Category Archive: 6a) Gold & Monetary Metals

MARC FABER : MARKET CURRENT LEVEL से 10 % और CORRECTION हो सकता है !

NIFTY TRADING STRATEGY ,NIFTY OPTIONS TRADING STRATEGIES ,BANK NIFTY TRADING STRATEGIES ,BANK NIFTY OPTION TRADING STRATEGY ,Stock Trading Tips, Stock Trading Strategies, Share Trading Tips, Share Trading Strategies , Intraday Trading Strategies , Intraday Trading Tips , MULTIBAGGER STOCKS 2018, POSITIONAL TRADING STRATEGY,

Read More »

Read More »

Zee Exclusive conversation with famous Swiss investor Marc Faber

Watch this segment to know what famous Swiss investor Marc Faber has to say about India and its economy. In an exclusive interview to Zee Business today, famous Swiss investor Marc Faber said that the Sensex can still fall over 20 per cent, slipping below the 30,000 mark. About Zee Business ————————– Zee Business is …

Read More »

Read More »

Das Scheitern der Crash-Propheten (Dirk Müller, Max Otte, Marc Faber und Co.)

Im Video zeige ich dir chronologisch die Crash-Prognosen, warum es zu diesen Prognosen kommt, warum diese zum Scheitern verurteilt sind (3 Gründe) und dass diese kein alleiniges Phänomen der Gegenwart sind. Blog-Artikel zum Nachlesen (inkl. Quellen): https://aktienrebell.de/boersencrash-propheten/ ? DIE REBELL-METHODE: Lade dir den PDF-Ratgeber “Die Rebell-Methode: 6 zeitlose Erfolgsgrundsätzen für kluge Anleger” gratis herunter:...

Read More »

Read More »

Marc Faber To ET Now | Exclusive

Watch Latest Business News & Updates ►https://bit.ly/2pG5L9S Dr. Doom Marc Faber on #TradeWars, impact on EMs, Indian equities and more Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ibPb The NewsHour Debate : http://goo.gl/LfNgFF To Stay Updated Download the …

Read More »

Read More »

Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5%

– Bolton scares jittery markets already shell-shocked by US’ tariffs against China

– Currency wars and trade wars tend to proceed actual wars

– Gold now...

Read More »

Read More »

Gold +1.8 percent, Silver +2.5 percent As Fed Increases Rates And Trade War Looms

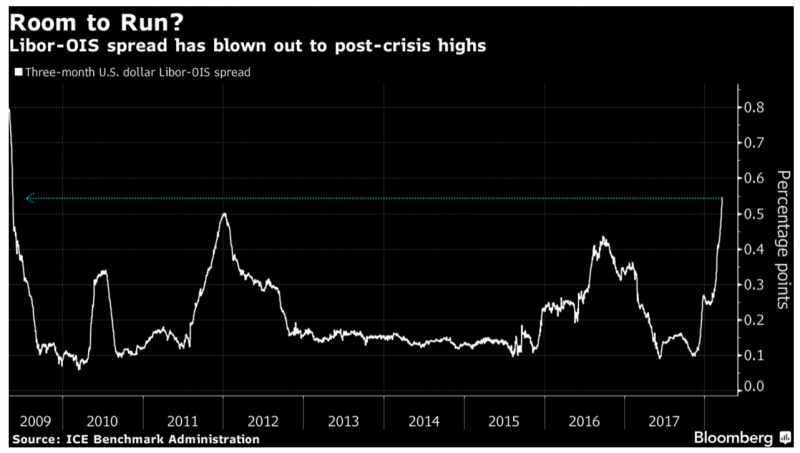

Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday. Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range. Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018. Markets disappointed at lack of hawkish comments from new Fed Chair. Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR.

Read More »

Read More »

Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

Key Metric LIBOR OIS Signals Major Credit Concerns. Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns. Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. Libor recently moved to over 2% for first time since 2008. Wider spread usually associated with heightened credit concerns.

Read More »

Read More »

Sprott Money News Ask The Expert March 2018 – Ronald-Peter Stöferle

Ronald-Peter Stöferle is a managing partner at Incrementum AG in Liechtenstein and the author of the annual report, “In Gold We Trust”.

Read More »

Read More »

Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

$8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies. Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher. Massive government and consumer debt eroding benefits of wage growth (see chart).

Read More »

Read More »

Buy Silver And Sell Gold Now

Buy silver and sell gold now – Frisby. Gold should cost 15 times as much as silver. Silver might have disappointed in short term – But it’s time to buy. Editor’s note: Silver has outperformed stocks, bonds and gold over long term (see table).

Read More »

Read More »

Gold Cup At Cheltenham – Gold Is For Winners, Not For the Gamblers

Gold Cup at Cheltenham – ‘The Olympics’ of the European horse racing calendar. Gold Cup trophy contains 10 troy ounces of gold – worth £9,000. £620 million bets on horses, 230,000 pints of Guinness will be drunk, 9.2 tonnes of potato eaten. Since the 5th century BC, gold has been the ultimate prize to award champions and gold has been constantly and universally awarded as top prize.

Read More »

Read More »

278: Marc Faber: The Billionaire They Call Dr. Doom

My guest in this interview is Dr Marc Faber. Dr. Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics magna cum laude. Between 1970 and … Continue reading...

Read More »

Read More »

BOOM: Wyoming Ends ALL TAXATION of Gold & Silver

Cheyenne, Wyoming (March 14, 2018) – Sound money activists rejoiced as the Wyoming Legal Tender Act became law today. The bill restores constitutional, sound money in Wyoming. Backed by the Sound Money Defense League, Campaign for Liberty, Money Metals Exchange, and in-state grassroots activists, HB 103 removes all forms of state taxation on gold and silver coins and bullion and reaffirms their status as money in Wyoming, in keeping with Article 1,...

Read More »

Read More »

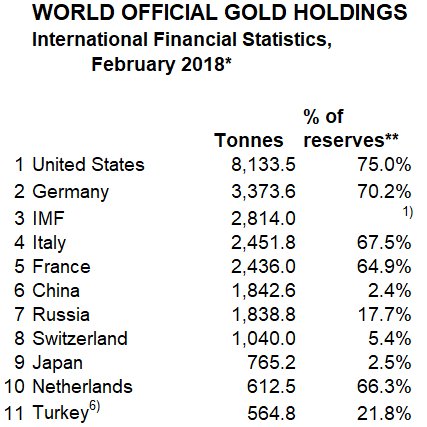

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony. Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England. Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil. Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes. Central bank gold purchases continue to be major drivers of gold market.

Read More »

Read More »

TheTalk@TheStudio – Marc Faber

Abonnieren Sie unseren Channel: http://bit.ly/1Tn4aOQ Für weitere Informationen: https://www.helvetia.ch Facebook: https://facebook.com/helvetia.versicherungen.schweiz Twitter: https://twitter.com/helvetia Google+: https://plus.google.com/+helvetiaschweiz Video der Helvetia Versicherungen Schweiz: TheTalk@TheStudio – Marc Faber. Weitere Videos finden Sie auf unseren Channels: YouTube: https://youtube.com/helvetiaschweiz Vimeo:...

Read More »

Read More »

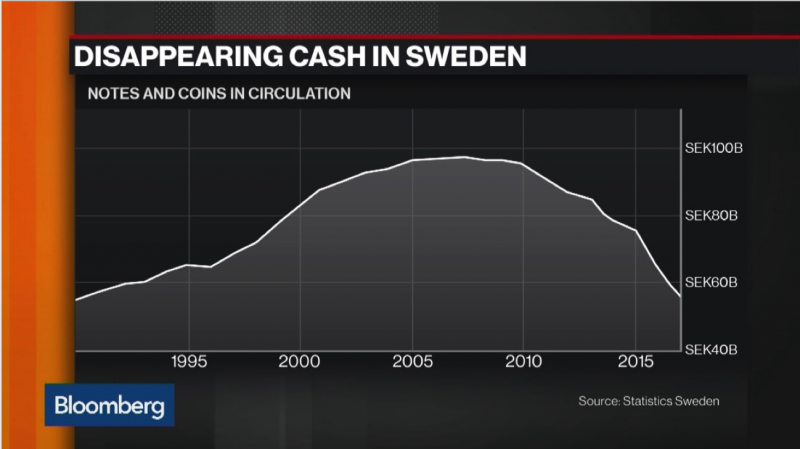

Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable. Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’. Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash. Cash usage in Sweden falling both as share of GDP and in nominal terms. Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona. Cashless is not a disincentive for illegal drug...

Read More »

Read More »

Gerald Celente Exclusive: “If rates go up too high, the economy goes down, end of story”

Read the full transcript here: https://goo.gl/f51wud Gerald Celente, world-renowned trends forecaster and publisher of the Trends Journal, parses through all of the major new stories these days and tells us which one is the most important storyline that will affect the stock markets, the economy, and gold. Don’t miss our explosive conversation with Gerald Celente, …

Read More »

Read More »

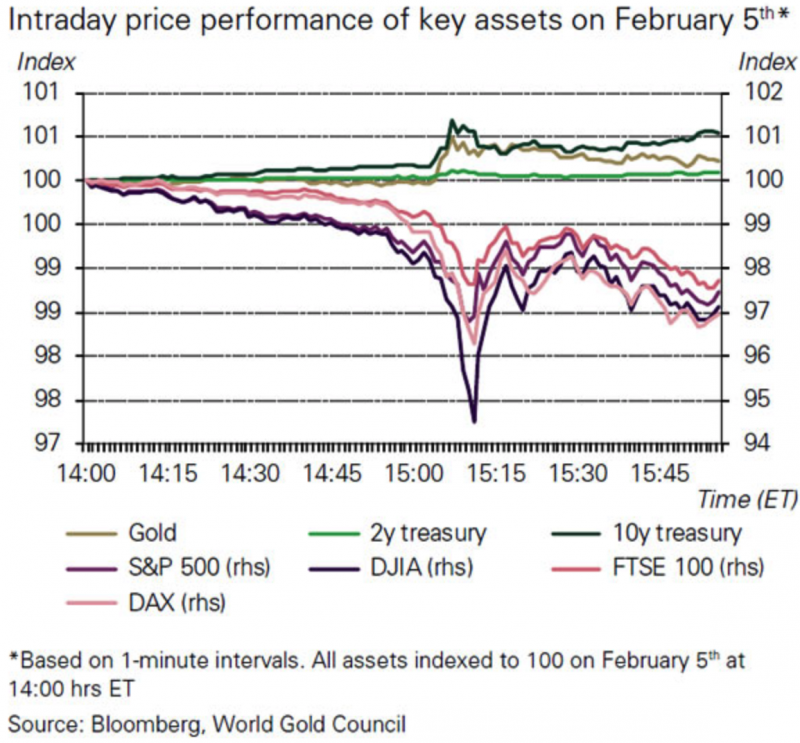

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold...

Read More »

Read More »