Category Archive: 6a.) Monetary Metals

Monetary Metals Completes Gold Lease to European Refiner L’Orfebre

Scottsdale, Ariz – January 11, 2022 – Monetary Metals has leased gold to L’Orfebre, a European precious metals refiner. The lease expands Monetary Metals’ gold and silver lease portfolio to include five industry verticals: bullion, jewelry, manufacturers, miners, and now refiners, on four continents.

Read More »

Read More »

Reflections Over 2021

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices.

At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments....

Read More »

Read More »

Gold Under the Mattress vs Gold Investments

“If you can’t hold it in your hand, you don’t own it.”

That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake.

This popular phrase conflates and entangles two different concepts.

Read More »

Read More »

The Zombie Ship of Theseus

The Ship of Theseus is an old philosophical thought experiment. It asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system.

Read More »

Read More »

Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.”

Read More »

Read More »

Episode 25: The Origins and Machinations of the Federal Reserve

This week’s episode of the Gold Exchange Podcast explores the topic of Central Banks, most notably the US Federal Reserve. Monetary Metals’ CEO Keith Weiner explores why the Fed was created and what deleterious effects it has on our economy including inflation, boom bust cycles and monetary debasement in this recorded talk given to investment bankers.

In this talk Keith discusses:

Additional Resources

Episode Transcript

John Flaherty:Hello,...

Read More »

Read More »

Mickey Fulp Interview: Investing in Interest-Bearing Gold Bonds

Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals’ CEO Keith Weiner to discuss the maturity of Monetary Metals’ recent gold bond. Gold bonds are denominated in gold, with principal and interest payable in gold.

Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933.

Read More »

Read More »

What’s In Your Loan?

“Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

Read More »

Read More »

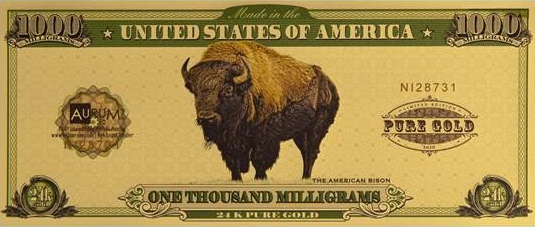

Monetary Metals Proves Marketplace for Gold Yield with Valaurum Gold Lease

Scottsdale, Ariz – November 16, 2021 – Monetary Metals is pleased to announce a new gold lease to Valaurum to expand production of the Aurum®, their physical gold currency product. The lease size has grown by 800%.

Read More »

Read More »

Perversity Thy Name is Dollar

Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »

Read More »

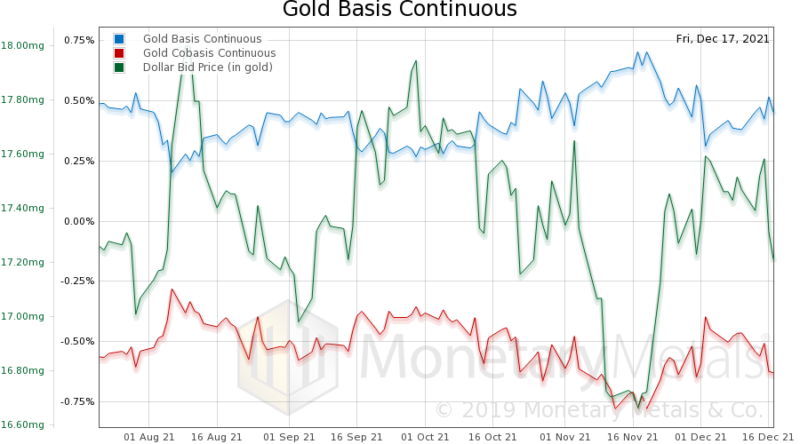

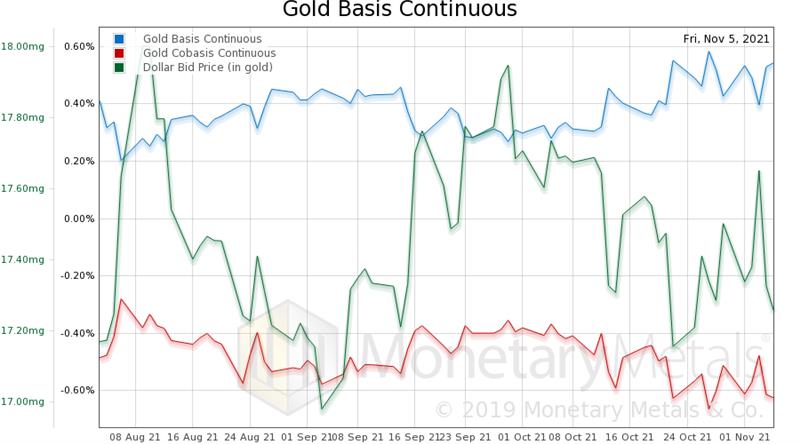

Rising Fundamentals of Gold and Silver

Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move.

Read More »

Read More »

Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold.

Read More »

Read More »

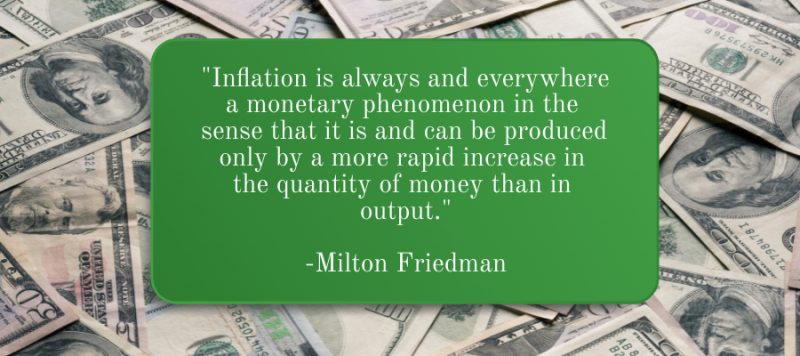

Why Isn’t Gold Going Up with Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”.

Read More »

Read More »

Can Interest on Gold Outpace Inflation?

Yield. It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be. A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%.

Read More »

Read More »

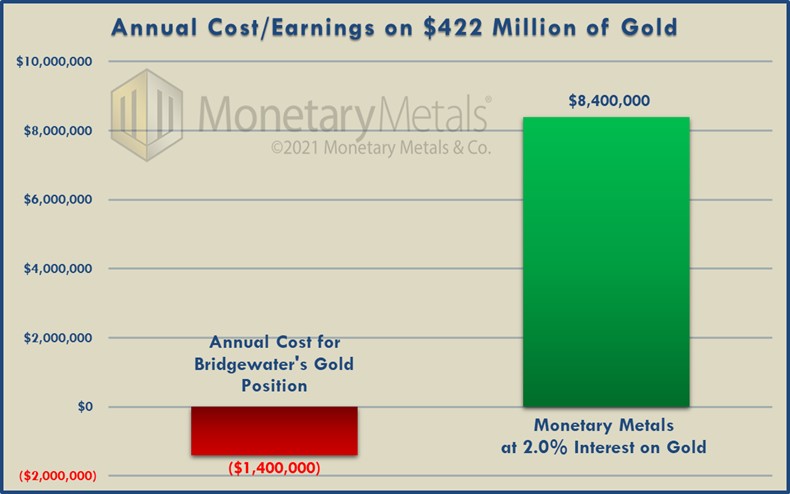

How to Invest in Gold Better than Ray Dalio

Ray Dalio made waves earlier this year when he acknowledged that Bridgewater bought an undisclosed amount of bitcoin. In a recent interview, however, Dalio made it clear that his love for gold is still greater.

Read More »

Read More »

Episode 24: Destructive Profit vs Productive Profit

This week’s episode of the Gold Exchange Podcast explores the idea of profits, and why it matters how you get them. Much of the financial world has confused the idea of profit with price appreciation. Or as we like to say, they confuse investment with speculation. Investment is deploying capital productively in a business for a yield. Speculation is betting one’s capital on an asset price rising.

Read More »

Read More »

Palisades Gold Radio Interview

Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not.

Read More »

Read More »

Transitory Inflation and Useless Ingredients

Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…)

Read More »

Read More »

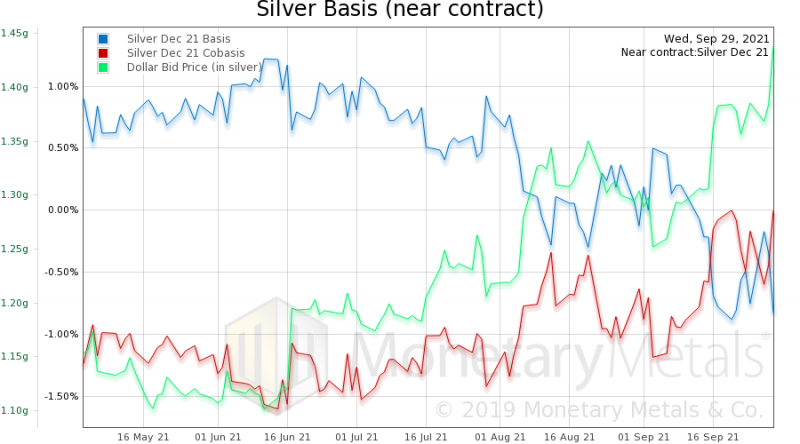

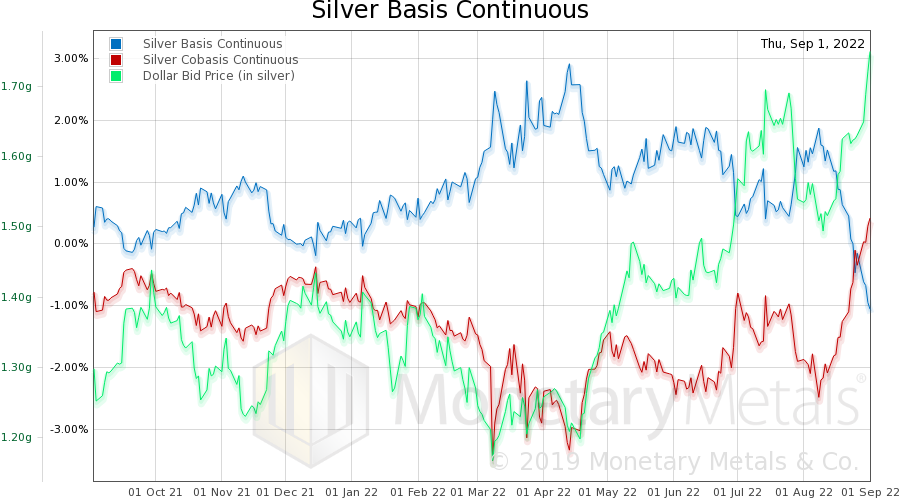

Silver Crash Makes Silver Trash?

The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.”

Read More »

Read More »

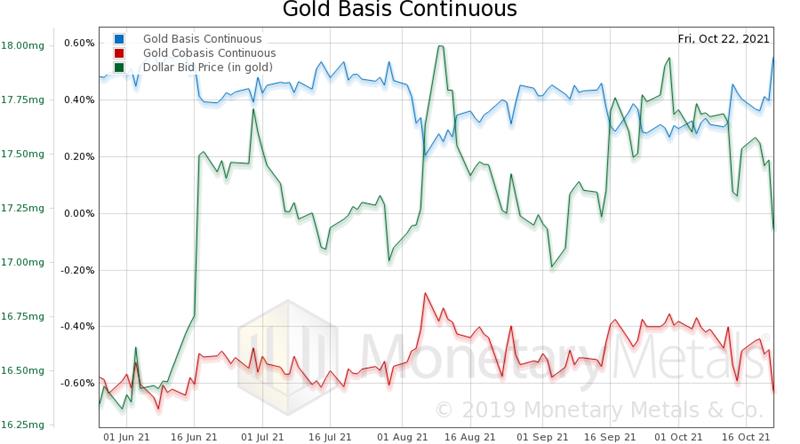

Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August:

“…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist -

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”! -

Switzerland, the country of four seas

Switzerland, the country of four seas -

The Business Cycle Narrative & War With Iran

The Business Cycle Narrative & War With Iran -

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen -

Cash für Medaillen

Cash für Medaillen -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

Achtung: Elon Musk zerstört gerade Wikipedia!

Achtung: Elon Musk zerstört gerade Wikipedia! -

1776 Patriot Silver Bars Are Selling Out

1776 Patriot Silver Bars Are Selling Out

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022