Category Archive: 9a) Buy and Hold

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

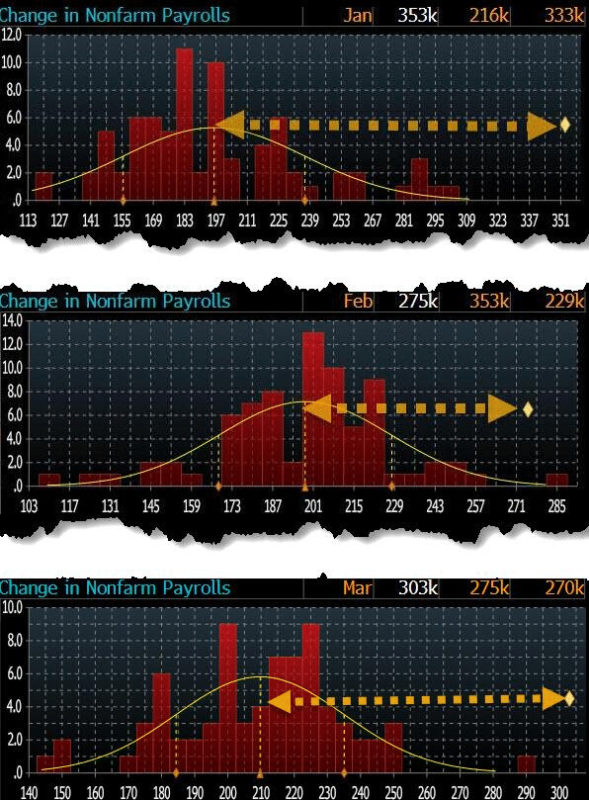

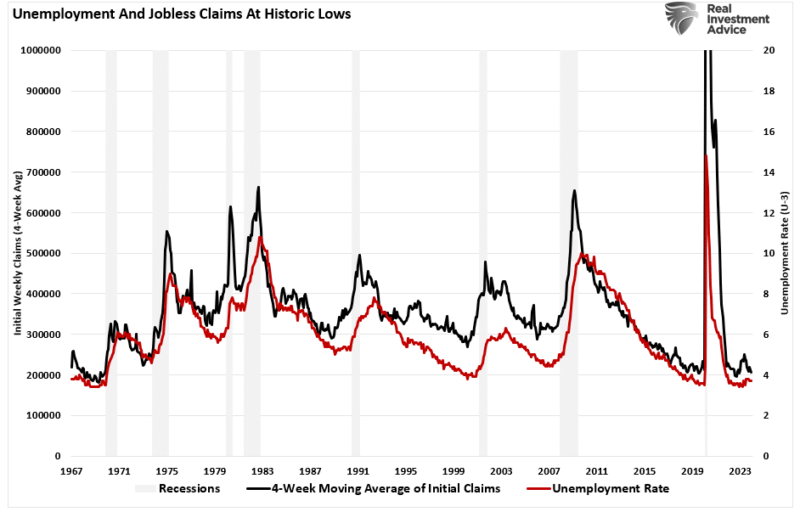

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

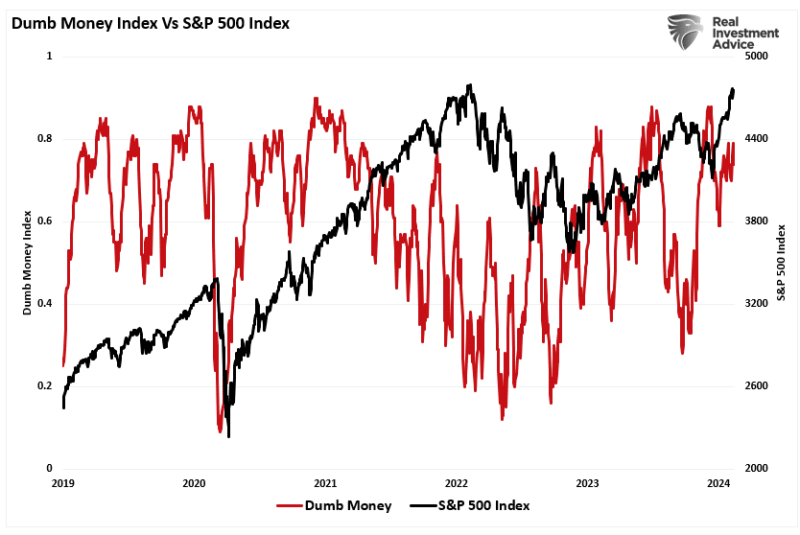

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

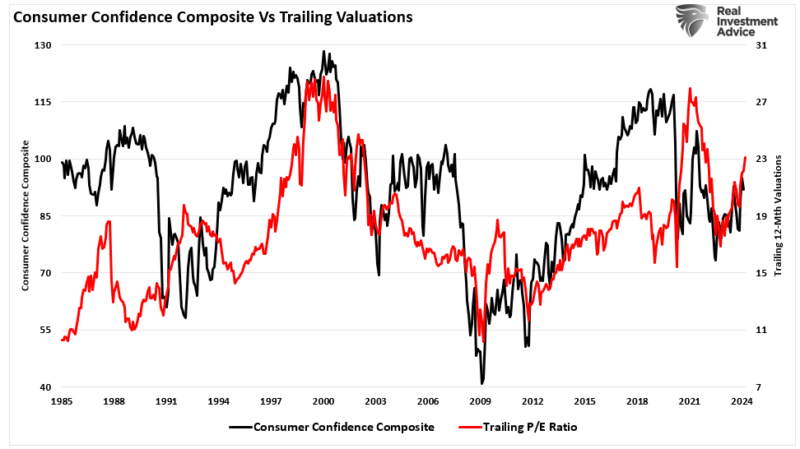

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Three Ideas to Tackle Financial Ghosts.

Is money distress part of your life? Do the dollars & cents of poor decisions past sneak up on you and rattle around your house like chains? What if I could provide three ideas to tackle 2022’s financial ghosts and put them at rest for good?

Read More »

Read More »

Employees Want Paychecks for Life: Pros and Cons of Guaranteed Lifetime Income

Annuities and similar products may help address retirement readiness in an aging workforce. People are living longer, which means they may need their retirement savings to last decades. As a result, nearly half (48%) of participants are concerned about outliving their retirement savings.

Read More »

Read More »

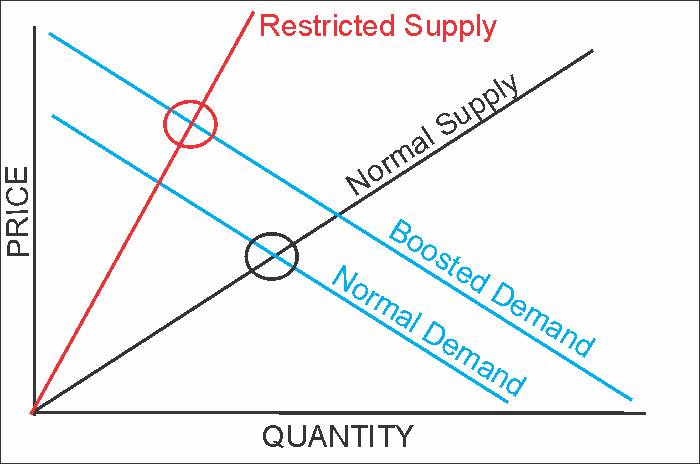

How Could Inflation Impact Corporate Retirement Plans?

Increasing prices may put pressure on employers and delay workers from retiring. Inflation is the increase in the general price of goods and services, which can decrease the purchasing power of American workers. So how does this recent upward trend affect your workplace benefits, employees and retirement plan?

Read More »

Read More »

Giant Corporations Are Causing Inflation?

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging” – Sen. Elizabeth Warren

Read More »

Read More »

High Inflation May Already Be Behind Us

High inflation has captured the headlines as of late particularly as CPI recently hit the highest levels since 1981. Some are even suggesting we will face hyperinflation. However, while inflation is certainly present, the question to be answered is whether it will remain that way, or if the worst may already be behind us?

Read More »

Read More »

Snap Goes The Economy

“…the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month.” -Snap CEO Evan Spiegel

Read More »

Read More »

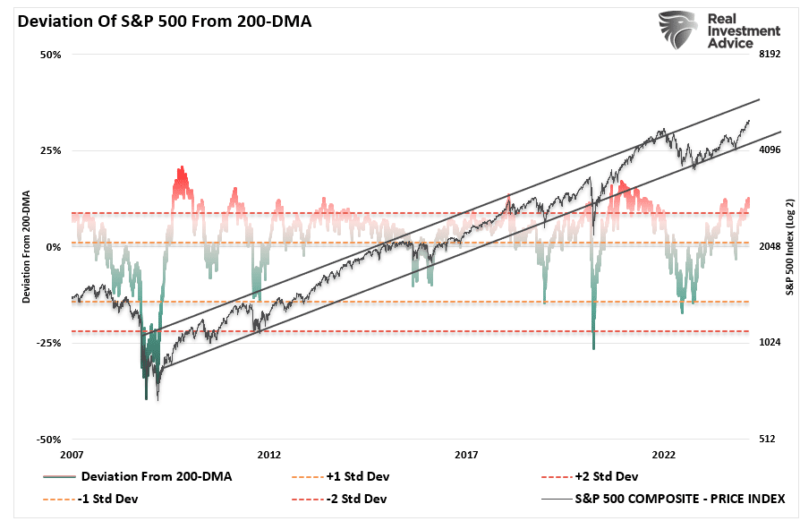

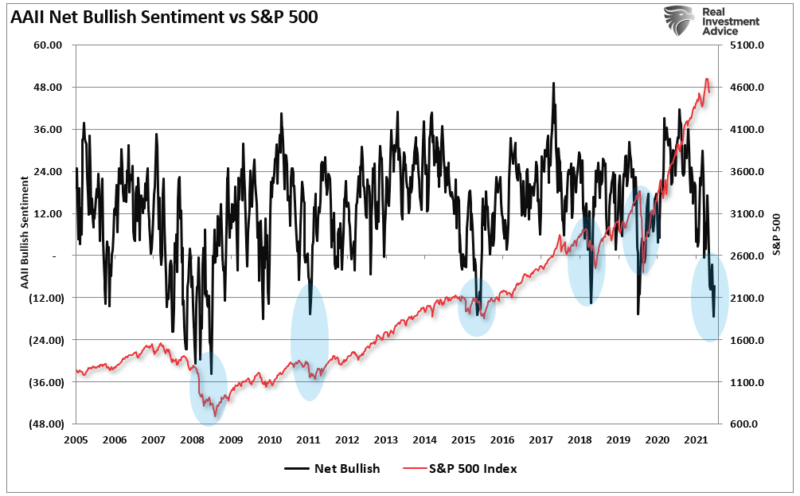

Market Perspective Is Important To Avoid Mistakes

Market perspective is essential in avoiding investing mistakes. With CNBC airing “Markets In Turmoil” every time the market dips, it’s no wonder investor sentiment is now the lowest we have seen financial crisis lows.

Read More »

Read More »

Hiking Rates Into Peak Valuations Is A Mistake

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article.

Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be...

Read More »

Read More »

Sell Energy Stocks? The Time May Be Approaching

“Sell Energy Stocks” Was Originally Published At Marketwatch.com

Sell energy stocks? Such certainly seems counter-intuitive advice given high oil prices, geopolitical stress, and surging inflation. However, some issues suggest this could indeed be the time to “sell high.”

Before we go further, it is essential to state that I am not recommending selling energy stocks in total. As is always the case, portfolio management is...

Read More »

Read More »

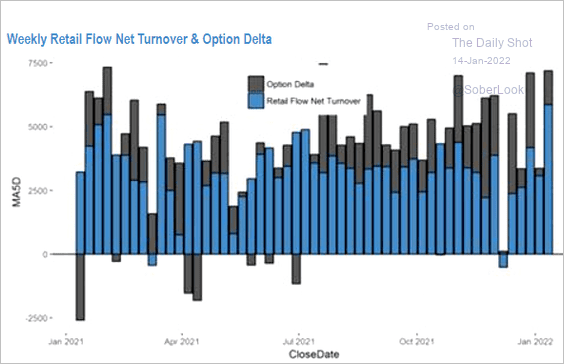

Market Selloff Into January

The market selloff into January rattled investors as concerns of “So Goes January, So Goes The Year” began to dampen expectations. Combined with a more aggressive stance from the Federal Reserve, rising inflation, and a reduction in liquidity, investor concerns seem to be well-founded.

Read More »

Read More »

Binance Review 2021: The best in Switzerland?

At Investing Hero, I aim to provide the best investing platform reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Investing Hero is for informational purposes only. Please read the disclaimer.

Read More »

Read More »

Crypto’s Crash and Stocks Head Higher

“Crypto’s Crash,” says some financial news headlines. The reality is Bitcoin, Ethereum and others are down about 10-15% in the last few days. The word “crash” may seem appropriate to describe the sharp decline, except 10%+ moves in a matter of days is the norm, not the exception for crypto.

Read More »

Read More »