Category Archive: 6a) Gold & Monetary Metals

From Fake Boom to Real Bust

More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf.

Read More »

Read More »

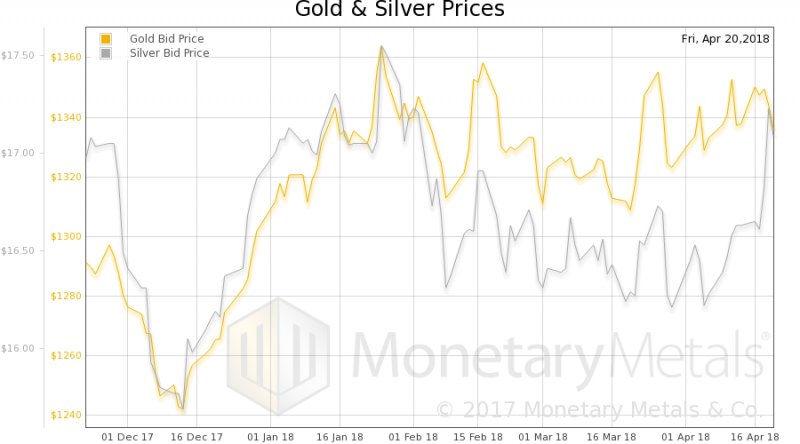

Silver Bullion Remains Good Value On Positive Supply And Demand Factors

Silver bullion remains good value on positive supply and demand factors. Industrial demand set to continue to climb from 2017, into 2018 and beyond. Speculators are bearish on silver as net short positions in silver futures reach record. Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs. 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz. Global silver mine production fell 4% last year,...

Read More »

Read More »

Hair Club For Traders S01E01

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/

Monday morning run down of the recent trending phase in equities. We'll also go through some basic statistical stats in the context of recent price action.

If you want to pull your own stats for any Yahoo Finance symbol then...

Read More »

Read More »

New All Time Record Highs For Gold In 2019

New all time record highs for gold in 2019. ‘Powerful bull market’ will likely send gold to $5,000 to $10,000. If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’. Traditional portfolio of stocks and bonds will not protect investors. “Gold will replace bonds as the go-to hedge”.

Read More »

Read More »

Hair Club For Traders S01E01

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Monday morning run down of the recent trending phase in equities. We’ll also go through some basic statistical stats in the context of recent price action. …

Read More »

Read More »

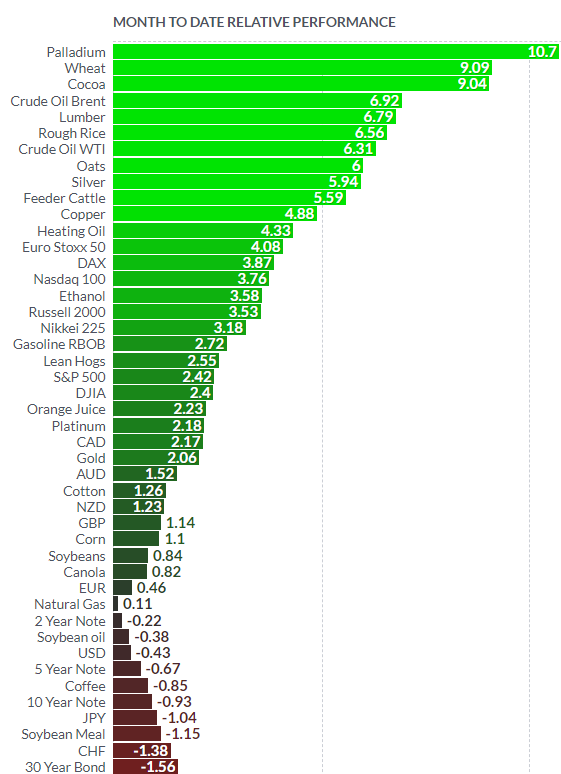

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »

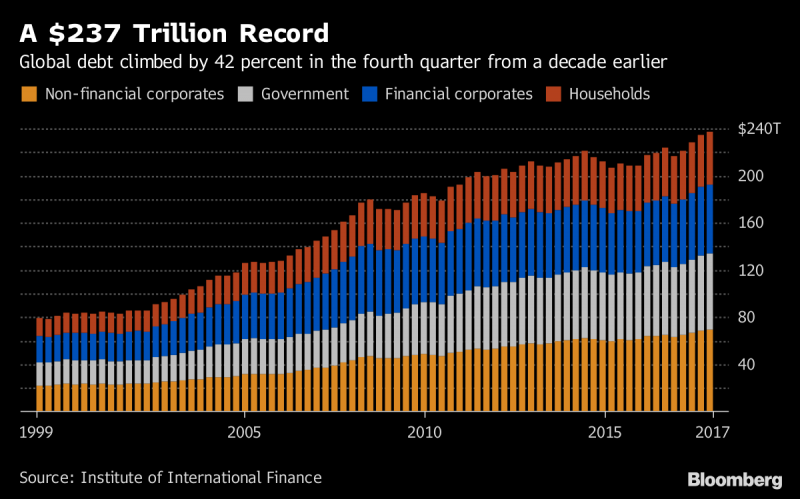

Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Global debt bubble hits new all time high – over $237 trillion. Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD. Increase in debt equivalent to United States’ ballooning national debt. Global debt up $50 trillion in decade & over 327% of global GDP. $750 trillion of bank derivatives means global debt over $1 quadrillion. Gold will be ‘store of value’ in coming economic contraction. Global debt is the mother of all...

Read More »

Read More »

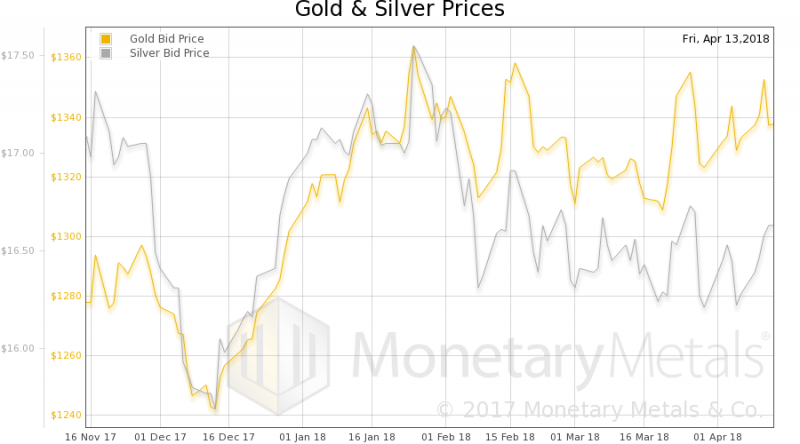

Volatile Week Sees Oil and Palladium Surge Over 8percent, Gold and Silver Marginally Higher and Stocks Gain

Gold & silver eke out small gains; palladium surges 8% and platinum 2%. Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk. U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns. Stocks rally and shrug off trade war, macro and geo-political risks. Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply. Russia-US tensions high: Trump warns attack ‘could be very soon or not so soon at all’.

Read More »

Read More »

Sprott Money News Ask The Expert – April 2018 Michael Kosowan

Michael Kosowan is the CEO of Torq Resources. In this interview, he fields Sprott Money customer questions regarding gold, the Canadian dollar and the mining sector.

Read More »

Read More »

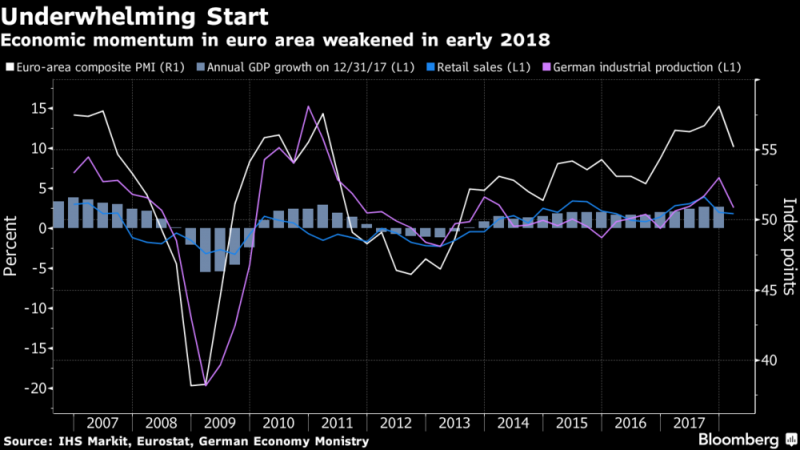

EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East. – Middle East war involving Russia may badly impact energy dependent & fragile EU. – Trade and actual wars on European doorstep show the strategic weakness of the EU. – Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations.

Read More »

Read More »

Silent Circle founder joins metals-backed crypto coin project

Renowned cryptographer Philip Zimmermann, who moved his smartphone encryption firm Silent Circle to Switzerland four years ago, has signed up to the metals-backed crypto Tiberius Coin venture as chief science and security officer. Zimmermann, who was inducted into the Internet Hall of Fame by the Internet Society in 2012, came to Switzerland to further develop his anti-snooping Blackphone away from invasive surveillance techniques in his native...

Read More »

Read More »

Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

Dow set to drop 300 points at open after Trump tweet today. Stocks see sell off and gold pops to test resistance at $1,350/oz. US stock futures suggest over 1% losses at New York open. Oil surged to a two-week high and has surged nearly 7% this week. U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East.

Read More »

Read More »

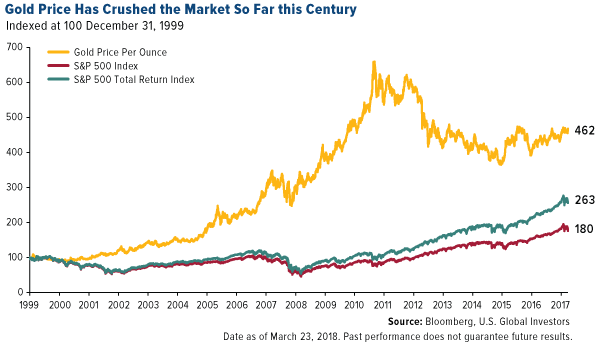

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets.

Read More »

Read More »