Category Archive: 6a.) GoldCore

“Perfect Environment For Gold” As Fed To Weaken Dollar and Create Inflation

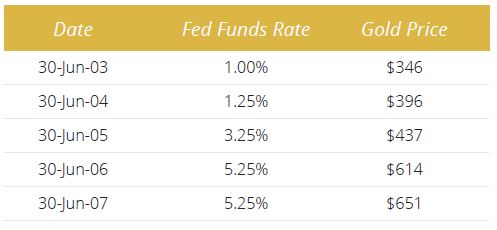

“Fed is tightening into weakness and will eventually over-tighten and cause a recession”. “More inflation and a weaker dollar” is “the perfect environment for gold”. Geopolitical shocks will return when least expected and gold will soar in flight to safety.

Read More »

Read More »

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle. We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast.

Read More »

Read More »

“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council

– “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…”

– “When the going gets tough, gold becomes the ultimate money” reports Die Presse

Read More »

Read More »

Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars. The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest.

Read More »

Read More »

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later. Guest post by Dominic Frisby of Money Week. This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…

Read More »

Read More »

Gold And Silver Bullion Obsolete In The Crypto Age?

What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? Fresh insights as CrushtheStreet.com interview Mark O’Byrne who gives his diagnosis on the outlook for gold in 2018, and looks at the long-term relevance of precious metals in the digital age of crypto and the blockchain alongside Bitcoin’s emergence as a potential digital store of value.

Read More »

Read More »

Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea. – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300. – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes. – Gold Demand in Turkey as Lira falls sharply, true inflation near 40%. – EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’. – Silver Trading in Tight $1 range, Pressure Building for a Breakout.

Read More »

Read More »

‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and EU officials in equal measure.

Read More »

Read More »

Gold Looks A Better Bet Than UK Property

Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar.

Read More »

Read More »

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

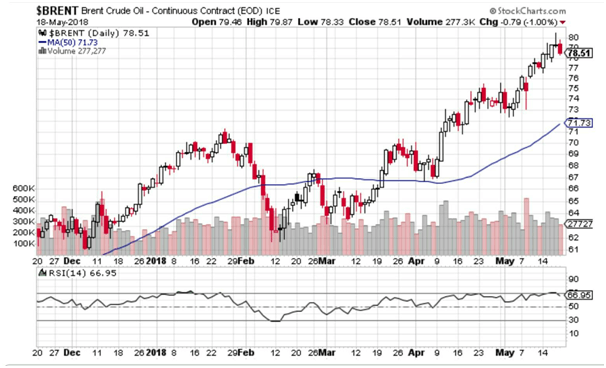

US 10-Year Yields Top 3%, US Dollar Pushes Higher. Brent Hits $80, Highest in 4 years. Emerging Market Chaos, the Lira and Peso in Freefall. Italy’s New Coalition Signal Their Plans, Yields Jump. Japanese Economy Contracts, GDP Worst Since 2015. And Where Next for Gold?

Read More »

Read More »

Welsh Gold Being Hyped Due To The Royal Wedding?

Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world. Investors to be reminded that all mined gold is rare and homogenous. Nothing chemically different between Welsh gold and that mined elsewhere. Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold...

Read More »

Read More »

Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal. Oil jumps past $70. Argentina hikes interest rates to 40%. S. 10 year disparity. Western buying returns to gold. Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

Read More »

Read More »

Gold Mining Supply Looks Set To Decline

Global demand for gold is increasing while new discoveries of gold remain small. Gold mining output in Australia is forecast to decrease by 50% in the next eight years. Decline in global gold mining supply makes a price increase almost certain.

Read More »

Read More »

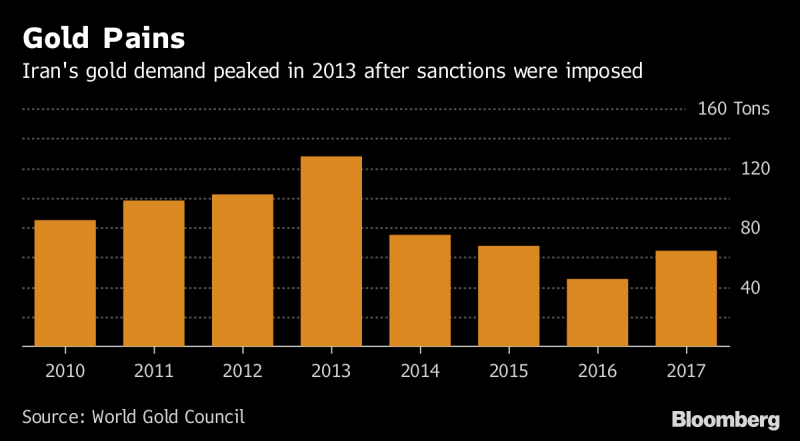

Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council.

Read More »

Read More »

Own Some Gold and Avoid Overvalued Assets

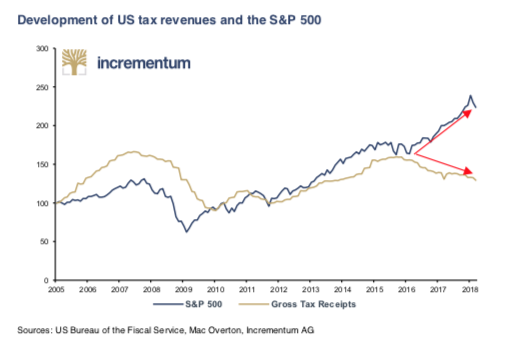

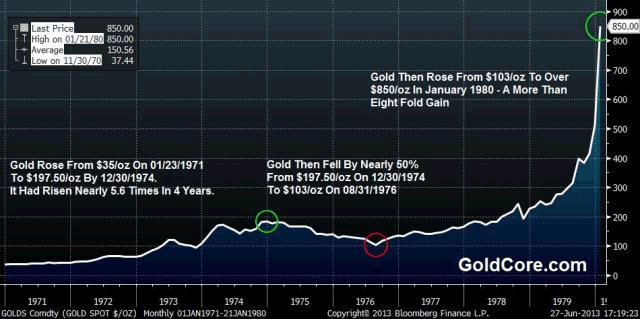

We could be heading for a golden age – or a return to the 1970s. The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number.

Read More »

Read More »

“Blood In The Streets” Of U.S. Gold Bullion Coin Market

Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25 percent from the year prior. However, April sales were up 29 percent from March.

Read More »

Read More »

New All Time Record Highs For Gold In 2019

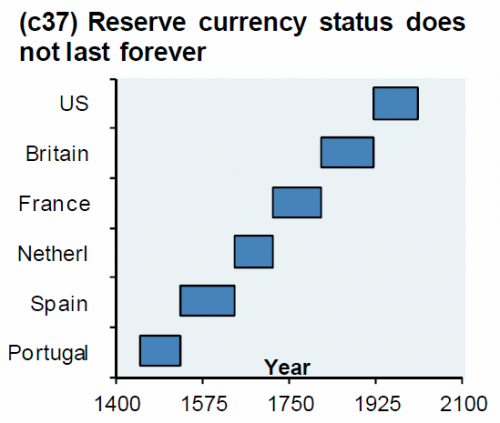

New all time record highs for gold in 2019. ‘Powerful bull market’ will likely send gold to $5,000 to $10,000. If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’. Traditional portfolio of stocks and bonds will not protect investors. “Gold will replace bonds as the go-to hedge”.

Read More »

Read More »

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

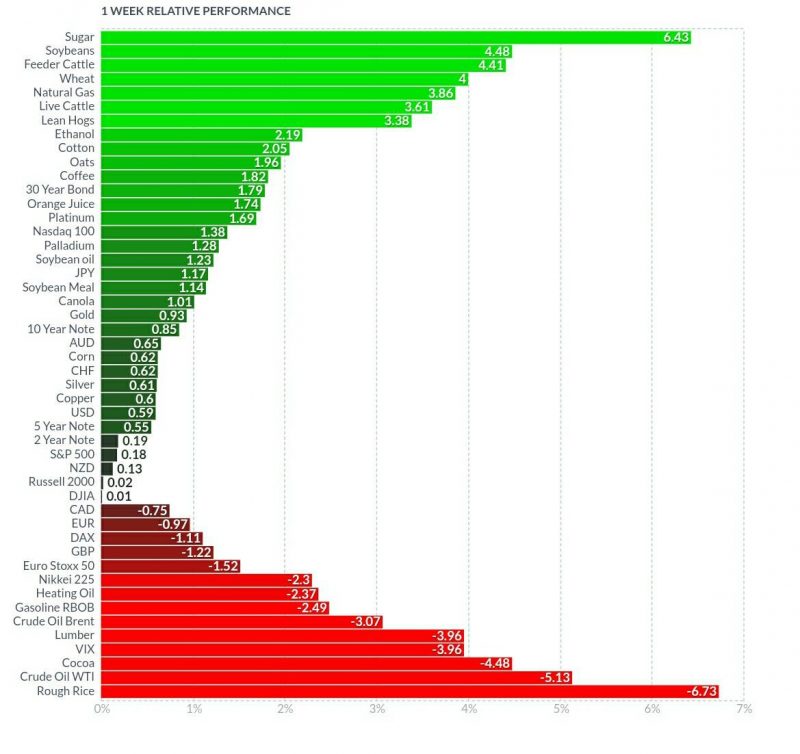

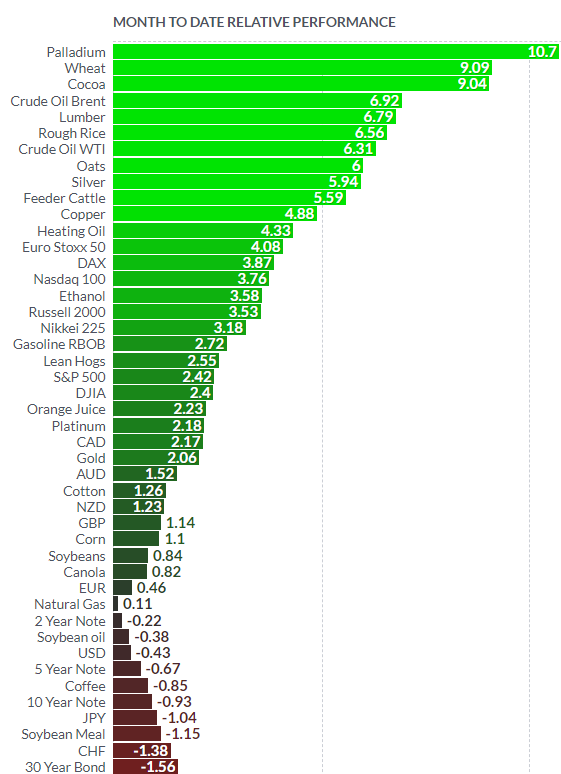

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »

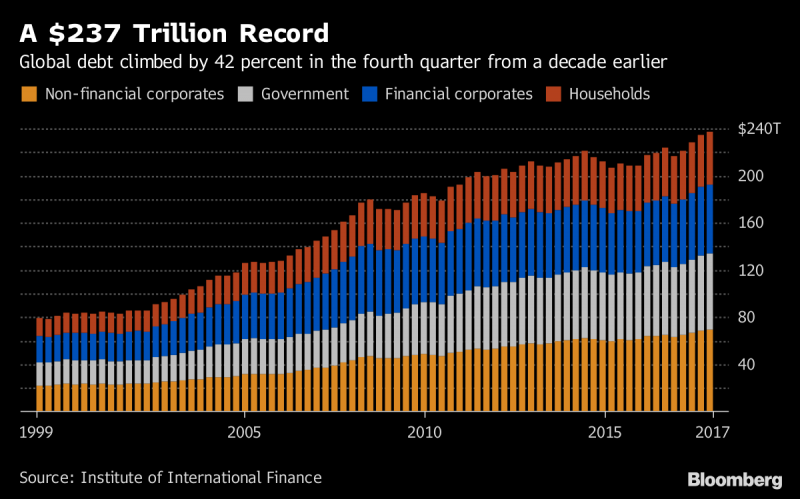

Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Global debt bubble hits new all time high – over $237 trillion. Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD. Increase in debt equivalent to United States’ ballooning national debt. Global debt up $50 trillion in decade & over 327% of global GDP. $750 trillion of bank derivatives means global debt over $1 quadrillion. Gold will be ‘store of value’ in coming economic contraction. Global debt is the mother of all...

Read More »

Read More »

Volatile Week Sees Oil and Palladium Surge Over 8percent, Gold and Silver Marginally Higher and Stocks Gain

Gold & silver eke out small gains; palladium surges 8% and platinum 2%. Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk. U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns. Stocks rally and shrug off trade war, macro and geo-political risks. Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply. Russia-US tensions high: Trump warns attack ‘could be very soon or not so soon at all’.

Read More »

Read More »