Category Archive: 6a) Gold & Monetary Metals

Marc Faber: Politik zerstört Wirtschaft

Befinden sich die westlichen Industrienationen auf dem Weg in den Sozialismus? Michael Mross im Gespräch mit Marc Faber. Die Politik wird immer mächtiger, die Wirtschaft schrumpft. Wie soll das enden? Außerdem die Frage, welche Rolle spielt das CO2-Thema in Asien?

Read More »

Read More »

The Sound Money Showdown in U.S. States

Policies relating to sound money have been the subject of substantial debate at the state level this year, with bills, hearings, and/or votes taking place in nearly a dozen legislatures. As most state legislatures have now wrapped up their work for the year, let’s review the victories (both offensive and defensive)—and lone defeat—for sound money during the 2019 session.

Read More »

Read More »

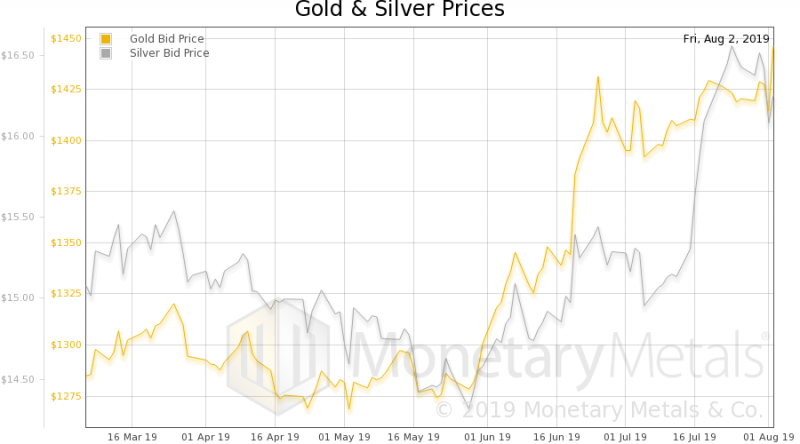

Sprott Money News Weekly Wrap-up – 8.2.19

Eric Sprott discusses current events affecting the precious metals market and he also reviews some of the latest developments in the mining sector.

Read More »

Read More »

Marc Faber: Darum würde ich die Notenbanker gerne zur Guillotine führen // Mission Money

The Gloom, Boom & Doom Report: https://www.gloomboomdoom.com/ Droht uns der Börsencrash? Wir fragen nach bei Dr. Doom Marc Faber. Er sieht gerade schwarz für Deutschland und das europäische Bankensystem. Zudem schätzt er ein, wie sich der chinesische Markt entwickeln könnte. Gerade wenn man die Entwicklung für die kommenden 40 Jahre fortschreibt. Bitcoin schätzt er mittlerweile …

Read More »

Read More »

After Fed Disappoints, Will Trump Initiate Currency Intervention?

Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated. The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries.

Read More »

Read More »

Marc Faber: Währungsreform unausweichlich?

Zerstören Notenbanken und Politik die Wirtschaft? Wie geht es weiter an den Finanzmärkten? Kommt eine Währungsreform? Michael Mross im Gespräch mit Marc Faber über Finanzen und Bitcoin. – Der letzte Satz ist leider etwas abgehackt. Er lautet: Faber in Bezug auf die Notenbanken: wie viel Gas können Sie noch geben?

Read More »

Read More »

Gold and Silver Are “Safe Haven Money” and Have Never Failed Throughout History – Silver Guru

- "I feel called to this ... I feel it is my duty to educate as many people as possible"

- The Fed is engaged in "extend and pretend" but we are in the "end game"

- The gold silver ratio is headed "much much lower" - likely back to 30:1

- Only some $16 billion worth of above ground investment grade silver

- U.S. bonds are no longer safe due to negative yields and the risk of massive currency depreciation

- A...

Read More »

Read More »

Gold and Silver Are “Safe Haven Money” and Have Never Failed Throughout History – Silver Guru

– “I feel called to this … I feel it is my duty to educate as many people as possible” – The Fed is engaged in “extend and pretend” but we are in the “end game” – The gold silver ratio is headed “much much lower” – likely back to 30:1 – Only some $16 …

Read More »

Read More »

493: Marc Faber: The Unfolding Pension Crisis

My guest in this interview is Dr Marc Faber. Dr. Faber is the editor of the Gloom, Boom & Doom Report. He is referred to as the Billionaire they call Dr. Doom in Tony Robbins book, Money Master The Game. In this episode, we will look at what the global economy and markets are telling … Continue reading »

Read More »

Read More »

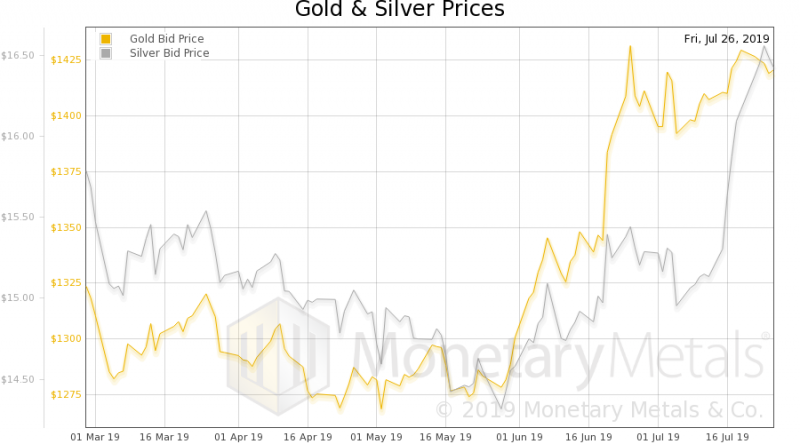

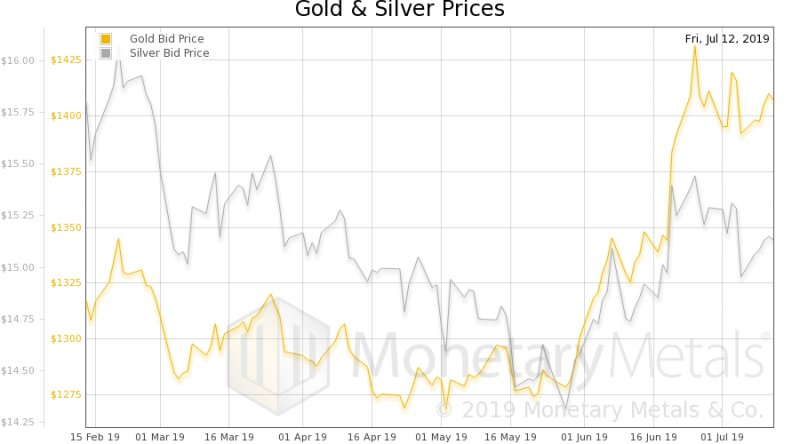

Sprott Money News Weekly Wrap-up – 7.26.19

Eric Sprott discusses the ongoing rally in precious metals and looks ahead to next week’s FOMC meeting.

Read More »

Read More »

Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today.

Read More »

Read More »

Financial Media Elite Defensively Bash “Useless” Gold

At least the Financial Times now has come clean about its hostility to gold – as well as to free markets and elementary journalism. Gold Anti-Trust Action Committee (GATA) friend Chris Kniel of Orinda, California, sent to the newspaper's chief economic columnist, Martin Wolf, the excellent summary of gold and silver market manipulation just written by gold researcher Ronan Manly.

Read More »

Read More »

Monetary Metals Don’t Need a “Gold Standard” Proxy System

President Trump moved recently to nominate an avowed sound money advocate, Judy Shelton, to the Federal Reserve Board. That triggered a flurry of superficial and derisive references in the controlled media to Shelton’s past support of a gold standard.

Read More »

Read More »

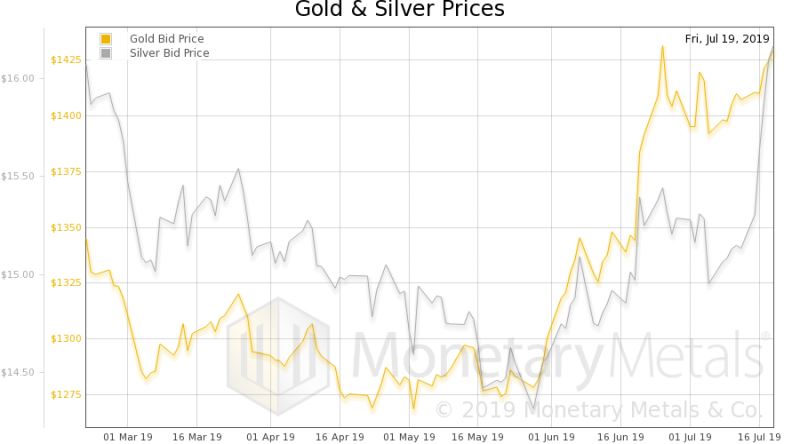

Sprott Money News Weekly Wrap-up – 7.19.19

Eric Sprott discusses the renewed and surging bull market in the precious metals as well as the intriguing profit potential offered by the mining shares.

Read More »

Read More »

Dr MARC FABER ? The Stars Are Aligned For A Major Move Up In The Precious Metals

Dr MARC FABER ? The Stars Are Aligned For A Major Move Up In The Precious Metals Dr MARC FABER ? The Stars Are Aligned For A Major Move Up In The Precious Metals ——————————————————————————————————— ? Subscribe To My Chanel: FINANCIAL TIMES...

Read More »

Read More »

Sprott Money News Ask The Expert July 2019 – Danielle DiMartino Booth

Danielle DiMartino Booth is a former advisor to The Federal Reserve Bank of Dallas. In this episode of “Ask The Expert”, she answers questions about the U.S. dollar, the U.S. economy and the recent shift in Federal Reserve policy.

Read More »

Read More »