Category Archive: 9a.) Real Investment Advice

Who’s Right–Stocks or Bonds?| 3:00 on Markets & Money

(7/25/22) Markets got a little over-extended last week, pulling back and retesting the 50-DMA without violating it. That turned previous resistance into support, broke out of the downtrend channel, and set up a row of higher lows.

Read More »

Read More »

Buy Back Blackout Ends

(7/25/22) It's a busy week of earnings reporting as July comes to an end, and the lifting of the blackout on corporate stock buy backs stands to free up $11-billion of daily activity. How did Markets react to inflation of the '60's vs now?

Read More »

Read More »

Will the S&P Reach 4,170? | 3:00 on Markets & Money

(7/21/22) From a bullish standpoint, there seems to be a lot of bullish input: MACD's on a buy signal, and markets are on a defined uptrend. The next level up will be 4170 on the S&P. We've seen this before, but here come the seasonally-weak months of the year.

Read More »

Read More »

Hasbro, Target, Wal-Mart’s Inventory Surpluses

(7/21/22) Will the Fed cave to inflation and pivot on its interest rate hike course--and what will the effects be on markets? Will Markets' recent bottoms hold? Negative sentiment prevails--much of the recent rally has been driven by short-selling.

Read More »

Read More »

Have We Reached the Bottom Yet? | 3:00 on Markets & Money

(7/20/22) We haven't seen investors THIS negative since 2008--does this suggest we're nearing a market bottom? This is not then: We're running the highest inflation rate in 40-years, the Fed is tightening its balance sheet AND hiking interest rates.

Read More »

Read More »

Could Millennials Sink the Mortgage Market?

(7/20/22) Mortgage eman is at a 22-year low; that's not the only reason house prices are falling; technical charts on't lie. The market is own less than 20% for the year; has FOMO become FOBO--the fear of missing the bottom?

Read More »

Read More »

Apple Announces Hiring Freeze–Others to Follow? | 3:00 on Markets & Money

(7/19/22) Stocks were poised to break above the downtrend, but Apple's announcement to freeze hiring killed market momentum. Hiring freezes are the first step before layoffs--because the economy is slowing down.

Read More »

Read More »

Why Home Ownership is Warped By Lending Gimmicks

(7/19/22) Monday's rally fails (thanks, Apple); things are so negative, it's positive. Investors' "fear of missing out (FOMO)" has become a "fear of missing the bottom (FOBO);" this market performance isn't as bad as post 2008 or post-Lehman markets; the "American Dream" of home ownership has been warped by lending gimmicks; Markets' reaction to Apple hiring freeze--there's bad news and not-as-bad news.

Read More »

Read More »

Earnings Season Has Arrived–More Disappointments Ahead? | 3:00 on Markets & Money

(7/18/22) Earnings season gets underway in earnest as most S&P 500 companies report; the Big Question is whether analysts have adjusted estimates enough--or are there more disappointments ahead? Forward-looking outlooks will be a big driver of prices.

Read More »

Read More »

Why There is No Middle Class in Italy

(7/18/22) Lance returns from Vacation: No Market crash while he was away! Why Markets are ripe for a Rally; Investors' FOMO is aimed at a Market Bottom. Earnings Season continues apace: Q1 Estimates becoming Q2 Results: Watch changes in valuation from start of Quarter to the end of Quarter;

Read More »

Read More »

Higher Taxes are Coming: What You Can Do About it Now

Are we in an Earnings Recession? With sticky price-inflation, is 2% inflation even achievable? How people are changing habits; the recovery will likely take longer this time. Where should you park your money?

Read More »

Read More »

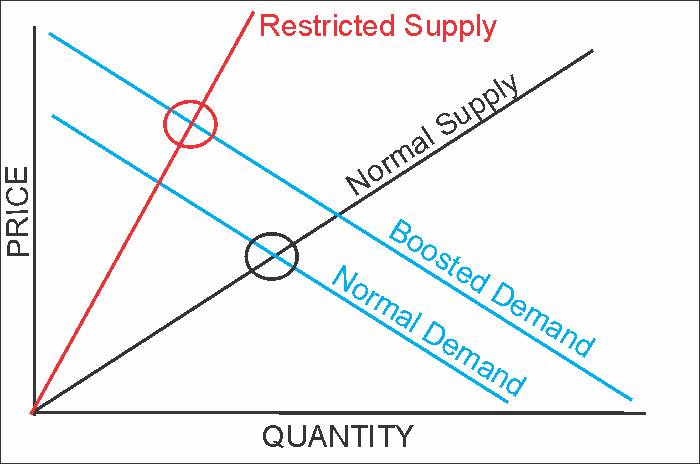

Giant Corporations Are Causing Inflation?

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging” – Sen. Elizabeth Warren

Read More »

Read More »

Is It Time to Shop in Thrift Stores?

(7/14/22) Richard Rosso's West Texas ERCOT Ditty; Inflation reality and Nana Clara's recipe for saving money; Demand destruction + Supply Disruption; shopping at Thrift Stores; the significance of JPMorgan's share buyback suspension; dealing with inflation on all levels. Let's put Salma Hayek on the $100-dollar bill; the similarities and differences of JPMorgan and Morgan Stanley's estimate misses; what late filings may mean.

1:37 - The Fed's 2%...

Read More »

Read More »

How to Look at Your 401k Without Freaking Out

(7/13/22) COVID fallout continues around the world: Travel delays and limitations at London Heathrow; what will Fed rate hikes mean for small businesses? Legislative changes for employee benefits; what are the benefits of Benefits?

Read More »

Read More »

What If the Fed Doesn’t Bail Out Investors, Pt-2

(7/12/22) The saga of Twitter vs Elon Musk continues; there's not enough fear in the markets, yet; true Bear Markets are a process; The Inflation Nation ditty; Ice Pops allow you to "eat the rich;" Red States outperforming in Jobs recovery; Luling BBQ & Melon Thump;

Read More »

Read More »

What If the Fed Doesn’t Bail Out Investors, Pt-1

(7/12/22) There's not enough fear in the markets, yet; true Bear Markets are a process; Is Jerome Powell really serious about the next rate hike; the worst performance of a 60/40 portfolio, ever.

Read More »

Read More »

How to Survive in a Down Market

(7/11/22) Lance remains on vacation; Elon Musk vs. Twitter, this week's economic preview: Down market Survival Guide; Optimism for Opportunity; CPI preview; retirement expenses & five surprises you don't want to have; inflation and housing expenses; healthcare expenses; the "Retirement Smile."

Read More »

Read More »

Lance is on Vacation this week!

Sometimes you've just gotta get away! Lance & Brent are on vacation for the week of July 4-8, but we've cooked up some Best-of segments for your review and enjoyment.

Read More »

Read More »

American Epidemic: Living Beyond our Means

Remember the 1970's--things were so much simpler then, right? Is this really a bear market, about which we're in denial? The Truth Comes from the Data. The Fed is raising rates so they can lower them again; Richard Rosso's Summer Reading List (preview); who's living paycheck-to-paycheck now?

Read More »

Read More »