Category Archive: 9a) Buy and Hold

US-Dollar im Sinkflug: Welche Vorteile und Probleme bringt das für Dich?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_pvwA4xXxaCA

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_pvwA4xXxaCA

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_pvwA4xXxaCA

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_pvwA4xXxaCA

Trade...

Read More »

Read More »

Mit einer Holding Steuern optimieren?

Vorteil einer Holdingstruktur:

👉 Steuern optimieren

👉 Gewinne effizient reinvestieren

👉 Und im besten Fall bis zu 50 % mehr vom Gewinn behalten

Wenn du wissen willst, wie das funktioniert:

Kommentiere STEUERN und ich schicke dir alle Infos zu meinem kostenlosen Steuerelitetraining.

📅 19. Februar | 19:00 Uhr

Dort verrate ich dir die Steuergeheimnisse der Top 1 % in Österreich.

#investmentpunk #steuern #vermögensaufbau

Read More »

Read More »

Frugal Chic: 3 Tipps von Mia McGrath

✨ Frugal Chic: 3 Tipps von Mia McGrath

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite #finanzbildung #ökonomie...

Read More »

Read More »

Das habe ich von den Ultra-Reichen gelernt.

💥 Das habe ich von der Ultra High Net Worth Individuals Konferenz mitbekommen:

Fast nur ältere Männer im Raum.

Was heißt das für dich?

Reichtum ist selten ein Sprint.

Es ist Zeit + Disziplin + keine großen Fehler machen.

Wenn du keine Blödheiten machst, die richtigen Schritte gehst und Zeit auf deiner Seite hast,

dann kannst du es kaum verhindern, mit hässlichen kleinen Löchern Millionär zu werden.

Kommentiere CASH und ich schick dir alle Infos...

Read More »

Read More »

So hoch ist die durchschnittliche Rente in Deutschland wirklich!

Rentenniveau 48 Prozent? Was bei der Rente tatsächlich bei dir ankommt

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=905&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt 📱

ℹ️ Weitere Infos zum Video:

Viele planen ihre Zukunft mit einer Zahl, die so in der...

Read More »

Read More »

unknown

🎭 Mit hässlichen kleinen Löchern kannst du gar nicht verhindern, dir deine eigene Rangloge zu leisten.

Im Leben geht es um Erfahrungen und die Wahrheit ist:

Wenn du reich bist, kannst du bessere Erfahrungen machen.

Aber der Weg dorthin?

👉 Hässliche kleine Löcher.

👉 Cashflow.

👉 Vermögen aufbauen.

👉 Mich am Opernball treffen!

#investmentpunk

#mindset

#finanziellefreiheit

Read More »

Read More »

2-14-26 This “Flat” Market Is Hiding Massive Rotations

Markets may look flat on the surface, but beneath the surface, massive rotations are taking place. Large-cap value is up sharply while growth has stalled, even as $SPX barely moves.

In this short video, Lance Roberts & Michael Lebowitz discuss how passive flows are driving capital aggressively between sectors and styles, pushing areas to historical extremes.

These divergences create opportunity, but also risk. When rotations stretch this far,...

Read More »

Read More »

Den perfekten Moment, um mit dem Investieren zu beginnen, gibt es nicht

Den perfekten Moment, um mit dem Investieren zu beginnen, gibt es nicht 🙌

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel...

Read More »

Read More »

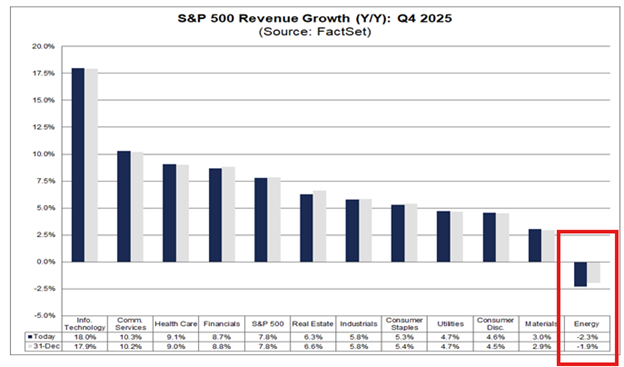

The Weak Dollar Narrative

🔎 At a Glance 🏛️ Market Brief - February Lives Up To Its Name We noted last week that February tends to be a weaker month for returns. So far, it has certainly lived up to its name. This past week opened with investors selling technology, and particularly software stocks, to buy value sectors. Energy, … Continue reading »

Read More »

Read More »

2-13-26 AI in HR

AI is transforming HR and payroll—but most mid-sized companies are still stuck doing critical work manually.

Tom Allen and Da'Miere Glover break down what’s real vs. hype in “AI in HR,” including where AI is already delivering value today: payroll accuracy and anomaly detection, recruiting and screening, employee self-service chatbots, and workforce forecasting. Tom and Da'Miere also cover the downside risks business owners must understand—bias...

Read More »

Read More »

2-13-26 Why The Market Didn’t Buy the “Strong” Jobs Report

The latest jobs report looked strong at first glance, but revisions wiped out much of last year’s gains, and underlying trends show slower growth.

Wage pressures continue to ease, and alternative payroll data suggest job creation is running far below headline numbers.

Lance Roberts & Michael Lebowitz explain why the bond market’s muted reaction suggests investors saw through the headline strength and remain unconvinced that the labor market is...

Read More »

Read More »

Das musst du über Steuern wissen!

Wenn du es richtig strukturierst, kannst du sogar als Angestellter oder EInzelunternehmer mit einer Holding bis zu 50 % mehr von deinen Gewinnen behalten.

Im kostenlosen online Webinar erfährst du am 19. Februar:

👉 Welche Strukturen wirklich für dich funktionieren

👉 Für wen sich Steueroptimierung lohnt

👉 Wie du legal deutlich weniger Steuern zahlst

Kommentiere STEUERN und ich schicke dir alle Infos.

#investmentpunk #steuern...

Read More »

Read More »

Minenzock und Rohstoffzyklus – Gold, Silber, Kupfer, Uran

Zum Jahresanfang habe ich meinen Minen-Zock gestartet. Wenn die #Rohstoffreise für #Metalle steigen, dann müssen auch in Folge die #Gewinne der Minengesellschaften steigen. Darauf setzt mein Zock.

-

✘ Werbung:

Mein Buch Politik für Wähler ► htts://amazon.de/d/B0F92V8BDW/

Mein Buch Katastrohenzyklen ► htts://amazon.de/d/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► htt://ts.la/theresia5687

Mein Buch Allgemeinbildung ► htts://amazon.de/d/B09RFZH4W1/

-

Q1...

Read More »

Read More »

Kaufe keine aktiven ETFs

Kaufe keine aktiven ETFs 🙃

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite #finanzbildung #ökonomie...

Read More »

Read More »

2-13-26 529 Leftovers, Retirement First, & the Real Cost of Cars

What happens when the “perfect” plan doesn’t happen—your kid skips college, your retirement clock is ticking, and the family budget gets ambushed by costs you never saw coming?

Jon Penn and Jonathan McCarty connect three real-world money stress points that are showing up everywhere right now:

1) The kid isn’t going to college—now what about that 529?

2) Retirement vs. college: the household tug-of-war

3) Hidden car ownership costs: the budget...

Read More »

Read More »

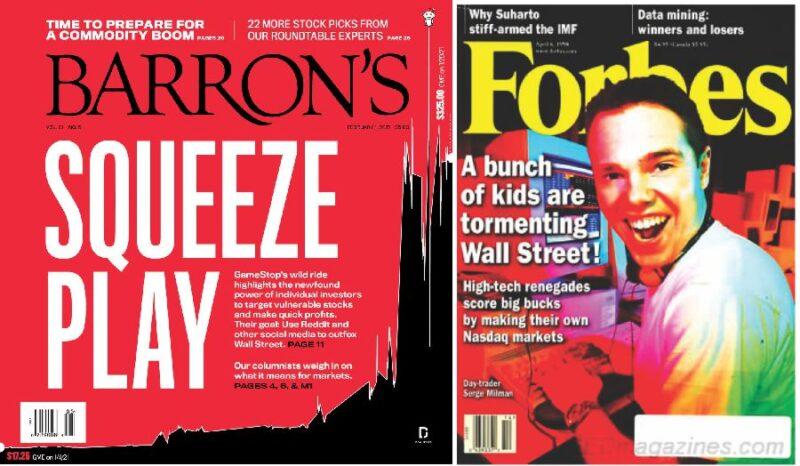

Financial Nihilism & The Trap Young Investors Are Walking Into

The article from the Wall Street Journal titled “Why My Generation Is Turning to Financial Nihilism” by Kyla Scanlon argues that Gen Z is embracing high-risk financial behavior out of despair and detachment. Of course, it is essential to recognize that Kyla, although well-intentioned, is a young twenty-something influencer with limited real-life experience, and sees …

Read More »

Read More »