Category Archive: 9a.) Real Investment Advice

The Pre-Hurricane Episode (Full Show EDIT) 8/26/20)

SEG-1: Market Momentum Doesn't Translate into Economic Growth

SEG-2: Bump Music; Politics & Promising the Moon

SEG-3: The Expiry of Federal Stimulus

SEG-4: Allowing Inflation to "Run Hot"

--------

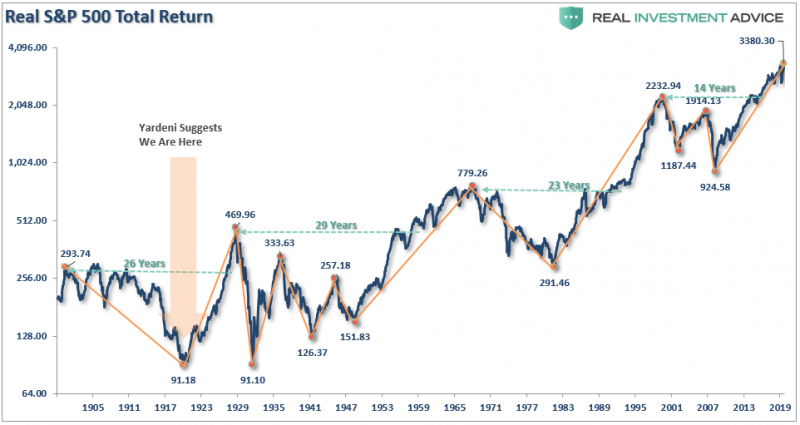

Market exuberance over new, all-time highs can sometimes cloud the view from such altitudes, obscuring lessons to be learned from past peaks and subsequent falls.

Chief Investment Strategist Lance Roberts w Senior Advisor Danny Ratliff,...

Read More »

Read More »

Markets’ All Time Highs – We’ve Been Here Before / Three Minutes on Markets & Money (8/26/20)

Market exuberance over new, all-time highs can sometimes cloud the view from such altitudes, obscuring lessons to be learned from past peaks and subsequent falls.

Chief Investment Strategist Lance Roberts

--------

Get more info & commentary:

https://realinvestmentadvice.com/newsletter/

--------

SUBSCRIBE to The Real Investment Show here: https://www.youtube.com/c/TheLanceRobertsShow

--------

Visit our Site: www.realinvestmentadvice.com...

Read More »

Read More »

Technically Speaking: Why This Isn’t 1920. Valuations & Returns

Why this isn’t 1920 has everything to starting valuations and future returns. While, generally, I’m not too fond of comparisons between today’s markets and the past, Ed Yardeni made a comparison too bombastic to disregard in his blog.

Read More »

Read More »

(8/25/20) Technically Speaking Tuesday

Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts

Read More »

Read More »

The Root of Wealth Insecurity [8/25/20]

The political and social turmoil that now grips the nation has it's seed in a very fundamental place.

Chief Investment Strategist, Lance Roberts

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/

--------

Register for the next Candid Coffee:

https://register.gotowebinar.com/rt/1959782027202558734?source=Ria+Website%22

Get more info & commentary:...

Read More »

Read More »

This is Not the Roaring ’20’s | Technically Speaking Tuesday – FULL SHOW [8/25/20]

SEG-1: Transformation of Dow Index from "Industrials"

SEG-2: Hurricane Preparedness & HEB; Changes in the Dow

SEG-2: The Root of Wealth Insecurity

SEG-4: 1920 vs 2020: Valuation & What We Pay

Chief Investment Strategist, Lance Roberts

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/...

Read More »

Read More »

Why This Isn’t The 1920’s | Three Minutes on Markets & Money [8/25/20]

The Roaring '20's: that was then, this is now... and they're not the same.

Chief Investment Strategist, Lance Roberts

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/

Get more info & commentary:

https://realinvestmentadvice.com/newsletter/

--------

SUBSCRIBE to The Real Investment Show here: https://www.youtube.com/c/TheLanceRobertsShow

Visit our...

Read More »

Read More »

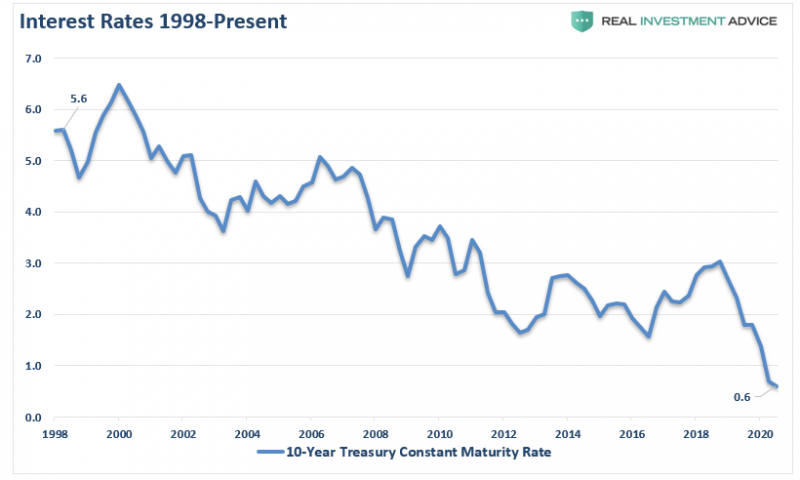

The 4.0 percent Rule Is Dead. What Should Retirees Do Now?

The 4% Rule Is Dead. A recent article by Shawn Langlois via MarketWatch pointed out this sobering fact but is one we have discussed previously. Retirees have long counted on being able to retire on their assets and take out 4% each year. However, a little more than 20-years later, the “death of the withdrawal rate” has arrived. What should retirees do now?

Read More »

Read More »

(8/21/20) Financial Fitness Friday

Market Analysis & Commentary from RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

Technically Speaking: COT Positioning – Back To Extremes: Q2-2020

As discussed in Is It Insanely Stupid To Chase Stocks, the market has gotten quite ahead of the fundamentals as money continues to chase performance. In the Q2-2020 review of Commitment Of Traders report (COT,) we can see how positioning has moved back to extremes.

Read More »

Read More »

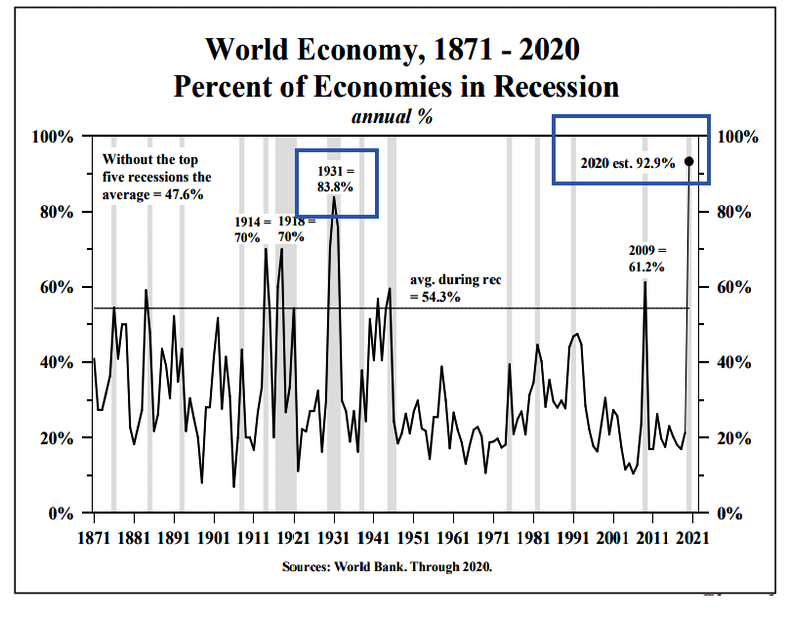

Unprecedented Recession Synchronization

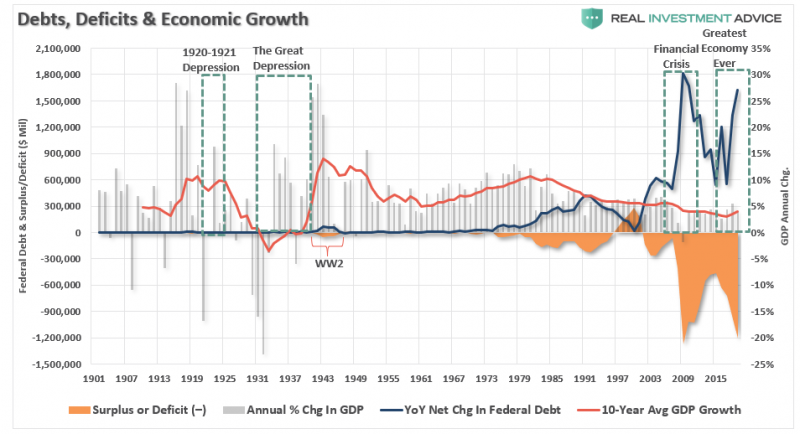

The global recession is an unprecedented recession synchronization. Deflationary Consequences: Lacy Hunt at Hoisington Management explains the deflationary consequences of the current global situation in its Second Quarter 2020 Review.

Read More »

Read More »

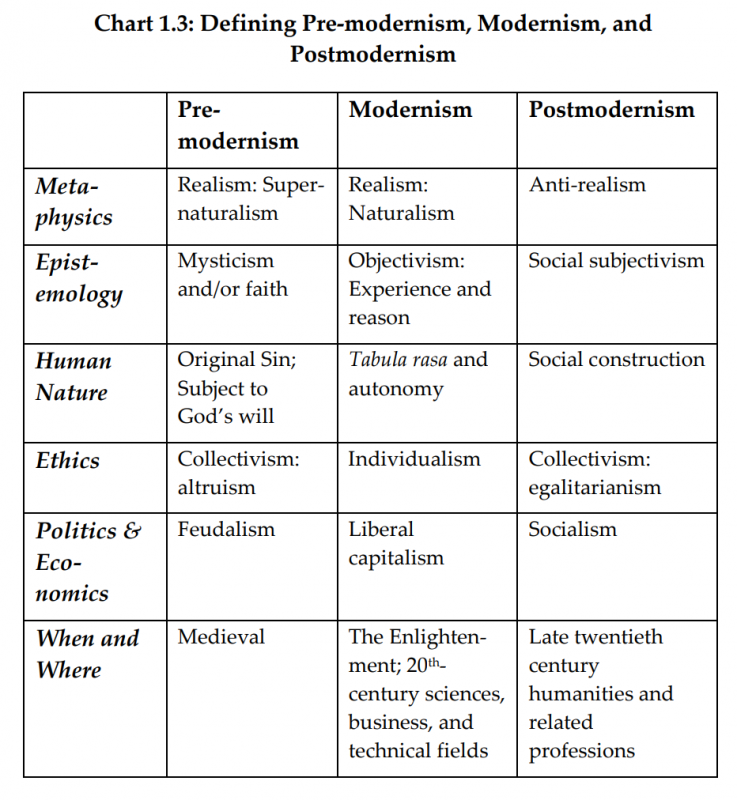

Reading The Market’s Postmodern Mind

No matter how you slice it, markets are human. This even applies to the “algos” as it’s we who write their mechanistic marching orders. Thus, understanding human behavior can be helpful in assessing and anticipating market moves. There’s no choice in the fact that we all need a philosophy to live.

Read More »

Read More »

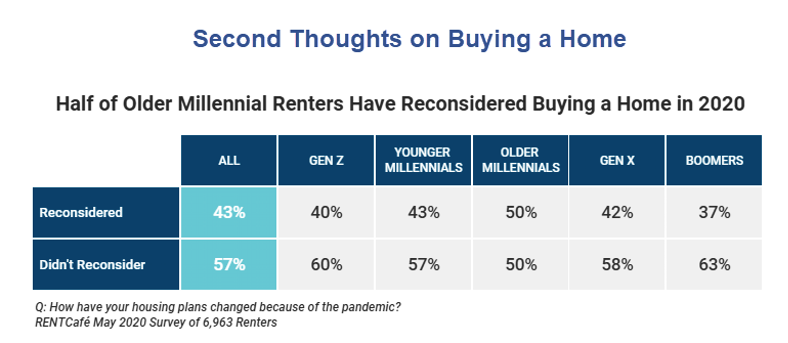

Shedlock: Millennial Renters Abandon Their Home Buying Plans

Millennial renters who were in the market pre-Covid just abandoned their home buying plans. A lifestyle survey shows millennials top the list of those canceling home-buying plans.

Read More »

Read More »

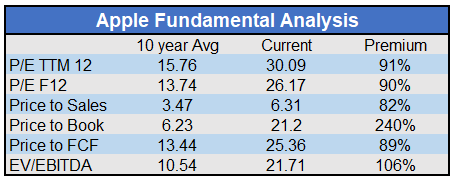

Passive Fingerprints Are All Over This Crazy Market

Passive Fingerprints Are All Over This Crazy Market. Apple’s stock is up over 20% since the market peak in February. Without a doubt, Apple, the company, is worse off due to the crisis and global recession. Revenue and earnings will be inferior to what Wall Street had forecast at lower stock prices. Valuations, shown below, are now astronomical.

Read More »

Read More »

The Fed Is Trapped In QE As Interest Rates Can’t Rise Ever Again.

Since the onset of the pandemic, the Fed has entered into the most aggressive monetary campaign. Its goal was to bolster asset markets to restore confidence in the financial system. However, the trap is the Fed is in a position where they can never stop QE as interest rates can’t rise ever again.

Read More »

Read More »

The Theory Of MMT Falls Flat When Faced With Reality (Part II)

If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton.

Read More »

Read More »

(5/29/20) Financial Fitness Friday (Full Show)

Market Commentary; Economic effects of Pandemic; 42% of Layoffs will be permanent job losses; wages no longer “sticky;” CARES Act is here to stay; Math Can Save Your Household: Ratio’s & Radical Downsizing; resetting expenses; assume you’re not going to get a raise; What if Unemployment hits 6% w 4% inflation? Why not allow business …

Read More »

Read More »

How Math Can Save You (5/29/20)

As we continue to assess the economic damage inflicted by the COVID-19 pandemic, adjusting household budgets to the reality of our situation will be key to financial survival. RIA Advisors Director of Financial Planning, Richard Rosso, CFP w Certified Financial Planner, Danny Ratliff, CFP, expound on household ratios, and what downsizing could look like for …

Read More »

Read More »

The Real Investment Show Best Clips for Week of 5/25/20

Life in these United States these days consists of staying home and finding even more, creative ways to utilize what’s on hand: This week we covered the dilemma of working, or not; received a primer in 2008 GDP drops vs today’s 30% vaccum, how not to be stupid, and another learning experience, courtesy of the …

Read More »

Read More »

(5/28/20) Why We’re Fed-up with The Fed (Full Show)

Power outages & Cherry Cobbler; Watching the economic numbers as the recovery begins; Michael Lebowitz on Baseball players’ salary cuts, shortened season, optics; What’s happening in America; NFL Status; Initial uptick in economic activity from pent-up demand: Is it repeatable? Amount of outstanding debt & size of Fed response; Pedro da Costa commentaries; the Fed’s …

Read More »

Read More »