Category Archive: 9a.) Real Investment Advice

How to Use Advanced Tax Planning to Maximize Long-Term Wealth

Tax planning is often viewed through the narrow lens of annual deductions and April deadlines. But for high-income earners and business owners, advanced tax planning strategies can be one of the most powerful tools for building and preserving long-term wealth. Strategic, forward-looking tax planning isn't just about minimizing what you owe today. Instead, it's about …

Read More »

Read More »

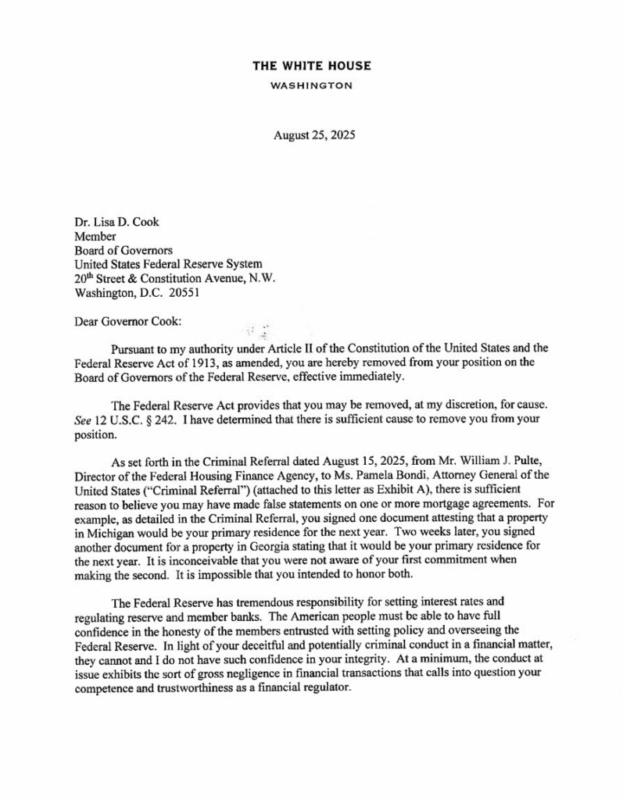

As The Fed Turns: The Soap Opera Grows More Intriguing

President Trump fired Fed Governor Lisa Cook for cause. The President claims, There is sufficient reason to believe you may have made false statements on one or more mortgage agreements. This is the first time in the 112-year history of the Fed that a President has fired a Fed Governor. Cook is fighting the dismissal, …

Read More »

Read More »

8-23-25 Savvy Social Security Planning

Will Social Security be there for you when you’re ready to retire?

Richard Rosso and Jonathan Penn host Candid Coffee on Savvy Social Security Planning, sharing the in's and out's of the Social Security system, answering questions like when you should apply for Social Security—and how much should you expect to receive?

INTRO/Genesis of Candid Coffee

4:30 Teaser questions

5:15 Claiming Options & Costly Decisions about Social Security

9:40...

Read More »

Read More »

8-27-25 The Taylor Swift Influence on Markets

Can Taylor Swift move markets?

Signet saw a 3% bump as a result of the pop star's engagement ring presentation by Travis Kelce.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

-------

➢ Listen...

Read More »

Read More »

8/27/25 Is the Taylor Swift Engagement a Market Event?

Taylor Swift’s engagement has captured global attention—but does it matter for investors? Lance Roberts & Danny Ratliff examine why celebrity headlines dominate financial chatter, what it says about investor psychology, and why distraction often shows up near the peak of speculative markets.

✅ How celebrity news becomes a market “story”

✅ Why investors chase hype instead of fundamentals

✅ The risks of distraction during late-stage bull...

Read More »

Read More »

Momentum Strategies And Physics: Mass And Velocity Matter

In his 1687 book, Philosophiae Naturalis Principia Mathematica, Sir Isaac Newton defined momentum as the product of mass and velocity, or p = m * v. The reason we begin with a physics lesson is that momentum strategies are very popular, and Isaac Newton's famous formula can teach us a lot about financial asset momentum. …

Read More »

Read More »

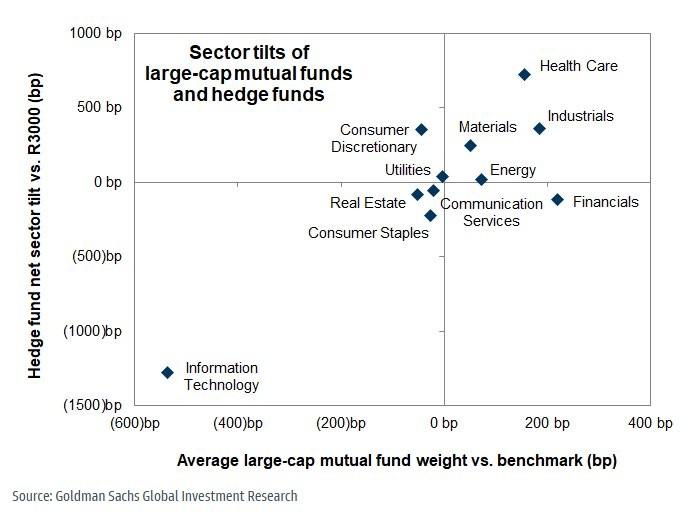

Smart Money Loves Healthcare: But Are They Now Dumb?

We have written a few Commentaries over the last year describing how retail, not institutional, investors are driving markets higher. To wit, there is ample evidence that with each market dip, retail investors are not selling, instead buying unrelentingly. In May, we wrote the following: Typically, institutional investors are right; however, over the last few …

Read More »

Read More »

8-26-25 The Importance of Saving First

There is no substitute for starting to save early, and paying yourself first.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

-------

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

8/26/25 Are Robo Advisors All They’re Cracked Up to Be?

New invesors ofen believe ha higher risk equals higher reward—bu ha’s no always he case.

Lance Robers & Jonahan Penn explore why newbie invesors ake on more risk han experienced ones, he common invesing misakes beginners make, and how risk managemen sraegies can proec long-erm wealh.

From porfolio allocaion o invesor psychology, we’ll compare how experienced vs. beginner invesors approach risk and why discipline maers more han luck. If you’re...

Read More »

Read More »

Gold Miners Are Benefitting From The Speculative Boom

As we noted in a recent article entitled The High Beta Melt Up: Echoes of 1999, there has been a notable change in investor preferences since the April lows. To wit: "What we do know is that, starting from the April lows, the market’s attitude toward riskier, more speculative activities has become much more intense." …

Read More »

Read More »

How to Build a Wealth Management Plan That Adapts to Life Changes

Most of us start financial planning with a basic idea: save, invest, and retire comfortably. But what happens when life throws something big your way, good or bad? Maybe you will sell your business sooner than expected. Maybe you receive an inheritance. Maybe life takes a sharp left turn through divorce, or you decide to …

Read More »

Read More »

T8-25-25 The Dangers of Margin Debt in Investing

Buying stocks on margin debt may seem like a great idea when markets are on the rise; but when markets decline, it's not up to you when margins are called.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Rich mentions on our website, and sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our...

Read More »

Read More »

8/25/25 “Buy Every Dip” Remains The Winning Strategy…For Now”

“Buy every dip” has been the mantra of this bull market — and so far, it has rewarded investors. Lance Roberts explains why the buy the dip strategy continues to work in today’s market, even as valuations stretch and risks build beneath the surface.

Lance looks at how investors are approaching stock market pullback investing, what history tells us about short-term market trends versus long-term risks, and the potential turning points that could...

Read More »

Read More »

“Buy Every Dip” Remains The Winning Strategy…For Now

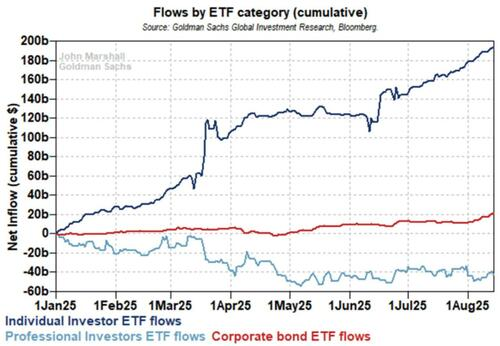

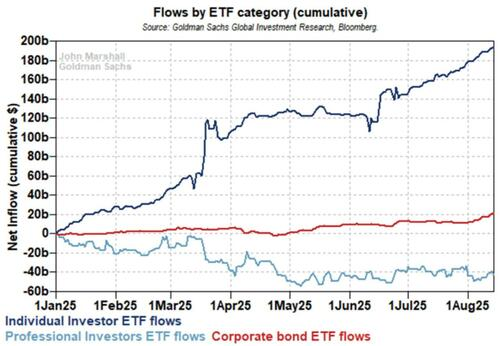

"Buy Every Dip" has lately been the "Siren's Song" for this market. Such is seen in the flows into ETFs over the course of this year. Retail investors treat pullbacks as temporary noise, and their behavior borders on mechanical. Every sell-off is seen as an opportunity, not a warning. Meanwhile, institutional managers sit it out. …

Read More »

Read More »

Start Your Financial Journey with Real Investment Advice | Wealth Management That Works

Discover how RIA Advisors can help guide your financial future with confidence.

We have a unique approach to financial planning, portfolio management, and real-world economic insight—all tailored to help you achieve long-term success.

Whether you're planning for retirement, growing your investments, or just getting started, RIA offers the tools, expertise, and personalized support to make a difference.

Start your journey today:...

Read More »

Read More »

Balance Of Risks Allows Powell To Pivot

"Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance." That key line from Chairman Powell's opening speech at the Fed's Jackson Hole symposium effectively summarizes Powell's view on monetary policy. Simply, the change in the balance of risks since the BLS jobs revisions …

Read More »

Read More »

Market Valuations Don’t Matter…Until They Do

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-22-25 Delayed Gratification is the Gateway to Financial Literacy

How can you enhance the chance for financial success in children?

Teach them to abstain from marshmallows...or develop their sense of delayed gratification.

RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Rich mentions on our website, and sign up for Lance's newsletter:...

Read More »

Read More »

8/22/25 Raising Money-Smart Kids | How to Teach Kids About Money & Saving

Raising money-smart kids is one of the most valuable lessons you can give them for life. Richard Rosso & Jonathan McCarty break down how to teach kids about money, from saving and budgeting to making smart financial decisions early on.

You’ll learn practical strategies for financial literacy for children, including:

Simple ways to explain money to kids

How to teach kids to save money and set goals

Smart money habits that last a lifetime...

Read More »

Read More »

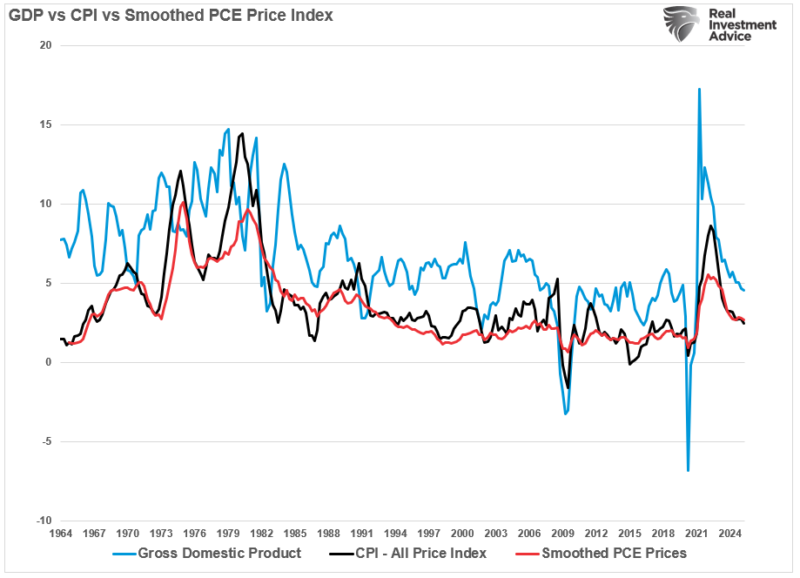

US Economy: Recent Data Suggests Risk To Earnings

The latest economic data suggests the US economy is decelerating. That means growth is slowing, jobs are shrinking, and households are spending less. As we showed in a recent #BullBearReport, economic growth, inflation, and personal consumption are trending lower. Unsurprisingly, with job growth weakening, consumer sentiment also took a hit in the latest report, with …

Read More »

Read More »