Category Archive: 9a.) Real Investment Advice

Capitalism: The Road To Wealth And Happiness

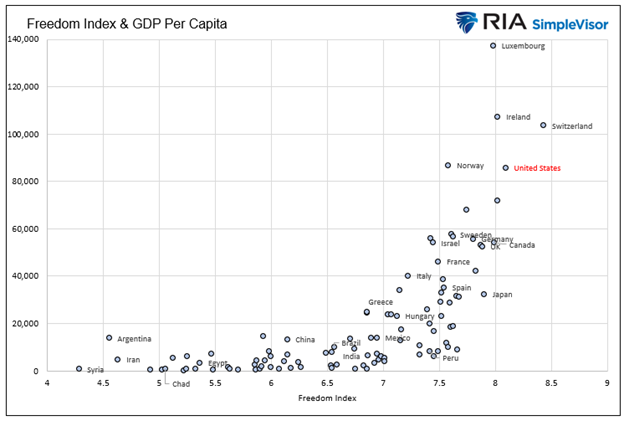

The graph below presents another opportunity to revisit how capitalism and the economic freedom it entails lead to prosperity. The scatter plot below shows the intersection of The Fraser Institute’s Economic Freedom Index with per capita GDP for 102 of the largest economies. Before analyzing the graph and what it implies for capitalism, let's gain …

Read More »

Read More »

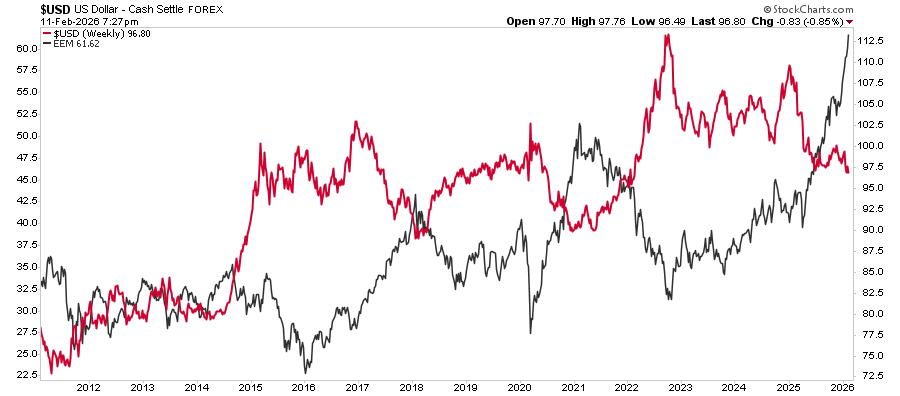

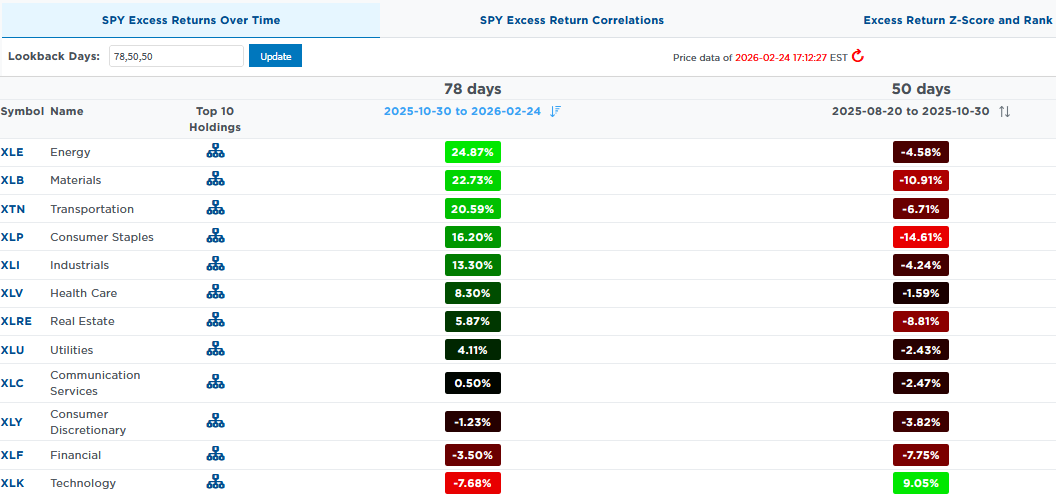

Dollar Correlation: Implications For Foreign Stock Indexes

On Tuesday morning, Bloomberg featured an article entitled The Great Debasement Is Rippling Across Markets. From the start of the year until its low in the middle of September, the US dollar index fell by nearly 15%. The weak dollar seems to fuel the debasement narrative, benefiting a few asset classes. The most obvious assets …

Read More »

Read More »

10-14-25 If The Market Fails Here, A 3-7% Pullback Comes Next

$SPX is standing at a critical inflection point.

In this Short video, I explain why failing to reclaim the 20-day moving average could trigger a 3–7% pullback toward key support levels — and why now’s a good time to take some profits and manage your risk.

Full episode: https://www.youtube.com/live/2hiFV4mdSY4?si=OGnPf2U2xFVcmMgy

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-14-25 Annuities: Good, Bad, & Ugly

Are annuities the safe retirement solution they’re sold as — or a financial trap in disguise?

Lance Roberts & Jonathan Penn unpack the good, the bad, and the ugly sides of annuities.

10:03 - Kitchen Sets & Intramural Flag Football

14:52 - Annuities - Good, Bad, & Ugly

18:08 - What is an Annuity?

20:16 - Different Flavors of Annuities

22:07 - The Ugly Truth About Early Surrender Fees

27:29 - Why Might You Need an Annuity?

31:20 -...

Read More »

Read More »

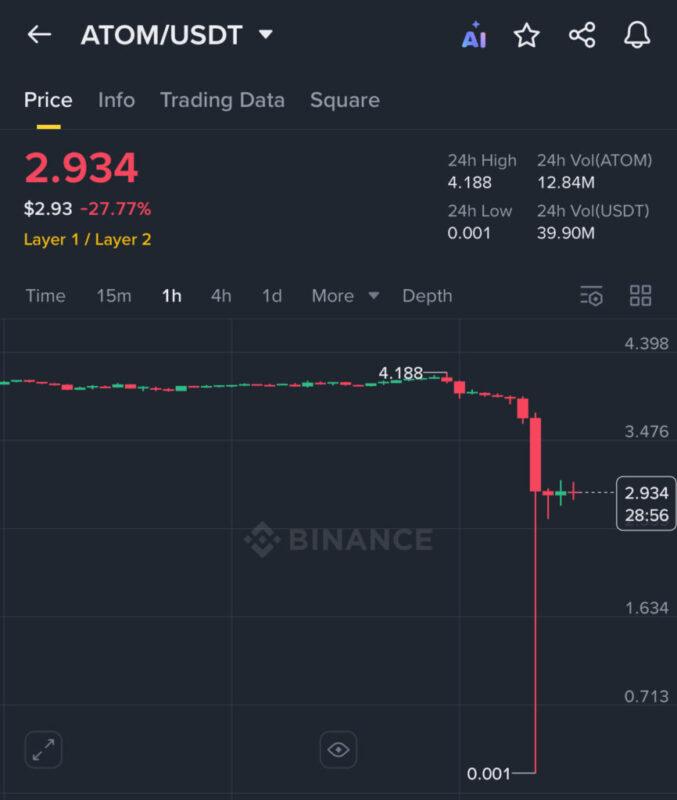

The AltCoin Liquidity Bloodbath

Last Friday, the cryptocurrency market experienced a violent crash. The trigger was President Trump's announcement of a 100% additional tariff on Chinese imports. The sudden and unexpected action reignited fears of a full-blown trade war. Global risk assets fell sharply. Of these, the most notable declines occurred in the cryptocurrency markets, particularly the altcoin market. …

Read More »

Read More »

10-13-25 Bitcoin vs Stablecoins: What Central Banks Actually Want

Bitcoin will never become a true reserve asset for central banks.

In this Short video, @dlacalle_IA and I discuss why its volatility and illiquidity make it unsuitable—and why stablecoins backed by Treasuries could be the more practical alternative.

$IBIT $CRCL $USDC

Watch the full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

ChatGPT Gives Financial Advice On Volatile Markets

Following Friday's selloff amid the resurgence of tariff threats on China, I asked ChatGPT a simple question: " How to Stay Calm In The Stock Market?" That simple question generated an engaging and humorous take on financial advice for navigating volatile markets. In this week's post, I thought it would be helpful to review ChatGPT's advice …

Read More »

Read More »

First Brands: Canary In The Rehypothecation Coal Mine?

The First Brands Group, manufacturer of auto parts, including Raybestos brakes and FRAM, filed for bankruptcy on September 29th. This bankruptcy is troubling in two ways. First, per the ZeroHedge chart below, the price of First Brands loans fell by 80% in a day. In other words, the loan market had no clue of financial …

Read More »

Read More »

Market Crack Or Beginning Of Something Bigger

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

10-10-25 Contrarian Trade That Could Shock Gold, Bitcoin & Stocks

➢ Listen daily on Apple Podcasts: The real contrarian trade is the dollar $DXY.

In this Short video, @michaellebowitz and I discuss how rapid dollar rally could catch markets off guard, forcing investors out of gold $GLD, Bitcoin $IBIT, and risk assets as money rushes back into the safety of the U.S. dollar.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-10-25 Maximize Your Money: The Hierarchy of Smart Savings Strategies

How do you make every dollar work harder for you?

Richard Rosso breaks down the Hierarchy of Smart Savings Strategies — a smart, structured approach to prioritize where to save and invest for maximum growth and minimum taxes. This simple yet powerful framework helps you build wealth efficiently, protect against taxes, and optimize your financial future.

0:19 - Foundational Basis & Economic Conundrum

8:05 - Prioritizing Saving Money - Pay...

Read More »

Read More »

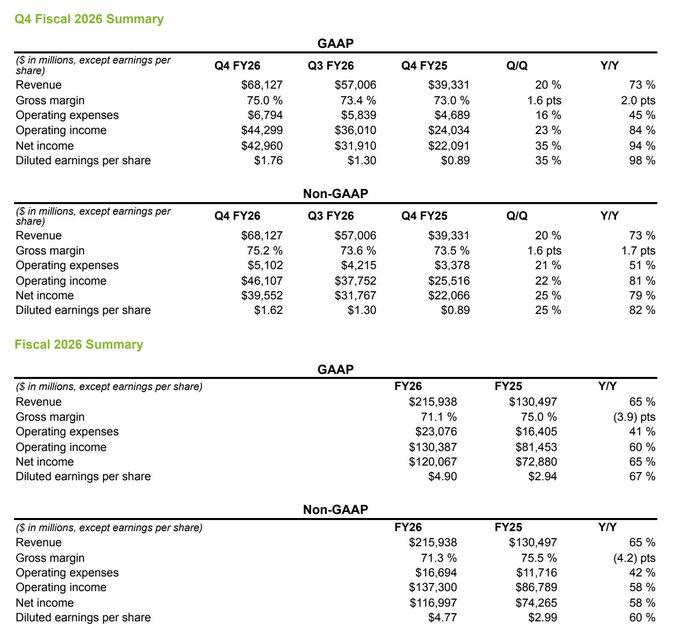

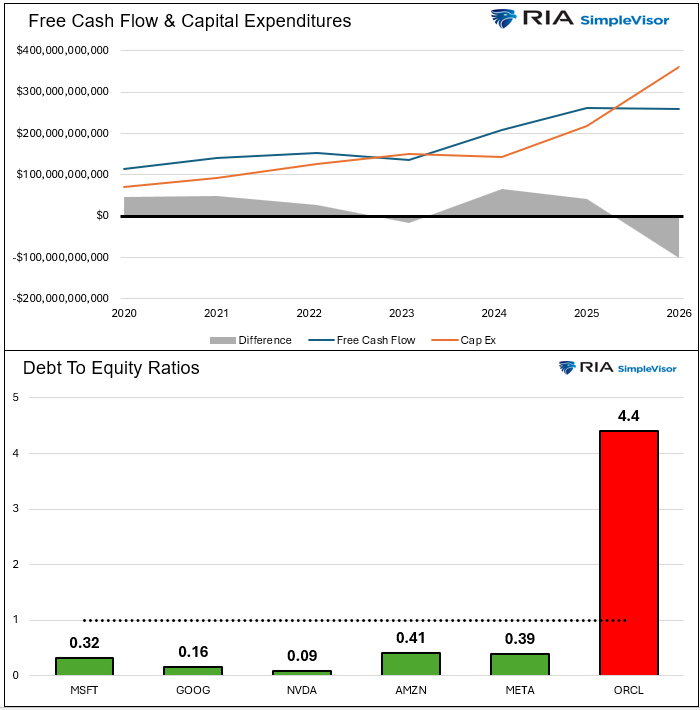

The AI Trillion Dollar Question

According to The Wall Street Journal, on an inflation-adjusted basis, technology companies have spent more in the last three years on data centers, chips, and energy than has been spent over the past forty years building out the nation's interstate system. The massive amount of investments being put to work is stunning. But the Wall …

Read More »

Read More »

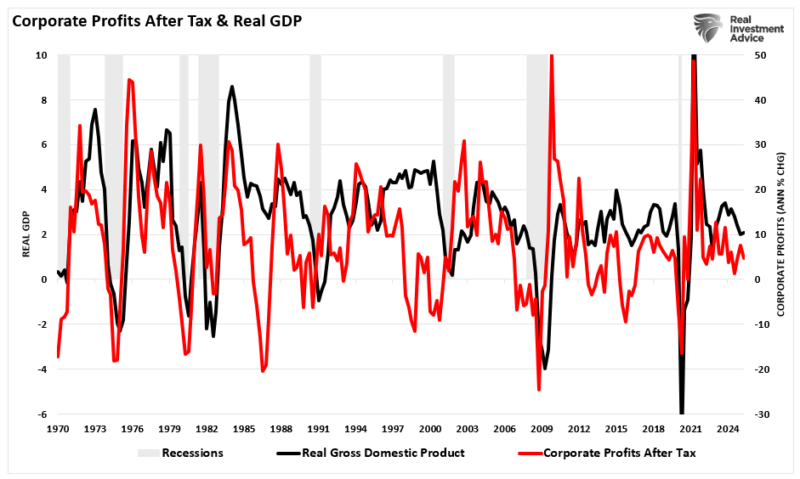

Corporate Profits: A Reading Without Rose-Tinted Glasses

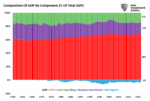

If you want to understand where we are in the cycle, skip the noise and follow profits. Corporate profits are the lifeblood of investment, hiring, and market returns. Crucially, linkage to the real economy is very tight. In the national accounts (NIPA), the BEA’s “profits from current production” (with inventory valuation and capital consumption adjustments) …

Read More »

Read More »

10-9-25 The Bearish Case For AI Boom: Revenues, Power, & The Cost

The AI capex boom is real but fragile. It isn’t built on profits, but on promises – circular funding between $NVDA, $ORCL, OpenAI, and others – alongside soaring power costs and looming energy constraints.

In this Short video, @michaellebowitz and I discuss why this self-feeding cycle could expose weak links and lead to costly surprises for investors.

Full episode:

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-9-25 Recession & Bonds: What Happens When The Next Downturn Hits?

A recession usually means falling inflation and lower bond yields — good news for bond investors. But what if this time is different?

Lance Roberts & Michael Lebowitz break down how the next recession could flip the bond trade from bullish to bearish — and why government policy and fiscal stimulus may once again distort the relationship between inflation, yields, and bond prices.

0:19 - US Dollar Impact on Multi-national Companies

3:32 -...

Read More »

Read More »

Excess Liquidity: Where Art Thou?

The graph below, courtesy of the St. Louis Fed, charts the amount of money in the Fed’s overnight reverse repurchase agreement (ON RRP) facility. To understand why the current lack of a meaningful balance in the program could become concerning, let's revisit the Fed's response to the Pandemic. During the pandemic and global economic shutdown, …

Read More »

Read More »

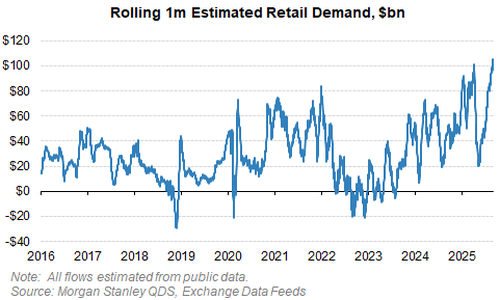

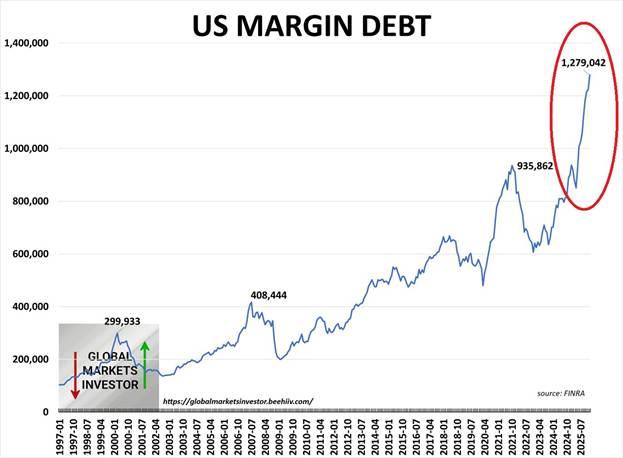

10-8-25 Retail Inflows Hit An All-Time Record – The Top Is Near?

Retail investors just poured record amounts into the market, much of it fueled by margin debt. Liquidity and FOMO are driving prices higher.

In this short video, I explain why this kind of late-cycle euphoria often appears right before markets peak.

Full episode: _Iqu1g

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-8-25 Markets, Money & Mindset: Live Q&A with Lance Roberts

JJoin Lance Roberts for a live open Q&A on markets, money, and investing.

We’ll cover what’s on your mind—from market melt-ups and Fed policy to portfolio positioning and economic risks. No scripts, no fluff—just real talk and real answers about what’s moving markets and shaping investor behavior.

0:19 - Markets are Absorbing Money

4:14 - Profit Taking in Bitcoin

9:15 - YouTube Poll - The #1 Thing on Your Mind About Markets

10:09 - How Do You...

Read More »

Read More »

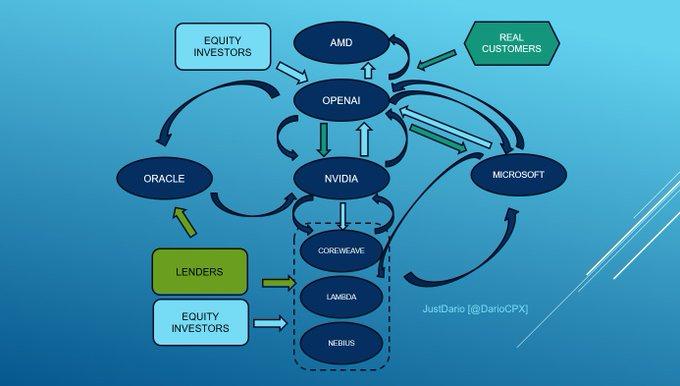

OpenAI: Fueling Massive AI Stock Gains

As we led in yesterday's Commentary, AMD rose 25% on the news that OpenAI would purchase 10% of AMD. In exchange, OpenAI will become a significant customer of AMD. This symbiotic relationship is just one of many that OpenAI is forming with companies at the forefront of the AI revolution. The bullet points and graphic …

Read More »

Read More »

Recession And Bonds: Navigating The Next Recession

It's odd to consider, but a recession could flip our bullish outlook on bonds to bearish. It's unusual because typically, inflation drops during a recession, leading to lower yields and higher bond prices. While we believe that if an economic downturn or recession occurs soon, the immediate effect on bonds will be favorable. However, the …

Read More »

Read More »