Category Archive: 6a) Gold & Monetary Metals

The Best Ways to Invest in Gold Today

The cost of buying and selling gold. How to buy gold on the cheap. How to avoid paying capital gains tax (CGT) on your gold. Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault. Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption.

Read More »

Read More »

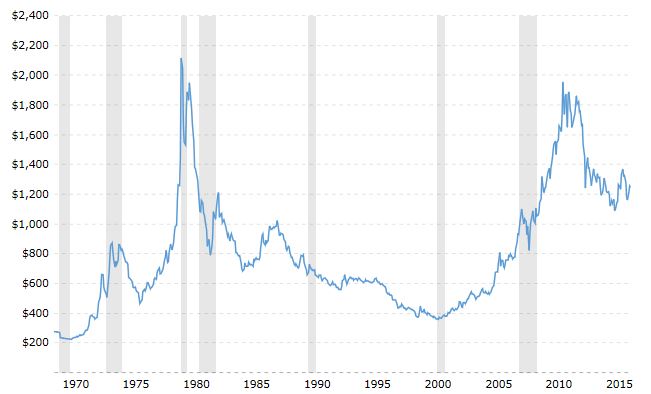

James Rickards: Long-Term Forecast For $10,000 Gold

James Rickards: Long-Term Forecast For $10,000 Gold. James Rickards, geopolitical and monetary expert and best selling author of the ‘The New Case for Gold’ has written an interesting piece for the Daily Reckoning on why he believes gold will reach $10,000 in the long term.

Read More »

Read More »

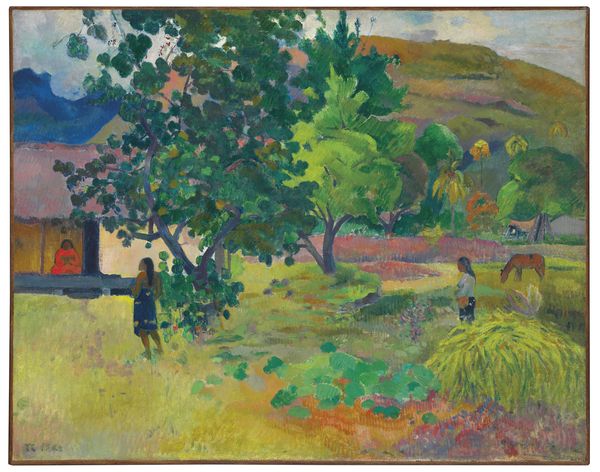

Art Market Bubble Bursting? Gauguin Priced At $85 Million Collapses 74 percent

Art Market Bubble Bursting? Russian Billionaire Takes 74% Loss On “Investment”. $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008. Christie’s auctioned the work at its evening sale in London. Global art sales plummet, but China rises as ‘art superpower’. China soon to dominates global art and gold market. Art price volumes doubled since 2009. As currencies debase super rich seek out stores of value. Gold remains accessible store of value...

Read More »

Read More »

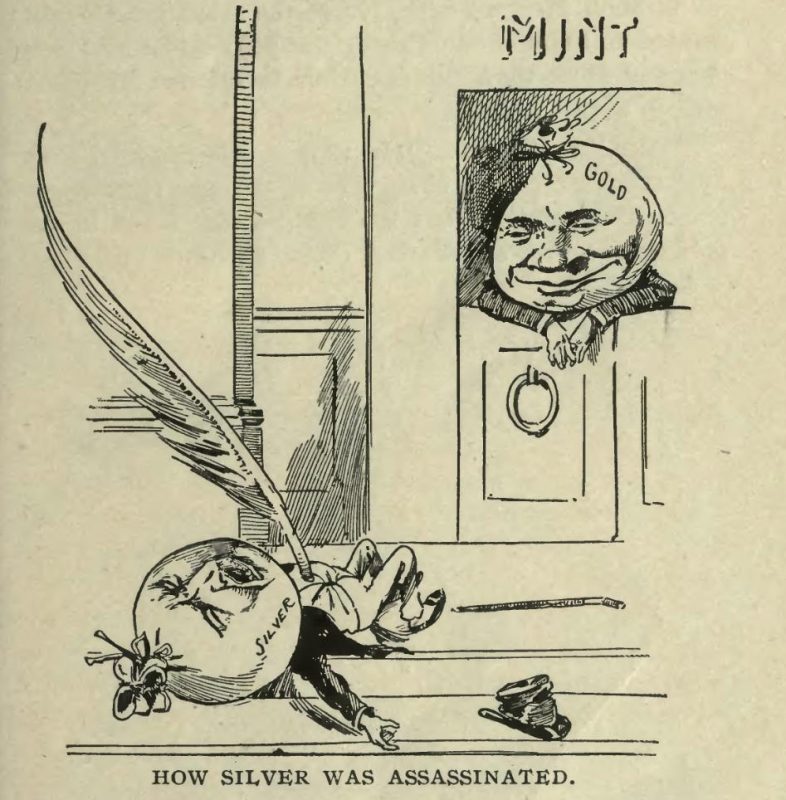

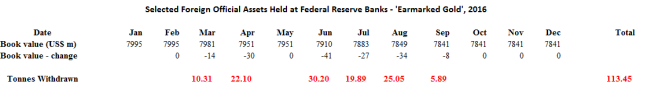

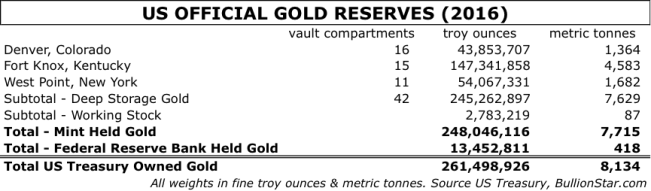

US Mint Releases New Fort Knox “Audit Documentation” The First Critical Observations.

In response to a FOIA request the US Mint has finally released reports drafted from 1993 through 2008 related to the physical audits of the US official gold reserves. However, the documents released are incomplete and reveal the audit procedures have not been executed proficiently. Moreover, because the Mint could not honor its promises in full the costs ($3,144.96 US dollars) of the FOIA request have been refunded.

Read More »

Read More »

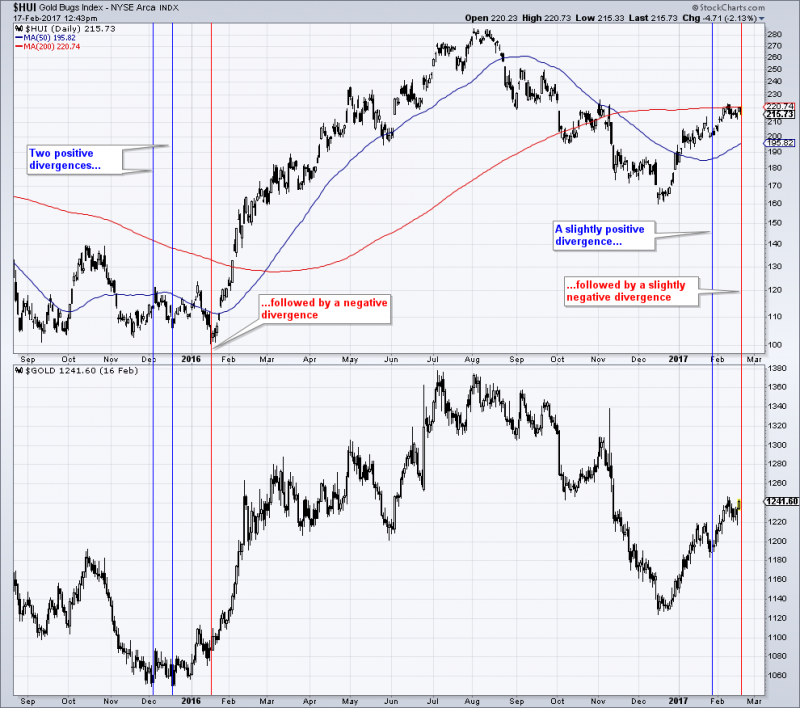

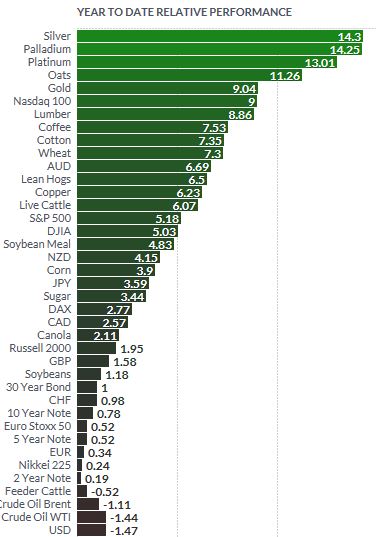

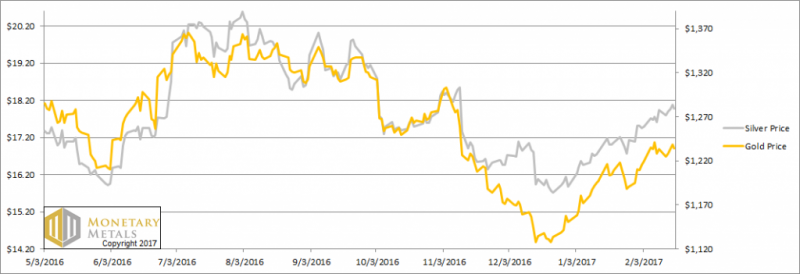

Gold Up 9 percent, Silver 14 percent YTD As Le Pen’s Lead Widens

Gold up 1.5% in euros and dollars this week. Silver up 1.4% this week and now up 14.3% and is the best performing market YTD. Gold up 9% year to date – fourth consecutive higher weekly close and breaks resistance at $1,250/oz. Gold up 9.4% in euros year to date as Le Pen’s lead in polls widened. Gold up another 6.4% in sterling pounds year to date as ‘Hard Brexit’ looms.

Read More »

Read More »

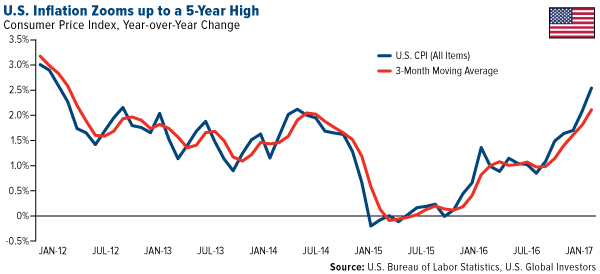

Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers. Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced for the sixth straight month.

Read More »

Read More »

Russia Gold Buying Returns – Buys One Million Ounces In January

Russia Gold Buying Returns – Adds Substantial One Million Ounces To Reserves In January. Russia gold buying returned in January with the Russian central bank buying a very large 1 million ounces or 37 metric tonnes of gold bullion. The increase in the gold reserves came after Russia did not buy a single ounce in December – a move seen as potentially a signal or an olive branch to the U.S. and the incoming Trump administration.

Read More »

Read More »

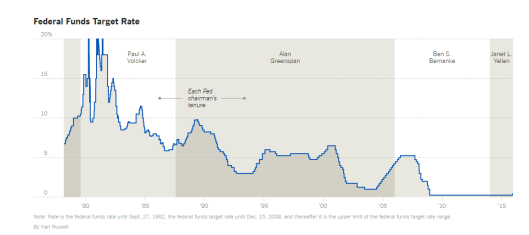

Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan, “I view gold as the primary global currency” said Greenspan, “Significant increases in inflation will ultimately increase the price of gold”, “Investment in gold now is insurance…”

Read More »

Read More »

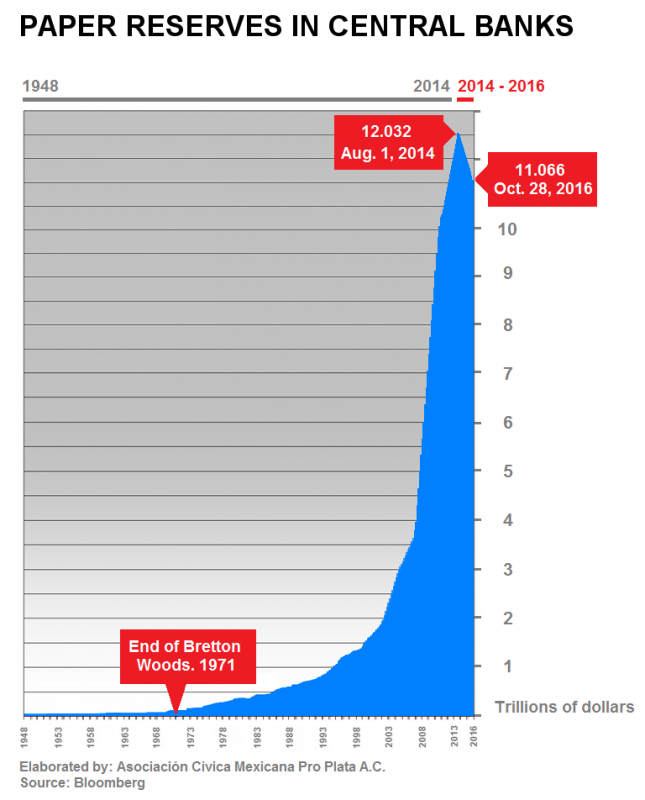

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »