Tag Archive: Blog

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money. The cash-value of promoting each of these anti-concepts is that they lead people to think that the central bank should impose a monetary policy. To make our lives better.

Read More »

Read More »

Gold Outlook 2024 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year.

Read More »

Read More »

CEO Keith Weiner Quoted in Barron’s

Published February 2nd, CEO Keith Weiner’s commentary was featured in a Barron’s article discussing “Why Silver is Outperforming Gold” written by Myra Saefong.

Read More »

Read More »

Reflections Over 2022

The life of an entrepreneur is not what most people would call “normal”. I don’t refer to the guy who buys a fast-food franchise. Nor to the gal who builds a chain of hair salons. Nor to the folks who have law or accounting firms. These are all entrepreneurship. I don’t know a lot about how these businesses work, but I do know one thing.

Read More »

Read More »

Sam Bankman-Fried FTX’ed Up

You can listen to the audio version of this article here. Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded. While the tragedy continues to play out, let’s summarize what has happened so far: FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies.

Read More »

Read More »

How to Build and Destroy a Pension Fund System in 22 Easy Steps

CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission.

Read More »

Read More »

The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh?

Read More »

Read More »

Keith Weiner on the VoiceAmerica Business Channel

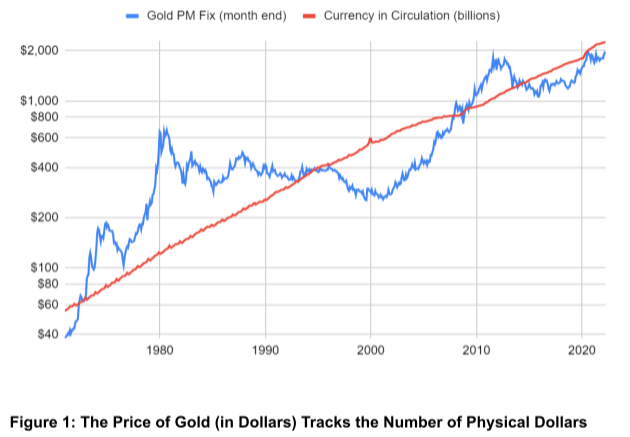

CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits.

Read More »

Read More »

The Knockout Blow to Crypto

A New Type of Fighter Bonus. The UFC has started paying fan bonuses to its fighters in Bitcoin. The UFC buys crypto at a fixed dollar amount and pays their fighters a bonus in cryptocurrency. As someone who loves the UFC and monetary economics, I wanted to offer an alternative solution to the UFC and its athletes.

Read More »

Read More »

Soho Forum Debate: Gold vs Bitcoin

The Soho Forum is a monthly debate series held in Soho/Noho, Manhattan. A project of the Reason Foundation, the series features topics of special interest to libertarians and aims to enhance social and professional ties within the NYC libertarian community.

Read More »

Read More »

Is Gold About To Go Mainstream?

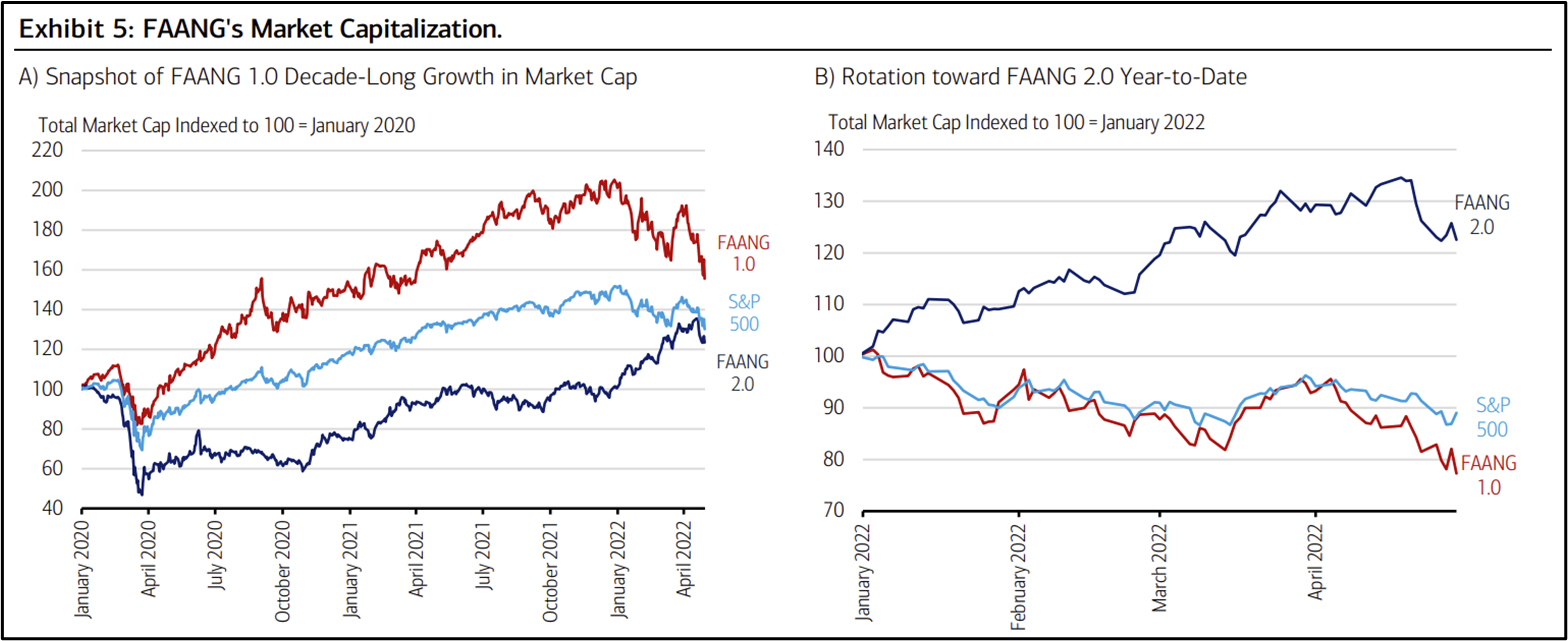

Every week Merrill Lynch publishes a Capital Market Outlook Letter. The letters provide market commentary, research and analysis, and the occasional investment idea. Merrill Lynch (together with parent Bank of America) is the third largest brokerage firm, managing over $3 Trillion in client assets[1]. When a firm of that size speaks up, you should listen.

Read More »

Read More »

CEO Keith Weiner on Real Talk with Zuby

CEO of Monetary Metals Keith Weiner was on Real Talk with Zuby discussing the difference between gold and “digital gold”.

Read More »

Read More »

Unit of Account and Current Valuations by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com.

Read More »

Read More »

Investments, Speculations and Money by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals.

Read More »

Read More »

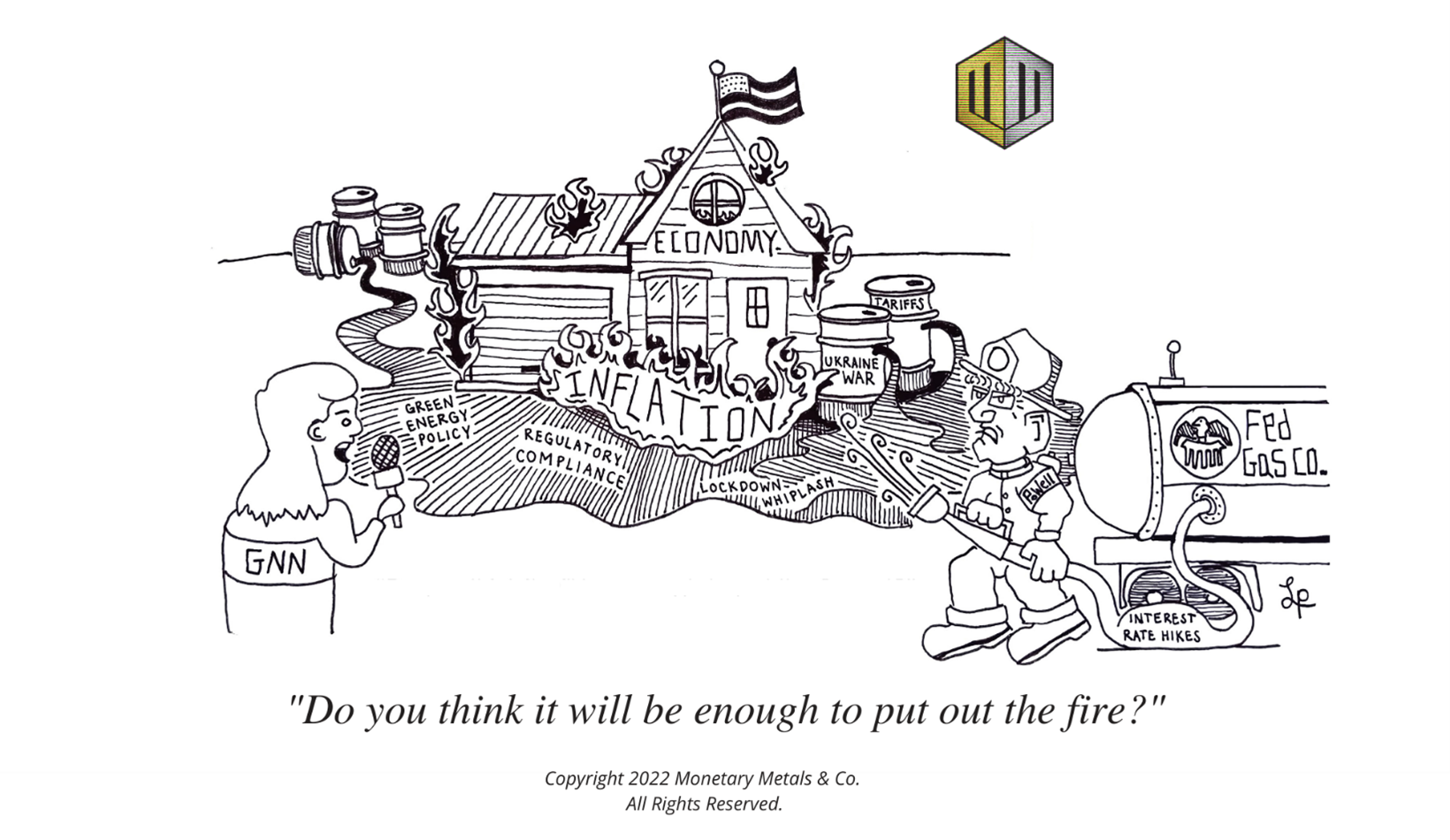

Will Interest Rate Hikes Fix Inflation?

Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same.

Read More »

Read More »

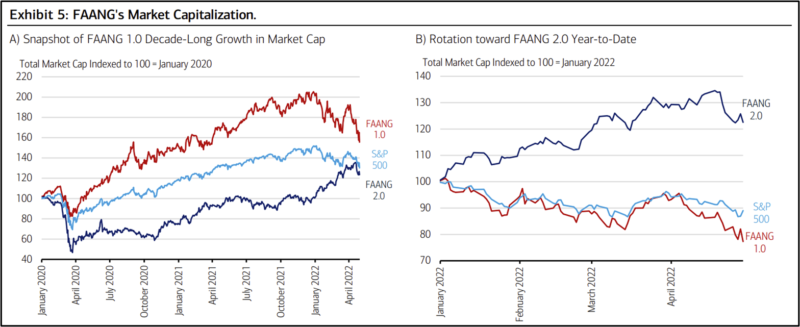

Analysis Featured In Gold We Trust Report 2022

For well over a decade, Ronnie Stoeferle has written the annual In Gold We Trust Report. Since 2013 it has been co-authored by his partner Mark Valek and has provided a holistic assessment of the gold sector and the most important factors influencing it, including interest rates, debt, central bank policy and fundamental analysis.

Read More »

Read More »

Monetary Metals CEO Keith Weiner Interviewed on RealVision

CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin.

Read More »

Read More »

Open Letter to Lex Fridman and Michael Saylor

Gentlemen: I am writing to you in response to your Podcast #276. The first thing I want to say is—well done! You talked about economics and money for four hours and attracted over two million viewers. The monetary system faces grave problems and discussing them is important.

Read More »

Read More »

Monetary Metals Completes Latest Capital Raise

Monetary Metals® has recently closed a $4.5 million equity capital raise, bringing the total funds raised to over $8.5 million. The goal of the capital raise is to support the company to scale up.

This round was oversubscribed, like all previous rounds. The company aimed to raise $3 million.

Read More »

Read More »

Time for a Silver Trade?

The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF gains ground near 0.8850, potential upside seems limited

9 days ago -

USD/CHF holds below 0.8950 amid Middle East geopolitical risks

2024-06-25 -

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

SNB Surprises the Market (Again)

2024-06-20 -

USD/CHF appreciates to near 0.8950 due to hawkish Fed, SNB Financial Stability Report eyed

2024-06-13

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

5 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Canada’s “Worst Decline in 40 Years”

Canada’s “Worst Decline in 40 Years” -

No exceptions, please!

-

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds

#517 Wie viel ist dein Immobilienfonds noch wert? #fonds -

Roboter – KI und Verdrängung des Menschen

Roboter – KI und Verdrängung des Menschen -

El Legado de Biden es PEOR de lo que Parece…

El Legado de Biden es PEOR de lo que Parece… -

Kamala’s Palace Coup

-

How to Invest in High Safety Corporate Bonds

How to Invest in High Safety Corporate Bonds -

7-26-24 Should You Tap Your Home Equity for Retirement Income?

7-26-24 Should You Tap Your Home Equity for Retirement Income? -

UBS questioned by US Senator over $350 million tax evasion case

UBS questioned by US Senator over $350 million tax evasion case -

Lanz: Das Allein “beseitigt” keine AfD Wähler!

Lanz: Das Allein “beseitigt” keine AfD Wähler!

More from this category

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

The Russians (Propaganda) Are Coming!

The Russians (Propaganda) Are Coming!15 Sep 2022

Keith Weiner on the VoiceAmerica Business Channel

Keith Weiner on the VoiceAmerica Business Channel7 Sep 2022

The Knockout Blow to Crypto

The Knockout Blow to Crypto24 Aug 2022

Soho Forum Debate: Gold vs Bitcoin

Soho Forum Debate: Gold vs Bitcoin19 Jul 2022

Is Gold About To Go Mainstream?

Is Gold About To Go Mainstream?16 Jul 2022

CEO Keith Weiner on Real Talk with Zuby

CEO Keith Weiner on Real Talk with Zuby28 Jun 2022

Unit of Account and Current Valuations by Paul Belanger

Unit of Account and Current Valuations by Paul Belanger27 Jun 2022

Investments, Speculations and Money by Paul Belanger

Investments, Speculations and Money by Paul Belanger24 Jun 2022

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

Analysis Featured In Gold We Trust Report 2022

Analysis Featured In Gold We Trust Report 202211 Jun 2022

Monetary Metals CEO Keith Weiner Interviewed on RealVision

Monetary Metals CEO Keith Weiner Interviewed on RealVision3 Jun 2022

Open Letter to Lex Fridman and Michael Saylor

Open Letter to Lex Fridman and Michael Saylor19 May 2022

Monetary Metals Completes Latest Capital Raise

Monetary Metals Completes Latest Capital Raise5 May 2022

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022