Category Archive: 6a.) GoldCore

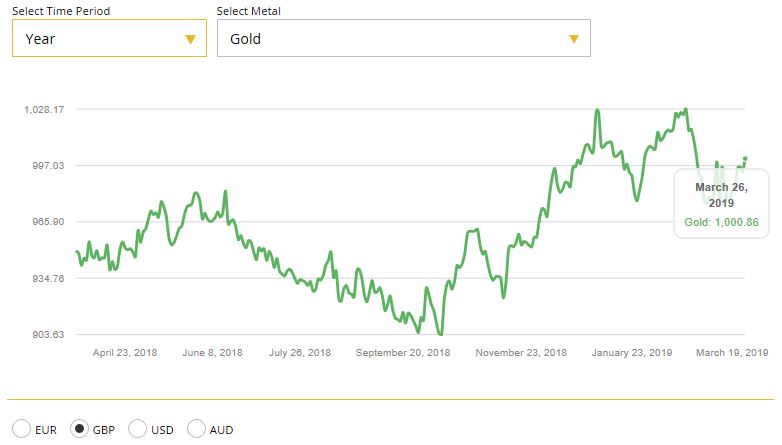

Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks

– Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland

– Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage

– UK sees sharp slowdown in mortgage approvals in February as housing market slows

– Gold surges to near all time record highs in Australian dollars at $1,860/oz

– Gold in sterling, euros and...

Read More »

Read More »

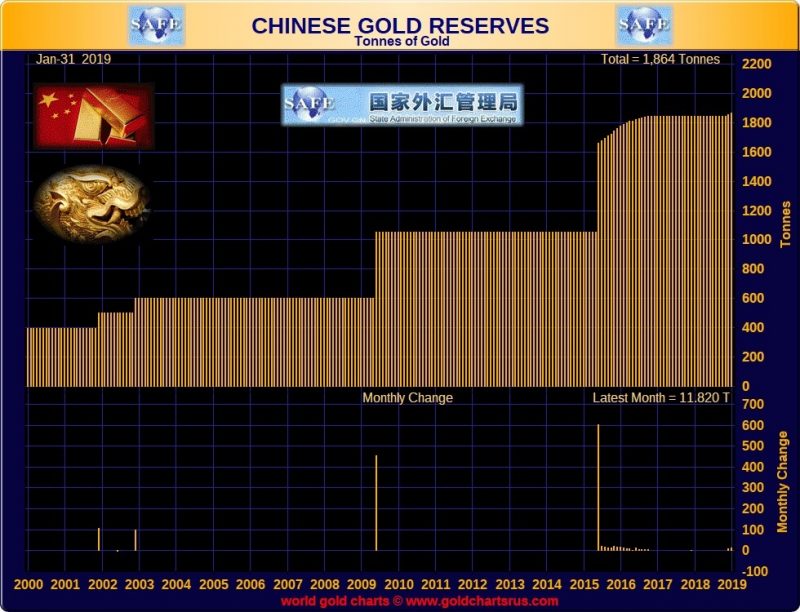

China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning.

The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

Read More »

Read More »

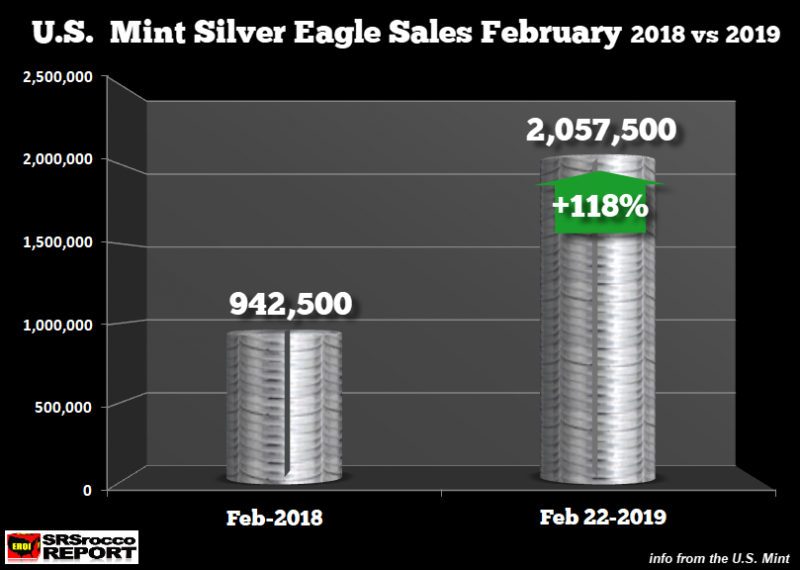

U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February. Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories. U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell.

Read More »

Read More »

Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen. – Growing demand from investors to relocate tangible assets out of the UK. – “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London”.

Read More »

Read More »

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit. – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote. – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies.

Read More »

Read More »

Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability, monetary policy and the US dollar, structural economic reforms.

Read More »

Read More »

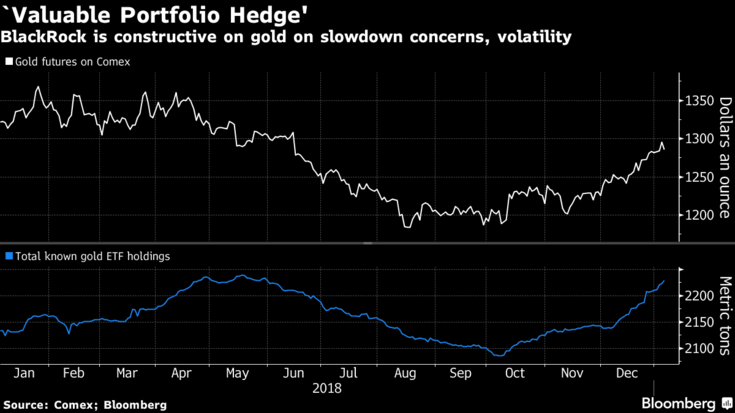

Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager. Global Allocation Fund adding to gold exposure through ETFs. Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising”. Gold bullion has been a “store of value for a very long time”.

Read More »

Read More »

China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

China increases gold holdings by large 320,000 ounces. Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion. China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces. Gold climbed 5% in December on equity rout, growth concerns

Read More »

Read More »

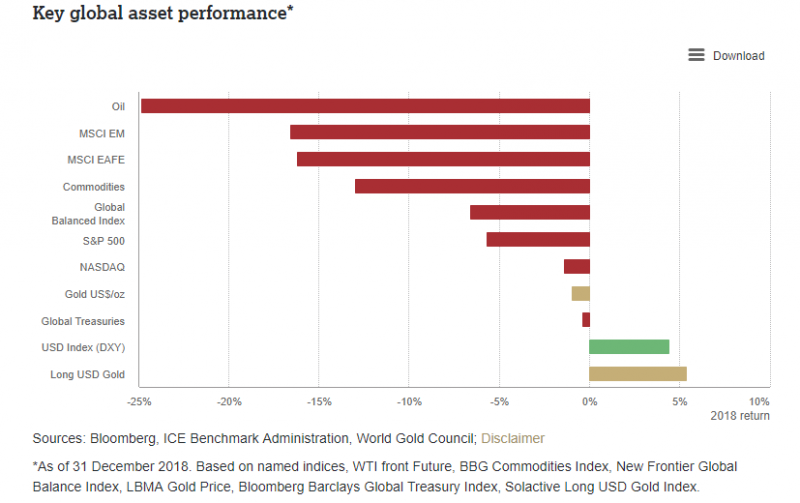

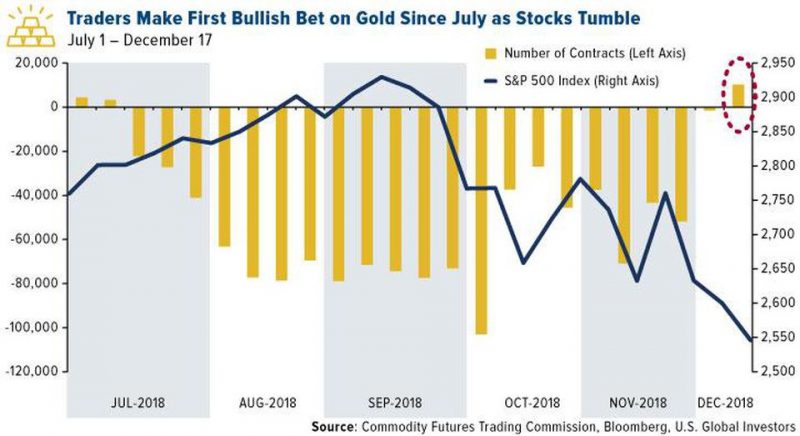

Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data.

Read More »

Read More »

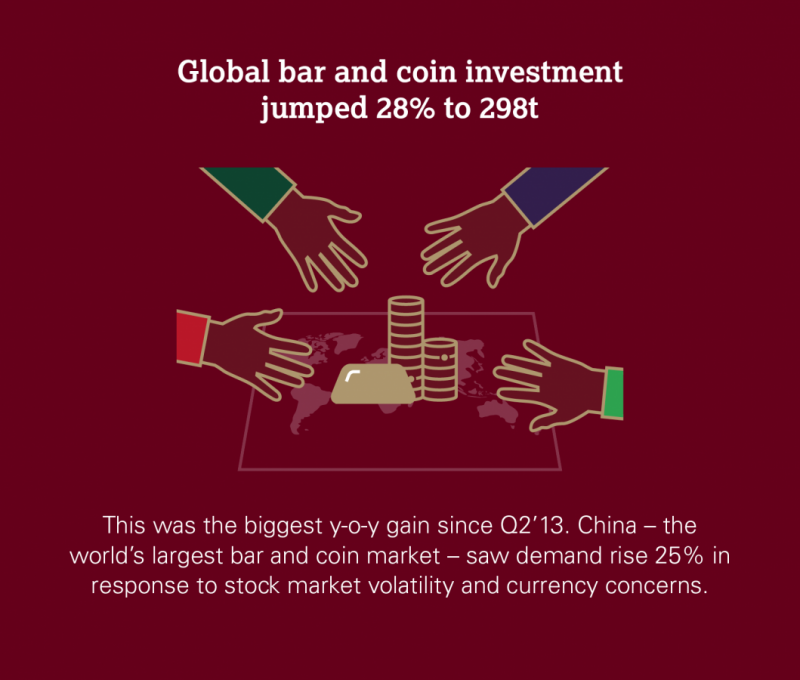

Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk. Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows. Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy.

Read More »

Read More »

Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium.

Read More »

Read More »

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets. News, Commentary, Charts and Videos You May Have Missed. Here is our Friday digest of the important news, commentary, charts and videos we were informed by this week. Market jitters and volatility have returned this week and the sell-off in US government bonds led to sharp falls on Wall Street centered on the very overvalued tech sector and the...

Read More »

Read More »

Perth Mint’s Gold and Silver Bullion Coin Sales Soar In September

Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday.

Read More »

Read More »

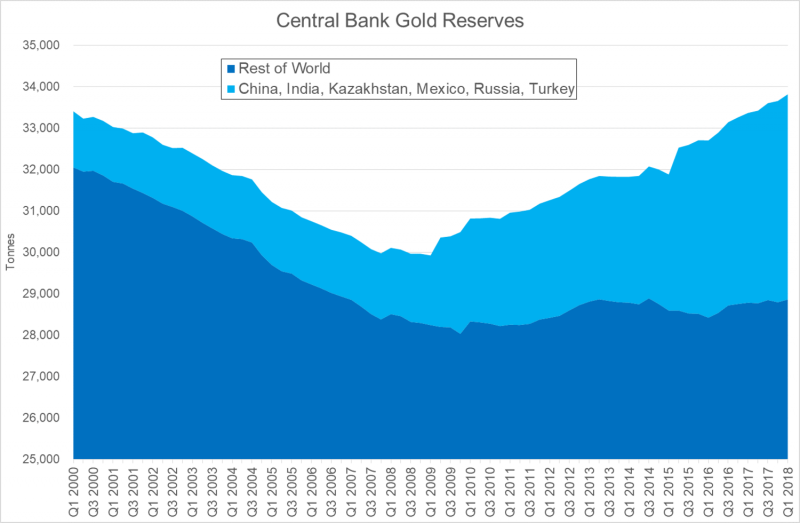

Central Banks Positivity Towards Gold Will Provide Long Term “Support To Gold Prices”

– There has been a recent change for the better in central bank attitudes to gold. – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification”. – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics. – Little in the current global economic and political environment to support any reason to change in this...

Read More »

Read More »

Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated price-to-earnings ratios, heavy debt-to-GDP ratios among major economies and...

Read More »

Read More »

Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner. “Gold is going to enter a new bull market”. “The first cycle will bottom after the summer”. “$1,212 per ounce is our downside target”. “It’s going to top $2,500 per ounce . . . in about two years or so”. “Gold is in a bull market even though it came down from $1,900 per ounce”

Read More »

Read More »

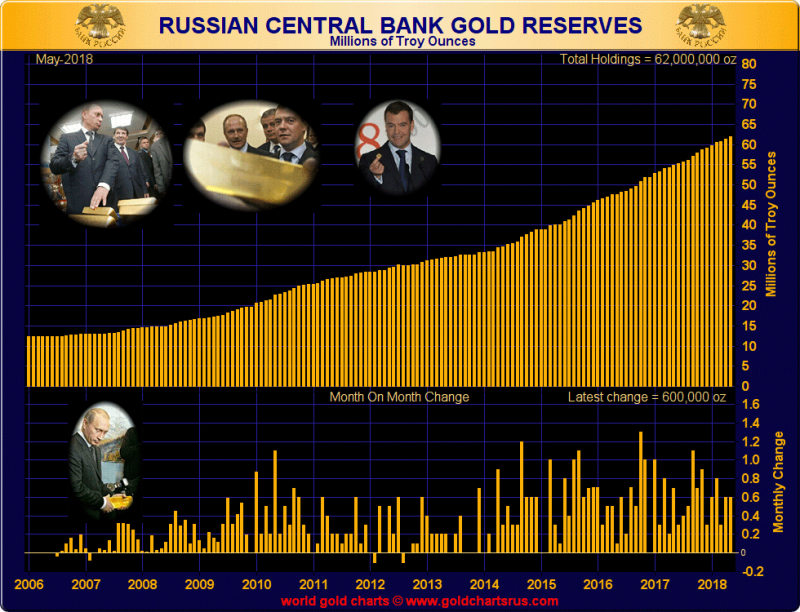

Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May. Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold.

Read More »

Read More »

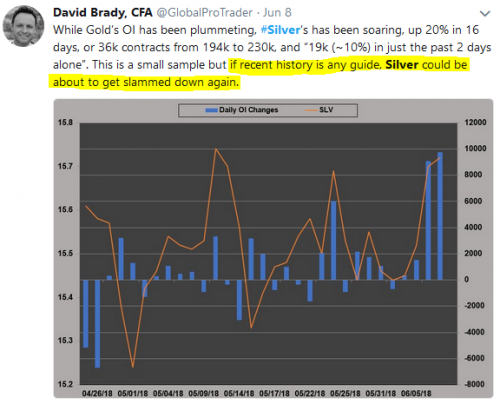

Manipulation of Gold and Silver Is “Undeniable”

Manipulation in precious metals is undeniable. Now so chronic that it is obvious and therefore predictable. Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come. I want to be long … “when that event occurs”.

Read More »

Read More »

Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May. Holdings of U.S. government debt slashed in half to $48.7 billion in April. ‘Keeping money safe’ from U.S. and Trump – Danske Bank. Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months. Asian nations accumulating gold as shield against dollar devaluation and trade wars.

Read More »

Read More »