Category Archive: 6a) Gold & Monetary Metals

Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech. ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal.

Read More »

Read More »

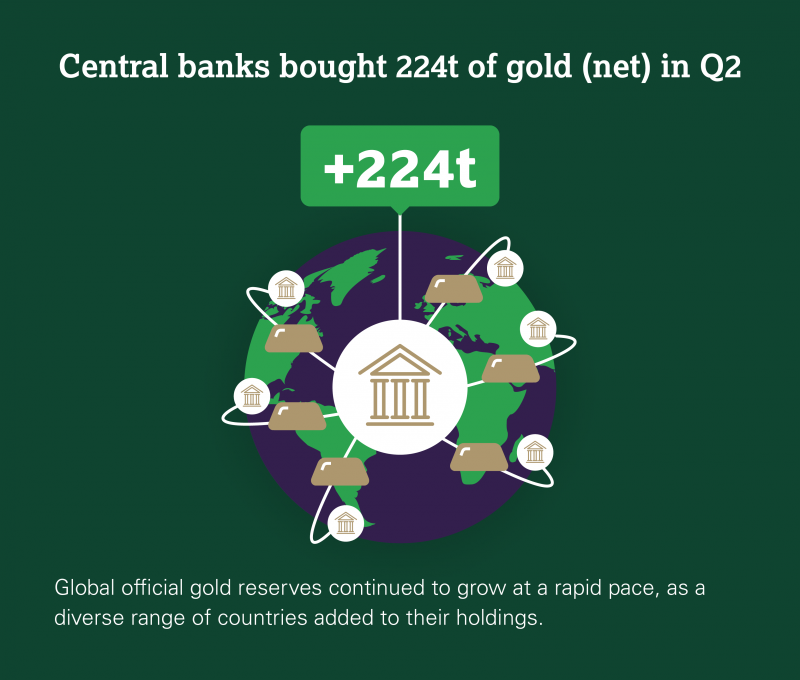

Central Bank Gold Buying Is “Sustainable and Indeed May Accelerate”

Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch. While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is...

Read More »

Read More »

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Where Does Gold Go From Here? — Ron Paul’s “Cautious” Prediction. “Gold is an ‘insurance policy’ as the dollar will continue go down in value as it is printed” and it will end in a monetary “calamity”. “Gold is not money due to any man-made laws. Gold is money despite man-made laws, and is a product of the voluntary marketplace”.

Read More »

Read More »

Cryptos/Switzerland: Mountain Pass

Facebook takes on global finance. But its proposed digital currency Libra frightens central banks and regulators. Below the radar, Switzerland launches its own skirmish. Two local crypto-finance pioneers this week became the first to win banking licences.

Read More »

Read More »

Bitcoin-Friendly Banks

Over its 10 years of existence, Bitcoin adoption has been just like its price—up and down. At this point in time, it’s safe to say that the adoption of our favourite cryptocurrency has never been higher. Since adoption is so high, it has never been easier to buy bitcoin (with hundreds of payment methods available on peer-to-peer marketplaces).

Read More »

Read More »

Switzerland’s First Crypto Banks Receive Licences

The Swiss financial regulator has awarded banking and securities dealer licences to two new “crypto banks”. SEBA and Sygnum have been cleared to operate in the new world of tokenised digital securities, a major milestone for the fledging industry.

Read More »

Read More »

Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

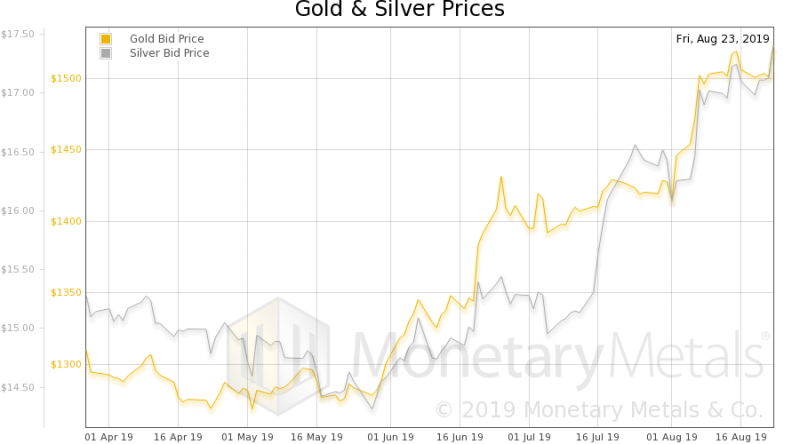

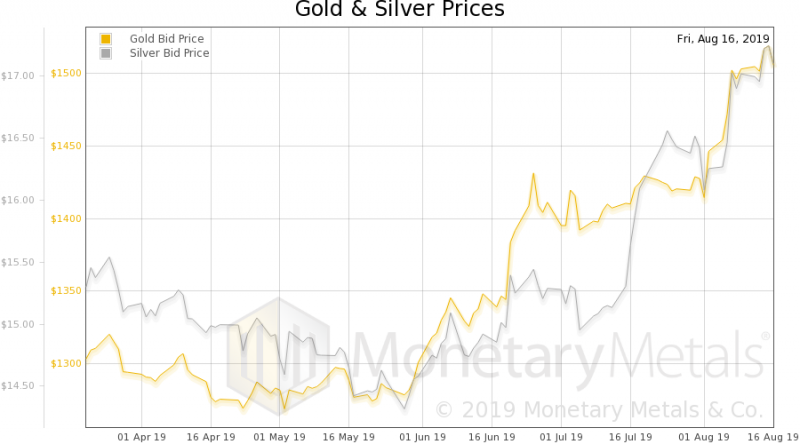

Update on gold – bad news is good news

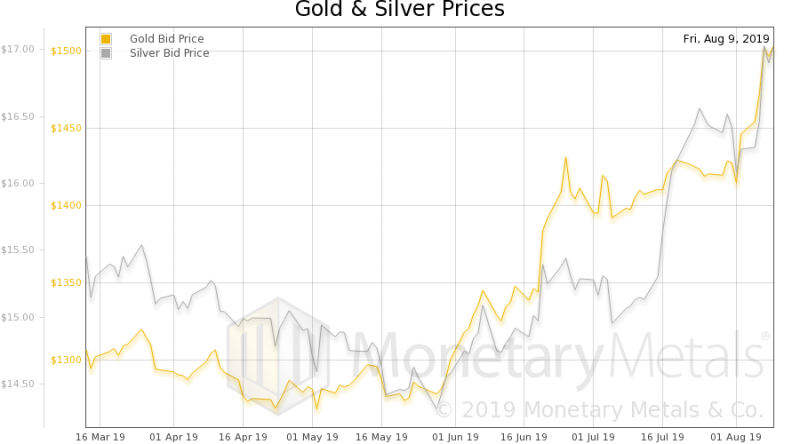

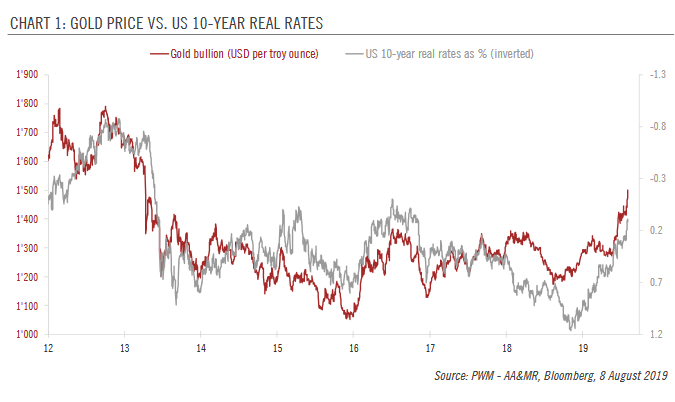

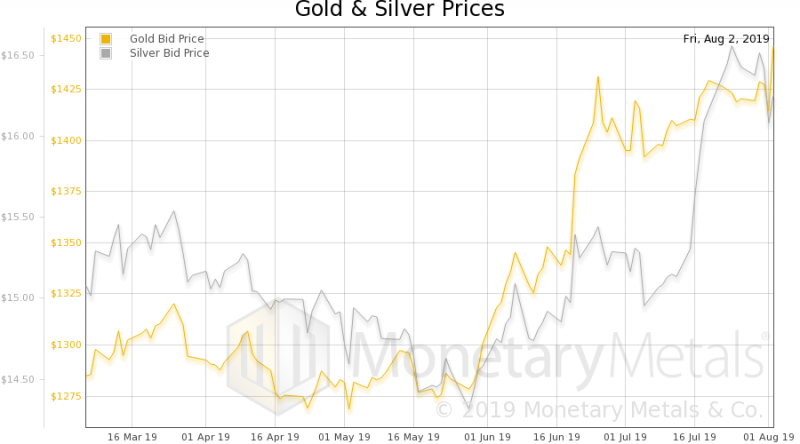

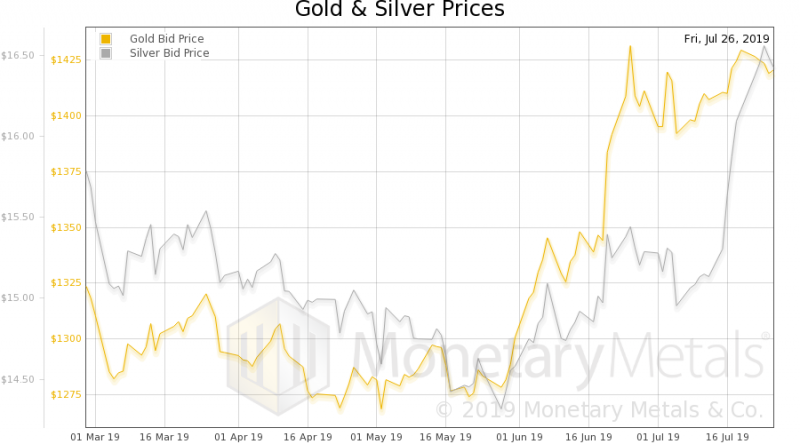

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets.

Read More »

Read More »

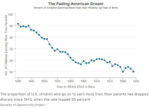

The Sound Money Showdown in U.S. States

Policies relating to sound money have been the subject of substantial debate at the state level this year, with bills, hearings, and/or votes taking place in nearly a dozen legislatures. As most state legislatures have now wrapped up their work for the year, let’s review the victories (both offensive and defensive)—and lone defeat—for sound money during the 2019 session.

Read More »

Read More »

After Fed Disappoints, Will Trump Initiate Currency Intervention?

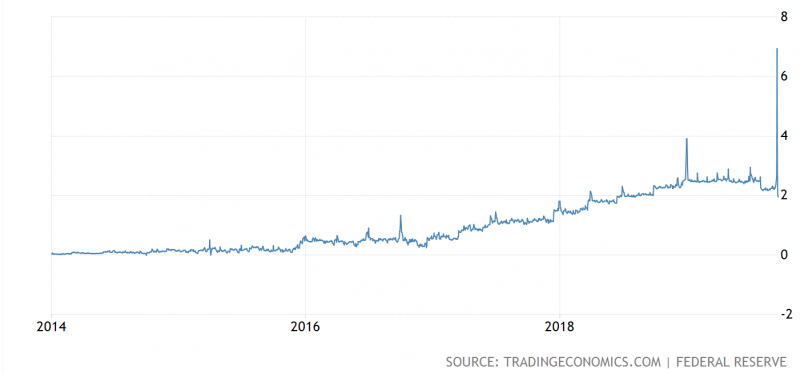

Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated. The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries.

Read More »

Read More »

Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today.

Read More »

Read More »

Financial Media Elite Defensively Bash “Useless” Gold

At least the Financial Times now has come clean about its hostility to gold – as well as to free markets and elementary journalism. Gold Anti-Trust Action Committee (GATA) friend Chris Kniel of Orinda, California, sent to the newspaper's chief economic columnist, Martin Wolf, the excellent summary of gold and silver market manipulation just written by gold researcher Ronan Manly.

Read More »

Read More »