Category Archive: 1.) CHF

Swiss trains the most expensive in Europe

A study by GoEuro, compares the cost of travelling 100km by train. Switzerland led the ranking with the most costly train trips in Europe. Travelling 100km in Switzerland cost CHF 52.

Read More »

Read More »

Cash in a box catches on as Swiss negative rates bite

It’s a sign the world is getting used to negative interest rates when what once seemed bizarre starts looking like the norm. Consider Switzerland, where more and more companies are taking out insurance policies to protect their cash hoards from theft or damage.

Read More »

Read More »

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency.

Read More »

Read More »

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

The relationship between CHF and gold

Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels.

Read More »

Read More »

CHF Price Movements: Correlations between CHF and the German Economy

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time.

Read More »

Read More »

Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger.

Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved.

Read More »

Read More »

FT Alphaville Izabella Kaminska interviews Geoffrey Brian West.

FT Alphaville’s Izabella Kaminska interviews theoretical physicist Geoffrey Brian West 2016, Festival of Finance. Camp Alphaville.

Read More »

Read More »

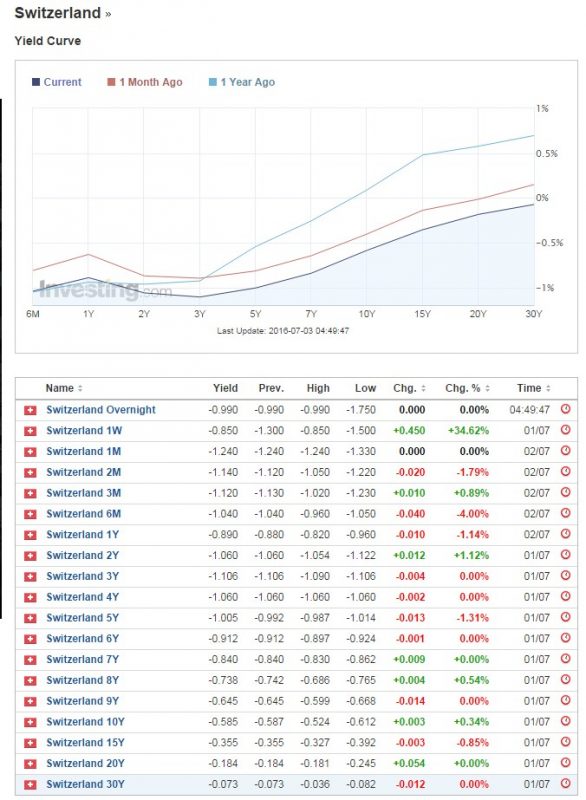

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

El-Erian: Cash is more valuable than ever

Mohamed El-Erian, chief economic adviser at Allianz Global Investors. says that Investors shouldn’t underestimate the role of cash in their portfolios We should add that the Swiss Franc is one of the most important havens for holding cash.

Read More »

Read More »

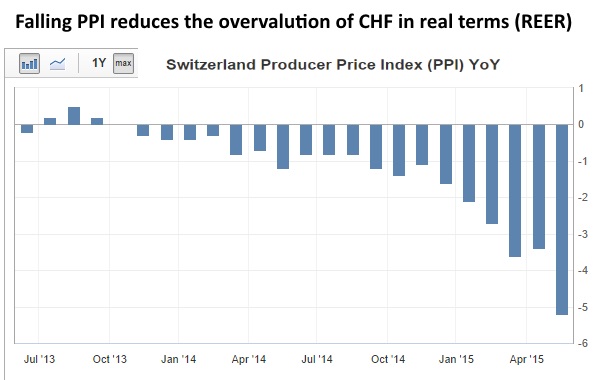

Purchasing Power Parity, REER: Swiss Franc Overvalued?

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

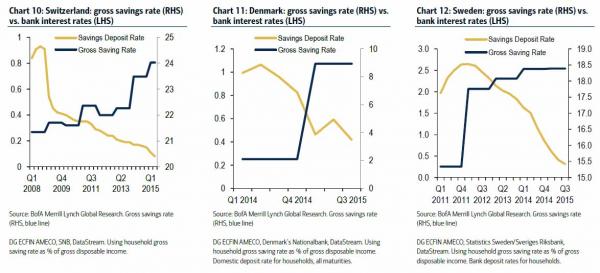

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

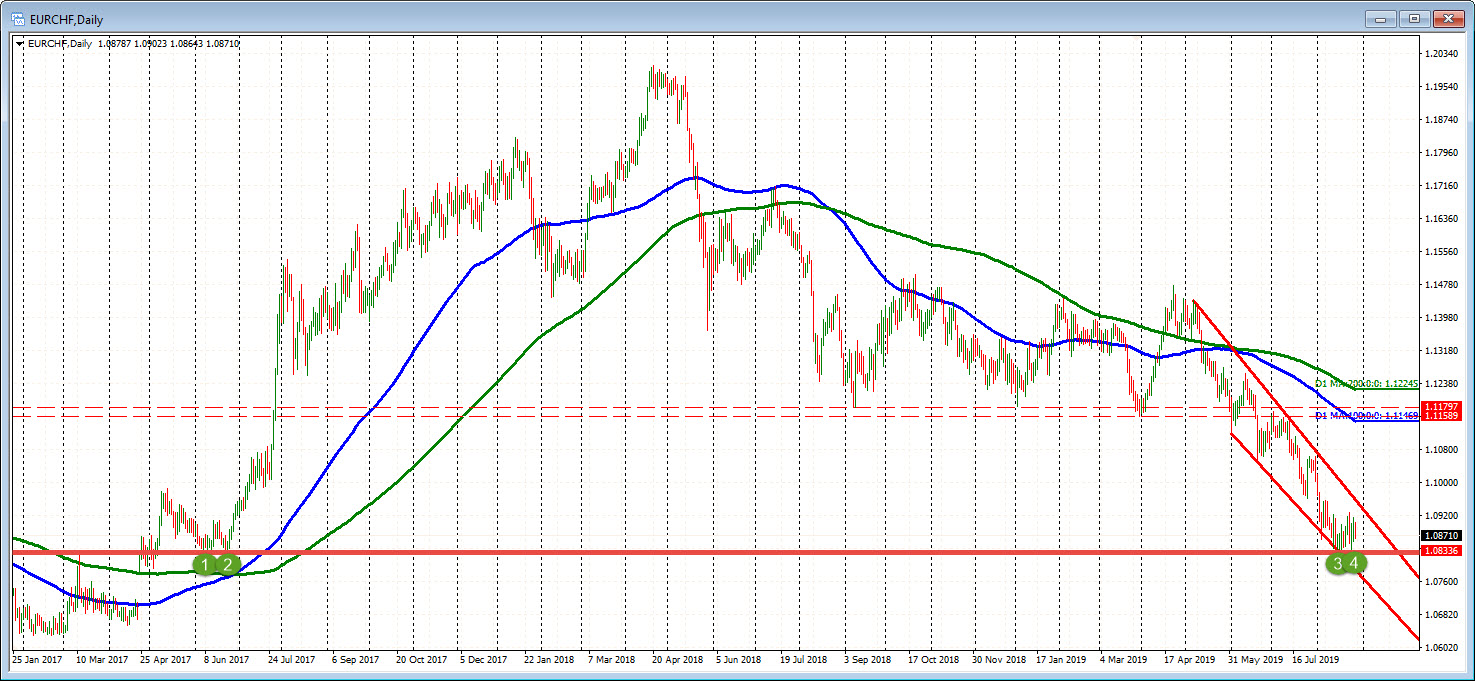

With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

Read More »

Read More »

Need Safe havens: CHF or Gold?

In times of negative interest rates and falling earnings per share, gold is the ultimate safe haven. Due to negative rates, it is not the Swiss Franc.

Read More »

Read More »

Fintech 2016 Röportajları: Izabella Kaminska

FT Alphaville’den Izabella Kaminska, Fintech ve Blockchain endüstrileri hakkındaki fikirlerini paylaştı.

Read More »

Read More »