Category Archive: 6a) Gold & Monetary Metals

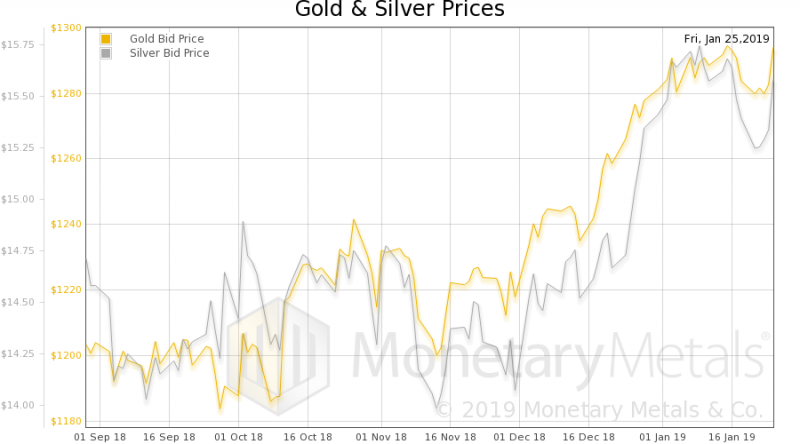

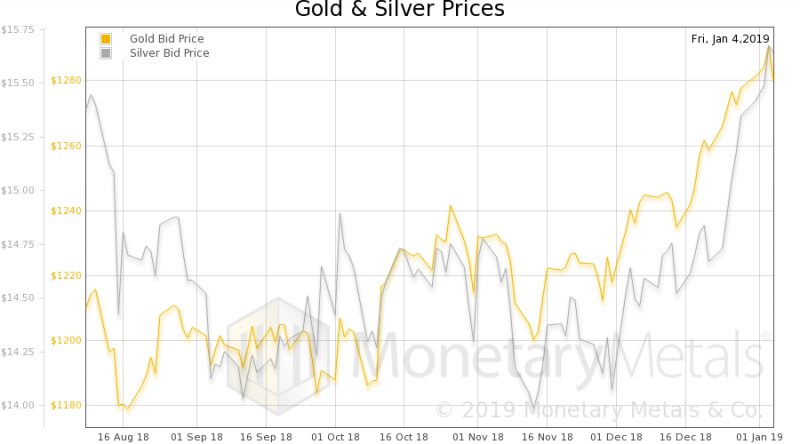

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.25.19

Eric Sprott discusses factors that are currently influencing the precious metals markets and looks ahead to an interesting year for the mining shares.

Read More »

Read More »

Brexit – The Pin That Bursts London Property Bubble

Brexit – The Pin That Bursts London Property Bubble – Investors need a ‘Plan B’ to protect against Brexit, currency and many other risks – Brexit uncertainty is impacting Irish and UK consumers, companies and economy – London home asking prices slump and drop below £600,000: Lowest since 2015 but still very over valued – …

Read More »

Read More »

Xapo shifting services from Hong Kong to Switzerland

Bitcoin services provider Xapo is winding down activities at its Hong Kong base and transferring key operations to Switzerland. Xapo president Ted Rogers said the move has been driven by Switzerland’s friendlier regulatory environment. “It was once thought that Hong Kong was the holy grail of crypto regulations,” Rogers told swissinfo.ch at the World Web Forum in Zurich. “But it has become more opaque.”

Read More »

Read More »

David Morgan: Gold & Silver Outlook for 2019

Read the full transcript here: https://goo.gl/6FdXyy Check live silver prices here: https://goo.gl/nKBsLZ Interview starts: 5:58 Coming up our good friend David Morgan of The Morgan Report joins me for a conversation on a range of topics, including his 2019 outlook for a number of different asset classes, most notably gold and silver. Don’t miss a …

Read More »

Read More »

Marc Faber: Default and/or Hyperinflation within 10 years?

An excerpt from a longer discussion with Dr. Marc Faber, on what he sees for the world economy over the next 10 years. Full Conversation: https://youtu.be/Vme4_V_7K_o More from John: TWITTER: https://twitter.com/johnkvallis INSTAGRAM: https://www.instagram.com/johnkvallis/ STEEMIT: https://steemit.com/@johnkvallis/ FACEBOOK: https://www.facebook.com/johnkvallis MEDIUM: https://medium.com/@johnkvallis

Read More »

Read More »

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

Sprott Money News 1 18 19

Eric Sprott discusses the start of the year for gold and silver and looks ahead to what should be a very interesting 2019.

Read More »

Read More »

Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit. – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote. – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies.

Read More »

Read More »

Palladium Price: David Jensen Explains the Recent Fireworks in Palladium Why It Matters

Coming up we’ll hear one of the more important interviews we’ve ever done on the broken nature of the precious metals’ futures exchanges, and what might be the driving force that ultimately destroys the confidence in these markets, paving the way to true price discovery. Mining analyst and precious metals expert David Jensen joins me …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.11.19

Eric Sprott discusses the great start to 2019 for the precious metals and looks ahead to what should be a very exciting year.

Read More »

Read More »

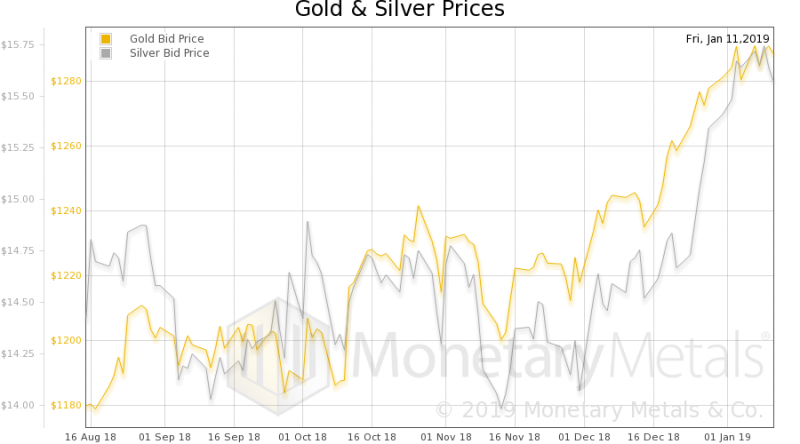

Gold and Silver Prices To Rise To $1,650 and $30 By 2020

Gold To Outperform Stocks Again In 2019 As Has Done In Last 15 Years – Gold to outperform stocks again in 2019 as seen in 2018 and last 15 years – Gold and silver likely to reach highs over $1,650 and $28 per ounce – Gold likely to see 15% to 20% gains and silver … Continue reading »

Read More »

Read More »

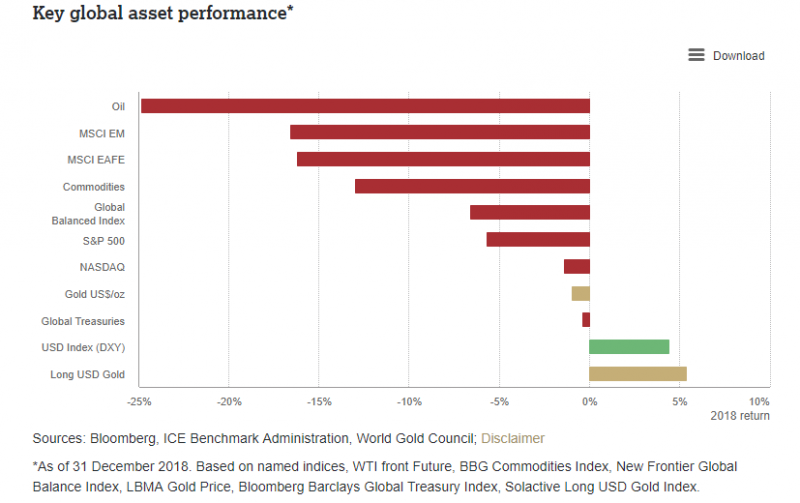

Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability, monetary policy and the US dollar, structural economic reforms.

Read More »

Read More »

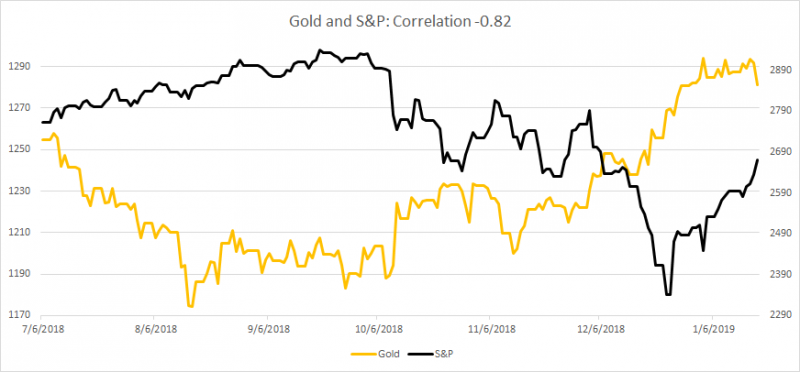

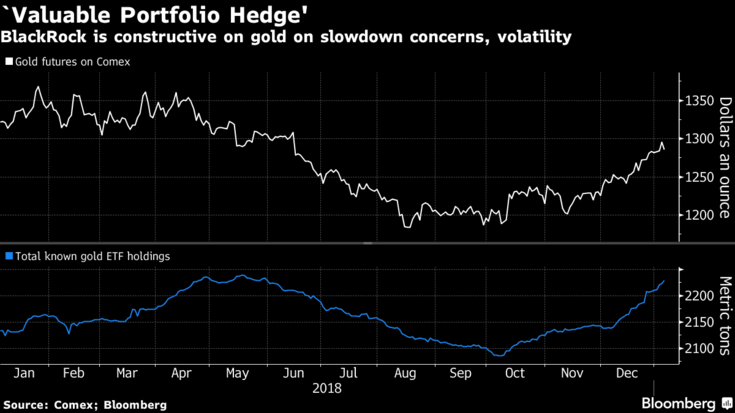

Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager. Global Allocation Fund adding to gold exposure through ETFs. Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising”. Gold bullion has been a “store of value for a very long time”.

Read More »

Read More »

China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

China increases gold holdings by large 320,000 ounces. Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion. China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces. Gold climbed 5% in December on equity rout, growth concerns

Read More »

Read More »