We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income asset managers. Moreover we publish the yield on investment.

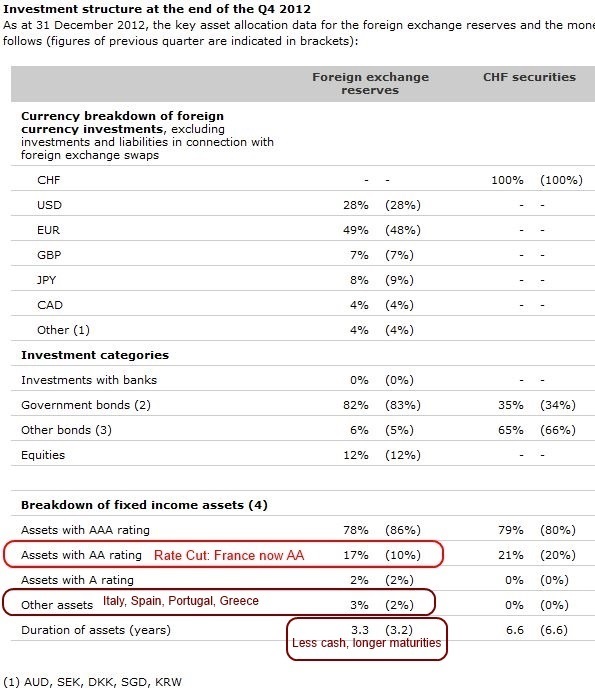

Composition of SNB Forex Reserves, Q4 2012

The Swiss National Bank (SNB) saw a reduction of AAA assets because France was downgraded to AA by two of the major rating agencies.

Since the price of French government bonds relative to others did not fall substantially despite the downgrade, it is obvious that the SNB exposure to France is 7% – the difference between AA assets as of Q3 (10%) and as of Q4 (17%). Other assets, e.g. government bonds of the European periphery rose in price. Therefore they have a higher percentage (3%). The SNB continues to increase duration and replaces redeemed bonds with securities with higher maturities.

This gives an indication that the central bank excludes an inflationary environment and a rise of bond yields. Otherwise it would not make sense to buy bonds with longer maturities at high prices now.

The central bank holds nearly 20% cash at other central banks. They are contained in the official statistics in the 78% government bond share, the net government bond piece is hence only 62%. (see comment 2 in the Q3/2012 structure).

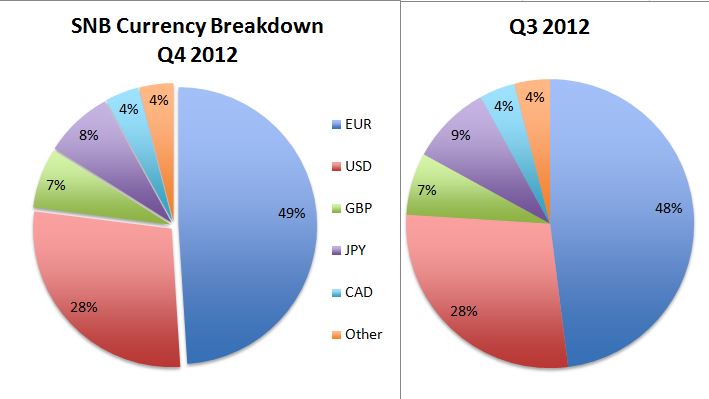

Breakdown by Currencies Q4 vs Q3

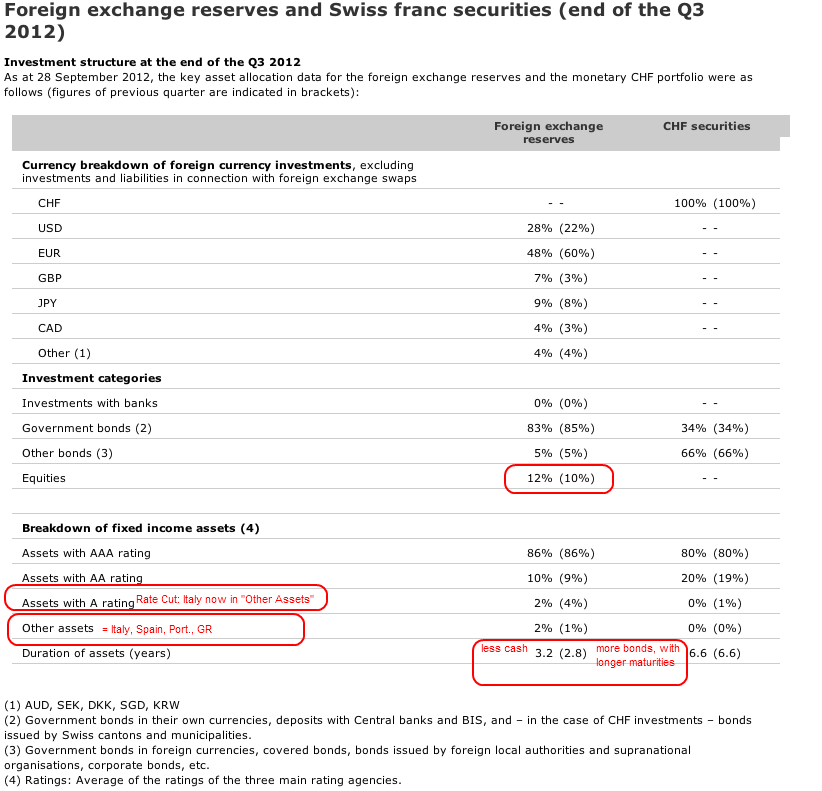

Composition of SNB Forex Reserves, Q3 2012

The SNB reduced the share of euros in the third quarter substantially from 60% in Q2 to 48% in Q3 and increased dollar and pound positions. The SNB bought 80 billion euros or more when the common currency was trading around 1.24$, especially at the end of May, in June and July.

After the ECB and the Fed promised monetary easing, the SNB used the moment to exchange the euros into the dollar and pound Sterling at prices of 1.30 US$ and more.

The central bank might have bought 70 billion dollars between the beginning of August and the end of September. Nomura even speaks of euros sold with the value of 76 billion CHF.

Based on the 5% difference between EUR/USD 1.24 and 1.30 and 40 billion euros exchanged into dollars and pounds, we judge that the SNB made trading gains of 2 billion €, a big part of the 5.2 billion CHF foreign exchange rate income in Q3/2012.

This page at the SNB shows exactly how the currency reserves are invested.

Breakdown by Currencies Q1 – Q4

The decomposition shows that the SNB currently underweights euro positions even against Q1/2012, the 2011 percentage of 52% and the 2010 value of 55 (see below). The reason is not that the euro is currently extraordinarily cheap against the dollar, like in Q2/2012. In both year-end 2010 and year-end 2011 EUR/USD traded around 1.30.

Q3 Decomposition in Currencies, Ratings and Asset Classes

Despite a better mood for peripheral bonds, the central bank cut the share of lower ratings (below AA) from 5% in Q2 to 4% in Q3. They might have sold Italian and Spanish bonds in the “europhoria” of September.

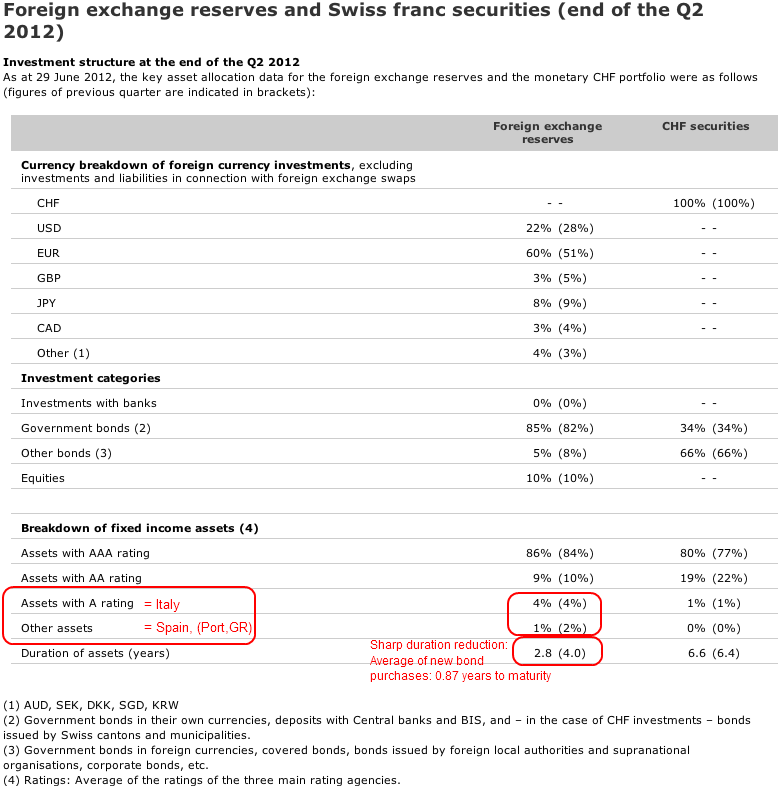

Decomposition at the end of Q2 2012

In the second quarter the SNB maintained the share of A-rated bonds. The major European country with an A-rating was Italy. Given that the central bank purchased many euro-denominated bonds, it also bought A-rated bonds for a share of 4%.

Either by price reduction or because the SNB did not buy them, the share of “Other Assets”, those with a rating under “A” decreased. The major European country with a rating below A was Spain.

Spain was downgraded to BBB (by Moody’s, Fitch, and Standard & Poor’s) before the end of Q2, for the SNB’s “Other Assets”. Moody’s downgraded Italy to under A rating only in July, Standard & Poor’s carried out this step earlier. Fitch currently maintains its A- rating. By common practice, the SNB kept Italy in its category “A ratings” until the end of Q2. (For the BIS rating comparison among the three providers see here.)

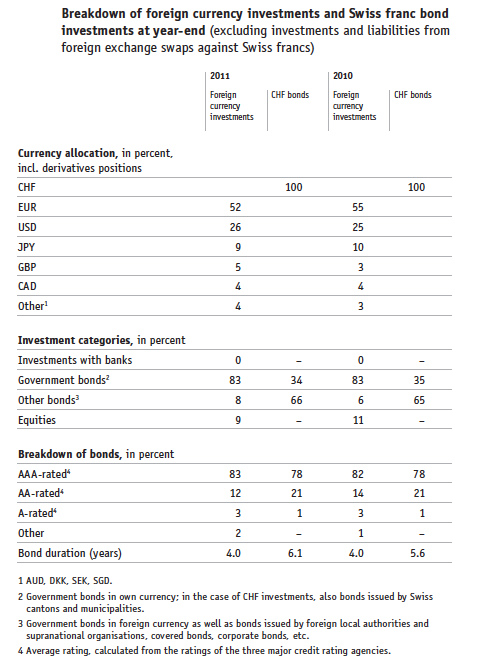

Investment structure at the end of 2011

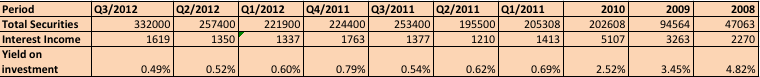

Seigniorage Effect: Income yield on bond investments

Given an average duration of four years for fixed-rate investments and an equity quota of 9%, interest rate risk and share price risk, by contrast, contributed very little to total risk.

(source SNB Annual Report 2011, page 68)

Tags: decomposition,Duration,equities,Forex reserves,FX reserves,Government Bonds,profit,Rating,Reserves,results,Seigniorage,SNB asset allocation,Swiss National Bank