Category Archive: 1) SNB and CHF

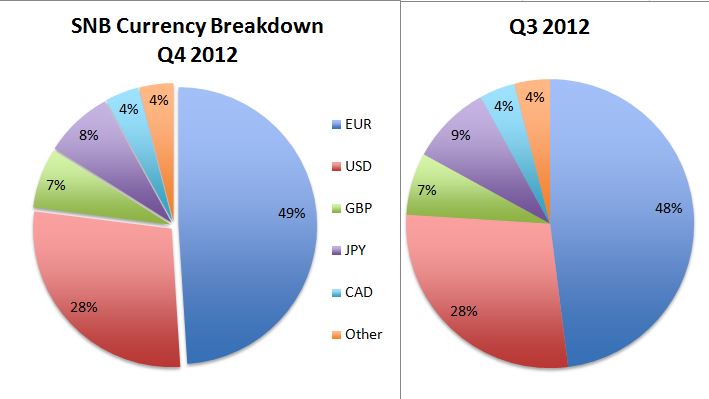

SNB Reserves Rise by 8 bln. CHF Thanks to Stronger USD, GBP, CAD and some FX Purchases

In March 2013, the foreign currency reserves of the Swiss National Bank (SNB) rose by 8 bln. CHF from 437 bln. to 445 bln. mostly thanks to valuation gains on US dollar, sterling and Canadian dollar. full details

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

SNB Monetary Assessment March 2013

In its monetary assessment the SNB maintains the EUR/CHF floor and warned against further risks in the euro zone. The SNB has downgraded the inflation path to -0.2% (previously-0.1%) in 2013 and +0.2% (+0.4%) in 2014.We do not completely agree.

Read More »

Read More »

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

SNB Liabilities (deposits & bank notes) at New Record High

SNB sight deposits are rising again, by 700 million CHF in one week. But the amount of cash in form of bank notes and coins has risen by 10% since September. It seems that the central bank is now not only virtually printing (via sight deposits) but also physically. SNB liabilities reached a new record high. Details

Read More »

Read More »

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »

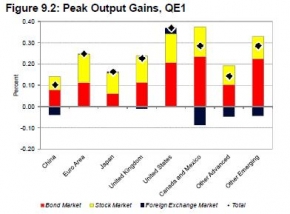

What QE means for the world: Positive-sum currency wars

Brazil’s finance minister coined the term “currency wars” in 2010 to describe how the Federal Reserve’s quantitative easing was pushing up other countries’ currencies. Headline writers and policy makers have resurrected the phrase to describe the Japanese government and central bank’s pursuit of a much more aggressive monetary policy, motivated in part by the strength of the yen.The clear implication of the term “war” is that these policies are...

Read More »

Read More »

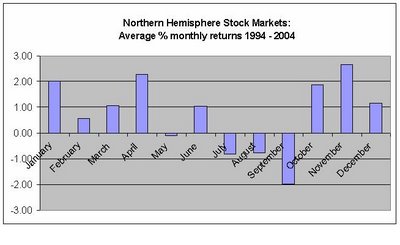

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

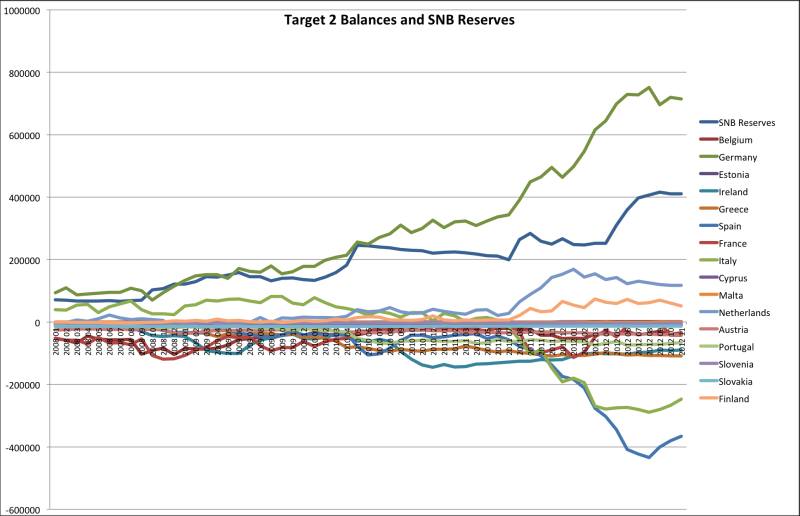

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Franc-ly we’re delighted, said the SNB

Here’s the Swiss franc at its weakest level against the euro since the Swiss National Bank put its cap into place in September 2011: The euro hit SFr1.2485 on Thursday, up 3.3 per cent since the 10th of January and back to levels not seen since May 2...

Read More »

Read More »

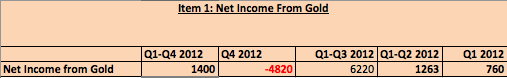

SNB Profit 6 Billion CHF over the Year, 10.9 Billion Loss in Q4/2012

The Swiss National Bank (SNB) obtained a profit of around 6 billion francs for the year 2012 (full statement). The profit was reduced from 16.9 billion francs between Q1 and Q3 2012, which means that in Q4/2012 the bank had a loss of around 10.9 billion francs. The profit in gold fell from 6.2 billion …

Read More »

Read More »

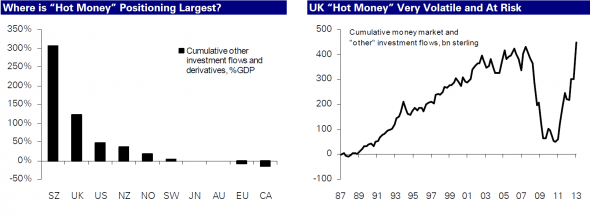

The wonders of the FX universe

Dark matter may more commonly be associated with physics, space exploration and Professor Brian Cox, but, according to Deutsche Bank’s FX strategist George Saravelos, there’s a good chance that it’s becoming a recognisable force in the world of forei...

Read More »

Read More »

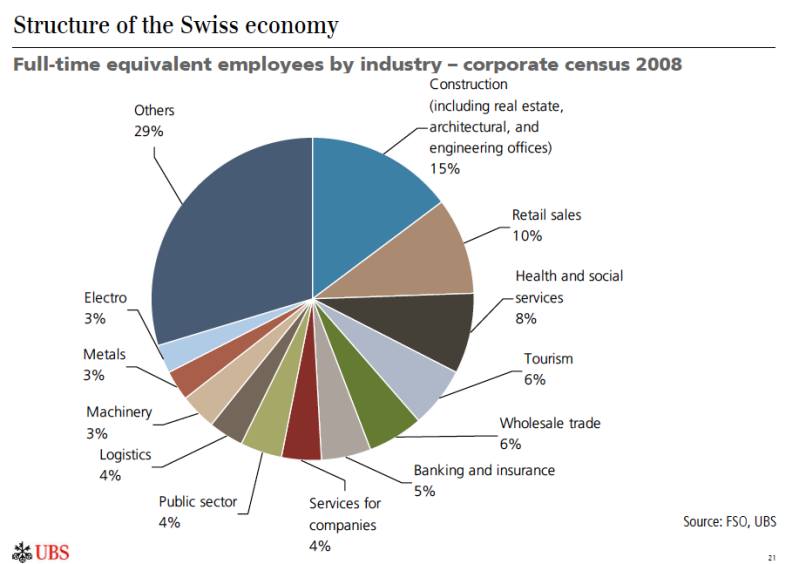

Yearly Swiss Doomsaying and Swissmem’s Control over the Swiss National Bank

The same as every year in December/January: Swiss media and economists are doomsaying. This time they claim that the banking industry and the UBS job losses will bring Switzerland into trouble. Once again they do not understand that the Great Recession was only to a small part a banking crisis, but it was mostly a … Continue reading »

Read More »

Read More »

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP.

Read More »

Read More »

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »