Category Archive: 6a) Gold & Monetary Metals

Craig Hemke: Ignore the Elliott Wave “Buffoons” Calling for a Gold Crash

Interview Starts at: 6:00 Check out the full transcript here: https://www.moneymetals.com/podcasts/2019/10/04/bank-liquidity-crunch-continues-to-raise-concerns-001879 ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤ https://instagram.com/moneymetals/...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.4.19

Eric Sprott discusses the recent economic news and the impact on gold and silver prices as Q4 begins.

Read More »

Read More »

Sprott Money News Ask The Expert September 2019 – Jim Rickards Part Two

In this episode, Jim answers question eight more questions regarding the physical precious metals and U.S. dollar.

Read More »

Read More »

Focus On Gold’s Safe Haven Value, Not Gold $16,000 and Silver $700 Prices !

◆ Important to focus on safe haven value of gold and not the coming record high prices

◆"Nobody has a crystal ball and you should not be buying these assets based on anybody's price predictions"

◆ "The possibility of gold over $16,000 per ounce and silver over $700 per ounce ... I hear people gasp in dismay when I say those figures and I will qualify them"

◆ "You would wonder if the criminal enterprises are continuing?...

Read More »

Read More »

Focus On Gold’s Safe Haven Value, Not Gold $16,000 and Silver $700 Prices !

◆ Important to focus on safe haven value of gold and not the coming record high prices ◆”Nobody has a crystal ball and you should not be buying these assets based on anybody’s price predictions” ◆ “The possibility of gold over $16,000 per ounce and silver over $700 per ounce … I hear people gasp …

Read More »

Read More »

World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

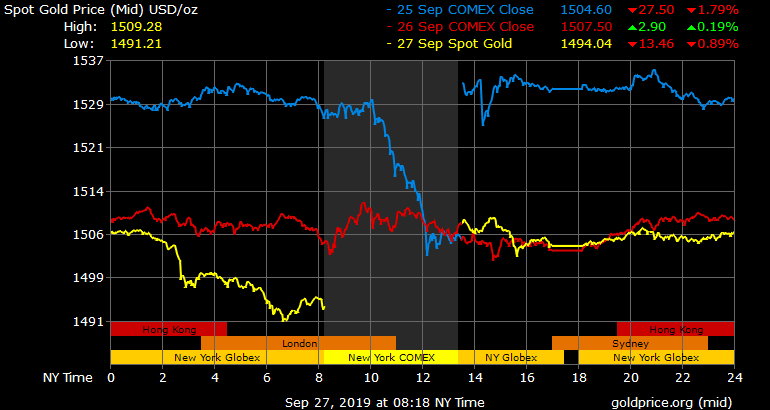

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters. ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed.

Read More »

Read More »

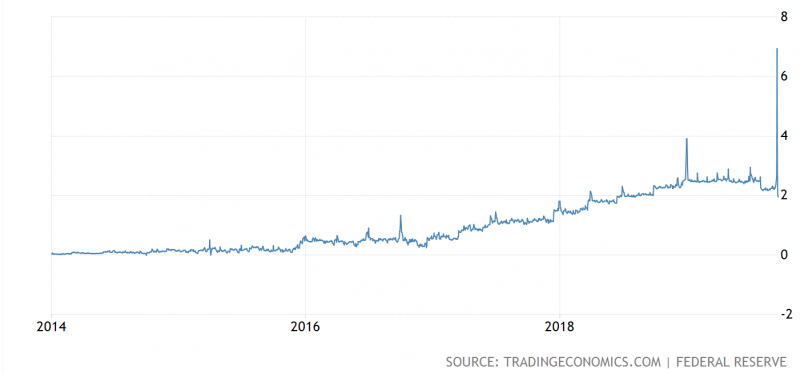

Michael Pento: Scary Warning Signs in Cash Funding Markets

Interview starts at 7:54 Read the full transcript here ➡️➡️https://www.moneymetals.com/podcasts/2019/09/27/what-happens-to-gold-when-interest-rates-go-up-001873 Check out live gold prices ?: https://www.moneymetals.com/precious-metals-charts/gold-price ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 9.27.19

Eric Sprott discusses the impact that quarter end and options expiration is having on the gold price but looks forward to higher prices in the weeks ahead.

Read More »

Read More »

Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech. ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal.

Read More »

Read More »

Sprott Money News Ask The Expert September 2019 – Jim Rickards Part One

In this episode, Jim answers questions regarding the global reserve currency and interest rates.

Read More »

Read More »

Steve Forbes Speaks Out on Gold, Central Bankers, and the 2020 Election

Interview starts at 6:40 Read the full transcript here ➡️➡️ https://www.moneymetals.com/podcasts/2019/09/20/panicky-fed-opens-cash-spigot-001870 Live precious metal prices ⬇️⬇️ https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 9.20.19

Eric Sprott discusses the price manipulation charges in precious metals and his personal method for trading the mining shares. He also answers listener questions regarding some specific mining companies.

Read More »

Read More »

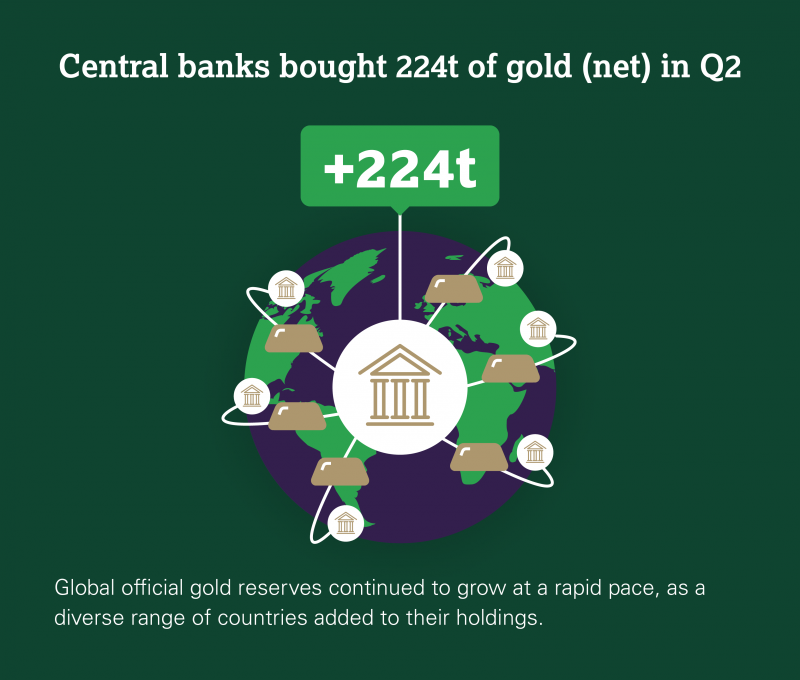

Central Bank Gold Buying Is “Sustainable and Indeed May Accelerate”

Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch. While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 9.13.19

Eric Sprott reacts to a volatile period in the precious metals and looks ahead to FOMC meeting next week. NOTE: The audio quality of the podcast is poor due to weak internet connection. The transcript for the audio will be posted on Monday. Visit sprottmoney.com for more details

Read More »

Read More »

Markets, Metals – Ross Clark. China/Hong Kong – Marc Faber. Canada Recession – Hilliard MacBeth. AMY

Air Date: Sept. 7, 2019 Ross Clark – Stock Markets, Precious Metals Guest’s website: https://chartsandmarkets.com/ Marc Faber – China, Hong Kong, Communism, Socialism Guest’s website: https://www.gloomboomdoom.com/ Hilliard MacBeth – Canada Recession, Real Estate Bust, Electric Car Owner Guest’s Twitter: https://twitter.com/hmacbe Larry Reaugh President & CEO of American Manganese Inc. on Company Showcase – American Manganese...

Read More »

Read More »

Greg Weldon: Expect a 3+ Year Up-Move in Metals as Banks Counteract Debt Deflation

Read the full transcript here ?: https://www.moneymetals.com/podcasts/2019/09/06/smarter-to-invest-in-gold-than-college-001860 Interview Begins ?: 9:18 Check Out Live Precious Metals Prices ✨: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »