Category Archive: 9a) Buy and Hold

Ich habe ChatGPT nach Finanztipps gefragt (beeindruckende Ergebnisse!)

Ich habe ChatGPT um Finanzberatung gebeten: Die Ergebnisse sind beeindruckend!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=586&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Is the bank system sound? – SPECIAL EPISODE – Robert Kiyosaki, Andy Schectman

The institutions that are deemed “too big to fail” will always be bailed out. In his book, “Conspiracy of the Rich: The 8 New Rules of Money,” Robert Kiyosaki wrote that “bailouts are the name of the game.”

This week, the Fed bailed out two regional banks that collapsed. As depositors of those banks feared money in their accounts was gone, the Fed stepped in to replenish any of the money depositors would have lost - including accounts holding over...

Read More »

Read More »

Wann Euch ein Börsencrash am heftigsten trifft | Renditereihenfolge erklärt

Renditereihenfolge - Welche Auswirkungen kann ein Börsencrash auf euer ETF-Depot haben? Saidi erklärt es euch im heutigen Video.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Die wahre Natur des Zinseszinses ►

Finanztip Renditerechner...

Read More »

Read More »

Die Welt ist positiv – oder nicht? Wie geht es mir?

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Mich hat mein unverbesserlicher #Optimismus ungefähr in den Jahren 2018/19 für die Gesellschaft ein Stück weit verlassen. Das spürt man auch in meinen Videos. Ein paar Kritiker (aus der Sozialistenfraktion hier auf dem Kanal) hat mir das vorgeworfen. #Deutschland wäre doch auf dem besten Weg in eine goldene bzw. rot-grüne #Zukunft. Alles würde gut.

Hmmm. Stimmt das? Stimmt...

Read More »

Read More »

Why Bank Math is Like Abbott & Costello

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/17/23) Bank math is a lot like Abbott & Costello math; the main issue with banks is lack of mark-to-market; SVB problem was it's the tech-darling, whose product was sub-prime business loans based on "social credit." (See "The Panic of 1907"). How diversity and equity nearly crashed the economy (NY Post). Is the...

Read More »

Read More »

Wie sich Pleiten von Silicon Valley Bank, Credit Suisse & Co. auf Welt-ETFs auswirken | Livestream

Folgt jetzt auf Bankpleiten ein Börsencrash?

Diskutier mit und stell Saidi und Xenia dazu Fragen im Live-Chat: Dienstag ab 19 Uhr geht's los!

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Finanztip Tagesgeld ►...

Read More »

Read More »

Why Banks Are About to Tighten Credit | Lance Roberts #Shorts

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/16/23) "There is not enough money in FDIC to cover bank bailouts. There's not even enough money to cover all of Silicon Valley Bank. If we go bank to a 2008 situation, where you've got bank after bank after bank failing, there is not enough moeny to cover those. In the Pension Benefit Guanraty Corporation, there is not enough money...

Read More »

Read More »

SVB & ESG: Why ESG Investing is a Scam| Lance Roberts #Shorts

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/17/23) "There is more than sufficient evidence that the ESG mantra does very little for the environment, and does a lot more for the managers that are chosing these funds, because out of those 915 ESG Funds, a lot of those funds have nothing to do with ESG investing. They were large cap funds that weren't getting any inflows because...

Read More »

Read More »

Why the Credit Suisse Bailout is Significant: SIFI

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

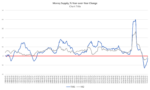

(3/16/23) Credit Suisse secures a $50-B loan from the Swiss National Bank: Is this only the first bailout? Why markets have really gone nowhere; this is why context matters. It's important to keep a proper perspective as an investor: Ignore the TikTok experts and look at the data; a longer-term view is best. Why the Fed will not cut rates...

Read More »

Read More »

Der Unterschied zwischen ARM und REICH #shorts 🤯

👉 https://gratis-workshop.com/yts 🔥 Jetzt Gratis Workshop-Platz sichern!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den...

Read More »

Read More »

Will Taxpayers Bear the Brunt of Federal Bank Bailouts?

(3/15/23) "There is not enough money in FDIC to cover bank bailouts. There's not even enough money to cover all of Silicon Valley Bank. If we go bank to a 2008 situation, where you've got bank after bank after bank failing, there is not enough moeny to cover those. In the Pension Benefit Guanraty Corporation, there is not enough money in that to cover all the pensions. There's just not enough money. So ultimatey, at the end of the day, this is...

Read More »

Read More »

Tesla Investor Day 2023

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Im März 2023 wurde beim Tesla Investor Day der #Masterplan #3 vorgestellt. Er ist sehr ambitioniert und zeigt auf, wie weit die restliche #Automobilindustrie hinter Tesla hinterherhinkt. Und der #Abstand zu den #Innovationen wird größer.

-

Investor Day Live Stream ►

Scheitert die Energiewende? ►

Munro zum Tesla Model Y ► _E

Toyota zu Tesla 'Kunstwerk' ►...

Read More »

Read More »

There Is Not Enough Money in the FDIC to Cover Everyone.

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/15/23) Despite Tuesday's CPI print of 6%, core inflation remains very high and very sticky. The realities of CPI and the fallout from SVB Failure are the context for The Great Debate: Will the Fed Hike or Pause? Was SVB an Event or a prelude to more trouble? Expectation for Tuesday's rally to be erased today; will bears take charge again?...

Read More »

Read More »

Why you should not save money – Robert Kiyosaki, Kim Kiyosaki, @MilesFranklinCo

Guest Andy Schectman owns Miles Franklin, a full-service for precious metals. “If you’re going to buy gold and start accumulating, storage is an issue,” says Host Robert Kiyosaki. It’s why he’s been with Miles Franklin for years.

As one of the hosts for the Rich Dad event this April 6,7 and 8th in Phoenix, Schectman has the financial advice you won’t get from schools, the stock market, or Wall Street. Schectman’s father once advised him to buy...

Read More »

Read More »

Vorabpauschale: Steuer zahlen ohne Geld zu sehen!

Im heutigen Video erklärt Saidi Dir, was die Vorabpauschale ist.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Saidis Podcast: https://www.finanztip.de/podcast/geld-ganz-einfach/

Instagram: https://www.instagram.com/finanztip

Newsletter: https://newsletter.finanztip.de/

Forum: http://www.finanztip.de/community/

So...

Read More »

Read More »

The Big Lie About Investing

The world is filled with example after example of people who started with nothing and have created tremendous wealth, yet many people still believe the lie it takes money to make money. Even though we know if we took a billionaire like Richard Branson and stripped him of all his wealth, he would become wealthy again… and even though there's evidence all around us to the contrary, there are still scores of people who believe it takes money to make...

Read More »

Read More »

Geld geschenkt vom Arbeitgeber? #shorts

Geld geschenkt vom Arbeitgeber? Möglich gemacht wird dies durch Vermögenswirksame Leistungen. Was das ist, erfahrt ihr in diesem #short

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=585&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Why SVB Failure is Not Likely a One-off Event (3/23/23)

(3/23/23) Markets have priced-in a massive Fed pivot; why SVB is likely not a one-off event, as previous rate hikes being to impact economy; banks will make loan requirements more stringent, effectively tightening credit; banks will be forced to clean up their balance sheets.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

--------

Watch...

Read More »

Read More »

Don’t Panic; Banks are Recovering | Lance Roberts #Shorts

(3/14/23) "Reduce some risk; reduce your financial exposure for right now, and then once we get through this problem in the markets over the next few days, we can look to where we can rebalance risk, and to do we do that. But right now, it looks like money is starting to flow, not only into Bonds, which had one of the biggest moves since 1987 yesterday, but also into Technology and growth stocks, which have less exposure to interest rate...

Read More »

Read More »

Day-Two of Bank Bailout Week

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/14/23) It's Day-Two of Bank Bailout Week, with still-inflationary CPI numbers adding to the mix of woes and worries for the Federal Reserve. The failure of Signature Bank and SVB underscore what happens when regulations are defanged, and Rule 157 is repealed, allowing fuzzy math to prevail. Are banks really too big to fail? The irony of...

Read More »

Read More »