Ray Dalio made waves earlier this year when he acknowledged that Bridgewater bought an undisclosed amount of bitcoin. In a recent interview, however, Dalio made it clear that his love for gold is still greater.

“If you put a gun to my head, and you said, ‘I can only have one,’” says Dalio. “I would choose gold.” (Source of Quote)

We agree with Dalio’s decision to choose gold over bitcoin, but we think it’s high time that he explores some better ways of owning gold.

Ray Dalio’s History of Buying Gold

Dalio and Bridgewater have been noted buyers of gold over the years.

Most recently they increased their gold position in the winter of 2019 just before the pandemic hit. The price exploded as the pandemic grew.

While Bridgewater has achieved massive gains in dollars in recent years, it is still paying to own that gold via the expense ratio of its ETF holdings. When the gold price goes up, the cost to store that metal goes up as well. And this is a recurring annual cost.

Expense Ratios are a Negative Yield for Gold

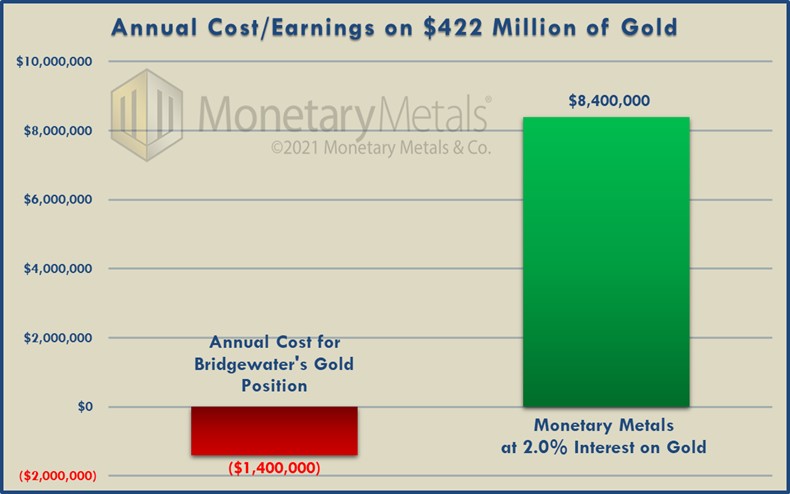

As of their latest 13F report (6/30/2021), Bridgewater owns about $422 Million of gold. About $276 million in GLD and $146 Million in IAU. GLD’s expense ratio is 0.40% and IAU’s expense ratio is 0.25%. Taken together that’s an effective rate of 0.33%. Translated into dollars, this means Bridgewater is paying about $1.4 Million per year to own this gold.

Despite the dollar gains on their position, Bridgewater owns a negative-yielding asset. If Bridgewater were to redeem their GLD shares for actual physical gold ounces today, they’d have less ounces than when they started. And their redeemable ounces will continue to dwindle going forward.

I don’t want to downplay the wisdom to buy gold. But, Dalio and the rest of the world need to know that gold doesn’t have to be a negative-yielding asset anymore! Gold is a capital asset, and capital assets should be deployed productively to earn a yield.

A Better Way to Invest in GoldInstead of investors paying to own gold, Monetary Metals has been paying investors interest on gold, in gold since 2016. You can earn interest on gold to the tune of 2.0 to 4.5% annually. Not only that–there’s zero storage and insurance fees! 2% interest might not seem like a lot, but when you start working with large numbers over time, the difference between earning 2% on your gold vs paying 0.33% is as stark as night and day In Dalio and Bridgewater’s case, this would mean that instead of losing $1.4 million annually due to gold storage fees, their $422 million gold investment could be earning them $8.4 million each year. That’s nearly a $10 million net improvement. I know these guys are billionaires, but $10 million in savings is nothing to turn your nose up at! |

|

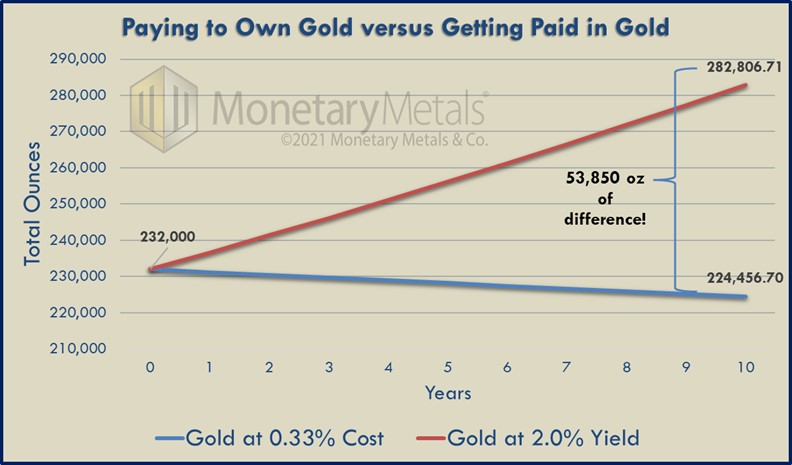

| This isn’t the full impact of course. Since both the cost to store metal, and the interest you could earn on your gold recur annually, you have to take into account the effect of compounding interest (or cost).

$422 Million in gold equals just under 232,000 ounces, assuming a gold price of $1,820. If Bridgewater were to put their gold to work at 2% per year for 10 years with Monetary Metals, they would end up with just under 283,000 oz, a gain of about 22% on their metal. Measured in dollars at the same gold price, that’s $92.5 million. If they continue paying to own their gold, they end up with about 7,543 less ounces. A loss of about 3.25%, or $13.7 million. Over a decade, the Monetary Metals’ difference is 53,850 oz or over $100 million. |

|

Dalio, Bridgewater, and you could level up your gold by treating it not just like an ordinary commodity, but as a yield-generating capital asset.

Additional Resources for Earning Interest on GoldIf you’d like to learn more about how to earn interest on gold with Monetary Metals. Here are a few great resources for you to consider: |

|

| In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

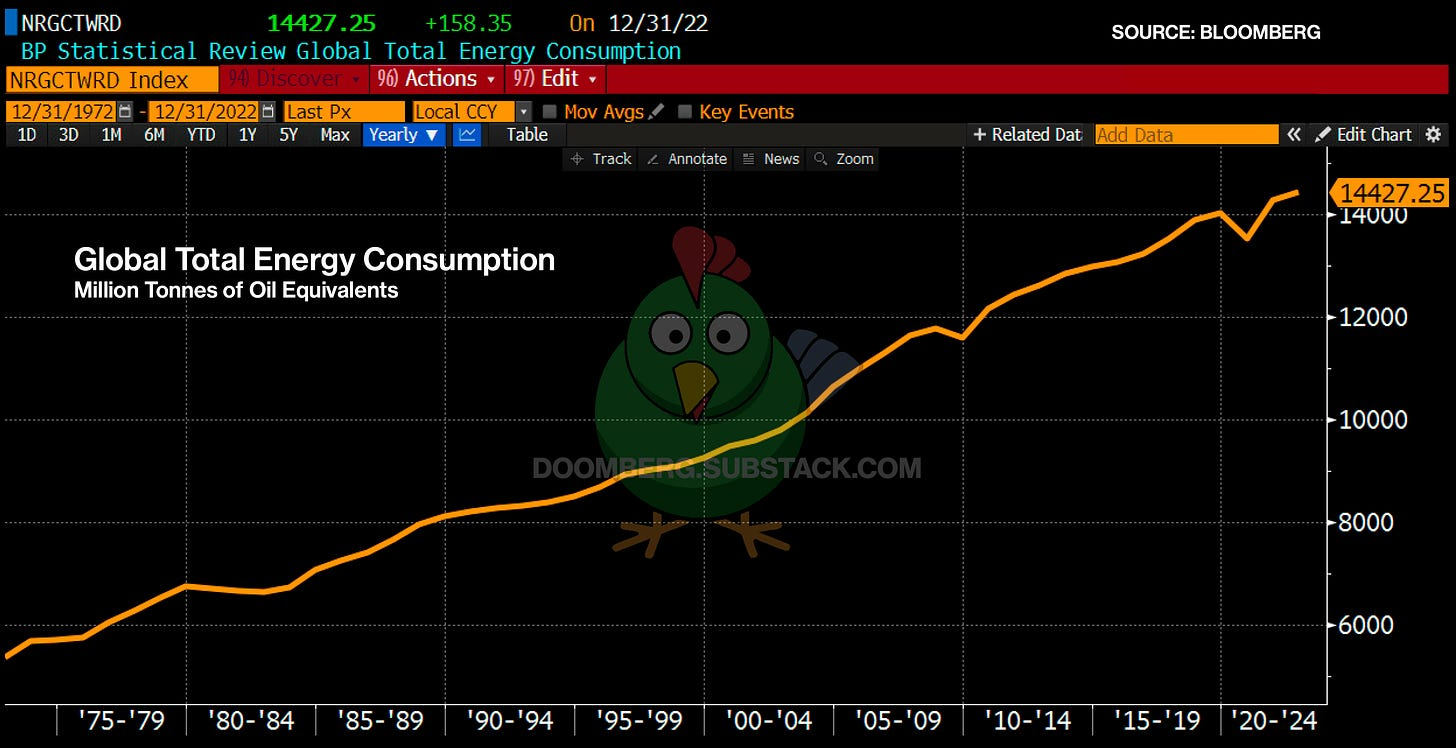

The Case for Gold Yield in Investment Portfolios Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972. |

Full story here Are you the author? Previous post See more for Next post

Tags: Blog,Featured,newsletter