Category Archive: 1) SNB and CHF

Lecture Series (online): Prof. Dr. Niepelt – Digital Money and Central Bank Digital Currency

This lecture series is about “Digital Money and Central Bank Digital Currency” with Dr. Prof. Dirk Niepelt, Director of Study Centre Gerzensee, Foundation of the Swiss National Bank. Associate Professor University Bern. About Central banks already issue digital money, but only to a select group of financial institutions. Central bank digital currency would extend this …

Read More »

Read More »

Que fait une banque centrale pour soutenir l’économie locale par temps de confinement? La BNS au menu

Voici une vidéo tournée par Christian Campiche lors d’une rencontre matinale autour d’un café. Christian s’est mis à enregistrer alors que nous parlions de ce que la BNS faisait, et surtout ne faisait pas, pour soutenir la population suisse dans cette période de post-confinement.

Read More »

Read More »

“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More »

Read More »

Zilliqa ZIL DeFi; Digibyte Announces Partnership; Crypto Bank Approved by FINMA

The Cryptoviser on YouTube.

Daily Cryptocurrency, Blockchain, Investing and Finance News and Discussions.

*************

Want to help support The Cryptoviser, there are 3 ways:

1. CashApp me directly $TheCryptoviser

2. JOIN CHANNEL MEMBERSHIP - by clicking the Join Button (or www.youtube.com/channel/UCq41LOyktVBW_CaVi2WKKXw/join)

3. Become a PATREON Member - www.patreon.com/TheCryptoviser

*************

Join COINBASE using my code,...

Read More »

Read More »

Swiss central bank could take negative rates lower

The rate on deposits at the Swiss National Bank (SNB) is currently -0.75%. And while taking the rate further into negative territory is not the base case scenario, it cannot be excluded, according to some economists at the bank UBS.

Read More »

Read More »

FINMA-Aufsichtsmitteilung 06/2020: Verlängerung oder Auslaufen von Erleichterungen infolge der COVID-19-Krise

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht eine weitere Aufsichtsmitteilung im Kontext der COVID-19-Krise. Sie passt darin die Fristen von diversen, bereits erteilten Erleichterungen an und präzisiert die Berechnung der Finanzierungsquote NSFR.

Read More »

Read More »

Why is the Pound to Euro Rate Falling? Will it Continue?

U.K jobless claims were released in early morning trading today, much like many economic data releases the figures were posted at an earlier than usual 07:00, we normally would see a release such as this out at 09:30. The figures, as expected were not particularly great reading for the U.K economy however there was a slight surprise in the fact that the official unemployment rate came in at 3.9% as opposed to the 4.3% which had been expected.

Read More »

Read More »

Announcement regarding recall of banknotes from eighth series

The issuance of the ninth banknote series was concluded on 12 September 2019. The Swiss National Bank intends to communicate the statutory recall of the banknotes from the eighth series two months in advance in the first half of 2021.

Read More »

Read More »

Questions That Need Answering [feat. Jonathan Watson]

Guest Worship Leaders Austin and Lindsey Adamec from Jacksonville,FL. Jonathan Watson from Charleston Southern University helps us to understand The Trinity.

With THE BLOC Online you can join us every Thursday for 7pm!

—

Follow Austin and Lindsey Adamec:

https://www.youtube.com/channel/UCIHRWN8MV6uzP9yaLURmRDg

Subscribe to our channel to see more messages from THE BLOC:

https://www.youtube.com/channel/UCVEI...

Follow us on Instagram:...

Read More »

Read More »

SNB COVID-19 refinancing facility expanded to include cantonal loan guarantees as well as joint and several loan guarantees for startups

The Swiss National Bank announced the establishment of the SNB COVID-19 refinancing facility (CRF) on 25 March 2020. This facility allows banks to obtain liquidity from the SNB by assigning credit claims from corporate loans as collateral. In so doing, the SNB enables banks to expand their lending rapidly and on a large scale.

Read More »

Read More »

Economic cost of pandemic will be enormous: SNB chief

Coronavirus is costing between CHF11 billion and CHF17 billion a month, putting such a strain on the Swiss economy that it will take years to recover. Swiss National Bank (SNB) chairman Thomas Jordan has predicted the worst depression since the 1930s.

Read More »

Read More »

Is capitalism broken? | Guy Standing, Izabella Kaminska, Jamie Whyte, and Steven King

Guy Standing, Jamie Whyte, Izabella Kaminska and Stephen King debate if we can save capitalism. Watch the full debate at https://iai.tv/video/is-capitalism-broken-democracy-reform?utm_source=YouTube&utm_medium=description It is just twenty-five years since Fukuyama’s claim, taken seriously at the time, that capitalism and liberal democracy had won, and represented the endpoint of cultural advance. Instead, after a decade of stagnation...

Read More »

Read More »

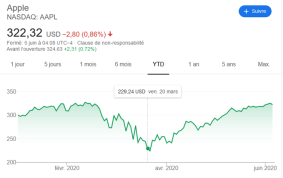

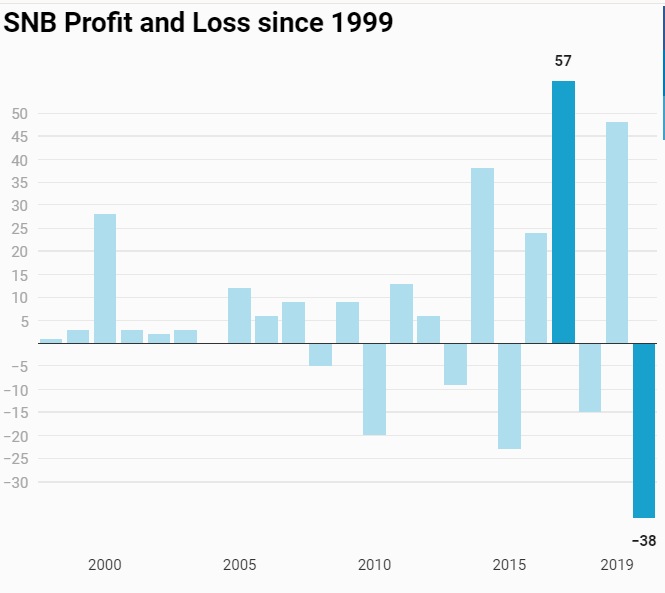

SNB’s swollen balance-sheet poses risk to ‘credibility’

When the Swiss National Bank (SNB) followed last year’s $50 billion (CHF48.6 billion) profit with a record $39 billion first-quarter loss, it was a stark illustration of the volatility created by a decade of unconventional monetary policy.

Read More »

Read More »

A More Connected American | Jonathan Watson | TEDxThunderRidgeHS

Very few Americans have the courage or motivation to live and work outside the USA. Americans need to be aware of cultural differences and teaching experiences outside the USA.

Jonathan Watson has been to 35 countries around four continents. His interests include reading, traveling, teaching, marketing, sales, and speaking. He wants to be the greatest speaker in the world. Jonathan wants to run a marathon on all seven continents of the world. He...

Read More »

Read More »

FINMA eröffnet Anhörung zur Teilrevision des Rundschreibens “Liquiditätsrisiken Banken”

Der Bundesrat hat im November 2019 die Einführung der Finanzierungsquote für Banken (Net Stable Funding Ratio, NSFR) beschlossen. Dies macht kleine Anpassungen des FINMA-Rundschreibens „Liquiditätsrisiken – Banken“ notwendig. Dazu eröffnet die FINMA eine Anhörung, die bis am 13. Juli 2020 läuft.

Read More »

Read More »

SNB appoints new delegate Fabian Schnell for regional economic relations for Zurich region

With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020.

Read More »

Read More »

The power of money, the 2008 crash, and the next economic crisis | Izabella Kaminska

Is the economy rigged against the working class, and is a new crash inevitable? Izabella Kaminska lifts the lid on the world of finance Find more debates and talks at iai.tv After the financial crisis in 2008, tigher regulations were imposed to curb bankers’ behaviour. But 12 years on, are the regulators now serving the …

Read More »

Read More »

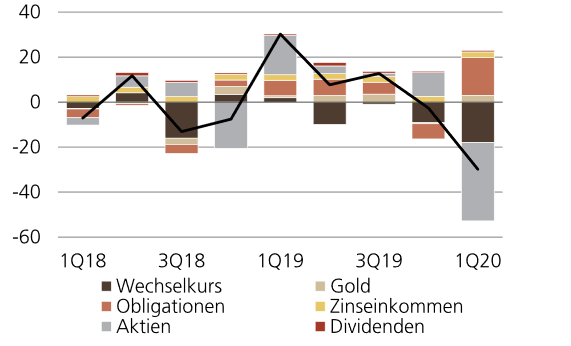

SNB Interim Results: -38 Billion, An Analysis

The Swiss National Bank reports a loss of CHF 38.2 billion for the first quarter of 2020. The loss on foreign currency positions amounted to CHF 41.2 billion.

Read More »

Read More »

SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB.

Read More »

Read More »

XLarge Assets Financial AG – Finma warnt. Erfahrungen

Wieder so ein merkwürdiges Geschäftsmodell der Xlarge Asset Financial AG vor dem nun auch die Eidgenössische Finanzmarktaufsicht (FINMA) warnt. Auf der Webseite der XLarge Assets Financial AG erfahren die Anleger nicht allzuviel, handelt es sich doch um einen billigen One-Pager die sich auch bei Anlagebetrügern immer größerer Beliebtheit erfreuen. Doch haben wir es hier mit …

Read More »

Read More »