Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 6.12.20

Eric Sprott discusses the week that was in the precious metals and shares his thoughts on a few companies in the mining sector.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 6.12.20

Eric Sprott discusses the week that was in the precious metals and shares his thoughts on a few companies in the mining sector. Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Why Gold Is Safe Haven Money And Will Go Over $3,000/oz

That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the point?”

Read More »

Read More »

Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek

Read More »

Read More »

Economist Marc Faber on Hong Kong’s future, interviewed on June 1, 2020

I’m Chris Oliver, a journalist in Hong Kong. I spoke with economist Dr. Marc Faber, aka “Dr. Doom”, the editor and publisher of “The Gloom, Boom & Doom Report” about his views on the outlook for the Hong Kong economy, global markets, and personal investing following the announcement that China’s central government has passed national …

Read More »

Read More »

Michael Pento: “Central Banks Have Jumped the Shark,” May Even Buy Stocks

Full Transcript: https://www.moneymetals.com/podcasts/2020/06/05/fed-buying-stocks-too-002049

Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Michael Pento: “Central Banks Have Jumped the Shark,” May Even Buy Stocks

Full Transcript: https://www.moneymetals.com/podcasts/2020/06/05/fed-buying-stocks-too-002049 Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤ https://instagram.com/moneymetals/...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 6.5.20

Eric Sprott discusses events that impacted the prices of gold and silver over the course of the past week.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 6.5.20

Eric Sprott discusses events that impacted the prices of gold and silver over the course of the past week.

Read More »

Read More »

Global Silver Investment Demand To Surge While Supply Weak (World Silver Survey 2020)

◆ WORLD SILVER SURVEY 2020 from the SILVER INSTITUTE GLOBAL SILVER DEMAND EDGED HIGHER IN 2019, WITH INVESTMENT DEMAND UP 12%, WHILE SILVER MINE SUPPLY FELL FOR THE FOURTH CONSECUTIVE YEAR Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal.

Read More »

Read More »

In gesprek met Marc Faber

Marc Faber is een Zwitserse belegger en de uitgever van het Gloom Boom & Doom Report. Het leverde hem de bijnaam ‘Dr. Doom’ op. In 2010 was hij mijn gast op een bijeenkomst van RBS in RAI te Amsterdam, waar 2.000 beleggers op af kwamen. Tien jaar later sprak ik hem weer, deze keer via … Continue reading »

Read More »

Read More »

Alasdair Macleod-The Path to Monetary Collapse

Alasdair Macleod explains why John Laws Mississippi Bubble shows the path to dollar destruction perhaps by the end of 2020.

Read More »

Read More »

Silver Price Analysis June 2020 – Silver Acceleration | Uranium Market, Marc Faber Is Silver $15

Full Document transcript go to:https://www.financialanalysis.tv Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Skype: akira10k Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Marc Faber: 5 vor Weimar

Notenbanken drucken Billionen. Staaten dirigieren Wirtschaft. Wie groß ist die Wahrscheinlichkeit einer Hyperinflation in den nächsten Jahren? Michael Mross mit Börsenlegende Marc Faber. Zum Faber Report: https://www.gloomboomdoom.com

Read More »

Read More »

Thomas Mayer: Darum sind Merkel und die EZB brandgefährlich für dein Geld // Mission Money

Die Schuldenbombe tickt, der Euro wackelt und die Kanzlerin überschreitet den Rubikon: Thomas Mayer erklärt, warum die Transfer-Union immer gefährlicher wird und unsere Währung bald fallen könnte. Der ehemalige Chefvolkswirt der Deutschen Bank ist heute für Flossbach von Storch tätig und erklärt im Video, warum er langfristig mit stärkerer Inflation rechnet. Wir reden auch darüber, wer die Schuldenberge bezahlen soll und wie gefährlich die...

Read More »

Read More »

Alasdair Macleod: The Path to Monetary Collapse!

Alasdair Macleod is the head of Research for GoldMoney and a sound money educator working to demystify finance and economics. You can find him at: https://twitter.com/MacleodFinance

?FREE e-Book: https://www.philipkennedy.com/

?Support: https://www.philipkennedy.com/support.html

?Coaching: https://www.philipkennedy.com/live-events.html

☕️KF Store: https://teespring.com/stores/kennedy-financial

AFFILIATE PROGRAMS:

Cash App:...

Read More »

Read More »

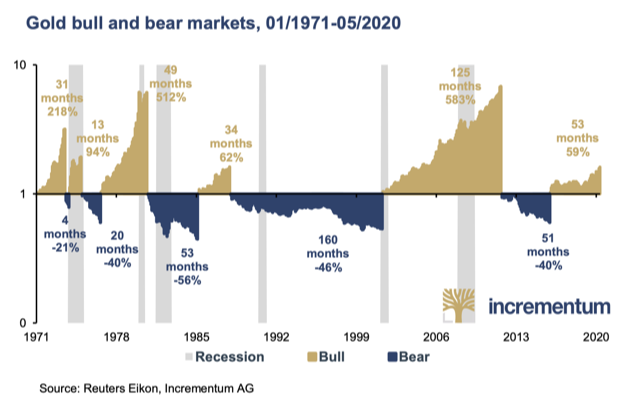

Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG.Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report.

Read More »

Read More »

Is Your Pension ‘Good as Gold’?

With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver.It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered a ‘pride in possession’ article or...

Read More »

Read More »

Gerald Celente Unloads: “We Got Sick Bastards DESTROYING Our Lives and There’s Hardly Any Protests…”

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/mone...

SOUNDCLOUD ➤ https://soundcloud.com/moneymetals

TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »