Category Archive: 9a.) Real Investment Advice

The Essential Guide to Risk Management in Investment and Retirement Planning

Risk management is one of the most crucial elements of successful financial planning, serving as the foundation for both protecting your assets and achieving your long-term financial goals.

Read More »

Read More »

5-12-25 Emotions Have No Place in Your Investing Strategy

Valuations have been high for the past 25-years, but is that reason enough to not be in the markets?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢...

Read More »

Read More »

5-12-25 How to Deal with a Bear Market Rally

It's Lance Roberts' 60th birthday, and the birthday faery made an early visit to the studio. Markets will be boosted today by news of an agreement between the US and China over tariffs. Is the recent market rebound a sign of recovery—or just a classic bear market trap?

Lance Roberts breaks down what defines a bear market rally, why investors often get whipsawed by false hope, and how to position your portfolio amid short-term optimism and...

Read More »

Read More »

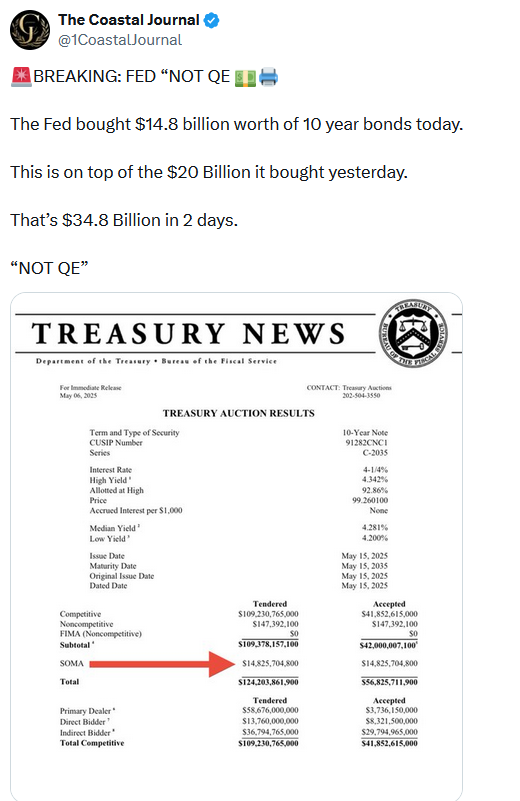

Stealth QE Or Routine QT? Unpacking Recent Fed Activity

Tweets like the one we share below allude that the Fed is doing stealth QE, despite the fact that they publicly claim to be conducting QT. Given the importance of the Fed balance sheet, let's dive into the stealth QE accusation and uncover the facts.

Read More »

Read More »

A Bear Market Rally? Or, Just A Correction?

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

Read More »

Read More »

Earnings Revision Shows Sharp Decline

The #RealInvestmentReport is our weekly newsletter which covers our thoughts on the current market environment, the risk to capital relative to the market, and how we are positioned currently. It includes our MacroView, analysis on markets and sectors, and our 401k plan manager tool. The post Earnings Revision Shows Sharp Decline appeared first on RIA.

Read More »

Read More »

5-9-25 Hour-One: Will Tax Reform Stall?

With a new administration in Washington and control of Congress shifting, tax reform is once again a high-stakes issue for investors and business owners. RIchard Rosso & Matt Doyle analyze what’s on the table—proposals to adjust capital gains rates, reduce or expand corporate tax burdens, and modify personal income brackets. We’ll break down where negotiations stand, what’s likely to change, and how gridlock could delay progress. This episode...

Read More »

Read More »

5-9-25 Hour-Two: Financial Advice for Single Mom’s on Mother’s Day

Being a single mom means wearing every hat—and that includes the CFO of the household. In this special Mother’s Day edition of The Real Investment Show, Richard Rosso & Matt Doyle offer tailored financial planning advice for single moms, covering essential strategies for budgeting, building an emergency fund, managing debt, and long-term investing. Whether you’re raising toddlers or teenagers, this episode is filled with actionable money tips...

Read More »

Read More »

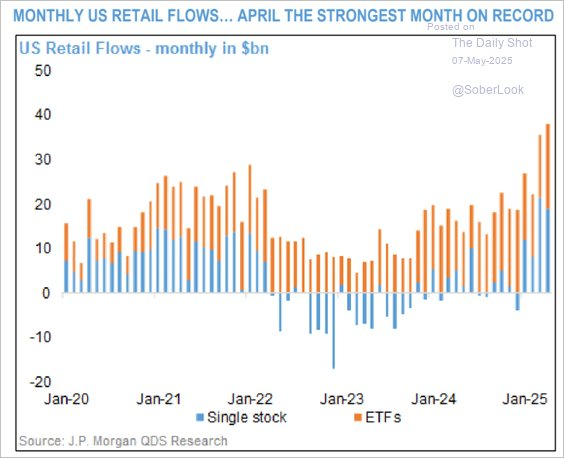

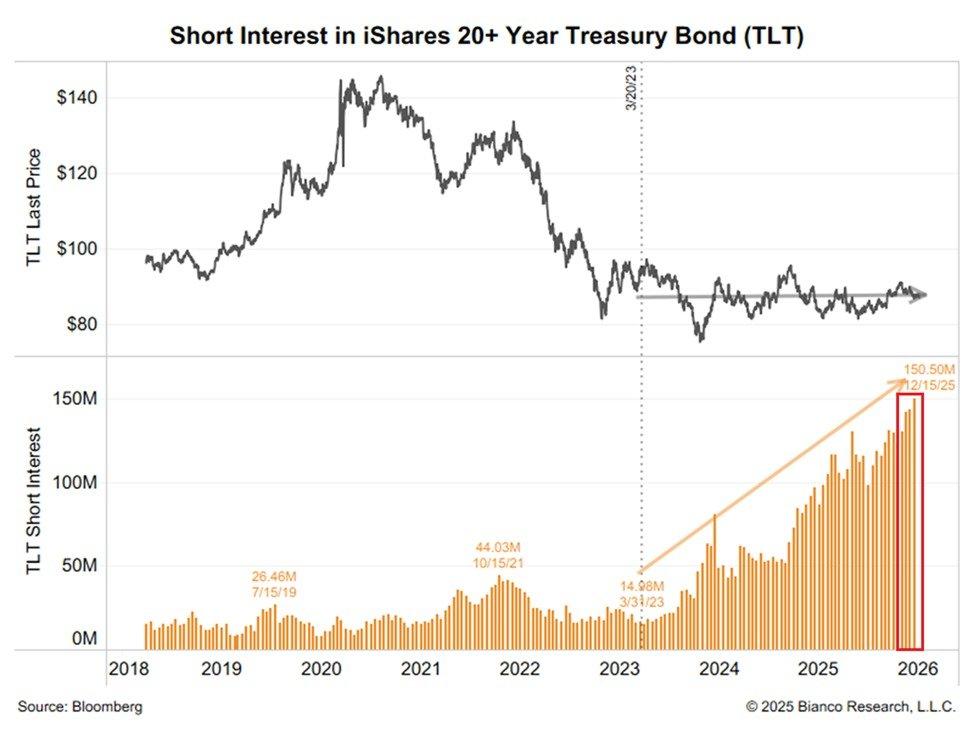

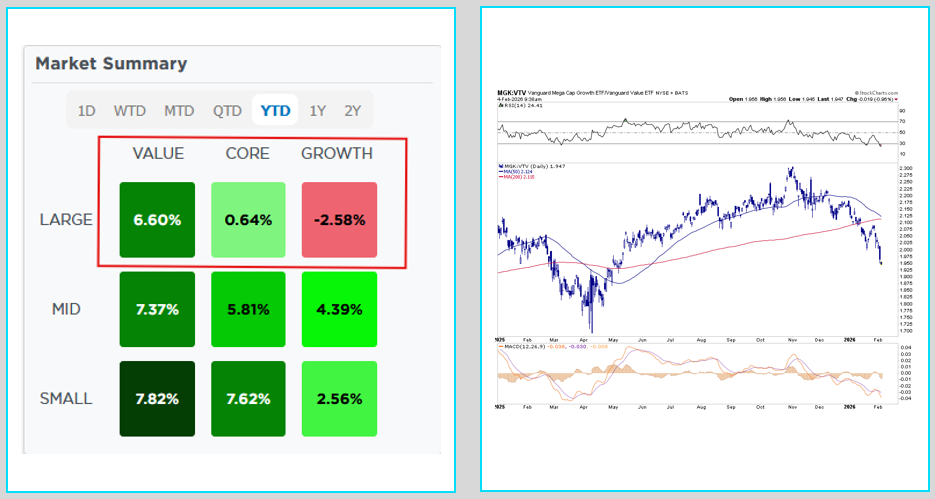

Smart Money Or Dumb Money? Who Will Be Right

The concepts of “smart money” versus “dumb money” refer to the level of investors’ information and experience. Smart money, typically institutional investors and often seasoned professionals, has extensive research and is more adept at data analysis. Therefore, they tend to […] The post Smart Money Or Dumb Money? Who Will Be Right appeared first on …

Read More »

Read More »

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

5-8-25 Some Trade Deficits are Okay

With all the focus on trade tariffs, we should not lose sight of the fact that some trade deficits are okay to have, and in some cases, needful things.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

5-8-25 The Fed Stays Hawkish

The Federal Reserve kept its stance firmly hawkish at their latest FOMC meeting — but what does that mean for stocks, bonds, and the economy? Lance Roberts & Michael Lebowitz break down the Fed’s latest interest rate decision, Jerome Powell’s comments, and the immediate market reaction, covering key sectors impacted, investor sentiment shifts, and the Fed’s outlook for inflation, growth, and monetary policy going forward. Lance and Michael...

Read More »

Read More »

How to Navigate Required Minimum Distributions (RMDs) and Minimize Taxes in Retirement

Required Minimum Distributions (RMDs) are an unavoidable part of retirement planning for many Americans. While they are designed to ensure retirees eventually pay taxes on their tax-deferred retirement savings, RMDs can also trigger unintended tax burdens if not planned for […] The post How to Navigate Required Minimum Distributions (RMDs) and Minimize Taxes in Retirement …

Read More »

Read More »

Market Is Tepid Over China Developments: Three Conclusions

“BREAKING: Treasury Secretary Scott Bessent says he will meet with Chinese officials in Switzerland to begin trade talks with China.” A month ago, when markets were grossly oversold, news of trade discussions between China and the US would have sent […] The post Market Is Tepid Over China Developments: Three Conclusions appeared first on RIA.

Read More »

Read More »

5-7-25 How Long Can You Stand to Wait?

Warren Buffett always says, 'buy-low, sell-high,' which is often easier said than done, and intellectually we know things will eventually get better. The question is not 'how long do you have to wait,' but 'how long can you wait" for the upturn to come?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Advisor Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

5-7-25 China Blinks

The Federal Reserve Open Market Committee meeting concludes this afternoon; expect some volatility. As the U.S. pushes forward with new tariffs and a tougher trade stance, China appears to blink — signaling potential cracks in its economic armor. Lance Roberts and Danny Ratliff dive into the latest developments in the U.S.–China trade conflict, why China is making strategic concessions, and what it means for global markets, supply chains, and...

Read More »

Read More »

The Storm Before The Calm

Risk management is critical to wealth preservation, especially in today's turbulent market storm. However, during such volatile times, we must also not consider what tomorrow may have in store. Are you prepared to adjust your portfolio in the coming months for the possibility that calm, tranquil markets and a resumption of the bullish trend emerge?

Read More »

Read More »

OPEC Does The Unthinkable

This past weekend, OPEC, led by Saudi Arabia, announced it would increase production by 411k barrels per day. The action follows a 250k increase last month. The decision is different from OPEC’s decision-making in the past. OPEC typically would use production quotas to manage oil prices. For example, in the current environment, with oil prices …

Read More »

Read More »

5-3-25 Candid Coffee Live Chat Episode

What do the latest economic reports indicate about the strength of the economy? How do commodities like Gold and Oil relate to the US Dollar? Are there effective strategies for avoiding taxes in retirement?

RIS Advisors Director of Financial Planning, Richard Rosso, CFP, is joined by our Portfolio Manager, Michael Lebowitz, CFA, to answer these and other question in this live-chat edition of our popular Candid Coffee series:

INTRO

2:10 -...

Read More »

Read More »

5-6-25 The Beauty of Bonds’ Guarantee

Investing in a fixed income (bond) portfolio can guarantee precisely what your return will be on a future date.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Advisor Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »