Category Archive: 6a) Gold & Monetary Metals

Bill Holter: Credit Seizure Could Someday Shut Down Supply Chains

Interview begins at ➡️➡️6:20 Full transcript here: https://www.moneymetals.com/podcasts/2019/10/18/fed-qe-scheme-transfers-wealth-to-banks-001888 Check out gold & silver live prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis. Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk.

Read More »

Read More »

What Is The Dow To Gold Ratio?

https://www.moneymetals.com/precious-metals-charts/gold-price#what-is-the-dow-to-gold-ratio – The Dow:gold ratio measures how highly valued the stock market is compared to gold. The Dow:gold ratio tends to move lower during both deflationary depressions (as in the 1930s) and inflationary panics (as in the late 1970s). At the bottom of the Great Depression, Dow:gold reached a 1:1 ratio. That same 1:1 ratio …

Read More »

Read More »

100 oz Silver Bars – The Most Cost Effective Way to Purchase Silver

https://www.moneymetals.com/100-oz-silver-bars/36 – 100 oz silver bars available at Money Metals Exchange are one of the most cost effective ways of purchasing silver. There are many types of 100 oz bars, but all should be stamped with weight, purity and the name of the manufacturer. This popular form of silver has been around for decades, and …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.18.19

Eric Sprott discusses the ongoing bank liquidity crisis and the Fed’s renewed QE program. He also answers listener questions regarding the ETFs and the mining shares.

Read More »

Read More »

How Many Grams Are in an Ounce of Gold?

https://www.moneymetals.com/precious-metals-charts/gold-price#how-many-grams-are-in-an-ounce-of-gold One troy ounce of gold is equivalent to 31.1 grams. Although gold prices are most commonly quoted in ounces, gold bullion is also bought and sold by the gram. Grams can be a more convenient unit for pricing when trading gold in small quantities or using gold for everyday barter transactions. ? SUBSCRIBE TO …

Read More »

Read More »

Libra cryptocurrency soldiers on despite key departures

Facebook’s cryptocurrency payments project, Libra, has suffered a major blow with the withdrawal of seven key partners. But the Geneva-based Libra Association continues to battle on against a regulatory onslaught by adopting a charter and forming an executive team.

Read More »

Read More »

Dutch Central Bank: Gold Bars ‘Always Retain Their Value, Crisis Or No Crisis’

◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis”

Read More »

Read More »

What Was the Highest Price of Gold Per Ounce Ever?

https://www.moneymetals.com/precious-metals-charts/gold-price#when-did-gold-prices-peak-what-was-the-all-time-high-for-gold Gold prices hit an all-time high of $1,900/oz. in August 2011. However, that nominal high wasn’t actually a new high in real terms. The January 1980 peak of $850/oz still hasn’t been surpassed when adjusted for inflation. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Why Does the Gold Price Fluctuate?

https://www.moneymetals.com/precious-metals-charts/gold-price#why-does-the-gold-price-fluctuate – Excessive money printing tends to drive gold prices up, as there are more currency units chasing basically the same number of gold ounces. On the other hand, the price of gold does not tend to perform as well as compared to other assets when governments are behaving responsibly and living within their means. …

Read More »

Read More »

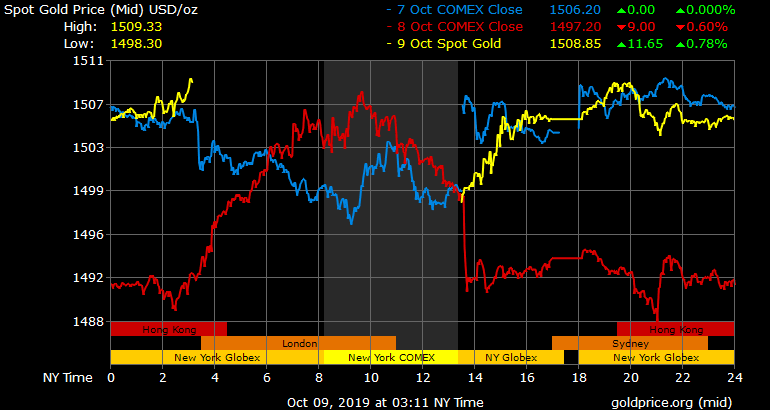

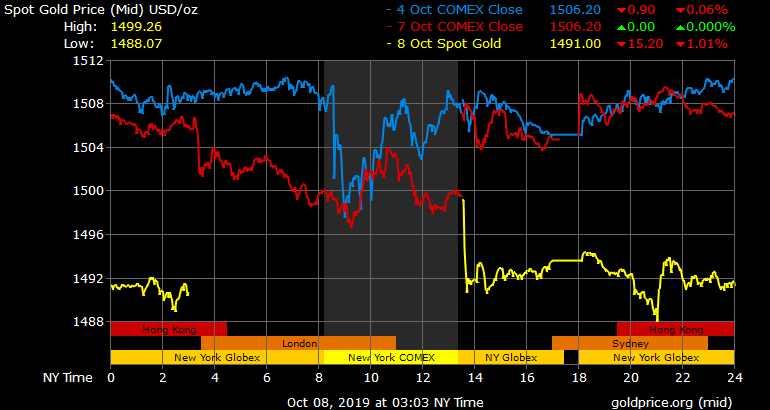

What Is The Gold Spot Price And How Is It Determined?

https://www.moneymetals.com/precious-metals-charts/gold-price#what-is-the-gold-spot-price-and-how-is-it-determined – Traders determine the spot price of gold on futures exchanges. Metals contracts change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price. ?...

Read More »

Read More »

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World

◆ GOLDNOMICS PODCAST - Episode 13 - Lucky for some !

◆ Why is nobody talking about the real risk of contagion to investors, savers & companies?

◆ "Contagion will impact stocks, bonds and deposits and both investments and savings across the spectrum"

◆ While all the focus in the UK, Ireland and the EU is on Brexit, the risk of another debt crisis looms as companies, banks, governments and the global economy grapple with massive levels...

Read More »

Read More »

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World

◆ GOLDNOMICS PODCAST – Episode 13 – Lucky for some ! ◆ Why is nobody talking about the real risk of contagion to investors, savers & companies? ◆ “Contagion will impact stocks, bonds and deposits and both investments and savings across the spectrum” ◆ While all the focus in the UK, Ireland and the EU …

Read More »

Read More »

David Smith: Consider Precious Metals for Insurance First, Profit Second…

Interview Starts at ⏰: 6:44 Read the full transcript here ?? https://www.moneymetals.com/podcasts/2019/10/11/chairman-powell-insists-fed-stimulus-not-qe-001884 Check out live gold bullion prices ?: https://www.moneymetals.com/precious-metals-charts/gold-price ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.11.19

Eric Sprott discusses the latest economic news and answers listener questions regarding the precious metals mining sector. Send your questions to [email protected] or visit www.sprottmoney.com for more details.

Read More »

Read More »

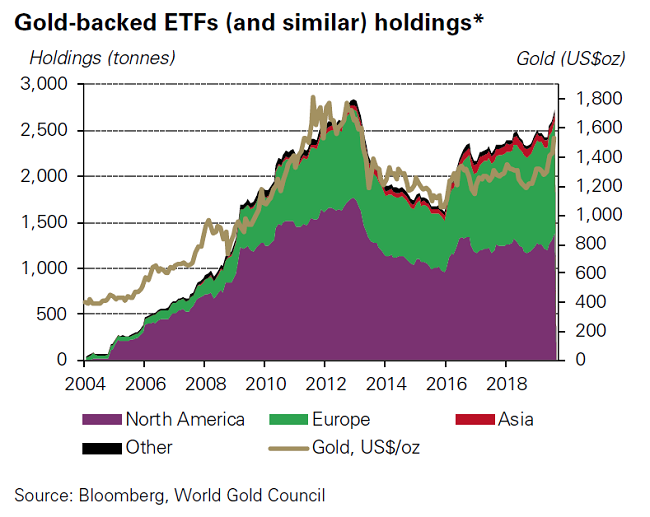

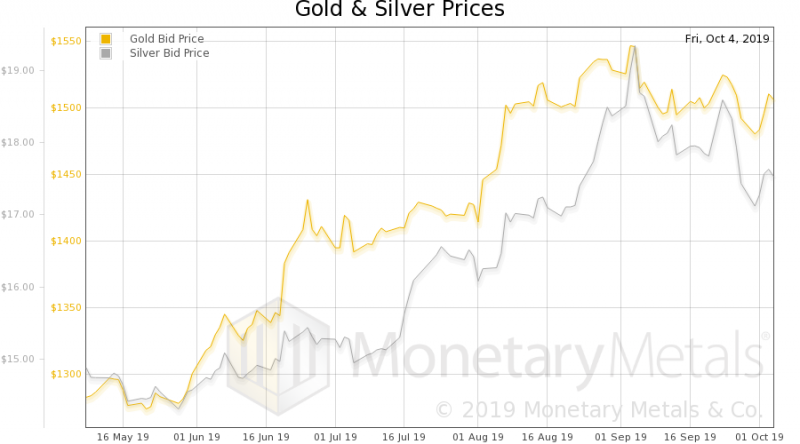

Gold ETFs See Holdings Reach All Time Record Highs In September

◆ Global gold ETF holdings reach all time record highs, increasing by 13.4% so far in 2019 on hedging and safe haven demand. ◆ Global gold ETFs, ETCs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2 tonnes(t) to 2,808t, the highest levels of all time in September.

Read More »

Read More »

China’s Central Bank Buys 100 Tons Of Gold As Trade and Dollar Tensions With U.S. Escalate

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month. ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious...

Read More »

Read More »

Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below).

Read More »

Read More »