Category Archive: 1) SNB and CHF

Credit Suisse “Beschattungsaffäre”: FINMA stellt schwere Aufsichtsrechtsverletzungen fest

Die Eidgenössische Finanzmarktaufsicht FINMA schliesst ihr Verfahren gegen die Credit Suisse im Zusammenhang mit der sogenannten Beschattungsaffäre ab. Sie stellt fest, dass bei der Credit Suisse im Zusammenhang mit Observationstätigkeiten gravierende organisatorische Mängel bestanden.

Read More »

Read More »

Mosambik-Kredite: FINMA schliesst Verfahren gegen Credit Suisse ab

Die Credit Suisse hat im Zusammenhang mit Kreditgeschäften aus dem Jahr 2013 mit Staatsunternehmen aus Mosambik schwer gegen das Organisationserfordernis und die geldwäschereirechtliche Meldepflicht verstossen. Die Eidgenössische Finanzmarktaufsicht FINMA schliesst in diesem Zusammenhang ein Enforcementverfahren ab und belegt das Kreditneugeschäft mit finanzschwachen Staaten der Credit Suisse mit Auflagen.

Read More »

Read More »

Devisen: Euro weitet Verluste fällt auf 15-Monatstief – Franken fester

Verstärkt gesucht ist mittlerweile auch der Franken. So hat das Euro/Franken-Paar seit dem frühen Handel annähernd einen halben Rappen eingebüsst. Wie es in einem aktuellen Devisenkommentar bei Raiffeisen Schweiz heisst, habe sich das Euro/Franken-Paar im September zwar noch über der Marke von 1,08 stabilisiert.

Read More »

Read More »

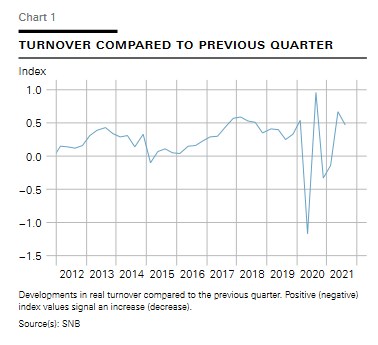

Q3/2021 – Business cycle signals: SNB regional network

The Swiss economy continued to recover in the third quarter. Turnover increased both in the services sector and in manufacturing and construction.

Read More »

Read More »

FINMA anerkennt angepasste Selbstregulierung der AMAS als Mindeststandard

Die Eidgenössische Finanzmarktaufsicht FINMA anerkennt die angepasste Selbstregulierung der AMAS als Mindeststandard. Damit werden hauptsächlich die neuen Regeln des FINIG und FIDLEG nachvollzogen.

Read More »

Read More »

+++Börsen-Ticker+++ – Erholung hält an – SMI baut nach SNB-Entscheid Gewinne aus

Der Schweizer Aktienmarkt tendiert am Donnerstag auf breiter Front fester und hat damit die Kursverluste vom vergangenen Montag bereits wieder wettgemacht. Zu verdanken ist dies laut Händlern zum einen der Entspannung der Lage bei dem in der Krise steckenden chinesischen Immobilienentwickler Evergrande, der eine heute fällige Couponzahlung einer Anleihe leisten will.

Read More »

Read More »

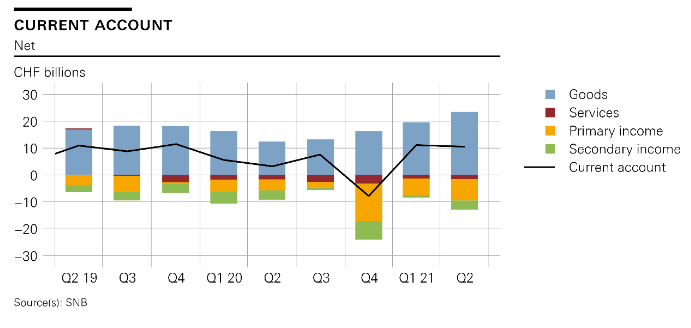

Swiss balance of payments and international investment position: Q2 2021

In the second quarter of 2021, the current account surplus amounted to almost CHF 11 billion, CHF 7 billion higher than in the same quarter of 2020. The rise was mainly attributable to a higher receipts surplus in goods trade.

Read More »

Read More »

MoneyLion to Offer Crypto Investment Ahead of SPAC Merger

US-based neobank MoneyLion announced the launch of its new cryptocurrency capabilities, enabling customers to buy and sell digital currencies within its app. MoneyLion said that eligible customers will initially be able to buy and sell Bitcoin and Ethereum, as well as round-up their debit card purchases in Bitcoin.

Read More »

Read More »

Devisen: Euro gibt etwas nach – Fed-Konjunkturbericht ohne Einfluss

Auch zum Franken hat der Dollar an Wert verloren notierte bei 0,9214 Franken nach 0,9228 Franken am Nachmittag. Der Euro blieb zum Franken unverändert bei 1,0895 Franken.

Read More »

Read More »

SNB-Vize: Franken ist weiterhin hoch bewertet

Die Schweizerische Nationalbank (SNB) hält den Franken trotz der jüngsten Abschwächung weiter für hoch bewertet. "Für uns ist es klar, auch auf dem jetzigen Niveau ist der Franken nach wie vor hoch bewertet", sagte SNB-Vizepräsident Fritz Zurbrügg am Mittwoch beim Zentralschweizer Wirtschaftsforum.

Read More »

Read More »

Personalien – SNB-Präsident Jordan nach medizinischem Eingriff in Auszeit

Der Eingriff habe sich nach einer Vorsorgeuntersuchung als notwendig erwiesen und sei erfolgreich verlaufen, teilte die Schweizerische Nationalbank (SNB) am Montag mit. Thomas Jordan befinde sich in guter Verfassung.

Read More »

Read More »

“Die Nationalbank ist an vielen Fronten gefordert (Challenges for the Swiss National Bank),” NZZ, 2021

Should the SNB follow the Fed and the ECB and rework its strategy? There is a case for rethinking the broad inflation target, the monetary policy concept, and the communication strategy. Equally important is a strategy review outside of the SNB: The SNB cannot and must not decide about the framework within which it operates.

Read More »

Read More »

Devisen: Eurokurs etwas gefallen – Dollar zieht auch zum Franken an

Auch zum der Franken kann sich der Dollar erholen und wird aktuell zu 0,9066 Franken gehandelt, nachdem er im frühen Geschäft bis 0,9036 gesunken war. Entsprechend ist der Euro zum Franken nicht weiter gefallen und kostet kaum verändert 1,0737 Franken.

Read More »

Read More »

SNB-Gewinn von 5 Mrd. Franken im zweiten Quartal erwartet

Die starke Performance des SNB-Portfolios während der Krise helfe Bund und Kantonen, die zusätzlichen Ausgaben teilweise zu decken. (Bild: ZVG)Am 30. Juli publiziert die Schweizerische Nationalbank (SNB) ihr provisorisches Finanzergebnis für das zweite Quartal 2021.

Read More »

Read More »

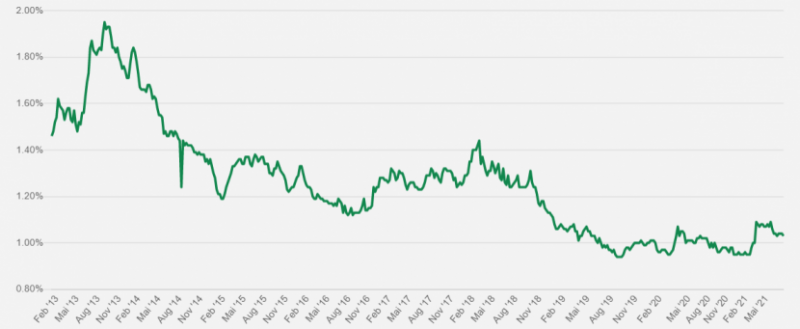

Immoblien – Wie Hypotharzinsen entstehen – und wie man mit diesem Wissen Geld spart

Wenn die Federal Reserve, das amerikanische Pendant zur Schweizerischen Nationalbank (SNB), die Zinsen erhöht, dann kann dies Menschen in der Schweiz mit eigenem Haus oder eigener Wohnung direkt Geld kosten. Aber warum eigentlich? Die Fed ist weit weg und die Schweiz hat ja ihre eigenen Zinsen.

Ganz so einfach ist es nicht. Die in der Regel monatlich fälligen Zinsen für den Kauf eines eigenen Hauses oder einer Eigentumswohnung sind von mehreren...

Read More »

Read More »

SNB und SIX schützen Datenkommunikation vor Cyberrisiken

Das neue Kommunikationsnetzwerk soll den zugelassenen Teilnehmern des Finanzplatzes Schweiz ermöglichen, untereinander und mit den Finanzmarktinfrastrukturen sicher zu kommunizieren. (Bild: Shutterstock.com/Deepadesigns)

Read More »

Read More »

Pandemie beschleunigt bargeldloses Bezahlen

Ein Drittel der Befragten gibt an, aufgrund der Pandemie das Zahlungsverhalten nachhaltig angepasst zu haben. (Bild: Shutterstock.com/Viktoriia Hnatiuk)Im Herbst 2020 hat die Schweizerische Nationalbank (SNB) nach 2017 ihre zweite repräsentative Zahlungsmittelumfrage durchgeführt.

Read More »

Read More »

Swiss Banks Boost Capital Bases Despite Coronavirus Crisis

Swiss banks have been able to strengthen their capital bases despite deteriorating economic conditions during the coronavirus pandemic, according to the Swiss National Bank (SNB). This applies to the two big banks, UBS and Credit Suisse, and also domestic banks.

Read More »

Read More »

SNB Monetary Policy Assessment June 2021

The SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Aktualisierte Sanktionsmeldung

Am 10. Juni 2021 hat das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF die Liste der in diesem Kontext sanktionierten Personen, Unternehmen und Organisationen geändert. Die Änderung ist in der Schweiz direkt anwendbar. Das WBF hat daher die für die Schweiz massgebliche Sanktionsdatenbank SESAM (SECO Sanctions Management) angepasst und die Anpassung auf seiner Internetseite publiziert.

Read More »

Read More »