Category Archive: 9a.) Real Investment Advice

Leveraged ETFs: Yet Another Sign Of Rampant Speculation

Not only is the market chasing the most speculative of assets, but it is employing record amounts of leverage to do so. Traditionally, investors use margin loans to gain leverage. More recently, however, leveraged ETFs allow investors to get leverage in one package. To wit, the graph below, courtesy of BofA, shows that there are …

Read More »

Read More »

Dollar Debasement: Reality Or A Dangerous Narrative?

Gold prices are soaring. And with each tick higher, more and more market pundits and investors are coming out of the woodwork, asserting that dollar debasement is the reason. Is that the correct reason, or might gold be in a momentum-fueled speculative bubble like many other assets? The answer has significant implications for the price …

Read More »

Read More »

10-21-25 5x ETFs & Margin Debt: The Hidden Risk BehindThe Year-End Rally Narrative

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

10-21-25 Cash Value Life Insurance: Smart Strategy or Costly Mistake?

Cash value life insurance often sparks debate — is it a smart financial tool or an expensive way to mix insurance with investing? Lance Roberts & Jonathan Penn break down how cash value life insurance actually works and where it may (or may not) fit into your overall financial picture.

0:18 - Preview - Life Insurance & BYOB, Earnings Season Continues

6:00 - Markets Confirm Bullish Trend

10:55 - Private Credit Fund Warning - Subprime Credit...

Read More »

Read More »

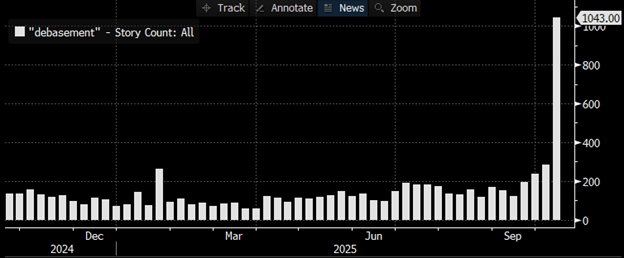

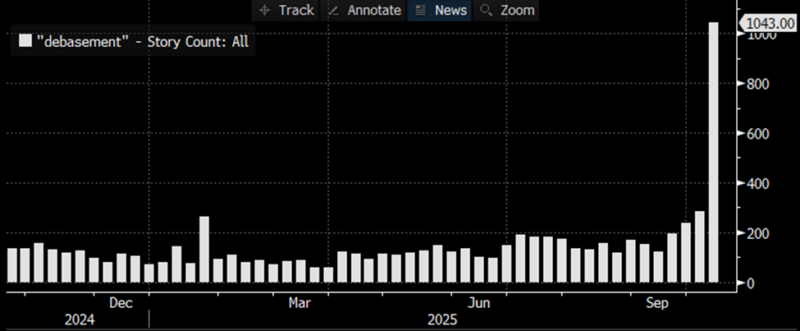

Joe Weisenthal’s Take Down Of The ‘Debasement’ Trade

Bloomberg's Joe Weisenthal wrote an interesting article (Maybe 'Debasement' Isn't The Best Way To Put it), sharing his opinion on the rising popularity of the so-called debasement trade. The debasement trade logic that Joe generally debunks is growing very popular in the media, per the Bloomberg graph below. While Joe thinks the debasement trade logic …

Read More »

Read More »

10-20-25 The Illusion Of Zero Risk: When Volatility Returns, This Market Will Break

Years of easy money trained investors to believe markets have no risk. Buying every dip still works because volatility is low, but this illusion of safety won’t last.

In this Short video, I argue that when volatility returns, this “zero-risk” market will break.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-20-25 Invest Like a Bull…Think Like a Bear

IInvest like a bull. Think like a bear.

Lance Roberts dives into the mindset of successful investors: staying bullish on opportunity, but thinking like a bear when it comes to risk.

Learn how to stay optimistic without losing discipline, why emotional control outperforms market hype, and how blending bullish conviction with bearish caution can help you thrive through any cycle.

* How to stay invested while protecting capital

* Recognizing when...

Read More »

Read More »

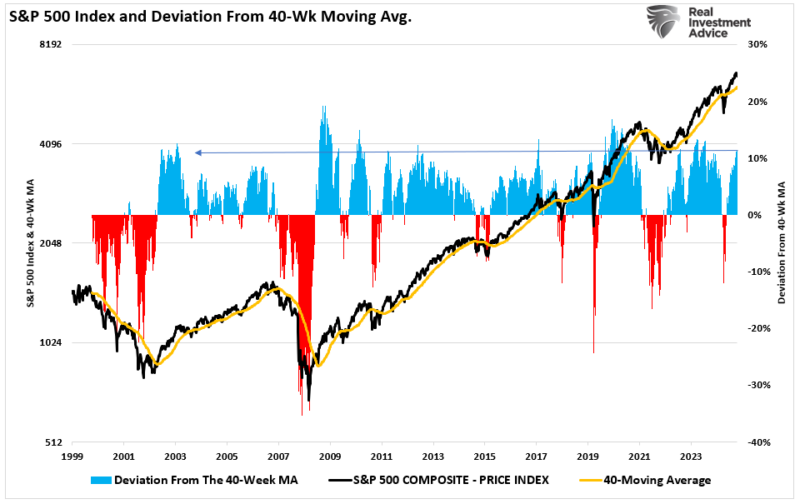

Speculative Bull Runs And The Value Of A Bearish Tilt

The recent market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are …

Read More »

Read More »

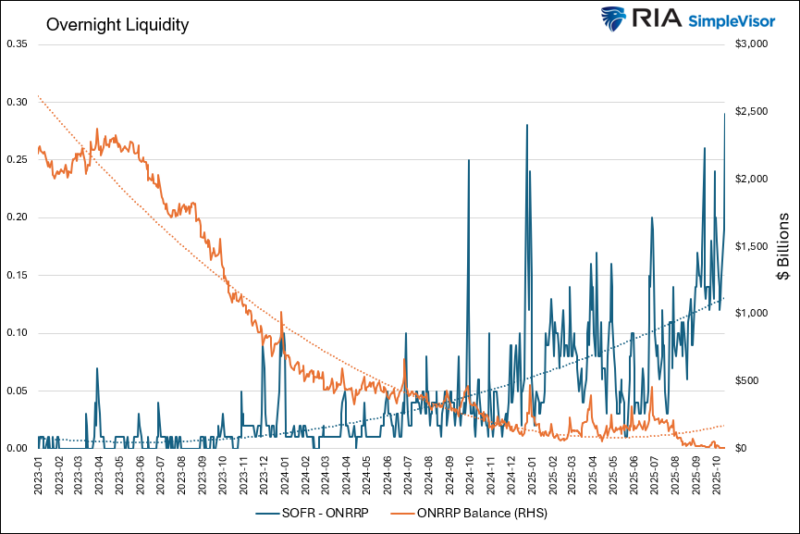

SRF: The Fed’s Newest Liquidity Backstop In Action

In July of 2021, after the pandemic and the liquidity issues that arose in 2019, the Fed established a new liquidity backstop. This program, the Standing Repo Facility (SRF), allows financial institutions to borrow on a collateralized basis from the Fed. Unlike the Overnight Reverse Repurchase facility (ON RRP), which allows financial institutions to park …

Read More »

Read More »

Rally Into Year-End: 3-Reasons To “Buy Dips”

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

10-17-25 The Leverage Trap: Why The Next Selloff Could Be Brutal

Leverage drives bull markets higher—but when sentiment shifts, it accelerates the fall.

In this Short video, I explain how margin debt above $1 trillion fuels gains today but can trigger a rapid, cascading selloff when the tide turns. $SPX $QQQ

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-22-25 Teaching Kids About Money – Lessons From Investing’s Biggest Mistakes

How do we raise the next generation to be financially wise in a world obsessed with “getting rich quick”?

Lance Roberts and financial writer Benjamin Gran discuss teaching children about money, work, and investing.

#FinancialEducation #TeachingKidsAboutMoney #InvestingWisely #FinancialLiteracy #MoneyLessons

Read More »

Read More »

10-17-25 Six Crucial Steps to Medicare Open Enrollment

Medicare’s Fall Open Enrollment runs from October 15 through December 7, and this is your chance to review, compare, and adjust your coverage for 2026.

Richard Rosso & Jonathan McCarty review six crucial steps to help you make smarter Medicare choices — from evaluating plan changes and comparing drug coverage to avoiding common enrollment mistakes.

Whether you’re already on Medicare Advantage or reviewing Part D drug plans, understanding how...

Read More »

Read More »

Liquidity Warning: SOFR Raises The Red Flag

In our Daily Commentary from October 9th, we alerted readers to the fact that the Fed’s Overnight Repurchase Program was warning that the financial system was running out of a reliable store of excess liquidity. While not a concern, as we share in our quote below, it was worth monitoring. Said differently, after years of …

Read More »

Read More »

The Psychology Of Investing In A Zero-Risk Illusion

Every market cycle eventually changes investor psychology to believe risk has been conquered. The storylines may change, from “this time it’s different” to “the Fed has our back,” but the psychology does not. When markets rise steadily and volatility remains low, investors confuse stability with safety. That’s precisely the illusion forming in markets today. The …

Read More »

Read More »

10-16-25 Guidance, Buybacks, & The Case For a Year-End Rally

Near-term tape will be choppy and guidance-sensitive, especially for AI / Mag 7 stocks.

In this short video, Lance Roberts discusses how massive buybacks and year-end seasonality could still lift markets higher despite short-term volatility.

Watch the full episode:

Catch Lance Roberts daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

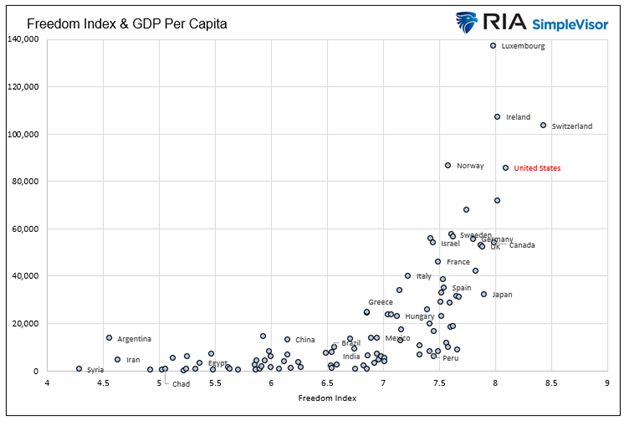

10-16-25 Capitalism: The Real Path to Wealth & Happiness

What makes capitalism the most successful wealth-building system in history?

Lance Roberts & Michael Lebowitz explore how economic freedom, private ownership, and innovation incentives have lifted billions out of poverty and created unmatched prosperity.

Why do societies that embrace free markets and entrepreneurship tend to enjoy higher standards of living, longer lifespans, and greater personal happiness? Lance & Michael examine the...

Read More »

Read More »

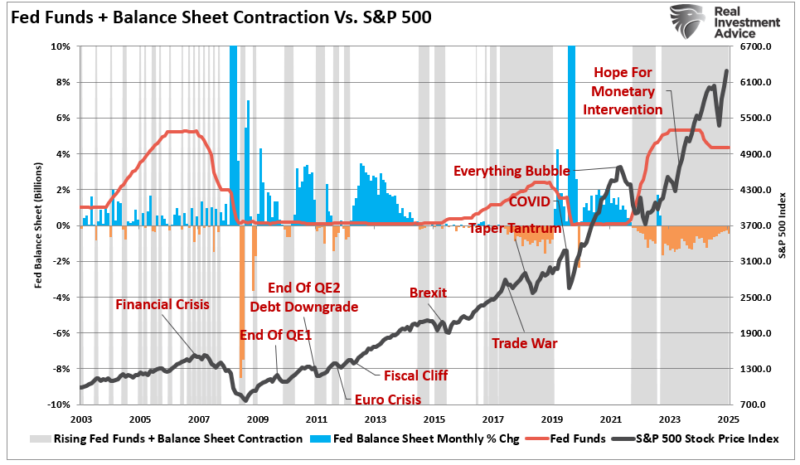

Is QT On Its Last Lap?

Chairman Powell spoke on Tuesday, addressing several topics. Of note was the following quote: "We may be approaching the end of our balance sheet contraction in the coming months." The market interpretation is that QT is ending soon. As a reminder, QT, also known as quantitative tightening, has been in effect for over three years. … Continue reading...

Read More »

Read More »

10-15-25 The Fed’s Quiet Pivot: Ending QT Is Bullish for Risk Assets

The Fed just made a quietly bullish move. In this short video, I explain how ending quantitative tightening and stabilizing its balance sheet adds liquidity, supports Treasuries, and sets up a stronger backdrop for risk assets.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-15-25 Is the Fed Poised to Pause Quantitative Tightening?

Federal Reserve Chair Jerome Powell just hinted that the Fed may soon pause its balance-sheet runoff — a potential shift that could reshape market liquidity and investor sentiment.

Lance Roberts breaks down:

* Why the Fed may pause QT — and what it signals about financial conditions.

* How ending balance-sheet runoff affects liquidity, yields, and asset prices.

* What history tells us about QT pauses and subsequent market rallies.

* Why the Fed’s...

Read More »

Read More »