Category Archive: 9a.) Real Investment Advice

9/30/25 The Truth About Government Shutdowns

A government shutdown is likely but not catastrophic, as the media portrays it.

In this Short video, I break down what actually happens when the government shuts down.

Full episode: https://www.youtube.com/live/OAZFiVQoJYU?si=tD3sA1GaxNZdAMrp

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

e

Read More »

Read More »

9-30-25 Why Do We Invest? 10 Powerful Reasons Explained

Why do we invest? The answer goes far beyond just making money. Lance Roberts & Jonathan Penn, Two Dads on Money, break down the most important reasons people put their money to work in the markets.

Lance and Jon also show why investing is not just for Wall Street professionals—it’s for everyone.

Whether you’re just starting out or refining your long-term strategy, this episode will give you a clear framework for why investing is essential...

Read More »

Read More »

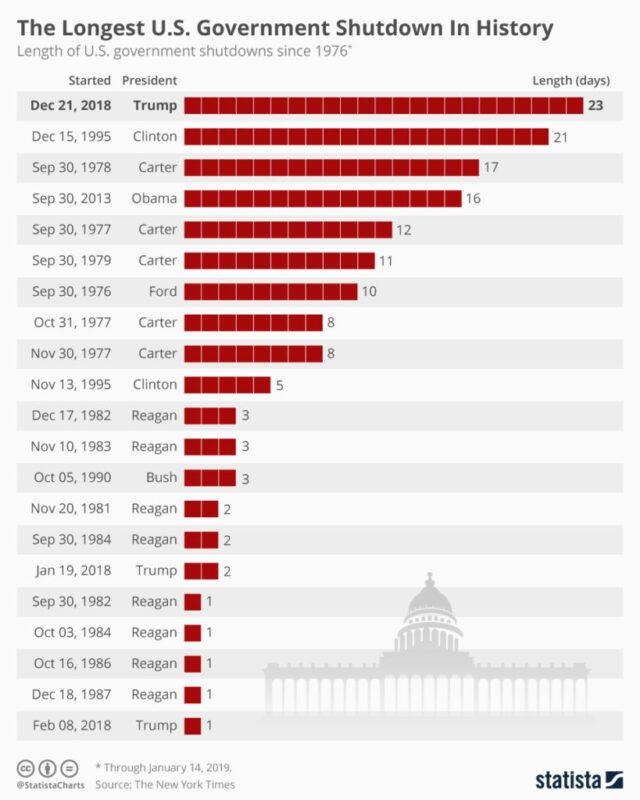

The Government Is Shutting Down Again: Who Cares?

If Congress can’t come to a budget resolution in the next 24 hours, the government will shut down. Sound familiar? We have become numb to the prospect of a government shutdown because it occurs so frequently. Most often, continuing resolution bills are agreed upon before a shutdown, thus enabling the government to continue operating. In …

Read More »

Read More »

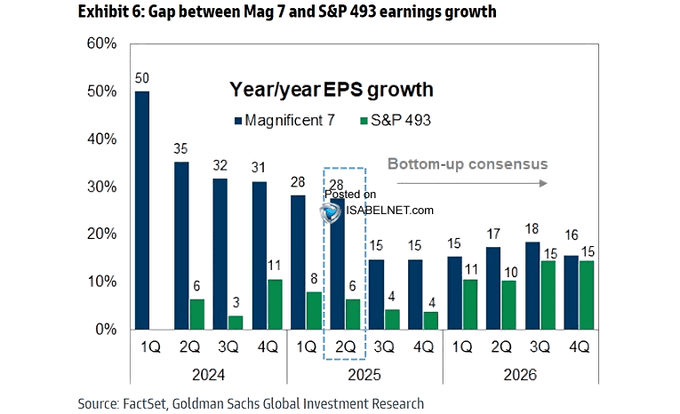

9/26/25 2026 Growth Expectations Are Ahead of Reality

Wall Street expects a broad earnings rebound (beyond MAG7) in 2026, but the data says otherwise.

In this short video, I discuss why hopes for strong economic growth—without stimulus, with weakening leading indicators, and with the yield curve still inverted—are ahead of reality.

Read More »

Read More »

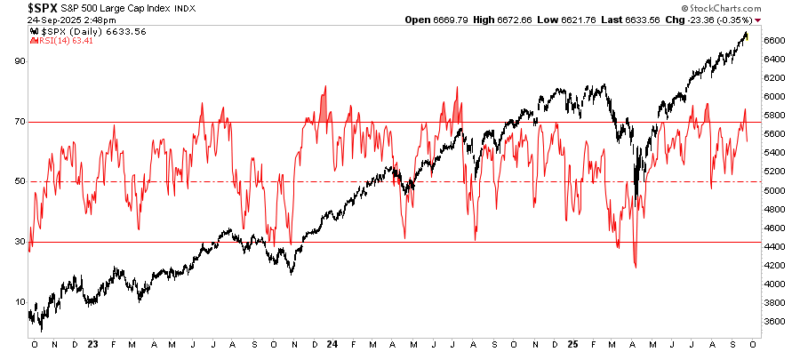

9/29/25 Is the Relative Strength Indicator (RSI) Flashing Caution? [REVISED*]

Lance Roberts examines one of the most reliable technical analysis tools investors use to measure market risk: the Relative Strength Index (RSI). The RSI helps identify when markets are overbought, oversold, or diverging from price action.

While RSI is not a perfect “buy or sell” signal, it is a powerful guardrail for risk management. History shows that overbought conditions can persist much longer than expected, but when momentum fades,...

Read More »

Read More »

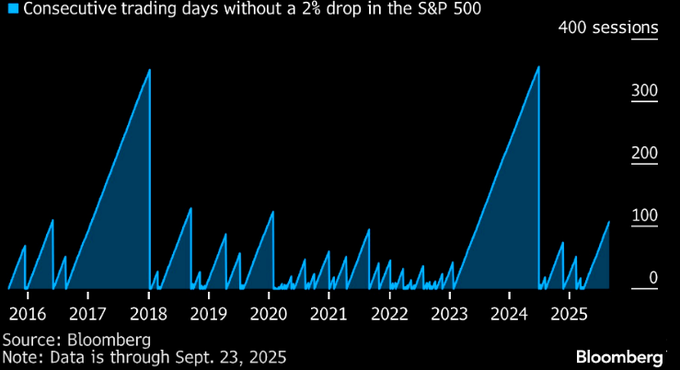

RSI (Relative Strength Index): Timing The Next Correction

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

Read More »

Read More »

Myth Busting: Foreigners Are Selling Treasuries

There appears to be a frequently repeated myth on social media that foreigners are selling US Treasury bonds in large quantities. Often, the myth is supported by the belief that certain foreign governments, such as China, Japan, and Saudi Arabia, are rapidly selling down their US Treasury securities. Concerns about trade deficits, inflation, and geopolitical …

Read More »

Read More »

Markets Detached From Economic Fundamentals

At a Glance Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? Email: [email protected] Follow & DM on X: @LanceRoberts Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue!

Read More »

Read More »

Defensive Rotation? Energy Stocks on the MoveThe Real Investment Show

Energy stocks $XLE are breaking out, even as oil remains flat near $64.

In this short video, I explain why a bullish golden cross and rising strength point to a potential defensive rotation from $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

9-26-25 College Planning 2025 – FAFSA, Scholarships, & Smart Funding Tips

College planning season is here — and the last quarter of 2025 brings critical deadlines for students and parents. Jonathan Penn and Sarah Buenger break down what you need to know about FAFSA, scholarships, and smart funding strategies for higher education.

🎓 Topics Covered:

Applications: Why applying to multiple in-state schools boosts negotiating power.

FAFSA 2025–26: Key deadlines, why it’s required (even if you don’t qualify for aid), and...

Read More »

Read More »

Slowdown Signals: Are Leading Indicators Flashing Red?

Lately, there’s been a growing sense of confidence among investors that the U.S. economy has dodged the proverbial bullet. Despite a historic rate-hiking cycle by the Federal Reserve, two years of stubborn inflation, and signs of strain in global trade, the dominant Wall Street narrative is now a curious mix of “soft landing,” “no landing,” …

Read More »

Read More »

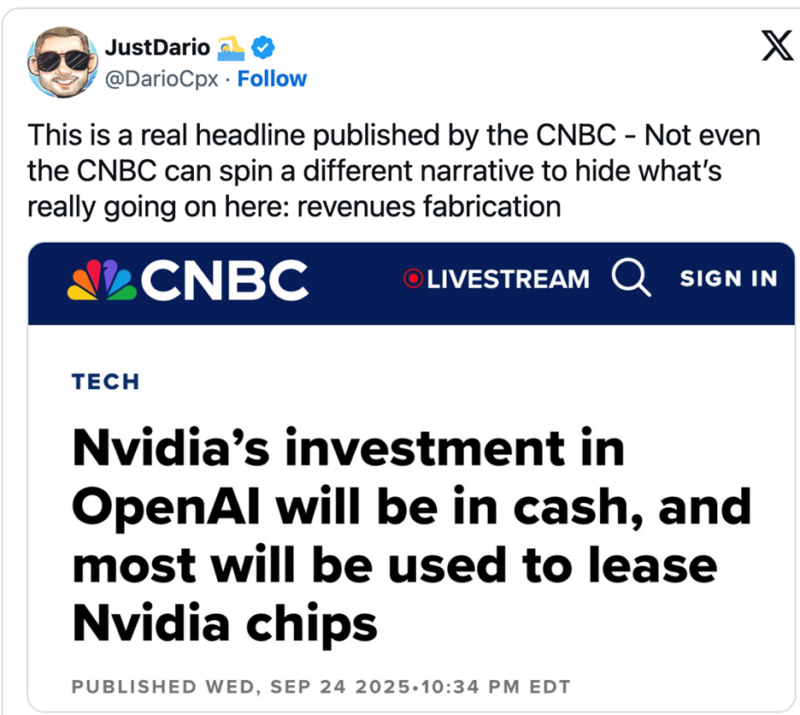

Is Nvidia Recycling Profits?

Several articles and social media posts have recently discussed the irregular partnerships that Nvidia is forming with some of its clients. The gist of the story is that Nvidia is investing in its clients, who then use the funds to buy Nvidia chips. This is what CNBC stated in a headline on Wednesday. This is … Continue reading »

Read More »

Read More »

9/25/25 Accommodative Or Restrictive? Decoding The Fed’s Latest Move

The Federal Reserve’s latest move has investors asking: Is policy turning more accommodative or staying restrictive? Lance Roberts and Michael Lebowitz decode the Fed’s decision, cut through the jargon, and explain what it means for markets, rates, and your money.

We’ll cover:

What the Fed actually signaled last week

The difference between accommodative and restrictive policy

How markets typically react to these shifts

Key risks for stocks,...

Read More »

Read More »

Pfizer Tries To Fatten Its Profits With Weight Loss Drugs

Eli Lilly (LLY) and Novo Nordisk (NOVO) dominate the market for weight loss drugs. The monopoly has proven incredibly profitable for both companies. Consider that in the last quarter, LLY reported that $8.58 billion of its $15.56 billion in total revenue came from its two GLP-1 weight loss drugs Mounjaro and Zepbound. Even a greater percentage …

Read More »

Read More »

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

Are we really on the edge of a recession—or are investors just overthinking the signals?

Beyond unemployment and consumer spending, unusual data points like men’s underwear sales, cardboard box demand, and even giant Halloween skeleton purchases are popping up as quirky economic indicators.

Lance Roberts & Danny Ratliff break down:

• Traditional recession signals like jobless claims, consumer spending, and market fundamentals.

• Technical...

Read More »

Read More »

Meme Stocks On Fire: Another Sign Of Animal Spirits

Meme stocks are highly speculative stocks, heavily traded by retail traders, and characterized at times by rapid price surges and equally sharp declines. The extreme volatility is often the result of social media platforms such as Reddit's WallStreetBets pushing these stocks. Among the most noteworthy meme stocks of the last few years have been GameStop …

Read More »

Read More »

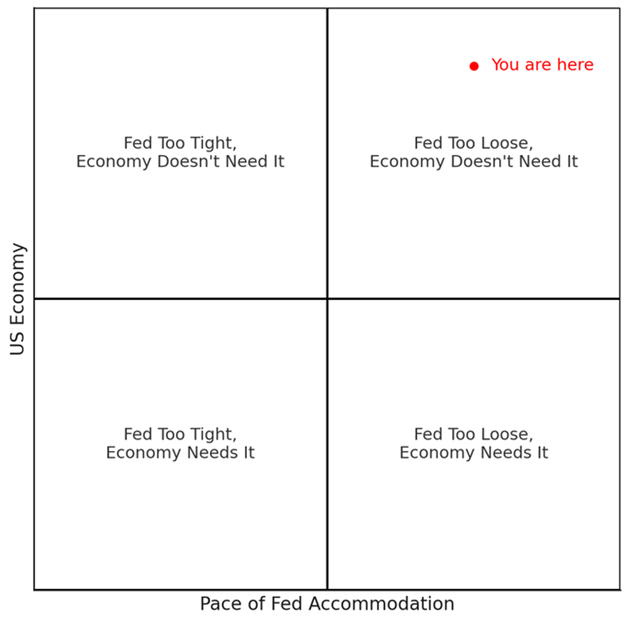

Accommodative Or Restrictive? Decoding The Fed’s Latest Move

Some Wall Street pundits believe that the recent Fed rate cut makes its policy too accommodative, and they also argue that the Fed is creating a “Goldilocks” scenario for the stock market. To wit, we recently saw the following comment and graph on X, which suggests we are in the “Goldilocks zone.” “Market is …

Read More »

Read More »

Equity Fund Outflows Soar: Blip or Warning?

Our friend Jim Colquitt, in his Weekly Chart Review, brought to our attention a large and irregular outflow from equity funds last week. He cites a Reuters article stating that investors withdrew $43 billion from US equity funds last week. That was the largest outflow since December 2024. The graph below shows that equity fund …

Read More »

Read More »

9/22/25 Stock Market Outlook: Bullish or Bearish?

Are markets set to keep climbing, or are we staring down the next pullback? Lance Roberts breaks down the bullish vs. bearish case for stocks, exploring what could fuel the rally—and what risks could trip it up.

From the Federal Reserve’s latest moves, to earnings trends, market breadth, and money flows, we’ll cover the key factors driving sentiment. Whether you lean bullish or bearish, this analysis will help you understand the forces shaping...

Read More »

Read More »

Size Matters: Can The Largest Stocks Continue To Lead?

Does size matter? Since the Pandemic, and judged by the recent performance of the Magnificent Seven and mega-cap indexes, many investors would say it matters, likely claiming that the greater the size, the better the returns. Those with data going back decades, rather than years, would also agree that size matters. However, their conclusion would …

Read More »

Read More »