Category Archive: 6a.) Monetary Metals

Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything.

Read More »

Read More »

What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / . When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other currency.

Redemptions Balanced With Deposits

No national...

Read More »

Read More »

Useless But Not Worthless, Report 21 Oct 2018

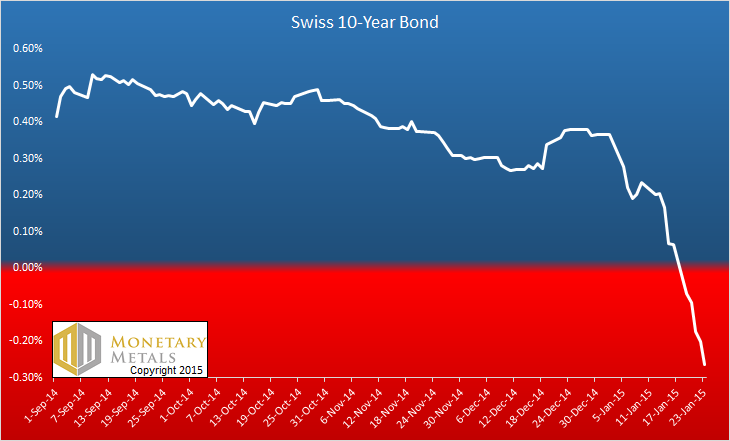

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal.

Read More »

Read More »

Interview, Ted Talk, Gold Bug Hope and will the Swiss Franc Collapse

I was on the Jay Taylor Show again, to talk about the the Swiss franc. No, the headline was not of my choosing. Adam Caroll gave a Ted Talk about how people behave differently when money isn’t real. And gets into a discussion of how kids will click to spend on their parents’ phones without any real appreciation for what it costs. It’s called “When money isn’t real“.

Read More »

Read More »

Keith Weiner-Guaranteed! The Swiss Franc Will Collapse

2018-10-17

by Keith Weiner

Keith Weiner, CEO & Founder of Monetary Metals, gives insights into the seldom understood dynamics leading to the pathology of currency market manipulation by central banks.

Read More »

Read More »

You Can’t Eat Gold, Report 14 Oct 2018

“You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing.

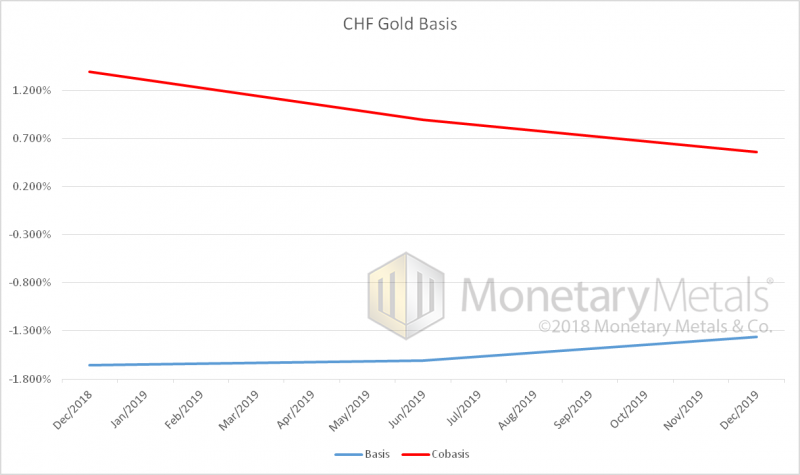

This gives us an idea. Let’s tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three, speculation is a bet on the price action.

Read More »

Read More »

The Toxic Stew, Report 7 Oct 2018

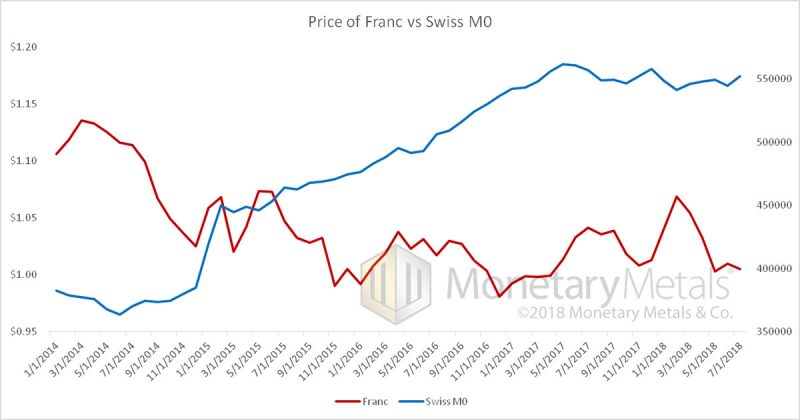

Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in January 2015).

Read More »

Read More »

Textbook Falling Interest Behavior

This is a textbook case. Well, it would be if there was a textbook that presented the dynamics of the rising and falling interest rate cycles. Costco is spending over a quarter billion dollars, to make a capital investment in chicken processing. This is not the typical entrepreneurial investment, which seeks to increase margins by serving an unserved or underserved demand.

Read More »

Read More »

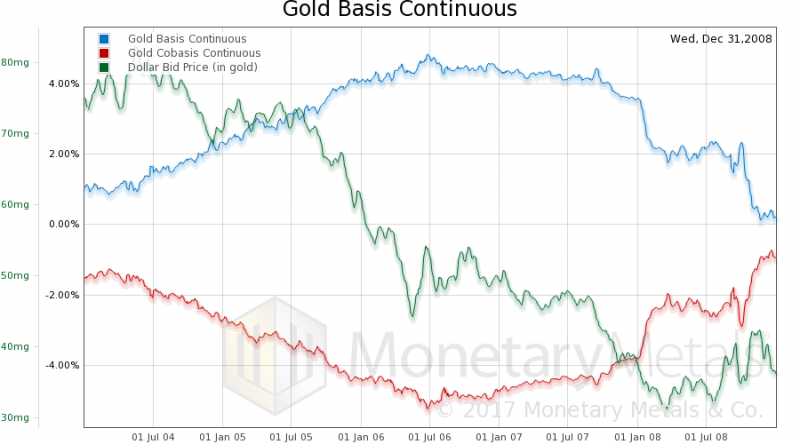

Permanent Gold Backwardation, Report 30 Sep 2018

Sometimes, one just needs to look in the right place. And often in those cases, it just takes a conversation to alert one where to look. We had a call with a Swiss company this week, to discuss gold financing for their business. They reminded us that there is a negative interest rate on Swiss francs. And then they said that a swap of francs for gold has a cost. That is, the CHF GOFO rate is negative (the dollar based 12-month MM GOFO™ is +2.4%).

Read More »

Read More »

We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops.

Read More »

Read More »

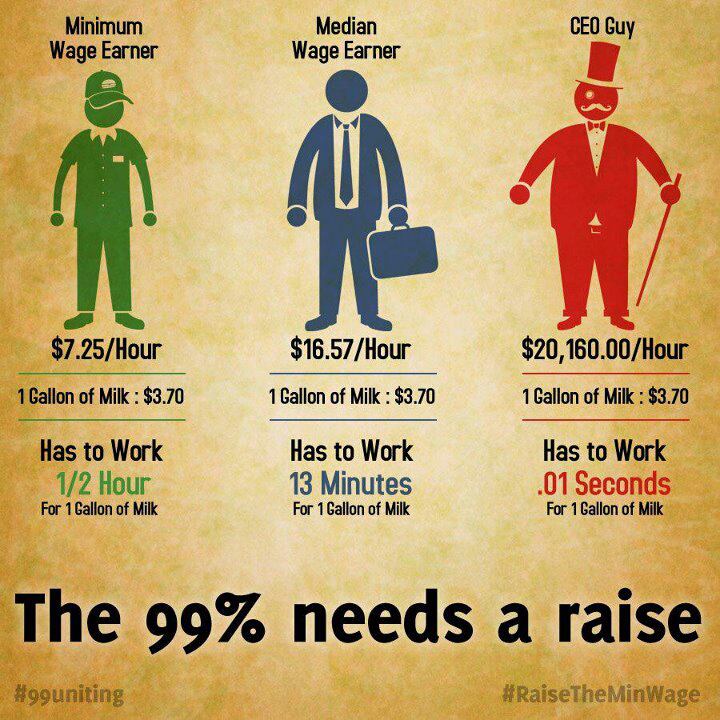

Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language).

Read More »

Read More »

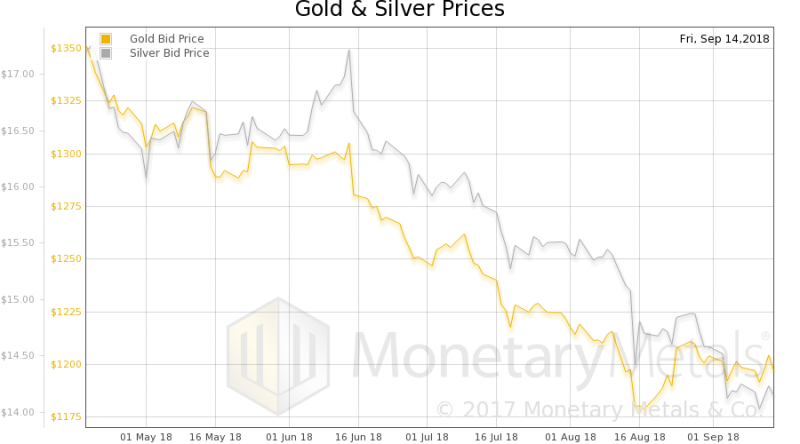

Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance.

Read More »

Read More »

Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York.

Read More »

Read More »

#NewtonInterviews Keith Weiner, Monetary Metals

2018-09-05

by Keith Weiner

Please note this is not sponsored content. Thank you Keith for speaking with me so extensively. Your insights are profound! Make sure to check the YouTube transcript for some great quotes. https://www.change.org/p/nevada-should-sell-gold-bonds Who Would Invest in a Gold Bond? Nevada Gold Bond Petition Vote “If Nevada Democrats perceive this as a Republican bill, they will …

Read More »

Read More »

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest rate.

Read More »

Read More »

Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects.

Read More »

Read More »

Why Am I Fighting for the Gold Standard?

2018-08-31

by Keith Weiner

Keith Weiner, CEO of Monetary Metals talks about his personal motivations, why he is fighting the fight.

He doesn’t believe that prepping for the so called “zombie apocalypse” makes any sense, when you think about what you’re prepping for. What a so called “reset” will be. A new dark age.

Recorded August 12, 2018.

------------------------------------------------------------------

Links of possible interest...

The Dollar Cancer and the...

Read More »

Read More »

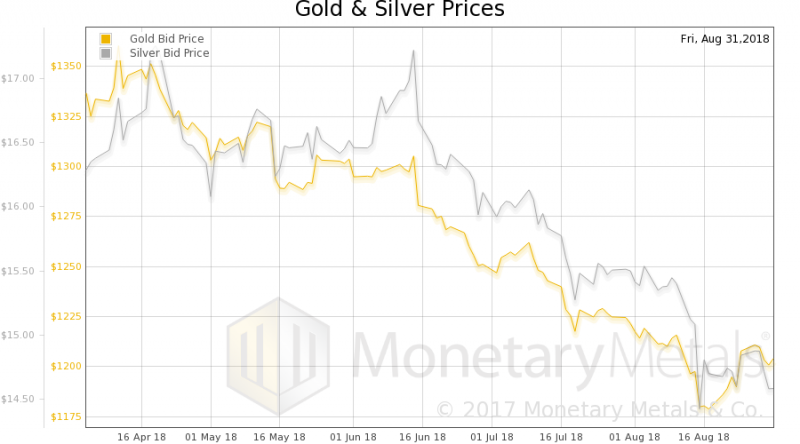

Another Gold Bearish Factor, Report 26 August 2018

Last week, we said that the consensus is that gold must go down (as measured in terms of the unstable dollar) and then will rocket higher. We suggested that if everyone expects an outcome in the market, the outcome is likely not to turn out that way. We also said that this time, there is likely less leverage employed to buy gold and that gold is less leveraged as well.

Read More »

Read More »

In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018

Last week, we discussed the tension between forces pushing the dollar up and down (measured in gold—you cannot measure the dollar in terms of its derivatives such as euro, pound, yen, and yuan). And we gave short shrift to the forces pushing the dollar down. We said only that to own a dollar is to be a creditor. And if the debtors seem in imminent danger of default, then creditors should want to escape this risk.

Read More »

Read More »

Who Would Invest in a Gold Bond?

Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh?

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

12 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Gold has no counterparty risk.

Gold has no counterparty risk. -

Was wir über Corona nie wissen sollten

Was wir über Corona nie wissen sollten -

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell -

Swiss wine growers seek to limit European imports

Swiss wine growers seek to limit European imports -

Swiss farmers hold greater sway than ever

Swiss farmers hold greater sway than ever -

Phänomen Luxus-Armut: Warum wir alles haben, aber nichts besitzen

Phänomen Luxus-Armut: Warum wir alles haben, aber nichts besitzen -

Lohnt sich ein Studium noch?

Lohnt sich ein Studium noch? -

What Took Gold To $5,000

What Took Gold To $5,000 -

When bond markets become political, gold doesn’t become fashionable it becomes logical.

When bond markets become political, gold doesn’t become fashionable it becomes logical. -

Kommst du auf 7 Stunden Schlaf?

Kommst du auf 7 Stunden Schlaf?

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

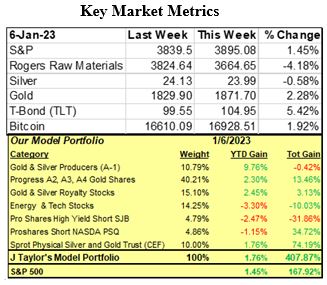

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

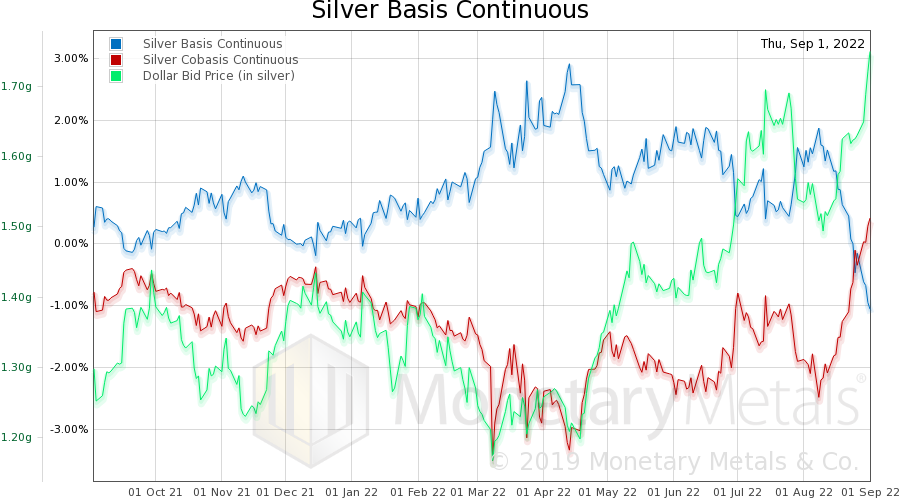

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022