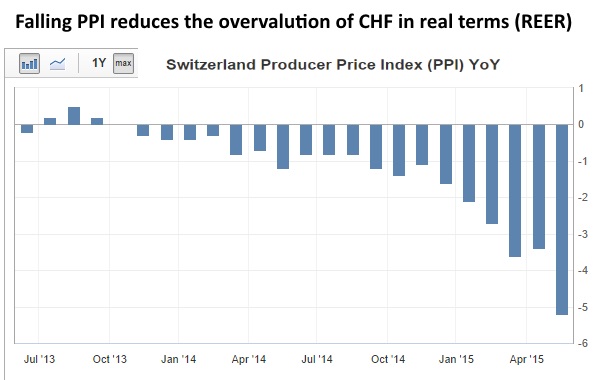

Purchasing Power Parity, REER: Swiss Franc Overvalued?

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

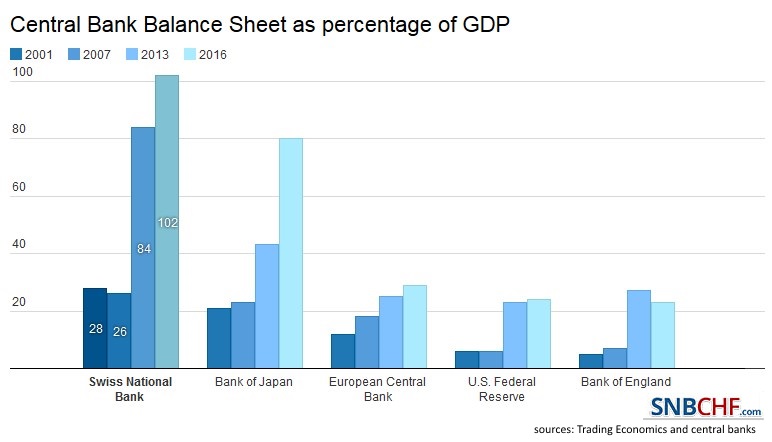

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

SNB Increased Equities Share to 20 percent, A High Risk Game for a Conservative Investor

A share of 20% equities is too much for a conservative investor.

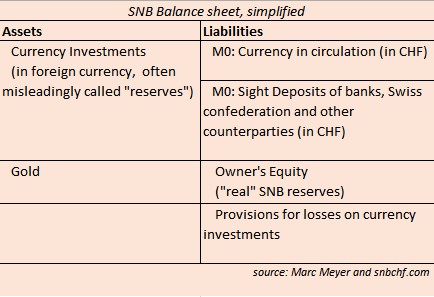

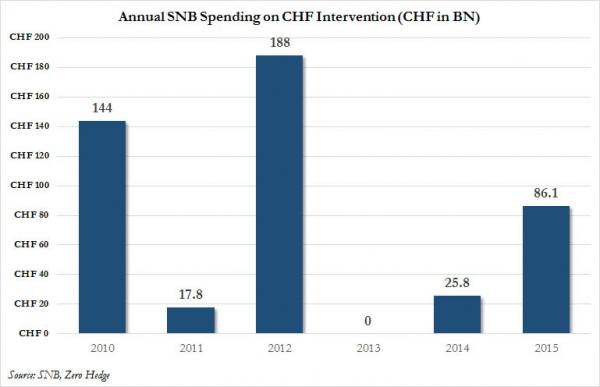

- She increases the CHF debt with continuing interventions at a pace of 10% per year.

- yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive.

Read More »

Read More »

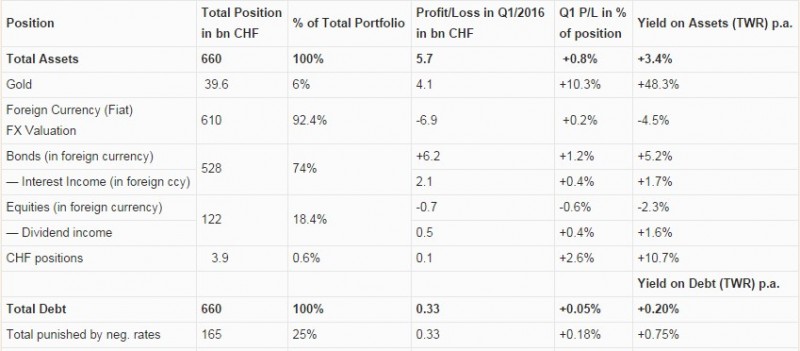

Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

SNB Results Q1 2016: Two thirds of SNB profit comes from Gold. Deflation helps with higher bonds prices and profit on negative interest rates.

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

April 2016: SNB running suicide again?

Speculative position: Speculators are even longer CHF (against USD): +9410x 125K contracts.

Sight Deposits: SNB intervenes for 6.4 bln. CHF in only three weeks. Sight deposits (aka debt) are rising by nearly 1% per month, this is 10% per year. The SNB can never achieve such a yield on investment, her yield is between 1 and 2 percent. Is the bank running suicide again?

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

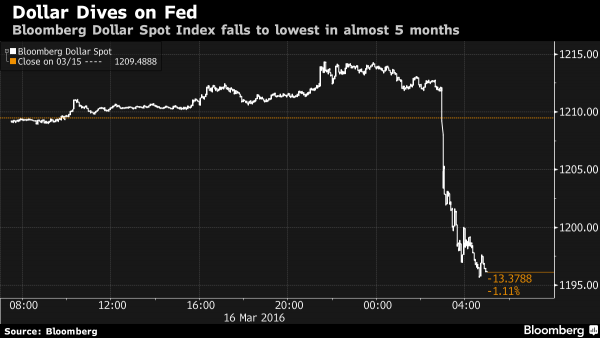

March 2016: Highest SNB Interventions since January 2015

Speculative position: Strong shift to CHF long: +4967x 125K contracts after the Fed reduced their expectations of rate hikes for this year. …………Sight Deposits: SNB intervenes for 6.1 bln. CHF during the month of March. This is the higest level since January 2016. ……….FX: EUR/CHF steady slightly over 1.09. As I expected last week, the EUR/CHF …

Read More »

Read More »

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »